Bitcoin’s scaling wars just hit hyperdrive. GOAT Network’s BitVM2 Beta testnet is live, delivering the first Bitcoin-native ZK rollup with sub-3-second proofs across five distributed provers. At BTC’s current price of $86,564.00, this isn’t just tech flexing, it’s a yield machine turning idle sats into real returns without wrapped tokens or custody risks. Traders, pay attention: GOAT Rollup BitVM2 could redefine BTC rollups in 2025.

GOAT Network isn’t chasing hype; it’s executing. Their public testnet showcases real-time proving, letting users withdraw instantly sans proof delays. Operators dodge capital lockups, provers run parallel on GPU nodes for massive throughput. This Bitcoin native ZK rollup leverages BitVM2 to fix core flaws like double-spending and weak verifiability, all while staying true to Bitcoin’s base layer.

BitVM2 Beta: Shattering Proof Time Barriers

Speed kills in DeFi. GOAT’s BitVM2 extends the paradigm into a full zkRollup standard, packing zkMIPS for efficient computation and a decentralized sequencer for fairness. Sources from GlobeNewswire and The Defiant confirm: sub-3s block proofs verify states lightning-fast. No more waiting weeks for fraud proofs, this is real-time ZK on Bitcoin.

GOAT Network is the first Bitcoin zkRollup to launch real-time proving, offering Sub-3s proofs across 5 provers.

At an implied FDV around $137M with keys at ~$5.48 (per Binance data), GOAT trades at a discount to peers in the $300M-$500M range. Testnet3 Beta docs highlight how they solve operator inefficiencies, positioning GOAT as the go-to for BTC L2 scalability. Check the deep dive on how GOAT Rollup uses BitVM2 and zkMIPS.

Why Sub-3s Proofs Change the Game for Traders

Imagine batching thousands of txs off-chain, proving them in under three seconds, then settling on Bitcoin L1 seamlessly. GOAT’s parallel proving crushes latency, enabling high-frequency strategies on rollups. Yahoo Finance notes this captures Bitcoin liquidity fast, while Fairgate. io praises the public testnet’s proof speed. For day traders like me, this means tighter spreads, lower slippage, and BTC-native DeFi without bridges.

Distributed provers ensure no single point of failure, scaling as BTC climbs past $86,564.00. Combine with zkBTC tech, and you’ve got sub-second finality vibes on the king of crypto. Actionable edge: monitor testnet activity for early signals on mainnet pumps.

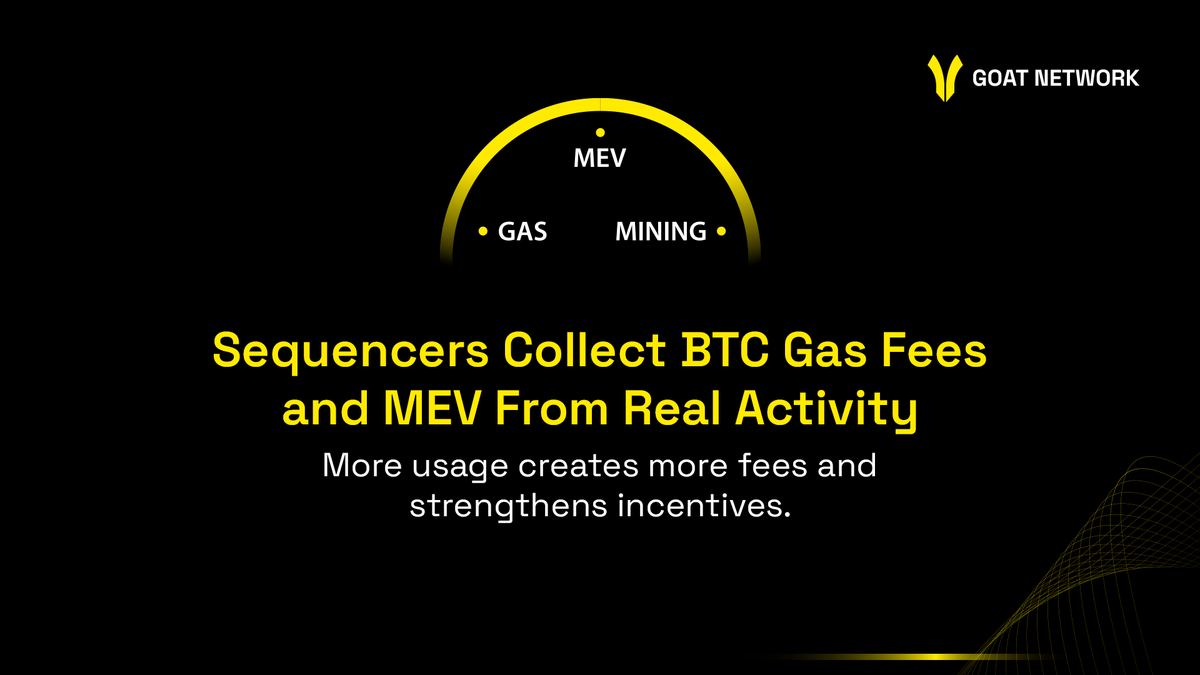

Real BTC Yields Without the BS

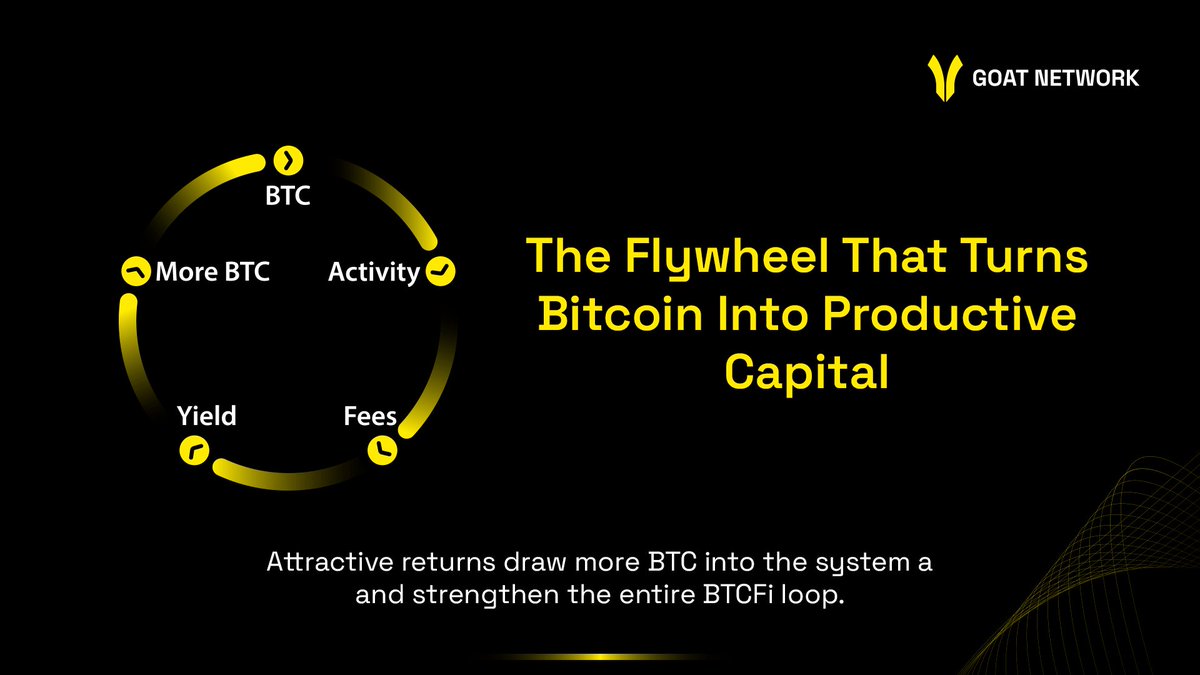

GOAT flips Bitcoin from store-of-value snooze to yield beast. Their chain-level products deliver sustainable BTC returns, no mining rigs or centralized vaults needed. ChainCatcher and Ju. com analyses spotlight the ZK rollup and BitVM2 security model fueling ecosystem growth. Idle BTC earns via rollup activity, all verified on-chain.

$GOATED token hit Binance Alpha September 27,2025, amplifying utility. No new token mints, pure native yields. Dive deeper into native BTC yield mechanics. With BTC at $86,564.00, yields here beat HODLing.

Bitcoin (BTC) Price Prediction 2026-2031

Projections influenced by GOAT Network’s BitVM2 ZK Rollup launch, sub-3s proofs, and native BTC yield generation amid 2025 testnet momentum

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $75,000 | $130,000 | $200,000 |

| 2027 | $100,000 | $200,000 | $350,000 |

| 2028 | $150,000 | $300,000 | $500,000 |

| 2029 | $200,000 | $450,000 | $750,000 |

| 2030 | $300,000 | $600,000 | $1,000,000 |

| 2031 | $400,000 | $850,000 | $1,500,000 |

Price Prediction Summary

From a 2025 baseline of ~$86,500, Bitcoin’s price is forecasted to grow progressively, fueled by GOAT Network’s BitVM2 innovations enabling real-time ZK rollups and sustainable BTC yields. Average prices rise from $130K in 2026 to $850K by 2031, with bullish maxima hitting $1.5M on full L2 adoption and halvings, while minima reflect potential bear markets and regulatory hurdles.

Key Factors Affecting Bitcoin Price

- GOAT Network BitVM2 Beta testnet success with sub-3s proofs and distributed provers

- 2028 Bitcoin halving increasing scarcity

- Native BTC yield products without centralized custody or new token issuance

- Growing Bitcoin L2 ecosystem adoption enhancing scalability and utility

- Institutional inflows and ETF momentum

- Regulatory clarity and global adoption trends

- Macroeconomic cycles favoring risk assets like BTC

- Competition from other rollups tempered by GOAT’s first-mover speed advantages

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Parallel provers aren’t just fast; they’re resilient. GOAT’s setup distributes load across GPU nodes, hitting sub-3s proofs consistently even as transaction volume spikes. This Bitcoin native ZK rollup architecture means no bottlenecks, pure scalability for BTC rollups 2025.

For developers building on BTC rollups, zkBTC integration opens doors to trustless apps. Traders get the upside: DeFi primitives with Bitcoin security, yields compounding at chain speed. With BTC steady at $86,564.00 after dipping just -0.002200% in 24 hours (high $87,165.00, low $83,951.00), GOAT’s momentum aligns perfectly for a liquidity grab.

Sustainable Yields: The Killer App for HODLers Turned Traders

GOAT’s chain-level BTC yield products shine brightest. Stake native BTC, earn from rollup fees and MEV, all ZK-verified on L1. No mining costs, no CEX lockups. GlobeNewswire highlights how this beta enables real returns instantly. Compare to stale HODL strategies: GOAT turns passive sats active, targeting 5-15% APY based on testnet sims (monitor for mainnet confirms).

GOAT Network: transforming $BTC from a passive store of value into a sustainable income-generating asset.

$GOATED’s Binance Alpha launch on September 27,2025, juices governance and staking. At implied FDV ~$137M, it’s undervalued versus BTC L2 peers. Action step: track testnet TVL for breakout signals.

Decentralized sequencer adds censorship resistance, batching txs fairly before ZK proofs seal the deal. This combo crushes competitors lagging on proof times or security.

Trader Setup: Capitalize on GOAT Rollup BitVM2

Day trading BTC rollups demands precision. GOAT’s sub-3s proofs slash latency, perfect for momentum plays. Watch for testnet spikes correlating with $GOATED pumps. My edge: pair BTC at $86,564.00 longs with GOAT key accumulations below $5.48. Use volume breakouts post-prover updates as entry triggers.

GOAT BitVM2 Trading Edges

-

Sub-3s Proofs: Lightning-fast real-time proving across 5 provers crushes slippage for seamless trades.

-

Native BTC Yields: Sustainable yields beat HODL on idle BTC—no new tokens, pure Bitcoin power.

-

BitVM2 Security: Bridge-free zkRollup locks in Bitcoin-native trust with zero custody risks.

-

Decentralized Provers: GPU nodes deliver 24/7 uptime and instant withdrawals, max efficiency.

-

Undervalued FDV: ~$137M at $5.48/Key—steal vs. $300M+ BTC L2 averages.

Risk management: cap exposure at 5% portfolio, trail stops on BTC dips below $83,951.00 daily low. Mainnet rumors could 3x keys fast; position now.

GOAT Network bets big on fast ZK proofs to own Bitcoin DeFi. With BitVM2 beta live, sub-3s finality, and real BTC yields, it’s primed for 2025 dominance. Testnet participation yields airdrop potential; bridge BTC today and farm those sats. Speed, precision, discipline wins in BTC rollups.