As Bitcoin continues to dominate headlines, its network faces a perennial challenge: how to scale transaction throughput without sacrificing security or decentralization. In 2024, zkBTC rollups have emerged as a transformative answer, leveraging zero-knowledge proofs to aggregate hundreds of transactions off-chain and settle them efficiently on the Bitcoin mainnet. This innovation is not just theoretical – it’s already reshaping the landscape for developers, investors, and end users alike.

Bitcoin Maintains Position Above $100,000: Why Scalability Matters More Than Ever

With Bitcoin (BTC) currently trading at $116,439.00, network congestion and high transaction fees are no longer just technical nuisances – they’re critical barriers to mass adoption and innovation. As more users flock to Bitcoin for everything from payments to Ordinals and BRC-20 tokens, the need for robust Bitcoin scaling solutions in 2024 has never been clearer.

This is where zkBTC rollups enter the picture. By bundling transactions off-chain and generating cryptographic proofs that can be quickly verified on-chain, zkBTC rollups dramatically increase throughput while slashing costs. Recent research suggests that these protocols can boost Bitcoin’s transaction capacity from an average of seven per second to more than 700 – a game-changer for both retail payments and DeFi applications (source).

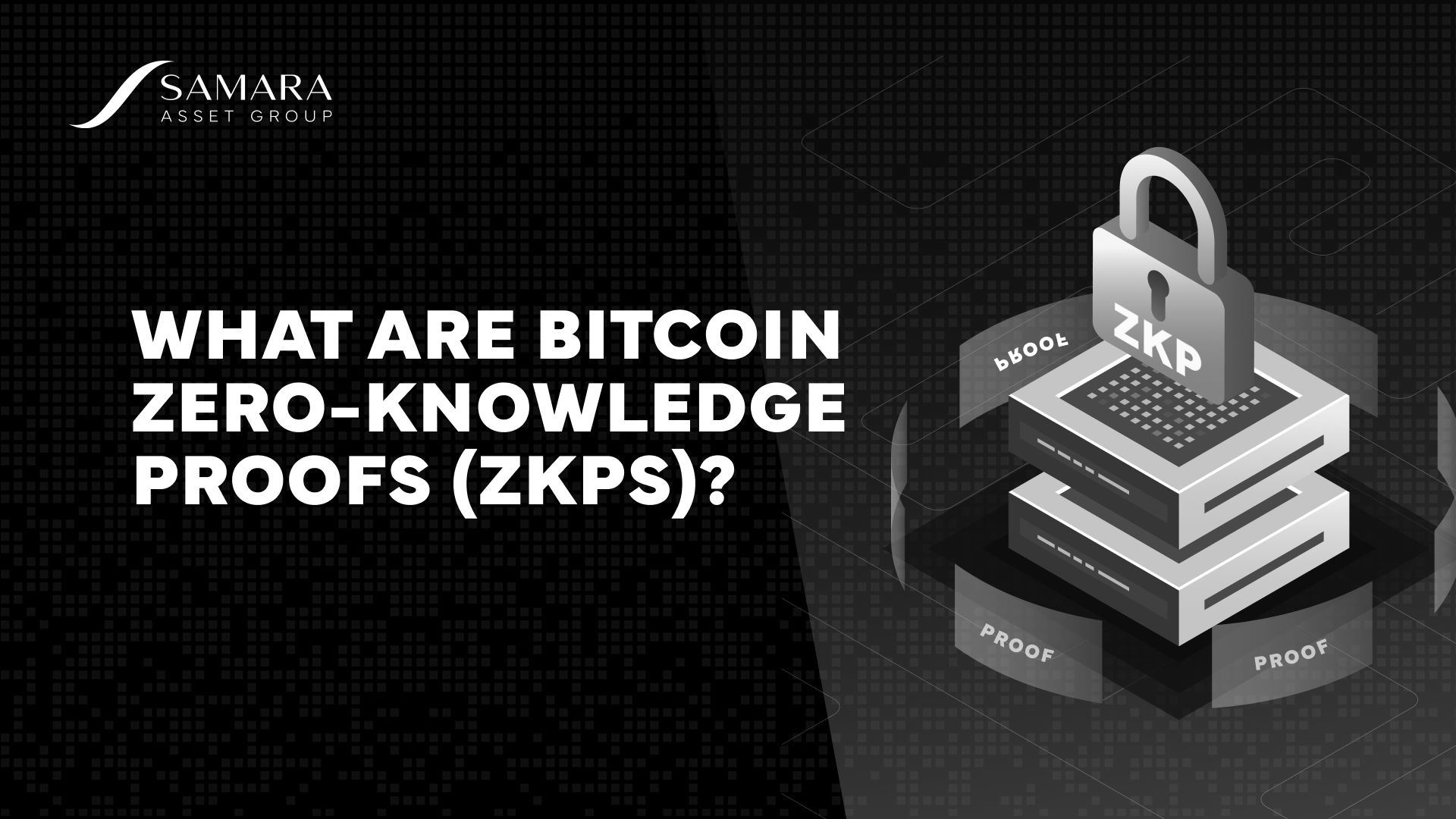

How zkBTC Rollups Work: Zero Knowledge Meets Bitcoin

The core innovation behind zkBTC rollups is the use of zero-knowledge proofs (ZKPs). Instead of posting every transaction directly to the blockchain, zkBTC aggregates them off-chain into a single batch. A succinct proof is then generated to cryptographically guarantee the validity of all transactions in that batch. Only this proof – not each individual transaction – is submitted to the Bitcoin mainnet.

This approach delivers several benefits:

- Dramatic scalability gains: Hundreds or thousands of transactions can be settled with a single on-chain operation.

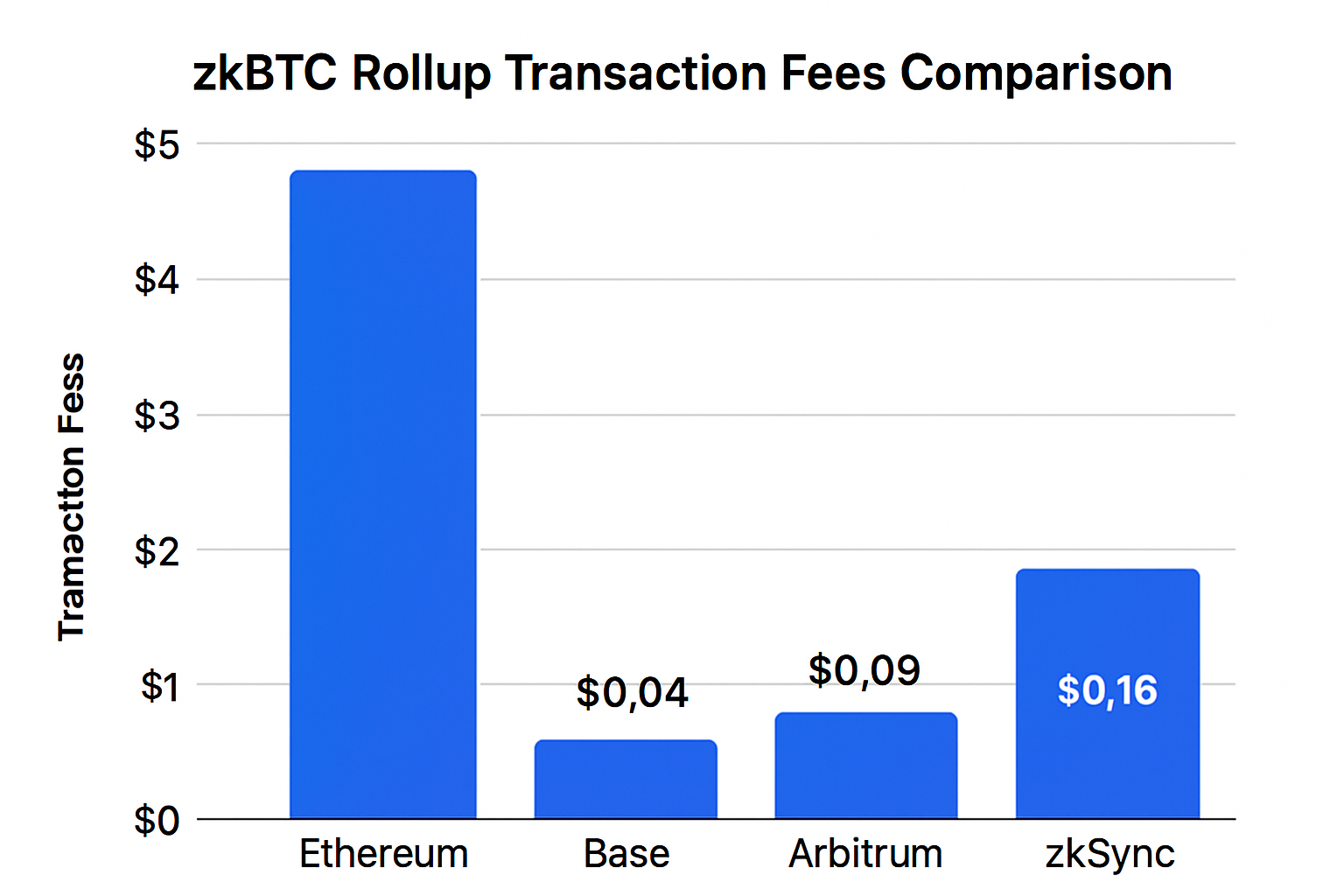

- Lower fees: Users pay only a fraction of what they would for base layer transactions.

- No compromise on security: The integrity of each batch is enforced by Bitcoin’s consensus rules.

The integration with Polygon’s zkEVM further amplifies these advantages, creating a flexible ecosystem for assets like Ordinals and Runes without undermining Bitcoin’s core value propositions (source).

The Rise of Layer-2 Innovation: From Ethereum Lessons to Bitcoin Breakthroughs

The story of rollup technology began with Ethereum’s quest for scalability but has now firmly arrived in the world of BTC. Projects like Starknet and Polygon have demonstrated how zero-knowledge rollups can deliver fast, low-cost transactions while preserving decentralization (source). In 2024, these lessons are being applied directly to Bitcoin via protocols like zkBTC.

This rapid progress isn’t just technical – it’s also cultural. The introduction of NFTs (Ordinals), fungible tokens (BRC-20), and new data formats (Runes) has created both opportunity and friction within the community. By providing scalable infrastructure that accommodates these innovations without bloating the base layer, zkBTC rollups are helping heal rifts between traditionalists and innovators within the BTC ecosystem.

Bitcoin (BTC) Price Prediction 2026–2031: Impact of zkBTC Rollup Adoption

Forecasting BTC price amid increasing zkBTC rollup scalability and ecosystem growth

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $130,000 | $175,000 | +12% | Healthy post-halving consolidation; zkBTC rollup adoption continues, but market faces macro headwinds. |

| 2027 | $110,000 | $157,000 | $210,000 | +21% | Bullish scenario as zkBTC rollups reach mainstream, transaction fees drop, and DeFi/BRC-20 use cases expand. |

| 2028 | $125,000 | $185,000 | $250,000 | +18% | Sustained growth as institutional adoption increases and zkBTC ecosystem matures; regulatory clarity improves. |

| 2029 | $145,000 | $220,000 | $300,000 | +19% | Major Layer-2 and zkBTC-driven innovation; Bitcoin solidifies dominance as scalable digital asset. |

| 2030 | $170,000 | $260,000 | $370,000 | +18% | Peak cycle driven by new applications (e.g., Ordinals, Runes) and global regulatory harmonization. |

| 2031 | $155,000 | $235,000 | $350,000 | -10% | Early bear market/cycle correction; robust zkBTC infrastructure cushions price volatility. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is strongly influenced by the rapid adoption of zkBTC rollups, which drive scalability, lower transaction fees, and enable new innovations on the Bitcoin network. While the average price is projected to steadily rise through 2030, typical crypto market cycles suggest a correction phase by 2031. Both bullish and bearish scenarios are considered in the min/max ranges, reflecting the impact of macroeconomic, regulatory, and technological developments.

Key Factors Affecting Bitcoin Price

- Widespread zkBTC rollup adoption increasing transaction throughput and lowering fees

- Growth of Bitcoin-native assets (Ordinals, Runes, BRC-20 tokens) and DeFi on Bitcoin

- Market cycle timing (post-halving effects, cyclical corrections)

- Institutional adoption and integration with traditional finance

- Regulatory clarity and global harmonization impacting investor sentiment

- Competition from other scalable Layer-1 and Layer-2 solutions

- Potential technological breakthroughs or setbacks in zk rollup technology

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

A Glimpse Ahead: What Mass Adoption Could Look Like

If current momentum holds, we could see mainstream use cases emerge as early as next year. Imagine peer-to-peer payments settling instantly at negligible cost or DeFi protocols launching natively atop BTC using secure ZK infrastructure. With real-time prices holding above $116,000 per coin and institutional interest surging alongside technical progress, few doubt that scalability will be central to Bitcoin’s next act.

Yet, the real-world impact of zkBTC rollups is best seen in their ability to unlock entirely new economic activity on Bitcoin. For years, developers faced a hard ceiling imposed by high fees and slow settlement times. Now, with transaction throughput scaling up to 700 and TPS and fees dropping precipitously, builders are free to experiment with everything from micro-payments to on-chain gaming and complex financial products, all secured by Bitcoin’s battle-tested consensus.

As the network effect grows, so does the diversity of applications. The integration of Ordinals, Runes, and BRC-20 tokens into a scalable layer-2 ecosystem means that Bitcoin is no longer just “digital gold”: it’s a programmable platform for decentralized innovation. This shift is already attracting both legacy institutions and crypto-native teams looking to leverage Bitcoin’s trust-minimized environment for new use cases.

Key Benefits for Developers and Investors: Why zkBTC Rollups Are Gaining Traction

Top Reasons Developers & Investors Are Adopting zkBTC Rollups in 2024

-

Massive Scalability Gains: zkBTC Rollups aggregate hundreds of transactions off-chain, enabling Bitcoin to process over 700 transactions per second—a dramatic leap from the base chain’s average of seven. This breakthrough unlocks mainstream and institutional use cases previously limited by Bitcoin’s throughput.

-

Significantly Lower Transaction Fees: By batching and verifying transactions via zero-knowledge proofs, zkBTC Rollups drastically reduce on-chain data usage, resulting in substantially lower transaction fees for users and dApps.

-

Enhanced Ecosystem for Bitcoin Assets: zkBTC Rollups, leveraging Polygon zkEVM, support seamless transfers and innovation for Ordinals, Runes, and BRC-20 tokens, fostering a vibrant and utility-rich Bitcoin ecosystem.

-

Maintaining Bitcoin’s Security & Decentralization: zkBTC Rollups inherit the robust security model of the Bitcoin main chain, ensuring that scalability improvements do not compromise the network’s core trust assumptions.

-

Future-Proof & Adaptable Infrastructure: zkBTC is designed to integrate with upcoming Bitcoin-native advancements, providing developers and investors with a future-ready platform that can evolve alongside the ecosystem.

-

Resolving Community Fragmentation: By supporting diverse innovations without clogging the base chain, zkBTC Rollups help bridge divides between traditionalists and innovators in the Bitcoin community, promoting unified growth.

For developers, zkBTC rollups offer composability and flexibility previously only available on other chains. Interoperability with Polygon’s zkEVM allows seamless porting of smart contracts and dApps, while maintaining exposure to the world’s most liquid digital asset. Investors, meanwhile, benefit from lower friction in trading, increased liquidity for BTC-based tokens, and access to emerging DeFi protocols built atop this new layer.

What sets zkBTC apart is its forward compatibility. As future upgrades like BitVM or more expressive scripting languages arrive on Bitcoin, zkBTC’s architecture is designed to adapt, ensuring that today’s scaling gains don’t become tomorrow’s bottlenecks (source).

Risks and Open Questions: What Should the Community Watch?

No technology is without trade-offs. While zero-knowledge rollups have proven security models, they introduce new complexities around proof generation and data availability. Governance of layer-2 protocols also remains an evolving question: who decides upgrade paths or fee structures? The answers will likely shape the future balance between decentralization and efficiency on Bitcoin.

Regulatory clarity is another factor to monitor, especially as institutional capital flows into BTC at prices north of $116,439.00. Transparent frameworks will be needed to ensure compliance without stifling innovation or privacy guarantees inherent in ZK technology.

The Bottom Line: Scaling Without Compromising Values

The arrival of zkBTC rollups marks a turning point for Bitcoin transaction scalability. By marrying zero-knowledge cryptography with robust layer-2 design principles honed on Ethereum, these solutions are finally giving Bitcoiners what they’ve long demanded: speed and scale without sacrificing security or decentralization.

If you’re a builder or investor seeking exposure to the next wave of blockchain infrastructure, and want to do so atop an asset holding steady above $116,000, now is the time to pay attention. The future of Bitcoin isn’t just about price appreciation; it’s about transforming what’s possible on-chain while safeguarding what made BTC valuable in the first place.