With Bitcoin trading at $115,743.00, the network’s scalability and privacy limitations are more apparent than ever. As transaction volumes surge and institutional adoption accelerates, the need for efficient, private transfers is no longer theoretical. Enter zkBTC rollups: a breakthrough Layer-2 solution that leverages zero-knowledge proofs to transform how Bitcoin transactions are processed, verified, and kept confidential.

Why Bitcoin Needs Scalable and Private Transactions

Bitcoin’s base layer was designed for security and decentralization, not speed or confidentiality. The average block processes only a limited number of transactions every 10 minutes, leaving users exposed to high fees during periods of congestion. Moreover, all transaction details (amounts, addresses) are publicly visible on-chain – a non-starter for institutions and privacy-conscious individuals alike.

This bottleneck has led to growing interest in Bitcoin privacy solutions and scalable protocols that can extend Bitcoin’s utility without sacrificing its core principles. But until recently, most innovations in scalability (like rollups) were confined to Ethereum and other smart contract platforms – not Bitcoin’s UTXO model.

How zkBTC Rollups Work: The Technical Edge

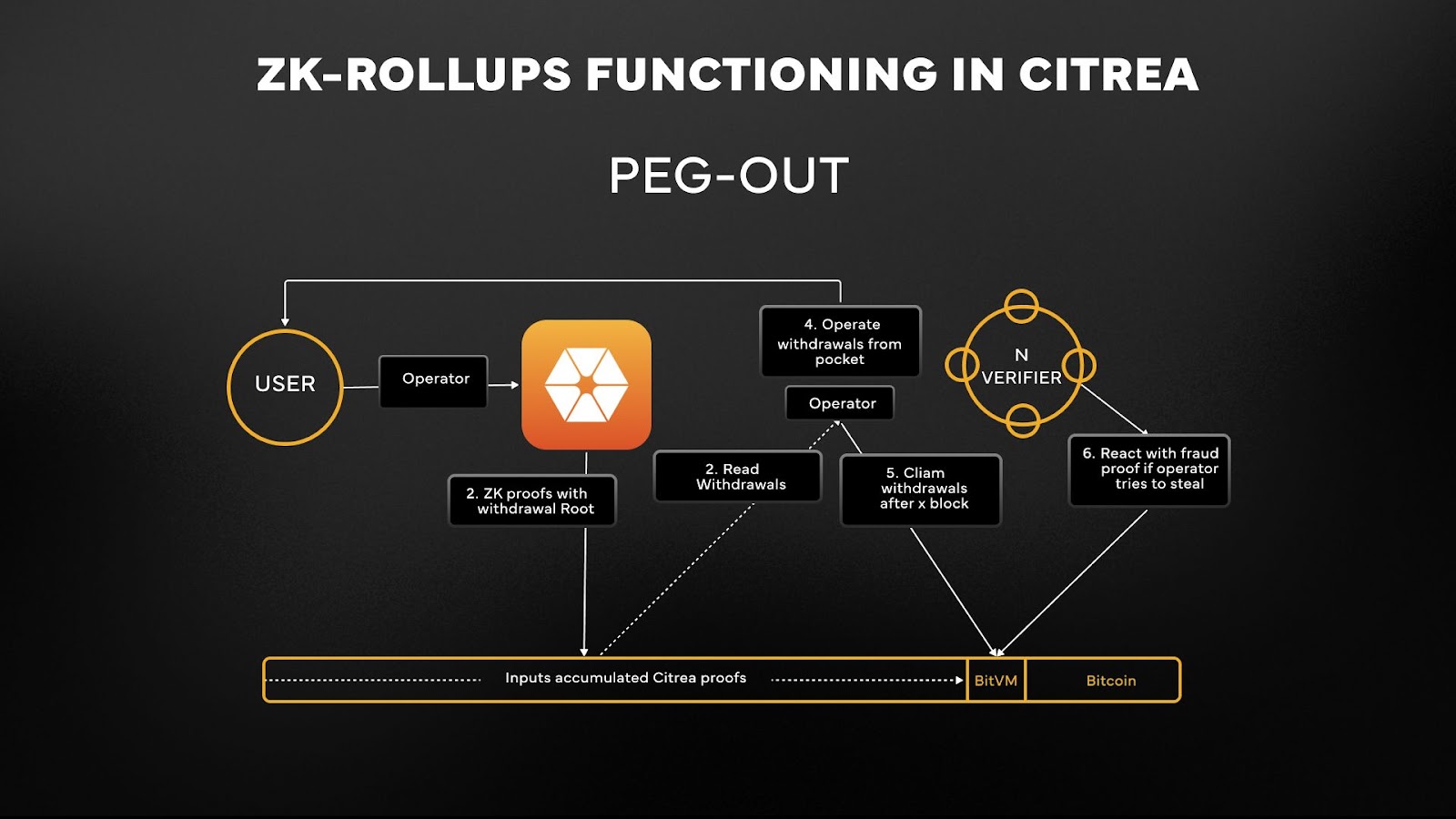

zkBTC brings EVM compatibility to Bitcoin via ZK-rollups – a technique that bundles hundreds or thousands of off-chain transactions into a single batch. Instead of publishing every transaction on the main chain, zkBTC submits a succinct cryptographic proof (a zero-knowledge proof) attesting to the validity of all bundled transfers. This drastically reduces on-chain data requirements while ensuring that only valid state transitions are accepted by the network.

The result?

- Massive throughput increases: By processing transactions off-chain and batching them efficiently, zkBTC enables orders-of-magnitude more transactions per second compared to native Bitcoin.

- Enhanced privacy: Zero-knowledge proofs allow validators to confirm transaction correctness without revealing sender/receiver information or amounts.

- No compromise on security: Final settlement still occurs on Bitcoin’s base layer, preserving decentralization and censorship-resistance.

The Market Impact: BTC Above $115,000 Spurs Layer-2 Innovation

The current market landscape is accelerating demand for scalable solutions. With BTC holding steady at $115,743.00, network activity is approaching historic highs – raising both transaction costs and privacy concerns. ZK-rollup protocols like zkBTC are emerging as frontrunners because they address both pain points simultaneously.

This dual advantage is drawing developer attention away from older scaling approaches (like sidechains or simple payment channels) toward more advanced cryptographic solutions tailored for real-world usage. Integrations with Polygon’s zkEVM further expand what’s possible: developers can now build dApps on Bitcoin that benefit from both high throughput and robust privacy guarantees (source).

Bitcoin (BTC) Price Prediction 2026-2031

Professional forecast considering zkBTC rollups, scalability, privacy, and market trends (2025 baseline: $115,743)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $92,000 | $128,000 | $162,000 | +10.6% | Rollup adoption accelerates, minor regulatory headwinds |

| 2027 | $105,000 | $145,000 | $185,000 | +13.3% | zkBTC rollups widely adopted, DeFi/BTC dApps growth |

| 2028 | $118,000 | $168,000 | $210,000 | +15.8% | Mainstream privacy use cases, institutional inflows |

| 2029 | $132,000 | $190,000 | $240,000 | +13.1% | Strong regulatory clarity, global payment adoption |

| 2030 | $145,000 | $215,000 | $275,000 | +13.2% | BTC as digital gold, robust L2 ecosystem |

| 2031 | $158,000 | $241,000 | $310,000 | +12.1% | Sustained L2 dominance, competition from other protocols |

Price Prediction Summary

Bitcoin is expected to benefit from the integration of zkBTC rollups, which enhance scalability, privacy, and utility. Average price predictions show steady, double-digit yearly growth, with potential for higher gains if Layer-2 adoption and regulatory clarity accelerate. The minimum price scenario reflects possible bear markets or macroeconomic shocks, while the maximum considers a highly bullish environment with mass adoption and institutional entry.

Key Factors Affecting Bitcoin Price

- Adoption rate of zkBTC rollups and Layer-2 solutions

- Global regulatory developments and clarity

- Growth of decentralized applications (dApps) on Bitcoin

- Competition from other blockchains and scaling solutions

- Macroeconomic factors (inflation, global finance trends)

- Institutional investment levels

- Network security and upgrade success

- User demand for privacy and scalability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Mechanics Behind Zero-Knowledge Proofs in Bitcoin Rollups

ZK-rollups use mathematical proofs (specifically SNARKs or STARKs) to demonstrate that all off-chain computations comply with protocol rules – without exposing any underlying data. When applied to Bitcoin rollup protocols like zkBTC, this means even large batches of transfers can be validated with minimal trust assumptions or information leakage (learn more here). For users transacting significant sums above $100K per transfer – increasingly common as BTC trades above $115K – this level of confidentiality is vital.

Beyond privacy, zkBTC rollups offer a critical boost to network efficiency. By compressing transaction data and offloading computation from the main chain, these protocols make it possible for Bitcoin to support new use cases, ranging from high-frequency trading to confidential business settlements, without bloating the blockchain or compromising security.

For developers, zkBTC’s EVM compatibility is a game-changer. It unlocks the ability to deploy smart contracts and dApps natively on Bitcoin, attracting a new wave of builders who previously gravitated toward Ethereum or Layer-2s like Arbitrum. This is especially significant at current price levels: with BTC at $115,743.00, the economic incentive to build scalable infrastructure has never been higher.

Adoption Drivers: Privacy, Scalability, and Institutional Demand

The intersection of privacy and scalability is not just a technical milestone, it’s an adoption catalyst. As more enterprises seek exposure to Bitcoin, their compliance requirements often mandate confidentiality in transactional flows. ZK-rollups address this by ensuring that even as volume surges, sensitive data remains shielded from public view.

Meanwhile, retail users benefit from lower fees and faster confirmation times during periods of high congestion, a persistent issue whenever BTC’s price approaches new highs like today’s $115,743.00. The ability to batch transactions means that spikes in activity no longer paralyze the network or price out smaller participants.

Key Benefits of zkBTC Rollups for Bitcoin Users

-

Enhanced Privacy: zkBTC rollups use zero-knowledge proofs to validate transactions without revealing sensitive details, ensuring confidentiality for users on the Bitcoin network.

-

Greater Scalability: By processing multiple transactions off-chain and bundling them into a single batch, zkBTC rollups significantly increase transaction throughput on Bitcoin.

-

Lower Transaction Fees: Off-chain processing and transaction batching reduce network congestion, resulting in lower fees for Bitcoin users compared to mainnet transactions.

-

Maintained Security and Decentralization: zkBTC leverages the underlying security and decentralization of the Bitcoin blockchain by submitting cryptographic proofs back to the main chain.

-

Expanded Utility for Developers: zkBTC’s integration with Polygon’s zkEVM enables developers to build decentralized applications (dApps) on Bitcoin, broadening its use cases beyond simple transfers.

Risks, Challenges, and What Comes Next

No scaling solution is without trade-offs. While zkBTC rollups preserve core Bitcoin security properties by settling on-chain, they do introduce dependencies on off-chain operators (sequencers) and complex cryptographic circuits. Ongoing audits and open-source transparency are essential for maintaining trust as these systems scale.

Another challenge is user education: explaining how zero-knowledge proofs work, and why they matter, remains a hurdle for mainstream adoption. However, as wallets and exchanges integrate zkBTC rollup support behind the scenes, most users will benefit from improved privacy and speed without needing to understand the underlying math.

The Road Ahead for Bitcoin Rollup Protocols

The momentum behind Bitcoin rollup protocols is undeniable. As more projects adopt zero-knowledge proofs for both scalability and privacy, expect continued innovation at both the protocol layer and user interface level. In the near term, watch for:

- Bigger transaction batches: Further reducing fees per transaction as adoption grows.

- Diversified dApp ecosystems: Expanding beyond payments into DeFi, NFTs, and private asset issuance, all secured by Bitcoin’s base layer.

- Tighter integration with hardware wallets: Making private transactions seamless for both retail users and institutions.

If current trends hold, and with BTC sustaining above $115K, the next wave of growth in Bitcoin will be defined not just by how much value it secures but by how efficiently it can move that value while protecting user privacy.