Bitcoin’s Layer 2 ecosystem is evolving rapidly, but few projects have managed to deliver true native BTC yield without introducing unnecessary trust or synthetic assets. GOATRollup is taking a data-driven approach to this challenge, pioneering the use of BitVM2 and zkMIPS to unlock sustainable, non-custodial BTC yield for holders. With Bitcoin (BTC) currently trading at $121,656.00, the demand for capital efficiency and yield on native assets has never been higher.

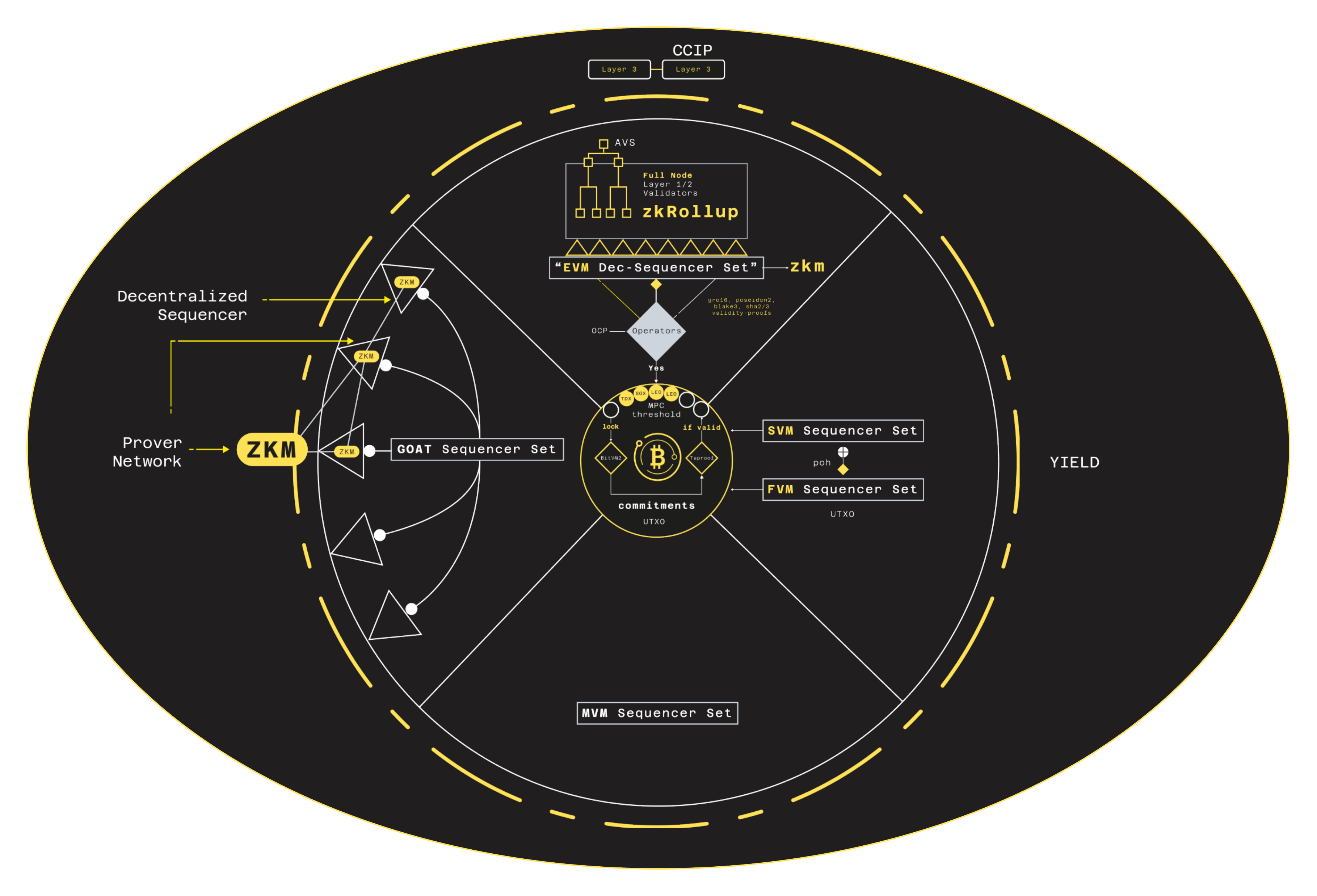

The Architecture: BitVM2 Meets zkMIPS for Secure, Efficient Rollups

At the core of GOATRollup’s innovation is its integration of BitVM2, a protocol enabling arbitrary computation on Bitcoin without L1 protocol changes. BitVM2 unlocks powerful new trust-minimized bridges and rollups, but faces practical hurdles such as double-spend risks, slow challenge periods, and incentive misalignments. GOATRollup addresses these issues by embedding zkMIPS, a zero-knowledge virtual machine purpose-built for real-time proof generation and rapid dispute resolution.

This technical synergy allows GOATRollup to reduce challenge periods from the industry-standard 14 days to less than 24 hours. As a result, off-chain computation can be efficiently verified on-chain, enhancing both security and user experience. This breakthrough was demonstrated in their recent testnet launch, where real-time ZK Rollup proofs were achieved across five independent provers, with sub-three second finality (source).

Decentralized Sequencers: The Engine Behind Real BTC Yield

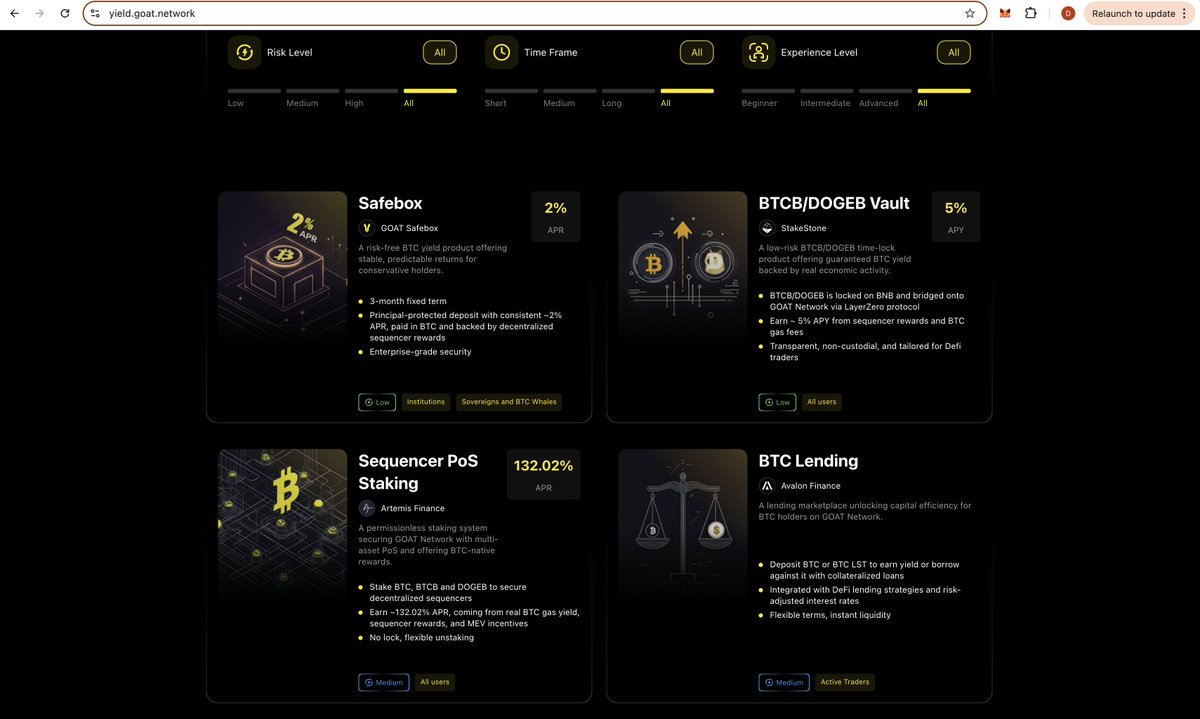

The decentralized sequencer network is what transforms technical innovation into tangible yield for Bitcoin holders. By staking BTC or supported assets like BTCB or DOGEB, users can participate in sequencer operations and earn up to 10% APY. Yield is derived transparently from sequencer rewards, BTC gas fees, and miner extractable value (MEV) – not from lending or synthetic derivatives. This model ensures that users retain control of their assets while benefiting from the economic activity of the network.

The recently released BTC yield dashboard provides granular transparency into these rewards, further reinforcing trust in the system. With Bitcoin’s price holding steady at $121,656.00, GOATRollup’s model offers a compelling alternative to centralized yield products that often expose users to hidden risks.

Bitcoin (BTC) Price Prediction 2026-2031

Incorporating the impact of Layer 2 innovation and native BTC yield from solutions like GOATRollup (BitVM2 & zkMIPS)

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $98,000 | $129,000 | $155,000 | +6% | Post-halving consolidation; BTC yield gaining adoption |

| 2027 | $110,000 | $145,000 | $185,000 | +12% | Layer 2 ecosystem growth; regulatory clarity improves sentiment |

| 2028 | $120,000 | $162,000 | $210,000 | +12% | Mainstream BTC yield adoption; broader institutional inflows |

| 2029 | $135,000 | $178,000 | $240,000 | +10% | Global macro headwinds; increased competition from other L1s |

| 2030 | $130,000 | $195,000 | $275,000 | +10% | Sustained adoption; next market cycle peak |

| 2031 | $145,000 | $215,000 | $320,000 | +9% | Yield platforms mature; BTC as digital yield-bearing asset |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is moderately bullish, supported by the emergence of native BTC yield solutions like GOATRollup and the integration of advanced Layer 2 technologies (BitVM2, zkMIPS). These innovations may drive new demand and utility for BTC, potentially making it a yield-generating asset while maintaining decentralization. Market cycles, broader adoption, and regulatory clarity are expected to provide upward momentum, though periods of consolidation and volatility are likely. Minimum and maximum ranges reflect both downside risks (e.g., macro shocks, regulatory hurdles) and upside potential (e.g., institutional adoption, technological breakthroughs).

Key Factors Affecting Bitcoin Price

- Adoption of native BTC yield platforms (e.g., GOATRollup)

- Layer 2 technology advancements (BitVM2, zkMIPS)

- Regulatory developments globally

- Institutional adoption and mainstreaming of BTC as a yield asset

- Market cycles (post-halving, macroeconomic conditions)

- Competition from other blockchains and yield solutions

- Network security, scalability, and continued decentralization

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Security Guarantees Through Optimistic Challenge Protocols

Security remains paramount in any Bitcoin rollup protocol. GOATRollup leverages an optimistic challenge system based on zkMIPS and BitVM2 to maximize both liveness and safety. By enabling fast contestation windows (under 24 hours) and leveraging decentralized sequencers, the protocol minimizes the attack surface for double-spending or fraud attempts. This architecture supports arbitrary computation while maintaining trust-minimized settlement directly on Bitcoin L1.

The combination of these technologies positions GOATRollup as a leader among Bitcoin zk rollups, setting a new standard for both performance and user alignment in BTCFi.

GOATRollup’s technical leap is not just theoretical. The live BitVM2-based testnet has already demonstrated sub-three second proof finality, a major milestone for Bitcoin L2s. This speed is critical: it allows for seamless user experience and minimizes capital lock-up, which is essential when BTC is valued at $121,656.00. The protocol’s ability to execute and verify arbitrary computation in real time is attracting attention from both developers and institutional players seeking to deploy scalable BTCFi primitives.

BTCFi Real Yield: Native Incentives Without Synthetic Risk

Unlike many so-called yield solutions that rely on wrapped assets or off-chain lending, GOATRollup’s design is anchored in native BTC yield. All rewards are paid directly in BTC, not IOUs or tokens that introduce additional counterparty risk. This aligns incentives between sequencers, stakers, and end users, creating a sustainable feedback loop where network activity directly drives yield potential. The inclusion of DOGEB and BTCB expands the addressable market, but the core value proposition remains laser-focused on Bitcoin itself.

For developers, this opens up new composability: DeFi protocols, payment rails, and even DAOs can now integrate with a Bitcoin rollup that offers both capital efficiency and uncompromising security. The transparency provided by the BTC yield dashboard ensures that all economic flows are auditable in real time, further differentiating GOATRollup from opaque or centralized competitors.

The Road Ahead: Scaling Bitcoin’s Future with Zero-Knowledge Proofs

With the mainnet launch on the horizon and testnet data validating its performance claims, GOATRollup is poised to become a foundational layer for Bitcoin-native DeFi. The fusion of BitVM2 and zkMIPS is more than a technical curiosity – it’s a blueprint for how Bitcoin rollup protocols can deliver real, sustainable yield without compromising on decentralization or self-custody.

As capital continues to flow into BTCFi, protocols that offer transparent, non-custodial, and native yield will stand out. At a time when Bitcoin is priced at $121,656.00, capital efficiency is not a luxury but a necessity. GOATRollup’s approach – combining advanced cryptography, decentralized sequencers, and real-time proof systems – could redefine what’s possible for Bitcoin holders seeking yield.

Key Benefits of GOATRollup BitVM2 zkMIPS for BTC Holders

-

Native BTC Yield Without Centralized Custody: GOATRollup enables Bitcoin holders to earn up to 10% APY in real BTC yield by staking BTC, BTCB, or DOGEB, eliminating the need for custodial or synthetic solutions.

-

Real-Time Proof Generation with zkMIPS: The integration of zkMIPS allows for real-time zero-knowledge proofs, reducing the challenge period for off-chain computations from 14 days to under 24 hours, significantly improving security and user experience.

-

Trust-Minimized and Decentralized Infrastructure: By leveraging BitVM2 and a decentralized sequencer network, GOATRollup ensures that yield generation and transaction settlement are fully decentralized and transparent, minimizing counterparty risk.

-

Efficient and Secure Off-Chain Computation: BitVM2 enables arbitrary computation on Bitcoin without changing the Layer 1 protocol, supporting secure, scalable rollups and trust-minimized bridges for BTC holders.

-

Multi-Asset Staking and Yield Options: Users can stake BTC, BTCB, or DOGEB to participate in sequencer incentives, broadening access to yield opportunities across multiple Bitcoin-native assets.

-

Transparent Yield Sources: Yield is generated from sequencer rewards, BTC gas fees, and MEV, with transparent on-chain tracking, ensuring users know exactly how their returns are earned.

For more technical details on zkMIPS and BitVM2, see the official documentation. As the ecosystem matures, expect further innovation in decentralized sequencer incentives, MEV capture, and cross-chain composability – all rooted in the trust-minimized ethos that defines Bitcoin’s next chapter.