Bitcoin is trading at a jaw-dropping $110,949.00, and the narrative is shifting fast: BTC is no longer just digital gold. With GOAT Rollup, the world’s most valuable blockchain asset is morphing into an active, yield-generating powerhouse, without the risks of wrapping, bridging, or synthetic tokens. If you’re still letting your BTC sit idle, you’re missing the next wave of native Bitcoin DeFi.

GOAT Rollup: Turning Bitcoin Into a Yield Machine

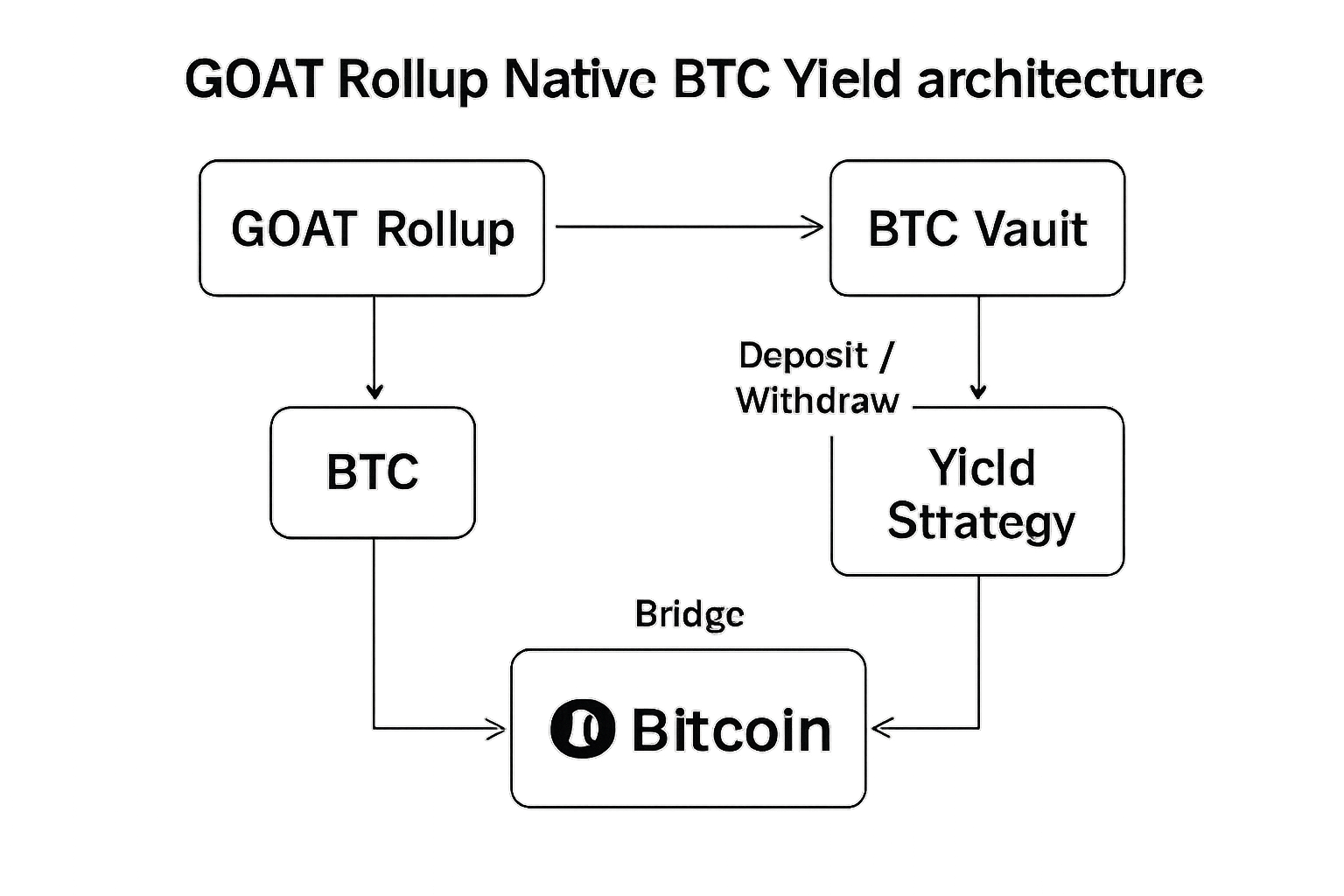

Most so-called Bitcoin DeFi solutions force you to wrap your BTC into wBTC or hop across bridges to Ethereum or other chains. That’s a security and counterparty risk nightmare, just ask anyone who’s lost funds to a bridge hack. GOAT Rollup flips the script with BitVM2-powered zkRollups that keep your BTC native, on-chain, and productive. No synthetic IOUs, no middlemen, no leaving the safety of the Bitcoin mainnet.

GOAT’s architecture combines zkMIPS zero-knowledge proofs with BitVM2 to deliver sub-3-second proofs, instant settlement, and a challenge period cut down from 14 days to less than 24 hours. That means you get the speed and programmability of an L2, with the ironclad security of Bitcoin L1. The result? Native BTC yield, paid directly in Bitcoin, not some wrapped or proxy asset.

BTC Yield Without Wrapping or Bridges: How Does It Work?

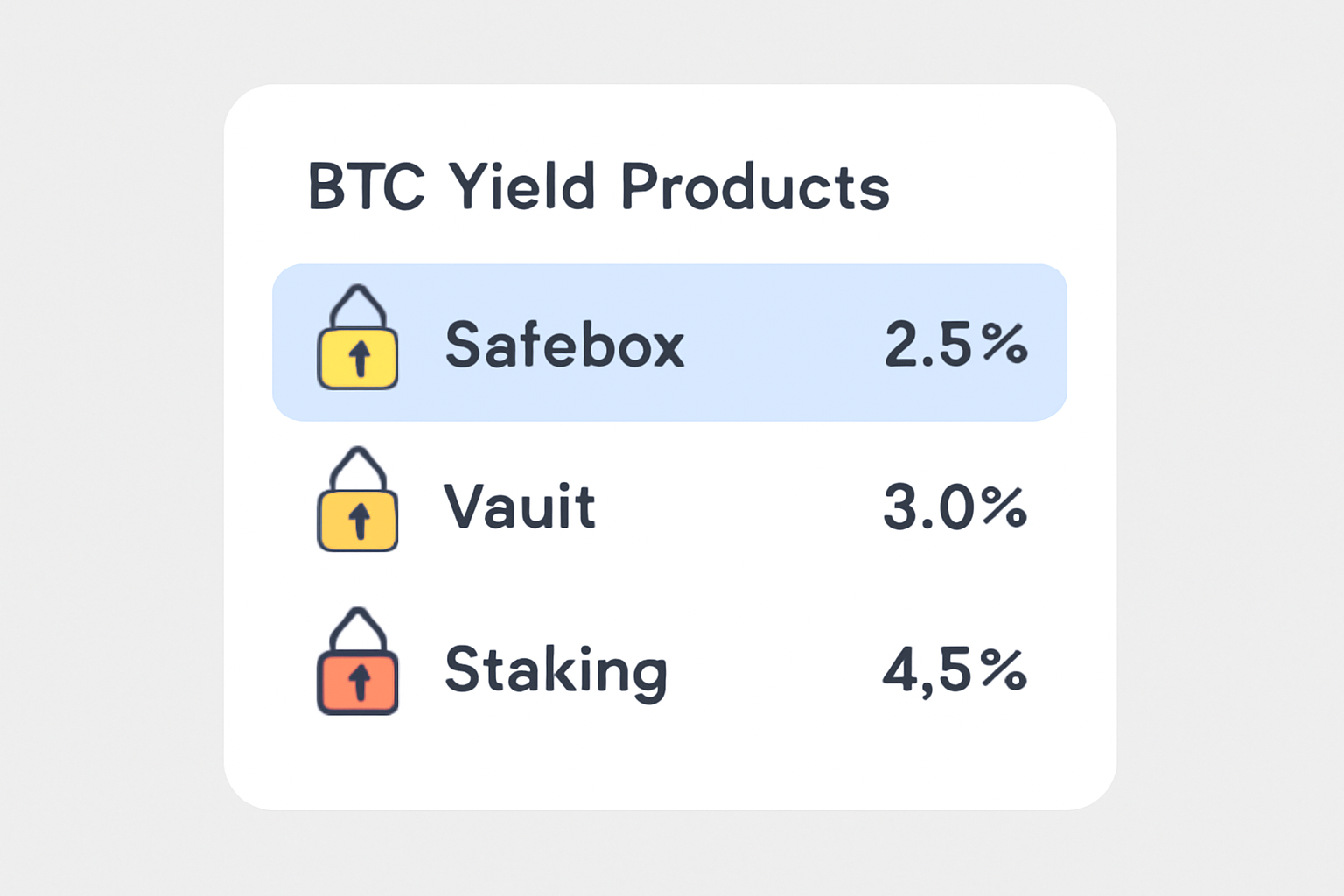

The GOAT Network ecosystem is built for both conservative holders and DeFi degens. Products like GOAT Safebox offer a 2% APY in real BTC for locking up your coins for 90 days, with no wrapping or bridge risk. More adventurous users can tap into the BTCB/DOGEB Vault, Sequencer PoS Staking, or the Avalon Finance lending protocol, each designed to maximize yield while keeping your BTC native and non-custodial.

This is a seismic shift. Instead of relying on centralized platforms or operating mining rigs, you can now earn sustainable, chain-level yield right from your Bitcoin wallet. The GOAT Yield Dashboard makes it easy to track returns, manage vaults, and participate in decentralized finance, all while your BTC remains pure and unwrapped.

Why BitVM2 and zkMIPS Matter for Native BTC DeFi

GOAT’s technical edge comes from its use of BitVM2 and zkMIPS. These technologies enable the rollup to inherit Bitcoin’s native security while supporting complex smart contracts and fast finality. With challenge periods slashed to under a day and real-time proving across five provers, GOAT Rollup is setting new standards for both security and scalability. This isn’t just another L2, it’s a full-stack Bitcoin-native zkRollup that actually delivers on the promise of on-chain yield.

Want to dig deeper into the tech behind GOAT Rollup? Check out our full breakdown of how GOAT Rollup uses BitVM2 and zkMIPS to bring real BTC yield to Bitcoin holders.

Let’s look at what this means for yield-hunters and risk-aware investors as Bitcoin continues to trade above $110,000.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook factoring in the launch of GOAT Network’s native BTC yield products and Bitcoin’s expanding DeFi ecosystem.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,000 | $120,000 | $145,000 | +9% | Consolidation after 2025 highs, BTC yield adoption grows, but macro tightening possible. |

| 2027 | $105,000 | $137,000 | $180,000 | +14% | Renewed institutional inflows, L2 adoption, but global regulations introduce volatility. |

| 2028 | $120,000 | $159,000 | $210,000 | +16% | Maturing BTC-Fi sector, broader DeFi integration, possible ETF-driven demand. |

| 2029 | $132,000 | $181,000 | $240,000 | +14% | Bitcoin L2 (GOAT and others) achieve mass adoption, halving anticipation boosts sentiment. |

| 2030 | $150,000 | $205,000 | $270,000 | +13% | Post-halving supply shock, BTC as an institutional yield asset, competitive L2 landscape. |

| 2031 | $170,000 | $230,000 | $320,000 | +12% | Peak BTC-Fi adoption, global regulatory clarity, increasing mainstream use cases. |

Price Prediction Summary

Bitcoin’s price is projected to steadily appreciate from 2026 to 2031, underpinned by the expansion of native BTC yield products (e.g., GOAT Network), increasing DeFi participation, and maturing institutional infrastructure. While periods of consolidation and volatility are expected, the overall trend is bullish, with each year’s average price reaching new highs. Minimum and maximum ranges reflect potential macroeconomic risks and crypto-specific market cycles.

Key Factors Affecting Bitcoin Price

- GOAT Network’s success in unlocking native BTC yield and driving on-chain utility.

- Broader adoption of Bitcoin L2s and DeFi protocols increasing demand for BTC.

- Potential for new Bitcoin ETFs and institutional investment vehicles.

- Regulatory developments in major jurisdictions (e.g., US, EU, Asia).

- Market cycles, including halving events and macroeconomic trends.

- Competition from other L1 and L2 blockchains offering yield and DeFi solutions.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

GOAT Network’s growing suite of products is catching fire for a reason: it’s the first time Bitcoin holders can put their coins to work without ever giving up custody or compromising on-chain purity. The GOAT Safebox, for example, is a non-custodial vault where you deposit BTC and earn a predictable 2% APY, paid out in real Bitcoin. No sidechain minting, no bridged assets, just pure BTC, locked and earning, with transparent rules and zero exposure to smart contract exploits outside the Bitcoin security model.

For those who want to dial up the risk and potential reward, GOAT’s BTCB/DOGEB Vault and Sequencer PoS Staking open up higher-yield, DeFi-style opportunities. The twist? All these products are built atop the BitVM2 zkRollup, so every transaction, every yield payout, and every vault movement is instantly provable and verifiable on-chain. The challenge window, once a 14-day headache for L2s, has been slashed to less than 24 hours, meaning funds are never stuck in limbo, and exit scams are practically impossible.

The End of Wrapped Bitcoin? Native BTC DeFi Goes Mainstream

Why does this matter? Because the old world of Bitcoin DeFi was a patchwork of hacks, bridges, and synthetic IOUs. GOAT Rollup’s BitVM2 and zkMIPS stack means you can finally earn real yield on real BTC, with all the composability and programmability of an L2, but none of the existential risks. That’s a game-changer for institutional allocators and retail stackers alike, especially with Bitcoin holding strong at $110,949.00.

GOAT Rollup’s architecture is the first to make native BTC DeFi not just possible, but practical and scalable. The technology is live, the yields are real, and the risks are transparent. This is what Bitcoiners have been waiting for.

GOAT Rollup vs. Wrapped BTC & Bridge-Based Solutions: Key Advantages

| Feature | GOAT Rollup 🟡 | Wrapped BTC (wBTC) 🔶 | Bridge-Based Solutions 🌉 |

|---|---|---|---|

| Native BTC Yield | ✅ Yes, direct BTC yield (2%+ APY) via on-chain vaults like Safebox | ❌ No, yield requires DeFi protocols on other chains | ⚠️ Possible, but often requires synthetic assets |

| Security | 🔒 Bitcoin-native security (BitVM2, zkMIPS, no bridges) | 🛑 Relies on custodians and multi-sig | ⚠️ Vulnerable to bridge exploits/hacks |

| Transparency | 🟢 Fully on-chain, transparent yields and vaults | 🟡 Custodian transparency varies; not always on-chain | 🔴 Opaque, risks of hidden bridge contracts |

| User Experience | 🚀 Simple, non-custodial, no wrapping or bridging | 🔄 Requires wrapping/unwrapping, extra steps | 🔄 Complex bridging, risk of errors |

| BTC Price Exposure | 💯 Pure BTC, no synthetic risk ($110,949.00 current price) | ⚠️ Synthetic representation; may diverge in extreme cases | ⚠️ Synthetic or wrapped; risk of depeg |

| Challenge Period (Withdrawal) | ⚡ <1 day (BitVM2) | ⏳ Up to several days (depends on protocol) | ⏳ 1–7 days (varies by bridge) |

| Custodial Risk | ❌ None (non-custodial vaults) | ⚠️ High (centralized custodians hold BTC) | ⚠️ High (bridges/custodians hold assets) |

| Yield Options | 🌈 Diverse: Safebox, BTCB/DOGEB Vault, PoS Staking, Avalon Lending | 🔸 Limited; must use external DeFi protocols | 🔸 Limited; depends on destination chain |

GOAT’s approach also unlocks a new era for Bitcoin-native perpetual DEXs and lending markets. With the Avalon Finance protocol, users can lend and borrow against their BTC without ever touching a wrapped token or centralized custodian. This is the missing link for Bitcoin to become a true base layer for global finance, not just a passive store of value.

Want to see how it all works under the hood? We’ve got a technical deep dive on how GOAT Rollup unlocks native BTC yield and why BitVM2 is the most important upgrade to Bitcoin scaling since SegWit.

What’s Next for Bitcoin Yield and Scaling?

As Bitcoin continues to trade above $110,949.00, the demand for real, risk-adjusted yield is only going to intensify. GOAT Network’s model is likely to become the blueprint for future Bitcoin L2s: native, non-custodial, and powered by zero-knowledge cryptography. The days of trusting bridges or settling for 0% yield are numbered.

Whether you’re a conservative HODLer or a DeFi power user, GOAT Rollup is rewriting the rules. Native Bitcoin DeFi is here, and it’s not waiting for anyone to catch up.