Bitcoin’s entry into decentralized finance (DeFi) has historically been hamstrung by an uncomfortable compromise: to access yield, lending, or composable protocols, BTC holders had to surrender their native coins for wrapped tokens or trust third-party bridges. This model, while functional, introduced custodial risk, fragmented liquidity, and exposed users to exploits that have cost the ecosystem billions. With Bitcoin now trading at $110,707.00, the stakes for secure and scalable integration into DeFi are higher than ever.

But 2025 marks a paradigm shift. New protocols are unlocking native Bitcoin liquidity in DeFi using zero-knowledge proofs and advanced cryptography – no wrapping, no bridges, and no compromise on security or decentralization. This article examines how zkBTC rollups and related innovations are reshaping programmable Bitcoin and scaling solutions for a new era of trust-minimized finance.

From Wrapped BTC to Native Integration: Why the Old Model Is Obsolete

Wrapped BTC (WBTC) and federated bridges once served as the only conduit between Bitcoin’s $2T and market cap and DeFi’s composability. However, these models rely on custodians or multi-signature schemes that create honeypots for attackers. Recent high-profile bridge hacks have demonstrated that even “trust-minimized” federations can fail under pressure.

As DeFi matures beyond its experimental phase and institutional capital enters the space, demand is surging for solutions that:

- Eliminate counterparty risk

- Preserve native BTC custody

- Enable seamless cross-chain functionality

The new wave of Bitcoin rollups and zkBTC protocols directly address these pain points by leveraging cryptographic proofs instead of trust in humans or centralized entities.

zkBTC: The Core Innovations Powering Native Bitcoin DeFi

The architecture behind zkBTC is built on two pillars: zero-knowledge proofs (ZKPs) and advanced multi-party computation (MPC). These technologies enable verification of real BTC ownership across chains without exposing private keys or requiring asset wrapping.

- Lightec’s zkBTC Bridge: Launched in July 2025 on mainnet, it allows users to move BTC onto Ethereum-based DeFi dApps without intermediaries. ZKPs validate that deposited BTC exists on-chain before enabling liquidity provision or collateralization.

- dWallet and Avail Native Rollups: By integrating MPC with Avail’s data availability layer, this solution lets users control their BTC directly within rollup environments – no wrapping required. Security is rooted in distributed key management rather than centralized custody.

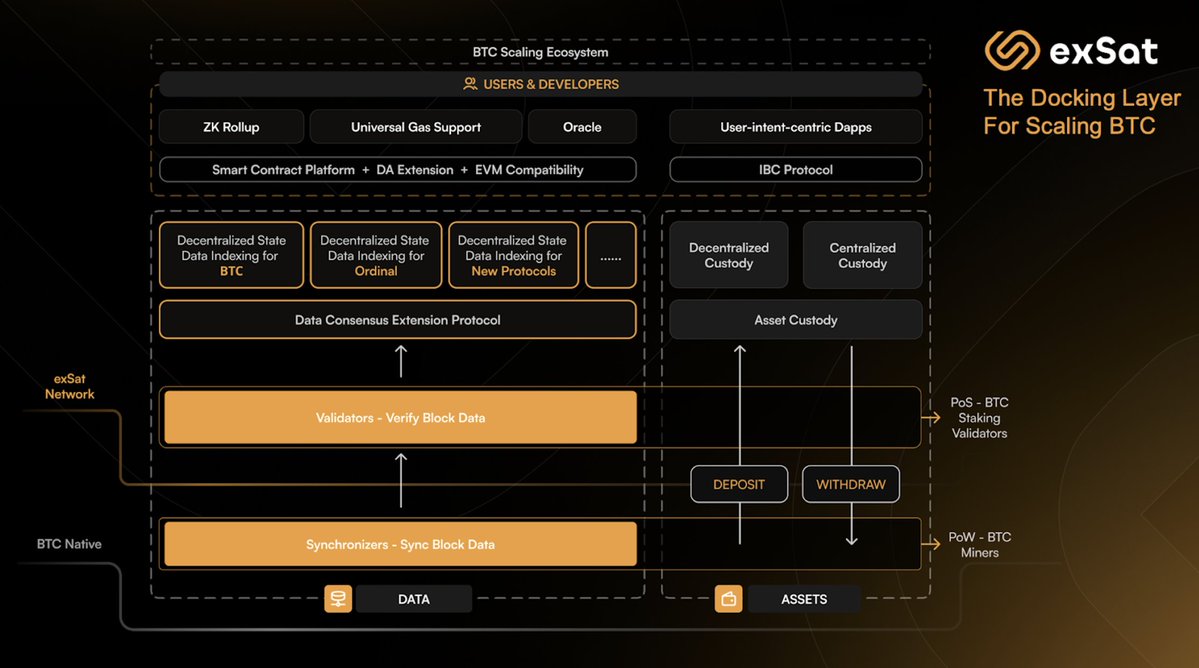

- Elastos BeL2 Protocol: Arbiter nodes verify transaction proofs between Bitcoin and EVM chains using ZKPs. This enables direct collateralization of native BTC while minimizing congestion and gas costs.

- Zeus Network’s BitcoinKit: Designed for Solana developers, this toolkit provides primitives for integrating native BTC into DEXs and lending protocols – with no wrapped tokens or custodians involved.

Bitcoin Technical Analysis Chart

Analysis by Harper McAllister | Symbol: BINANCE:BTCUSDT | Interval: 4h | Drawings: 7

Technical Analysis Summary

Aggressively mark the steep downtrend from early October 2025, then highlight the bottoming and sideways-to-slightly-bullish recovery into early November. Use horizontal lines to map out the key breakdown ($120,000) and local bottom ($106,000), and trend lines for the lower highs and higher lows forming a potential wedge. Draw rectangles for the accumulation range near $110,000. Annotate potential breakout and breakdown zones with arrows, and add callouts for the major sharp drop and subsequent recovery attempts. Include hypothetical long/short entry bands around $110,500 and $116,000 based on observed volatility.

Risk Assessment:high

Analysis: Volatility remains elevated post-capitulation, with no decisive trend direction restored.

aaa The aggressive accumulation could lead to a sharp move in either direction,

aaa favoring high-risk,

aaa high-reward plays.

aaa

Harper McAllister’s Recommendation: Trade aggressively around $110,500 support for scalps,

but size down and use tight stops.

aa Watch for breakout above $116,000 for a trend reversal,

or a breakdown below $106,000 for renewed downside.

aa

The promise of “No wrapped BTC. No bridges. No BS. ” isn’t just marketing hype – it reflects a fundamental advance in user experience (UX) for cross-chain finance. Instead of depositing coins into a black box controlled by a federation or smart contract administrator, users retain full control over their UTXOs at all times.

This approach also radically reduces attack surfaces:

- No single point of failure from custodians

- No need to audit complex bridge codebases prone to bugs

- No synthetic assets vulnerable to depegging events

The result is a system where native Bitcoin can interact with smart contracts on Ethereum, Solana, Cardano, NEAR and other chains – all without leaving the security perimeter of the original network.

Cryptocurrency Price Comparison: Native BTC vs Wrapped/Bridged Solutions (6-Month Performance)

Comparing the 6-month price performance of native Bitcoin and major wrapped/bridged assets relevant to DeFi integration, using real-time data as of 2025-11-02.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Bitcoin (BTC) | $110,594.00 | $94,500.00 | +17.0% |

| Wrapped Bitcoin (WBTC) | $110,682.00 | $94,600.00 | +16.9% |

| RenBTC (RENBTC) | $10,664.71 | $9,000.00 | +18.5% |

| Staked Bitcoin (STBTC) | $109,951.00 | $94,000.00 | +17.0% |

| Ethereum (ETH) | $3,871.15 | $3,200.00 | +21.0% |

| Litecoin (LTC) | $100.13 | $85.00 | +17.8% |

| Solana (SOL) | $185.14 | $150.00 | +23.4% |

| Zcash (ZEC) | $403.08 | $350.00 | +15.2% |

Analysis Summary

Over the past six months, both native Bitcoin (BTC) and its wrapped/bridged counterparts (WBTC, RENBTC, STBTC) have shown strong and nearly parallel price appreciation, with gains ranging from +16.9% to +18.5%. Major DeFi assets like Ethereum and Solana outperformed BTC in this period, while Litecoin and Zcash posted slightly lower but still robust gains. This parallel performance underscores the close market tracking between native and wrapped BTC, even as new native BTC DeFi solutions emerge.

Key Insights

- Native BTC and wrapped/bridged BTC assets (WBTC, RENBTC, STBTC) have moved nearly in lockstep, reflecting similar investor confidence and market demand.

- RenBTC showed the highest 6-month gain among BTC derivatives at +18.5%, slightly outperforming native BTC.

- Ethereum and Solana, as leading DeFi platforms, outpaced BTC and its derivatives in price appreciation over the last six months.

- The emergence of native BTC DeFi solutions (e.g., zkBTC, rollups, direct collateralization) is reducing reliance on wrapped/bridged assets, potentially shifting future market dynamics.

All prices and percentage changes are sourced directly from the provided real-time market data as of 2025-11-02. The table compares current prices to those from exactly six months prior, ensuring consistency and accuracy in performance measurement.

Data Sources:

- Main Asset: https://www.coinbase.com/bitcoin-halving

- Wrapped Bitcoin: https://www.coinbase.com/bitcoin-halving

- Ethereum: https://www.coinbase.com/bitcoin-halving

- RenBTC: https://www.coinbase.com/bitcoin-halving

- Staked Bitcoin: https://www.coinbase.com/bitcoin-halving

- Litecoin: https://www.coinbase.com/bitcoin-halving

- Solana: https://www.coinbase.com/bitcoin-halving

- Zcash: https://www.coinbase.com/bitcoin-halving

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Bitcoin (BTC) Price Prediction 2026-2031: Impact of Native DeFi Integration

Forecasting BTC price evolution as native DeFi integration matures and reshapes market dynamics. Based on BTC price as of November 2025: $110,707.

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $89,000 | $128,000 | $165,000 | +15.6% | DeFi adoption accelerates, regulatory clarity improves |

| 2027 | $105,000 | $152,000 | $198,000 | +18.8% | Institutional inflows, native BTC DeFi protocols mature |

| 2028 | $130,000 | $180,000 | $230,000 | +18.4% | Mainstream DeFi use of BTC, ETF expansion, new use cases |

| 2029 | $150,000 | $210,000 | $270,000 | +16.7% | Global macro adoption, CBDC integration, competitive L2 solutions |

| 2030 | $176,000 | $245,000 | $320,000 | +16.7% | Peak DeFi utility, robust cross-chain infrastructure |

| 2031 | $195,000 | $280,000 | $370,000 | +14.3% | BTC as core DeFi collateral, mature regulation, global trust |

Price Prediction Summary

Bitcoin’s integration into DeFi without wrapping or bridges is a transformative shift that unlocks new demand for BTC as yield collateral and financial infrastructure. This innovation, alongside continued institutional adoption and maturing regulation, is expected to drive steady price appreciation through 2031. While market cycles and macro risks remain, the expanding utility of native BTC in DeFi offers strong price support and upside potential.

Key Factors Affecting Bitcoin Price

- Expansion of native BTC DeFi protocols and use cases (e.g., zkBTC, rollups, BitcoinKit)

- Sustained institutional and retail demand for BTC collateral in decentralized finance

- Regulatory clarity in major economies (US, EU, Asia)

- Global macroeconomic environment and inflationary pressures

- Competition from alternative L1s and DeFi assets

- Advances in zero-knowledge proofs and secure cross-chain technology

- Potential black swan events or systemic risks in crypto markets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For developers and power users, the shift to native Bitcoin DeFi is about more than just risk reduction. It unlocks new composability: BTC can serve as collateral, liquidity, or programmable money across multiple ecosystems without ever being abstracted into a synthetic token. The user experience is streamlined, with simple deposit/withdrawal flows and no reliance on off-chain attestations or third-party signatures.

Protocols like Lightec’s zkBTC Bridge and Elastos’ BeL2 Protocol are setting new standards for cross-chain interoperability. Using zero-knowledge proofs and MPC, these solutions prove the existence and movement of native BTC in a decentralized manner. The result is a system where users’ funds remain verifiably secure – not just by design, but by mathematical certainty.

Ecosystem Impact: How Native BTC Is Reshaping DeFi Liquidity

The broader market implications are significant. With Bitcoin trading at $110,707.00, even a small percentage of on-chain BTC flowing into DeFi protocols represents billions in potential liquidity. In Q1 2025 alone, cross-chain aggregators like Thorchain processed $19.6 billion in native BTC swaps without wrapping – a clear signal that demand for non-custodial solutions is accelerating.

Key Benefits of zkBTC & Native Bitcoin Rollups for DeFi

-

Eliminates Wrapping and Bridges: Native BTC rollups like zkBTC Bridge by Lightec and Elastos BeL2 Protocol enable direct participation in DeFi without relying on wrapped tokens or third-party bridges, reducing counterparty and custodial risk.

-

Enhanced Security and Trust: Solutions such as dWallet & Avail’s Native Bitcoin Rollups use multi-party computation (MPC) and zero-knowledge proofs, ensuring users retain full control over their BTC and minimizing attack surfaces compared to traditional cross-chain solutions.

-

Direct Access to DeFi Yields: With protocols like zkBTC Bridge and BitcoinKit by Zeus Network, BTC holders can earn DeFi yields and utilize lending, staking, and DEXs without converting to wrapped assets, preserving the value and integrity of their BTC holdings (current BTC price: $110,707.00).

-

Lower Fees and Improved Efficiency: Native rollup solutions avoid congestion and high gas fees associated with bridging and wrapping, as demonstrated by Elastos BeL2, which leverages zero-knowledge proofs for efficient cross-chain communication.

-

Institutional-Grade Custody and Validation: Platforms like zkBTC Bridge back assets directly with BTC in institutional custody, validated by cryptographic proofs rather than intermediaries, increasing transparency and auditability for DeFi participants.

This influx of secure, high-value liquidity is already catalyzing new products:

- Lending markets collateralized by real BTC, not IOUs

- Decentralized derivatives with transparent settlement directly on Bitcoin’s ledger

- Yield strategies that don’t require trust in centralized bridge operators

- Programmable vaults and asset management tools leveraging native security guarantees

The composability unlocked by zkBTC rollups also paves the way for more advanced use cases: automated market makers with native BTC pools, cross-chain DAOs managing treasury directly in Bitcoin, and institutional-grade products built atop verifiable cryptographic proofs.

Developer Adoption and Future Outlook: Programmable Bitcoin at Scale

The developer experience is rapidly improving as toolkits like Zeus Network’s BitcoinKit lower the technical barrier to entry. Open-source libraries and robust APIs mean any team can now build DeFi protocols that natively integrate Bitcoin – no wrapped assets required.

This trend will likely accelerate as institutional players seek exposure to DeFi yields while complying with strict custody requirements. By eliminating intermediaries and enabling direct participation with real BTC, these solutions align with both regulatory clarity and user demand for transparency.

The next phase will see further convergence between data availability layers (like Avail), privacy-preserving cryptography (ZKPs), and multi-party computation frameworks – creating an environment where programmable Bitcoin becomes the norm across chains.

Key Takeaways:

- No more wrapped tokens or bridges: Native BTC can now seamlessly enter DeFi ecosystems using ZKPs and MPC.

- User self-custody is preserved: No need to trust federations or custodians; security remains at the protocol level.

- Ecosystem growth is accelerating: Billions in TVL are moving through trust-minimized channels as institutions enter the space.

- The UX gap is closing: Cross-chain transactions are becoming as simple as single-chain operations for end users.

The integration of native Bitcoin liquidity into DeFi isn’t just a technical milestone – it’s a foundational shift in how digital assets move across blockchains. As protocols continue to mature, expect native BTC to become one of the most sought-after forms of programmable money throughout the decentralized economy.