Bitcoin’s $111,430.00 price level in late 2024 reflects not just macro adoption but the rapid maturation of its scaling infrastructure. At the center of this transformation are zkBTC rollups, which leverage zero-knowledge proofs to aggregate and compress transactions, drastically improving Bitcoin transaction scalability and cost efficiency. Unlike earlier Layer 2 solutions, zkBTC rollups introduce cryptographic guarantees that maintain Bitcoin’s core security while enabling throughput previously unattainable on the base layer.

zkBTC Rollups: Technical Leap for Bitcoin Transaction Scalability

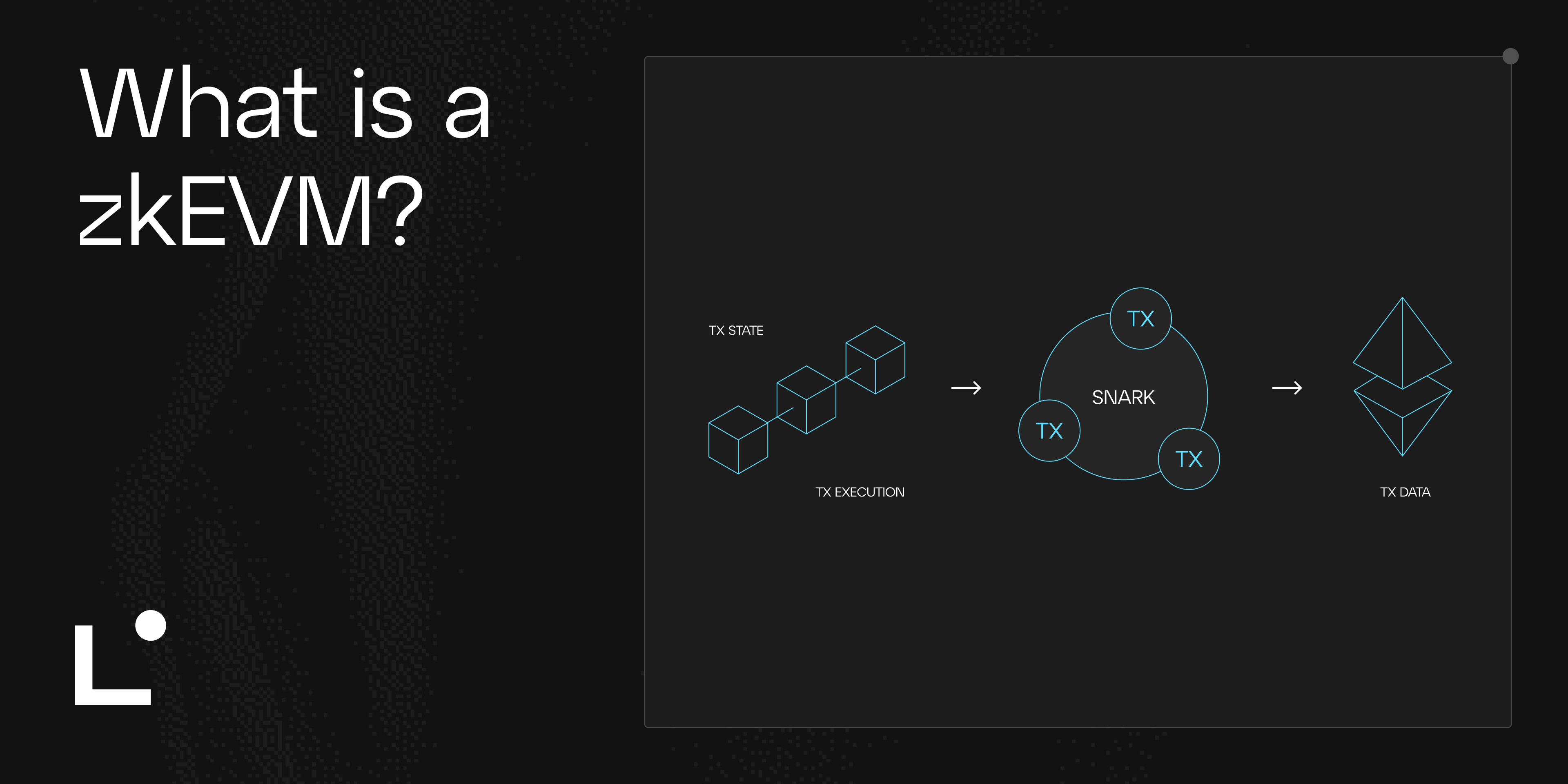

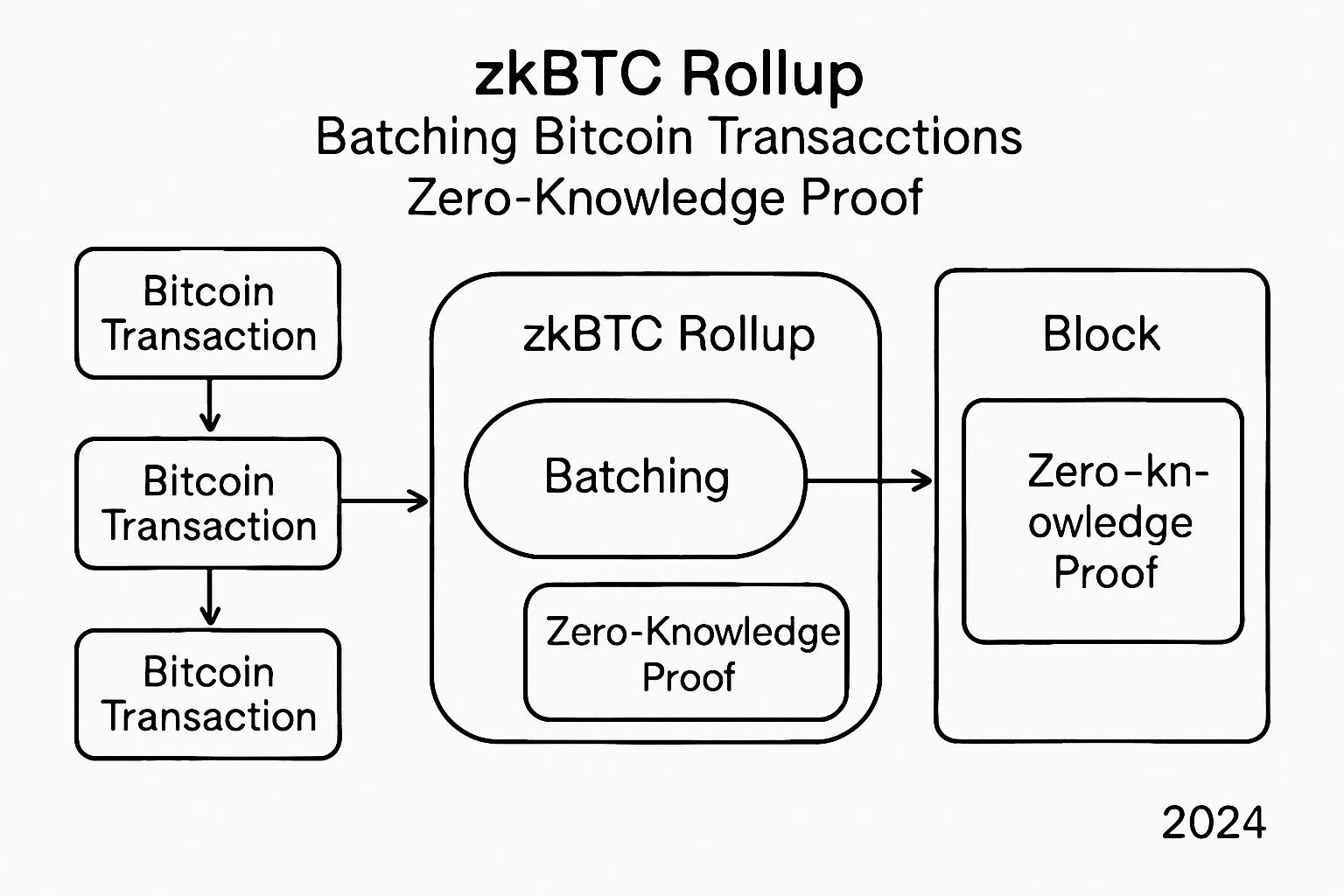

Historically, Bitcoin’s block size and interval constraints limited its throughput to approximately seven transactions per second (TPS). In 2024, zkBTC rollups have redefined these boundaries by batching hundreds or thousands of transactions off-chain and posting succinct validity proofs to the mainnet. This cryptographic mechanism – rooted in zero-knowledge proofs (ZKPs) – enables near-instant settlement finality without sacrificing decentralization or censorship resistance.

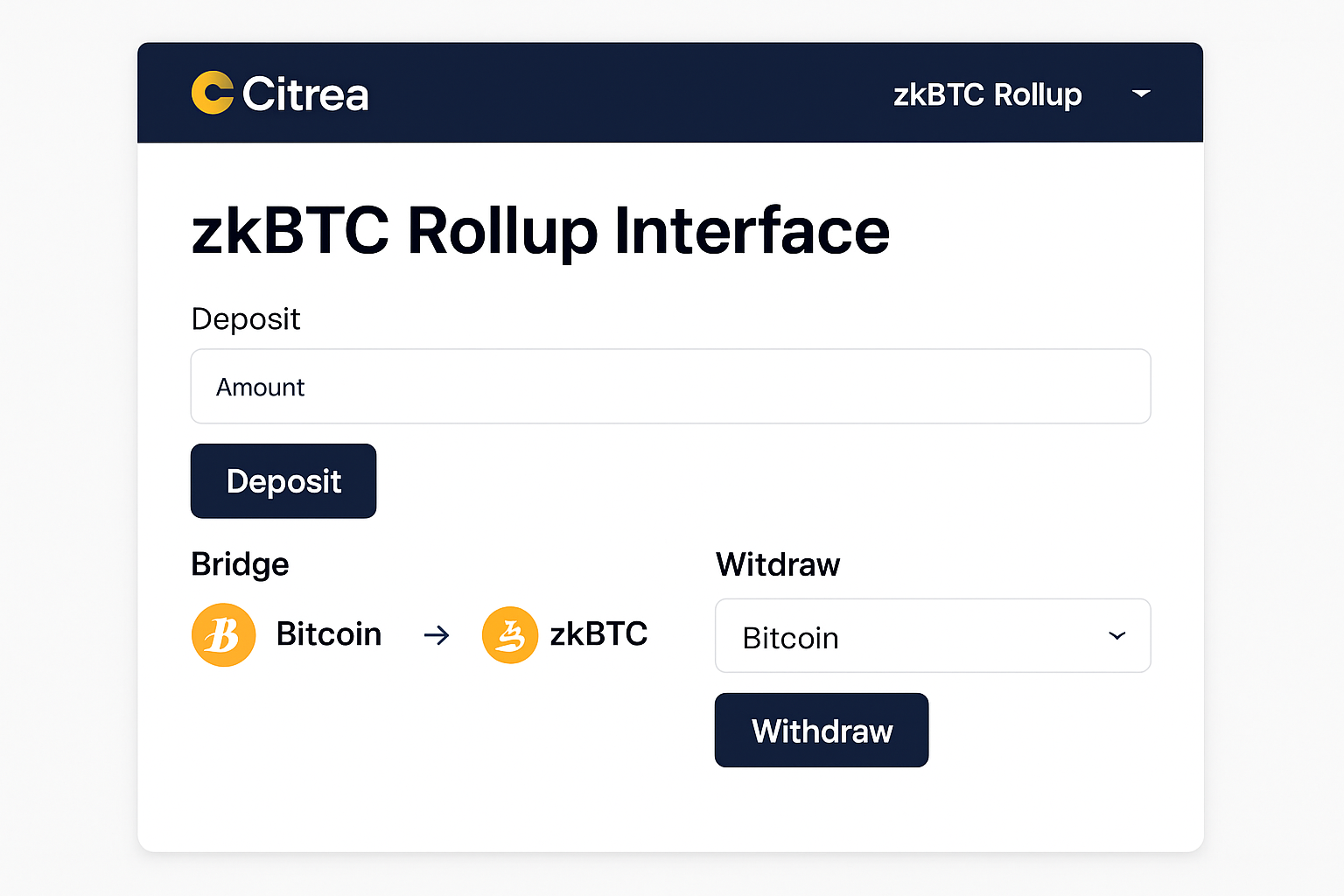

The launch of Citrea, developed by Chainway Labs, marks a pivotal milestone for Bitcoin scaling solutions. Citrea integrates with the Bitcoin Virtual Machine (BitVM), bridging native BTC assets with EVM-compatible smart contracts. In June 2024, Citrea’s public devnet went live, inviting developers to test scalable DeFi and cross-chain applications directly on Bitcoin’s security foundation. The project’s $2.7 million seed round underscores investor confidence in zero-knowledge-based rollup protocols as a path forward for mainstream adoption.

From Seven to Seven Hundred TPS: Quantifying the Throughput Revolution

The impact is quantifiable: validity rollups can theoretically scale Bitcoin’s TPS by two orders of magnitude. Recent research suggests that zkBTC rollups could enable throughput exceeding 700 transactions per second, compared to today’s average of seven. This improvement isn’t just academic, it translates into reduced congestion during peak periods and lower transaction fees for end users.

The underlying innovation lies in how zkBTC rollups compress data off-chain while maintaining verifiable state transitions on-chain via succinct ZKPs. Only minimal data is posted to the mainnet, typically a proof and a small set of metadata, dramatically reducing block space consumption per transaction batch.

Bitcoin (BTC) Price Prediction Table Post-zkBTC Rollup Adoption (2026-2031)

Forecasts based on the latest market data, scalability advancements, and projected adoption trends following zkBTC Rollup integration.

| Year | Minimum Price | Average Price | Maximum Price | Estimated Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $95,000 | $130,000 | $170,000 | +17% | Range reflects potential post-bull market correction or continued adoption gains; high volatility expected. |

| 2027 | $110,000 | $155,000 | $210,000 | +19% | Adoption of zkBTC Rollups boosts transaction throughput; institutional interest drives higher average. |

| 2028 | $125,000 | $180,000 | $260,000 | +16% | Wider DeFi and smart contract activity on Bitcoin Layer 2s; regulatory clarity enhances market confidence. |

| 2029 | $140,000 | $205,000 | $320,000 | +14% | New technological integrations and mainstream use cases emerge; bullish scenario if macro environment is supportive. |

| 2030 | $160,000 | $235,000 | $390,000 | +15% | Potential for Bitcoin as a global settlement layer; increased competition from other scalable blockchains. |

| 2031 | $185,000 | $265,000 | $470,000 | +13% | Mature zkBTC ecosystem with robust Layer 2 applications; price ceiling depends on global economic and regulatory climate. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is shaped by the transformative impact of zkBTC Rollups, which have significantly increased transaction capacity and reduced fees. As Layer 2 adoption grows and new use cases emerge, BTC is poised for substantial long-term appreciation, though not without periods of volatility and correction. The minimum prices reflect potential bearish scenarios such as regulatory headwinds or macroeconomic downturns, while maximum prices illustrate the upside if adoption and technological integration accelerate. Average price projections indicate a positive, but measured, growth trajectory for BTC as it solidifies its role in both traditional and decentralized finance.

Key Factors Affecting Bitcoin Price

- Adoption and maturity of zkBTC Rollups and related Layer 2 solutions

- Regulatory developments and institutional investment trends

- Competition from other scalable blockchain platforms (e.g., Ethereum, Solana)

- Global macroeconomic conditions and monetary policy

- Technological upgrades, including smart contract functionality on Bitcoin

- Market sentiment and cyclical crypto bull/bear trends

- Security, data availability, and decentralization challenges for rollups

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Citrea and the Rise of Native ZK Rollup Ecosystems

While Ethereum has seen rapid Layer 2 innovation with projects like zkSync, Polygon zkEVM, Starknet, and Scroll leading token metrics rankings in 2024, Bitcoin is now catching up through purpose-built zkBTC rollup protocols. Citrea stands out as the first natively integrated ZK Rollup designed specifically for Bitcoin’s UTXO model rather than retrofitting Ethereum-centric architectures.

This native approach preserves full compatibility with existing BTC wallets while enabling composable smart contract logic via BitVM bridges. For developers building next-generation DeFi or NFT platforms on Bitcoin, this unlocks programmability without compromising on-chain auditability or trust minimization.

“zkBTC Rollups are not just scaling solutions, they’re enablers for entire new classes of decentralized applications on Bitcoin. ”

The result is a more dynamic ecosystem where transaction costs are decoupled from mainnet congestion cycles and new use cases become economically viable at scale.

Leading zkBTC and ZK Rollup Projects in 2024

-

Citrea — The first ZK Rollup scaling solution built specifically for Bitcoin, Citrea leverages zero-knowledge proofs and the Bitcoin Virtual Machine (BitVM) to enable Ethereum-compatible applications on Bitcoin. In June 2024, Citrea launched its public devnet, marking a significant milestone for Bitcoin Layer 2 scalability. Developed by Chainway Labs, Citrea raised $2.7 million in seed funding in February 2024.

-

zkSync — A leading ZK Rollup platform originally designed for Ethereum, zkSync is recognized for its high throughput and low fees. Its technology and development have influenced cross-chain rollup designs, including those being explored for Bitcoin scalability.

-

Polygon zkEVM — Polygon zkEVM offers a zero-knowledge Ethereum Virtual Machine compatible rollup, providing EVM equivalence and robust scalability. Its advancements in ZK technology have set benchmarks for Layer 2 scaling across multiple blockchains.

-

Starknet — Powered by STARK-based zero-knowledge proofs, Starknet is a permissionless decentralized ZK Rollup. While focused on Ethereum, its innovations in proof generation and scalability are being referenced in Bitcoin Layer 2 research and development.

-

Linea — Developed by ConsenSys, Linea is a zkEVM-compatible rollup that emphasizes developer experience and scalability. Its architecture and tooling are influencing the broader ZK Rollup ecosystem, including projects targeting Bitcoin integration.

-

Scroll — Scroll is an open-source zkEVM rollup that prioritizes security and EVM compatibility. Its transparent approach and technical rigor make it a reference point for ZK Rollup implementations across multiple chains.

Yet, the journey to seamless Bitcoin transaction scalability is not without its technical and governance challenges. As zkBTC rollups like Citrea push throughput into the hundreds of TPS, data availability and decentralization emerge as critical vectors for risk assessment. Ensuring that transaction data remains accessible to all network participants is essential to prevent censorship or rollback attacks, especially as the volume of off-chain activity grows.

Zero-knowledge proofs introduce new cryptographic assumptions and require robust, decentralized sequencer networks. The composability of zkBTC rollups with existing Bitcoin infrastructure depends on open standards for proof verification and transparent mechanisms for dispute resolution. Projects are experimenting with decentralized data committees and succinct on-chain commitments to mitigate these risks, but the field is still evolving rapidly.

Fee Compression and User Experience: Real-World Impact

One of the most immediate benefits observed in 2024 is fee compression. As more transactions are aggregated into a single batch, per-user costs plummet even during periods of intense network activity. Users transacting on zkBTC rollup-enabled platforms report average fees dropping below $0.10 per transaction, an order-of-magnitude improvement over mainnet rates during congestion spikes. This cost efficiency opens up microtransactions, pay-per-use protocols, and new remittance models that were previously uneconomical on Bitcoin.

The improved user experience extends beyond fees. Transaction confirmation times are reduced from tens of minutes (or longer during mempool backlogs) to near-instant finality on Layer 2, with cryptographic guarantees enforced by ZKPs on mainnet settlement. For institutional users, this means deterministic settlement windows; for retail users, it translates into a frictionless onboarding process rivaling fintech incumbents.

Decentralization Tradeoffs and Security Considerations

The move toward higher throughput via zkBTC rollups does not come without tradeoffs. Data availability remains a central concern: if off-chain data becomes inaccessible or sequencers collude, user funds could be at risk until proper challenge mechanisms are triggered on the base layer. Protocols like Citrea are actively researching decentralized data committees and fraud-proof frameworks to address these vulnerabilities.

Security audits have become more rigorous in 2024 as capital inflows increase alongside protocol complexity. Layer 2 bridges must withstand both cryptographic attacks against ZKPs and economic attacks targeting validator incentives or sequencer liveness assumptions. The open-source nature of leading zkBTC projects invites continuous peer review, a key safeguard as adoption accelerates.

The Road Ahead: Integrating zkBTC Rollups Across Bitcoin’s Ecosystem

The integration trajectory for zkBTC rollups is clear: by late 2024, interoperability standards between Bitcoin-native Layer 2s and cross-chain protocols are being established in earnest. As more wallets add support for BitVM-based assets and zero-knowledge proof verification becomes standardized within node software, end-users will increasingly interact with scalable applications without needing deep protocol knowledge.

This paradigm shift positions Bitcoin not only as a store of value but also as a programmable settlement layer supporting high-throughput DeFi, NFTs, gaming assets, and real-world payments, all while maintaining its core ethos of decentralization and censorship resistance. For developers seeking to build on this foundation or investors tracking the next wave of crypto infrastructure innovation, monitoring zkBTC rollup adoption rates will be paramount.

As we close out 2024 with Bitcoin holding steady above $111,430.00, the maturation of native ZK rollup ecosystems signals that true scalability, and new economic frontiers, are finally within reach for the world’s original blockchain.