Bitcoin’s ascent to $93,265.00 underscores the urgent need for scalable infrastructure, as transaction volumes strain the network’s 13 transactions per second limit. GOATRollup emerges as a frontrunner in Bitcoin scaling solutions, pioneering BTC-native ZK rollups via the BitVM bridge. This approach inherits Bitcoin’s robust security without protocol alterations, positioning it for BTCFi yield and zkBTC technologies dominance.

GOATRollup’s BTC-Native ZK Rollup Architecture

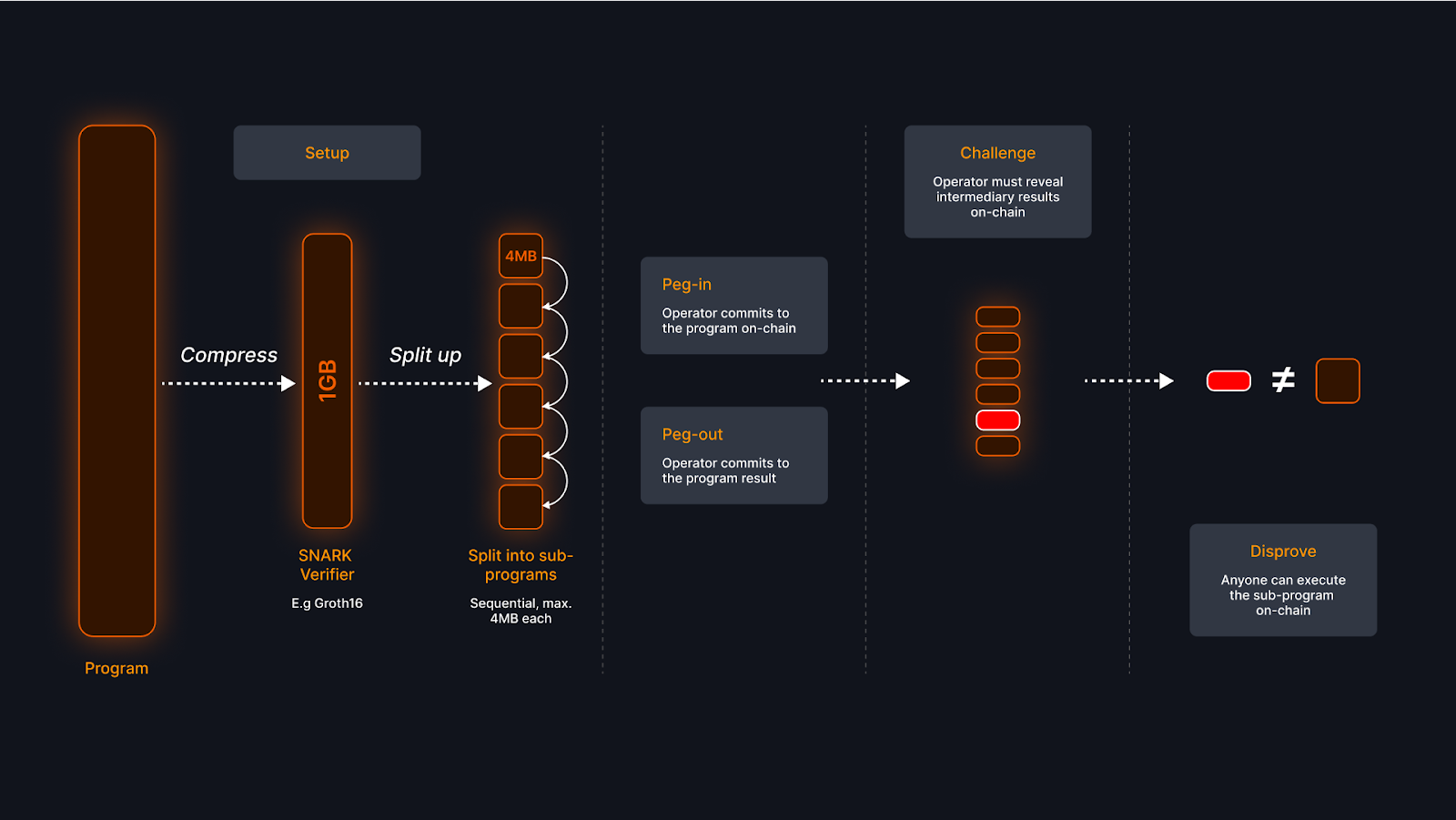

At its core, GOATRollup processes transactions off-chain in batches, compressing data with zero-knowledge proofs for on-chain settlement on Bitcoin. Leveraging BitVM2, it verifies computations trustlessly, sidestepping wrapped tokens or sidechains that dilute native BTC exposure. Developers benefit from zkMIPS, GOAT’s high-speed zkVM, slashing proof times and costs while ensuring verifiability.

This architecture targets blockchain builders and investors eyeing Bitcoin’s Layer 2 evolution. Unlike Ethereum-centric rollups, GOATRollup anchors directly to Bitcoin script, fostering composability with BTC-native DeFi. Recent testnet launches, including BitVM2 and bridge activations on October 29,2025, signal maturity amid Bitcoin’s rally from a 24-hour low of $86,412.00.

GOAT Network aims to be the first to legitimately claim the mantle of Bitcoin L2, with its BitVM2 tech making inheritance of native Bitcoin security possible. (Source: The Defiant)

Integration of recursive ZK-SNARKs/STARKs via BitVM3 further optimizes, supporting reusable circuits and data compression essential for high-throughput Bitcoin zk rollups.

Accelerated Finality and Security Innovations

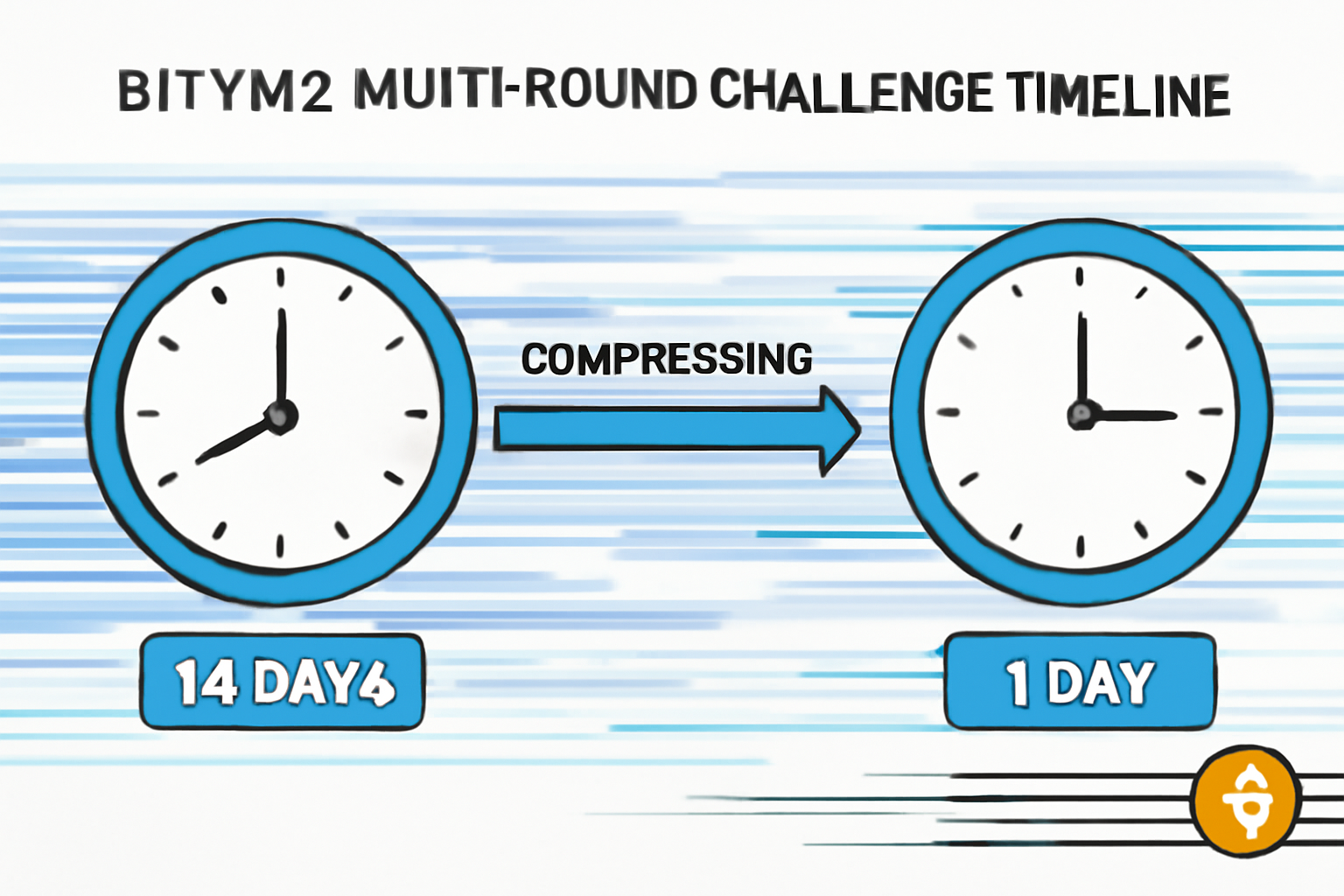

GOATRollup’s multi-round challenger selection slashes challenge periods dramatically, achieving effective finality under 24 hours. This addresses a core pain point in optimistic systems, where prolonged windows expose capital to risks. Dual-slashing deters double-spends, while fraud bounties incentivize network watchdogs, creating a self-reinforcing security loop.

Read the deep dive on GOATRollup’s BitVM2 usage for BTC yield without wrapped assets. zkMIPS integration stands out; as the fastest production zkVM, it cuts costs by optimizing MIPS instruction proofs, vital for sustainable scaling.

Bitcoin (BTC) Price Prediction 2026-2031: GOATRollup Scaling Impact

Forecasts incorporating BitVM2 ZK rollups, market cycles, halvings, and adoption trends from current $93,265 baseline

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY Change % (Avg) |

|---|---|---|---|---|

| 2026 | $75,000 | $120,000 | $160,000 | +29% |

| 2027 | $110,000 | $180,000 | $250,000 | +50% |

| 2028 | $150,000 | $280,000 | $450,000 | +56% |

| 2029 | $220,000 | $450,000 | $750,000 | +61% |

| 2030 | $350,000 | $600,000 | $950,000 | +33% |

| 2031 | $450,000 | $850,000 | $1,300,000 | +42% |

Price Prediction Summary

Bitcoin’s price is projected to grow significantly through 2031, fueled by GOATRollup’s innovations in Bitcoin-native ZK rollups via BitVM2/3, enabling faster finality, enhanced security, and scalable dApps. Average prices could reach $850K by 2031, with bullish maxima over $1M amid L2 adoption, 2028 halving, and institutional inflows; bearish mins reflect potential corrections.

Key Factors Affecting Bitcoin Price

- GOATRollup’s BitVM2 advancements: 1-day challenge resolution, dual-slashing, zkMIPS for efficiency

- Bitcoin halving in 2028 boosting scarcity

- Scalability enabling DeFi, NFTs, and high TPS on BTC L2s

- Regulatory progress and ETF inflows driving institutional adoption

- Macro trends: reduced volatility, global economic recovery

- Competition from other L2s but GOAT’s native BTC security edge

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Universal operator rotation balances economics, with sequencers earning fees, provers capturing proof premiums, and challengers profiting from disputes. This decentralization fortifies resilience, appealing to institutional players integrating crypto amid Bitcoin’s $93,265.00 stability post and $6,306.00 24-hour gain.

GOATRollup thus redefines Bitcoin scaling solutions, blending efficiency with uncompromised security for the zkBTC era.

Bitcoin’s current price stability at $93,265.00, following a 24-hour gain of and $6,306.00, amplifies the stakes for Layer 2 protocols like GOATRollup. Investors now demand solutions that not only scale but also unlock BTCFi yield directly from native holdings, bypassing the pitfalls of wrapped assets that introduce counterparty risks.

Unlocking BTCFi Yield Through Native ZK Rollups

GOATRollup’s BitVM bridge enables seamless BTC native rollup operations, where users stake raw BTC to earn yields from DeFi primitives like lending pools and perpetuals. This eliminates the dilution seen in bridges reliant on custodians; instead, zero-knowledge proofs attest to off-chain states, settling disputes on Bitcoin’s base layer. zkMIPS accelerates this by proving complex computations in seconds, making high-frequency trading viable on Bitcoin for the first time.

Consider the mechanics: sequencers batch user transactions, provers generate succinct proofs, and challengers enforce honesty via BitVM2’s compressed disputes. Successful challengers claim bounties from slashed stakes, aligning incentives akin to Bitcoin’s proof-of-work miners. This model sustains yields projected at 5-15% APY for BTC holders, far surpassing base layer staking illusions.

Comparison of Bitcoin Scaling Solutions

| Project | Finality Time | Native BTC Security | TPS Potential | Yield Mechanism |

|---|---|---|---|---|

| GOATRollup | 1 day | Yes via BitVM2 | 1000+ | Native BTCFi |

| Starknet | 7 days | Partial | 1000s | Wrapped |

| BitVM Others | 14 days | Yes | 100-500 | Limited |

From a risk management perspective, this cryptoeconomic design minimizes tail risks. Dual-slashing covers operator malice, while operator rotation prevents collusion. Yet, no system is flawless; sequencer centralization remains a watchpoint until decentralization matures post-mainnet.

Ecosystem Momentum and Developer Tools

GOAT Network’s October 29,2025, bridge launch coincided with Bitcoin’s rebound from $86,412.00, drawing developers to its EVM-compatible environment enhanced by zkBTC technologies. Audit fixes in recent forks bolster sequencer stability, paving the way for dApps in perpetual DEXes and real-world assets. Cross-chain interoperability via recursive proofs positions GOATRollup as a hub for Bitcoin’s multichain future.

Builders appreciate the docs outlining rollup deployment: from state root posting to ZK verification. This transparency, coupled with BitVM3’s SNARK/STARK hybrids, supports reusable circuits for everything from privacy mixers to prediction markets. As Bitcoin eyes $100,000 amid scaling breakthroughs, GOATRollup equips devs with tools for composable BTCFi, rivaling Ethereum’s maturity without its gas bloat.

Market data underscores adoption potential. With Bitcoin at $93,265.00 and and 0.0725% daily change, capital inflows favor projects inheriting full security. GOATRollup’s testnet metrics show sub-second proofs and 1,000 and TPS, outpacing optimistic alternatives vulnerable to long challenge windows.

Risks, Roadmap, and Strategic Positioning

Institutional integration demands rigorous assessment. GOATRollup mitigates liveness risks through multi-operator models, but prover centralization could bottleneck during peaks; ongoing zkMIPS optimizations address this. Roadmap milestones include mainnet Q1 2026, full decentralization, and Ethereum dual-settlement for liquidity.

Against competitors, GOATRollup leads in Bitcoin zk rollup purity. Starknet’s execution layer ambitions sacrifice native settlement, while others lag in finality. Waterdrip Capital notes ZK-rollups’ composability edge, yet GOAT’s BitVM focus delivers unadulterated security inheritance.

For portfolios, allocate cautiously: 5-10% to BTC L2s like GOATRollup amid volatility. Protect capital by monitoring testnet uptime and audit proofs. As Bitcoin scaling solutions mature, this protocol stands poised to capture value accrual, turning network constraints into yield engines for the zkBTC era.

Explore further in our guide on zkMIPS for BTC yield.