Bitcoin’s DeFi ambitions have long been limited by scalability and interoperability bottlenecks. Yet, with the BTC price holding steady at $113,391.00, the ecosystem is witnessing a new wave of technical innovation. At the forefront are BitScaler and advanced channel factory frameworks, which are redefining how Bitcoin can serve as a settlement layer for decentralized finance and seamless cross-chain liquidity.

BitScaler: A New Paradigm for Bitcoin DeFi Scaling

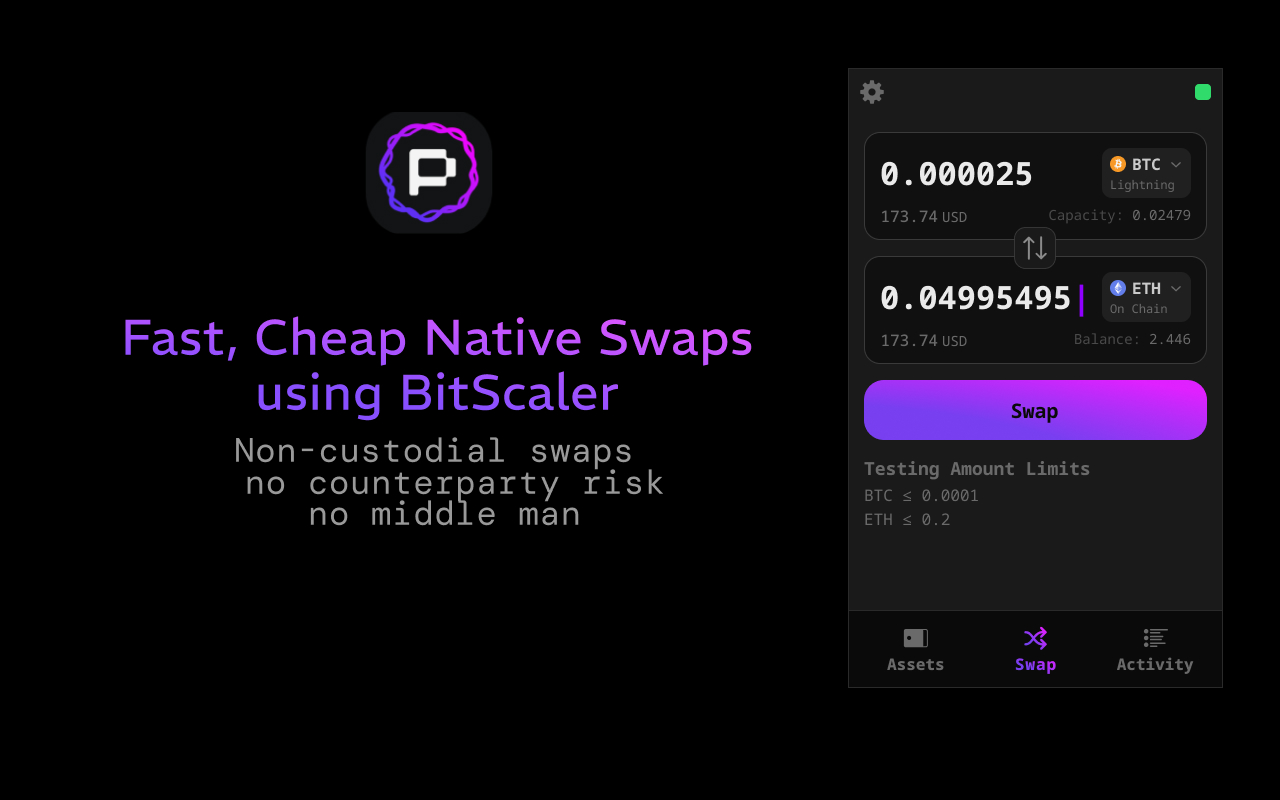

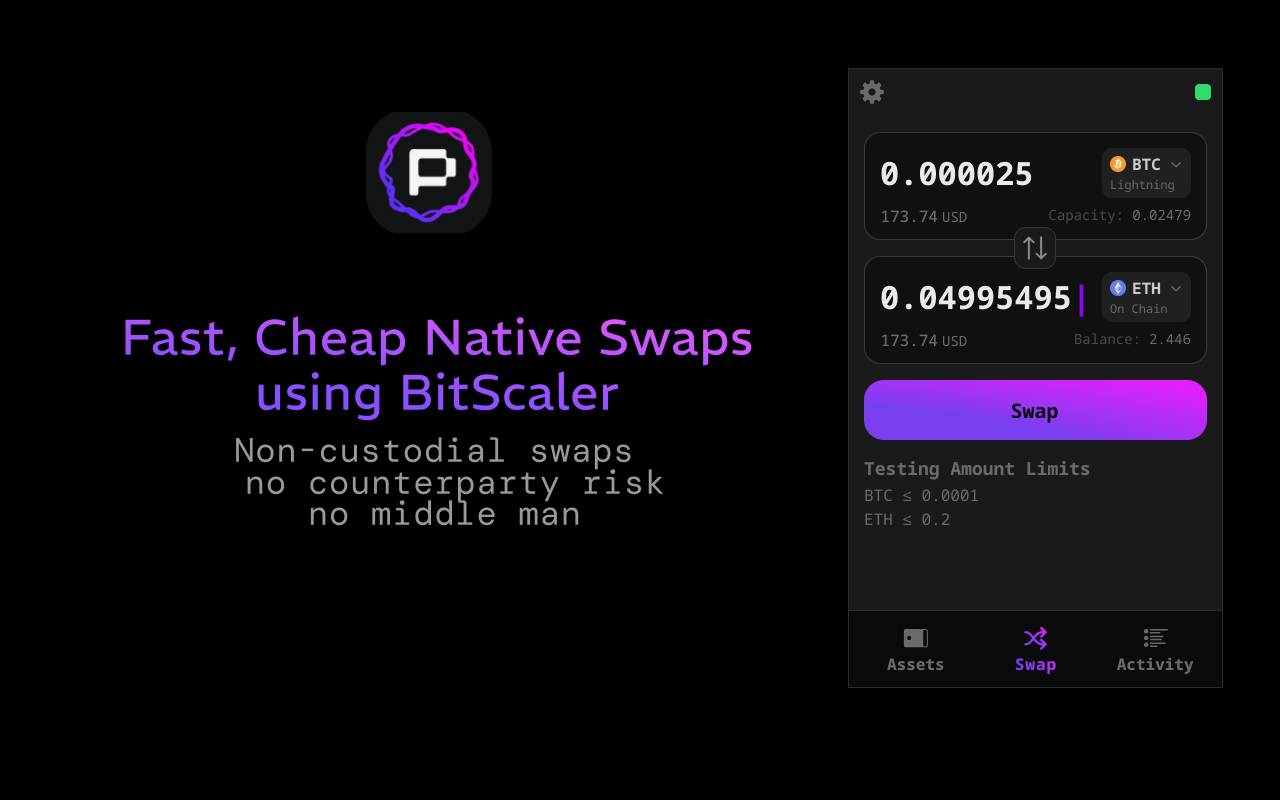

Developed by Portal to Bitcoin, BitScaler is not just an incremental improvement, it’s a leap in how Bitcoin can be used for custodyless cross-chain swaps and native BTC yield generation. Unlike traditional bridges or wrapped assets that expose users to custodial risk, BitScaler leverages modified multi-party channel factories and Taproot scripts to enable thousands of participants to form payment channels via a single on-chain transaction. This approach slashes fees and unlocks throughput that rivals even purpose-built smart contract chains.

The core innovation lies in BitScaler’s ability to aggregate liquidity providers (LPs) into scalable pools without requiring every transaction to be broadcast on-chain. Instead, LPs interact within a channel factory, a multi-signature contract where off-chain transactions can flow freely among participants. This design is foundational for automated market makers (AMMs), lending protocols, and trust-minimized asset transfers directly on the Bitcoin base layer.

Channel Factories: Scaling Lightning Network for Real-World DeFi

The concept of channel factories has existed since early Lightning Network discussions, but recent advances have made them much more practical for large-scale DeFi applications. In essence, a channel factory allows multiple users to deposit funds into a single multi-signature address, from there, any two or more participants can open off-chain payment channels with each other without further on-chain footprint. This not only reduces congestion but also minimizes transaction costs at times when block space is at a premium.

For developers and power users, this means the ability to spin up complex financial contracts, from multi-hop swaps to pooled lending, all secured by native BTC and without relinquishing custody. Channel factories are especially powerful when combined with Taproot’s flexible scripting capabilities, which enable more expressive contract logic while maintaining privacy and efficiency.

From Sidelined Asset to Settlement Powerhouse: The Impact of BitScaler at $113,391 BTC

The rise of BitScaler comes at a critical moment as Bitcoin continues trading above six figures. With $113,391.00 now the reference point for institutional flows and retail adoption alike, demand for scalable infrastructure has never been higher. Traditional DeFi protocols often sideline Bitcoin in favor of faster L1s or rollup-centric ecosystems due to high fees and slow confirmations; BitScaler is designed specifically to reverse this trend.

By consolidating thousands of peer-to-peer transactions into minimal on-chain operations, thanks to its modified channel factory architecture, BitScaler transforms Bitcoin into an efficient backbone for cross-chain liquidity routing and decentralized trading venues. The protocol’s non-custodial signing delegation allows users to participate in complex financial contracts without ever giving up control over their private keys or funds.

Key Benefits of BitScaler Over Traditional Bridges

-

True Non-Custodial Cross-Chain Transfers: BitScaler enables atomic swaps and cross-chain liquidity without relying on third-party custodians, eliminating the risks associated with bridge hacks and centralized intermediaries.

-

Massive Fee Reduction via Channel Factories: By leveraging multi-party channel factories, BitScaler consolidates thousands of payment channels into a single on-chain transaction, dramatically lowering transaction fees compared to traditional bridges that require numerous on-chain operations.

-

Enhanced Scalability and Throughput: BitScaler’s architecture allows for high transaction throughput and near-instant settlement, making it possible to support large-scale DeFi applications directly on Bitcoin’s base layer.

-

Taproot Integration for Privacy and Efficiency: Utilizing Taproot scripts, BitScaler improves transaction privacy and efficiency, unlike most bridges that do not natively benefit from Bitcoin’s latest protocol upgrades.

-

Elimination of Bridge-Related Security Vulnerabilities: Traditional bridges are frequent targets for exploits; BitScaler’s trustless, on-chain design minimizes attack surfaces and leverages Bitcoin’s robust security model.

-

Seamless Integration with Bitcoin DeFi Ecosystem: BitScaler empowers decentralized applications, AMMs, and liquidity pools to operate natively on Bitcoin, positioning BTC (current price: $113,391.00) as a true settlement layer for DeFi without external dependencies.

This shift isn’t just theoretical; it’s already attracting major capital allocations as evidenced by Portal’s recent $50M funding round (source). Investors recognize that true DeFi on Bitcoin must combine security with scale, exactly what BitScaler delivers through its innovative use of channel factories.

As the market absorbs the implications of Bitcoin’s robust $113,391.00 price point, the competitive edge of BitScaler becomes clear: it unlocks native BTC liquidity for DeFi protocols without forcing users to leave the Bitcoin security model or trust external custodians. This is a significant step forward from legacy cross-chain bridges that have historically been plagued by exploits and systemic risks.

Custodyless Cross-Chain Swaps and Native BTC Yield

Perhaps most compelling is BitScaler’s ability to facilitate custodyless cross-chain swaps. By leveraging atomic swap technology within channel factories, users can trade assets between Bitcoin and other blockchains, without intermediaries or wrapped tokens. This paves the way for a new era of non-custodial, permissionless DeFi where native BTC can be used directly in lending markets, AMMs, and synthetic asset platforms.

With non-custodial signing delegation now possible, institutional desks and retail participants alike can delegate transaction execution while retaining full control over their funds. This removes one of the last major barriers to mainstream institutional adoption of Bitcoin-based DeFi strategies.

Real-World Use Cases: DeFi Without Compromise

The impact of BitScaler and channel factories is already being felt across several high-value use cases:

DeFi Protocols Leveraging BitScaler for BTC Yield & Swaps

-

Portal to Bitcoin: As the creator and primary implementer of BitScaler, Portal to Bitcoin enables native BTC yield generation and cross-chain atomic swaps directly on Bitcoin’s base layer. Through its multi-party channel factories, Portal supports non-custodial liquidity pools and AMM functionality, allowing users to earn yield and swap assets across blockchains without relying on centralized bridges.

-

Portal AMM Pools: Within the Portal ecosystem, AMM pools powered by BitScaler allow liquidity providers to deposit BTC and participate in yield-generating strategies. These pools utilize Taproot-enabled channel factories for efficient, trust-minimized swaps and liquidity provision, making Bitcoin a viable settlement layer for DeFi.

-

Cross-Chain Atomic Swap Integrations: BitScaler’s architecture is being adopted to facilitate bridgeless cross-chain swaps between Bitcoin and assets on networks like Ethereum and Polygon. By leveraging BitScaler-enabled channel factories, these integrations provide fast, low-fee, and secure asset transfers, expanding BTC’s role in the broader DeFi landscape.

For example, automated market makers (AMMs) on Bitcoin can now operate with pooled liquidity from thousands of LPs, enabling efficient swaps at lower cost than ever before. Lending protocols can offer native BTC collateralization without requiring users to bridge assets or interact with wrapped tokens. Even tokenized real-world assets become feasible as collateral within these scalable multi-party channels.

“BitScaler isn’t doing the same old thing. . . cross-chain liquidity while staying fully self-custodied. The game-changer? Channel factories. ”. @Habibiofcrypto1

Security, Scale, and Sustainable Growth

The architecture underpinning BitScaler ensures that every transaction remains secured by Bitcoin’s base layer consensus, no shortcuts or compromises on trust assumptions. Taproot integration further enhances privacy and contract flexibility, allowing sophisticated financial logic to execute off-chain while remaining enforceable on-chain if disputes arise.

This combination of security and scalability positions Bitcoin not just as a store-of-value but as a true settlement powerhouse for global finance. As more capital flows into custodyless DeFi solutions, and with $113,391.00 serving as both a psychological and technical anchor, the network effects are poised to accelerate dramatically.

Looking Ahead: The Future of Bitcoin Scaling Solutions

The evolution driven by BitScaler and channel factories demonstrates that scaling solutions need not compromise on decentralization or user sovereignty. As these technologies mature, we’re likely to see an explosion in both developer experimentation and end-user adoption, especially as new primitives like zkBTC rollups begin integrating with these frameworks.

For developers seeking to build on this momentum, resources such as the BitScaler documentation offer a deep dive into implementation details and best practices for maximizing throughput while minimizing risk.

If the current trajectory holds, and with institutional capital signaling strong conviction, Bitcoin’s role in decentralized finance could soon rival or even surpass its status as digital gold. The synergy between BitScaler’s advanced channel factory protocol and Lightning Network innovations may well define the next chapter in custodyless finance at scale.