Bitcoin’s scaling journey has entered a new era. As BTC trades at $111,922.00, the demand for native yield and trustless DeFi has never been higher. Enter GOAT Rollup: a Bitcoin-native ZK-Rollup built on BitVM2 and zkMIPS, setting a new standard for secure, sustainable BTC yield. This article unpacks how GOAT Network’s technical breakthroughs unlock real Bitcoin yield, all without bridges, synthetic assets, or centralized custody.

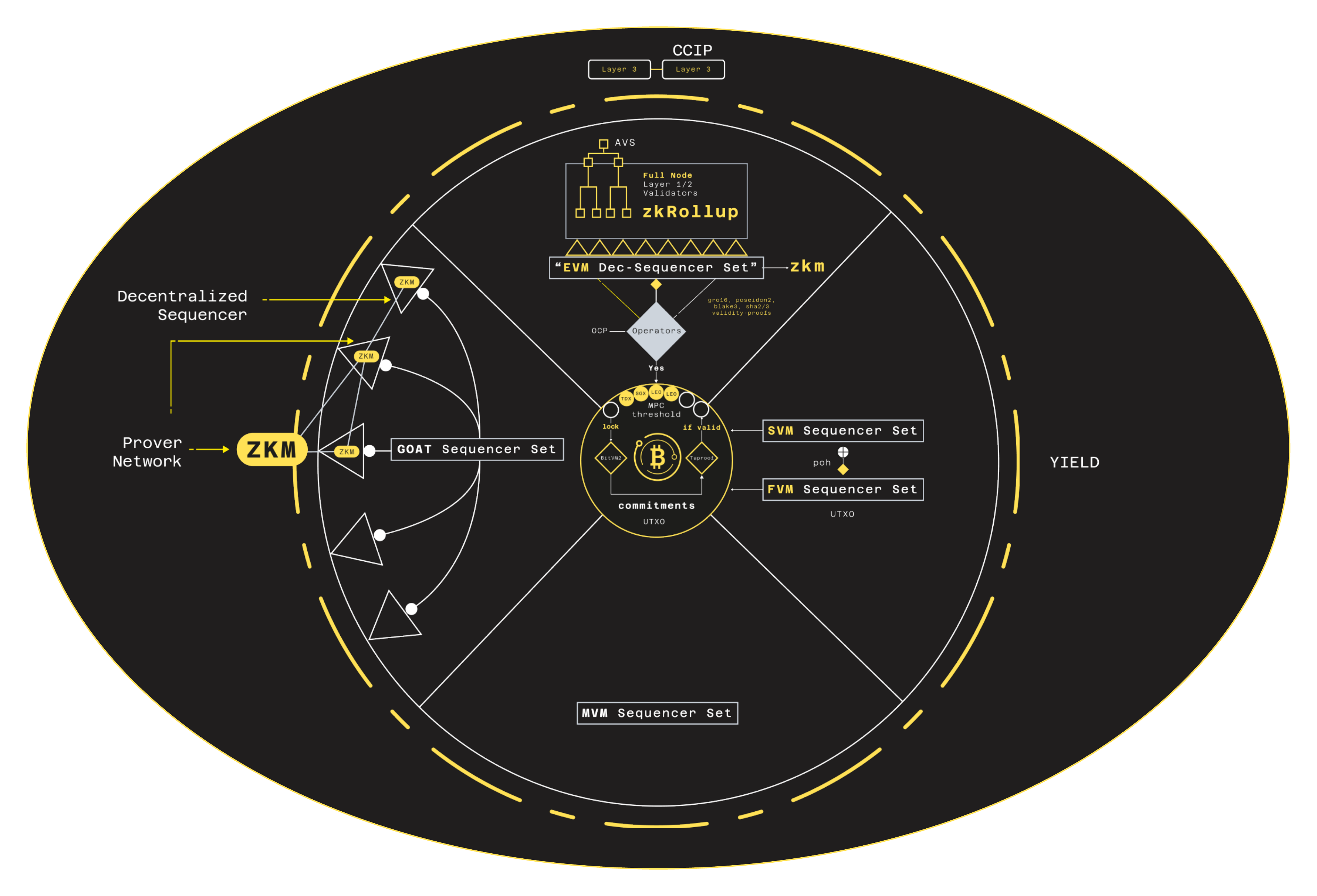

GOAT Network: The First Native Bitcoin ZK-Rollup

GOAT Network’s vision is bold: to make Bitcoin scalable, yield-generating, and DeFi-ready while preserving its core values of security and decentralization. Most so-called Bitcoin Layer 2s fall short, relying on custodial bridges or synthetic representations of BTC. GOAT Rollup changes the equation by leveraging BitVM2 for native security inheritance and zkMIPS for high-speed zero-knowledge proofs. The result is a true ZK-Rollup that operates directly on Bitcoin, with all rewards paid in native BTC.

In July 2025, GOAT launched its BitVM2 Beta Testnet, demonstrating sub-three-second real-time proving using a distributed GPU prover network. This is a game-changer for Bitcoin scaling: block proofs are generated in roughly 2.6 seconds, with aggregation proofs at 2.7 seconds, all running in parallel to match GOAT’s ~3.4-second block time. For users, this means instant peg-outs and seamless transaction finality – a leap forward compared to the hours or days typical of legacy rollup architectures.

Unlocking Native BTC Yield: Sustainable Products at Your Fingertips

While Ethereum DeFi has long offered yield opportunities (often with layered risk), Bitcoin holders have been left watching from the sidelines. GOAT Network’s BTC Yield Dashboard changes that by introducing sustainable, chain-level yield products:

- GOAT Safebox: Lock your BTC for three months in an enterprise-grade timelock to earn 2% APY in native BTC. No bridges, no DeFi risk, just pure protocol-level yield.

- BTCB/DOGEB Vault: For those seeking higher returns, deposit BTCB or DOGEB on BNB Chain and earn 5% APY, backed by real gas fees and sequencer rewards.

- Sequencer PoS Staking: In partnership with Artemis Finance, stake BTC, BTCB, or DOGEB permissionlessly to earn up to 10% APY via sequencer rewards, BTC gas fees, and MEV extraction.

- BTC Lending: With Avalon Finance, deposit BTC or LSTs to earn yield or borrow against them with flexible terms, maximizing returns while maintaining liquidity.

These products are not just marketing hype; they represent a fundamental shift in how Bitcoin holders can put their assets to work natively, without sacrificing custody or security. For more details on the BTC Yield Dashboard, see the official release at GlobeNewswire.

Bitcoin (BTC) Price Prediction 2026-2031

Professional BTC Price Forecast Incorporating Native Yield and ZK-Rollup Adoption (Post-GOAT Network Launch)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $92,000 | $130,000 | $175,000 | +16% | GOAT Network yield products gain adoption, BTC L2 narrative grows; volatility from regulatory reviews |

| 2027 | $110,000 | $155,000 | $220,000 | +19% | Sustained BTCFi growth, broader DeFi integration, institutional allocations increase |

| 2028 | $125,000 | $178,000 | $265,000 | +15% | Mainstream adoption of BTC yield, regulatory clarity, competition from ETH L2s |

| 2029 | $148,000 | $210,000 | $320,000 | +18% | Bullish macro environment, BTC as reserve asset narrative strengthens, halving effect priced in |

| 2030 | $135,000 | $245,000 | $390,000 | +17% | Peak L2 scaling, high real yield demand, possible speculative excess |

| 2031 | $180,000 | $278,000 | $420,000 | +13% | Market matures, stable yield products, robust regulatory framework |

Price Prediction Summary

Bitcoin’s price is projected to trend upward from 2026 through 2031, driven by the adoption of native BTC yield products (e.g., via GOAT Network), enhanced scalability from zkRollup tech, and increasing institutional interest. While volatility and regulatory developments may induce short-term corrections, the overall outlook is bullish with average annual gains of 13-19%. Bearish scenarios reflect potential setbacks in adoption or unfavorable macro/regulatory shifts, while bullish scenarios price in mass adoption of BTC-native financial products and increasing narrative strength as a digital reserve asset.

Key Factors Affecting Bitcoin Price

- Adoption and success of GOAT Network and other BTC-native yield platforms

- Advancements in ZK-Rollup and BitVM2 technology, improving scalability and utility

- Regulatory clarity and institutional acceptance of BTCFi products

- Macro-economic trends (e.g., inflation, monetary policy, global liquidity)

- Competition from other L1/L2 chains (notably Ethereum and emerging BTCFi protocols)

- Bitcoin halving cycles and network security incentives

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Technical Innovations: BitVM2, zkMIPS, and Decentralized Sequencers

The secret sauce behind GOAT Rollup’s performance lies in its robust technical stack:

- zkVM (Ziren): A high-speed zkVM powering the proving pipeline for low-latency execution and parallelizable proving. Learn more at zkm.io.

- BitVM2: A practical challenge model that slashes withdrawal challenge periods from two weeks to under one day, crucial for both user experience and economic security. Details are available at ChainCatcher.

- Decentralized Sequencers: Operators stake BTC directly in the protocol, with transaction fees denominated in BTC. This multi-asset PoS consensus ensures that on-chain revenue flows back to nodes and stakers in real Bitcoin, not synthetic tokens.

Together, these innovations create a bridge-free, natively secure infrastructure for Bitcoin DeFi (BTCFi). The result: a sustainable economic model where yield is paid in actual BTC, no wrappers, no rehypothecation risk.

Bitcoin Technical Analysis Chart

Analysis by Julian Farrow | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

Draw a dominant downtrend line from the recent October 2025 high near $126,000 to the current price area at $111,864. Mark horizontal support at $110,000 (recent wick low), $105,262 (recent session low), and resistance at $116,000 and $119,400. Use rectangles to highlight the sharp sell-off zone from $122,000 to $111,000. Add an arrow marker at the latest major red candle to emphasize the breakdown. Use a callout to note the recent high volatility and possible capitulation wick. Place a text label at the $111,864 level referencing the medium-term support test.

Risk Assessment:medium

Analysis: The chart shows high volatility and a clear shift in short-term momentum to the downside, but the presence of a long lower wick and strong support at $110,000 provide a potential base for stabilization.Macro/fundamental tailwinds (GOAT Network/Bitcoin L2 narrative) are supportive but not immediately offsetting technical damage.

Julian Farrow’s Recommendation: Wait for price to stabilize above $110,000 before increasing exposure.Aggressive traders could try to fade the panic with tight stops,but risk remains elevated until a reclaim of $116,000.

Key Support & Resistance Levels

📈 Support Levels:

- $110,000 – Recent wick low,key psychological and technical level after capitulation.strong

- $105,262 -24h low;if breached opens path to sub-$105,000.moderate

📉 Resistance Levels:

- $116,000 – Initial resistance after breakdown,recent consolidation zone.moderate

- $119,394 -24h high,marks upper bound of breakdown move.moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

- $111,000 – Speculative long entry if price stabilizes and forms a base above $110,000 support.medium risk

🚪 Exit Zones:

- $116,000 – Take profit at first resistance after recovery.💰 profit target

- $105,000 – Stop loss below last session’s low to protect against further downside.🛡️ stop loss