As Bitcoin holds steady at $66,814.00, reflecting a modest 24-hour gain of and $505.00 amid broader market consolidation, the narrative around BTC scaling solutions intensifies. In this macro environment, where institutional adoption pressures Bitcoin’s base layer toward its limits, projects like GOAT Rollup emerge as pivotal architects of off-chain innovation. GOAT Network, pioneering native Bitcoin ZK rollups, addresses the scalability trilemma head-on: throughput, security, and self-custody without IOUs or centralized bridges. This guide dissects how GOAT enables Bitcoin smart contracts off-chain and zkBTC technologies, positioning Bitcoin layer 2 rollups for dominance in 2026.

Bitcoin’s Scaling Imperative in a High-Price Equilibrium

With BTC trading at $66,814.00, we witness a market maturing beyond speculative froth into utility-driven valuation. Yet, base-layer constraints persist: congestion spikes during volatility, fees erode margins for DeFi users, and smart contract voids stifle dApp proliferation. Enter Bitcoin rollups, particularly GOAT’s ZK variant, which batch transactions off-chain, settle validity proofs on Bitcoin, and inherit its unparalleled security. This isn’t mere Layer 2 tinkering; it’s a macro pivot enabling Bitcoin to rival Ethereum’s programmability while preserving monetary primacy.

GOAT Network’s ascent underscores this shift. Launching its ecosystem token $GOATED on Binance Alpha in September 2025 catalyzed ecosystem momentum. By fusing zkVM for efficient computation, BitVM2 for fraud-proof security, and decentralized sequencers for censorship resistance, GOAT slashes withdrawal times to under 24 hours from Bitcoin’s traditional weeks-long delays. Capital efficiency surges, drawing stakers and developers into a BTC-native economy. In a world of fiat debasement and geopolitical flux, such innovations fortify Bitcoin as digital gold with yield-bearing superpowers.

Dissecting GOAT’s Technical Stack for zkBTC Supremacy

At GOAT’s core lies a trifecta redefining BTC scaling solutions. The in-house zkVM, optimized for zkMIPS, executes complex logic off-chain with succinct proofs verifiable on Bitcoin via BitVM2. This paradigm ditches optimistic rollups’ dispute windows for cryptographic certainty, mitigating risks in high-value BTC transfers. Decentralized sequencers, meanwhile, democratize block production, curbing MEV extraction through operator rotation and multi-round proofs as outlined in their economic paper.

Consider the implications for zkBTC technologies: users retain self-custody, posting ZK proofs to Bitcoin without wrapped assets or custodians. This natively secure model contrasts sharply with bridged alternatives prone to exploits. GOAT’s architecture supports real-time proof generation, fostering applications from perpetuals to lending protocols atop Bitcoin. Developers gain a canvas for smart contracts without Ethereum’s gas wars, all while BTC liquidity remains anchored at $66,814.00. Macro strategists note parallels to commodity supercycles; just as oil pipelines unlocked value, GOAT pipelines Bitcoin’s throughput.

Read more on foundational scaling in our deep dive: How zkBTC Rollups Revolutionize Bitcoin Transaction Scalability.

Sustainable Yield Mechanics: GOAT’s Economic Engine

GOAT transcends tech novelty with a BTCFi model returning on-chain fees directly to nodes and stakers in Bitcoin. No bridges, no dilution: transaction revenue funds operator incentives, yielding sustainable BTC returns. Their paper details fair MEV distribution via rotation, ensuring no single actor dominates. This closes BitVM’s incentive gaps, bootstrapping a virtuous cycle of security and adoption.

In 2026’s projected landscape, as Bitcoin layer 2 rollups proliferate, GOAT’s edge sharpens. Ecosystem grants and diversified products amplify network effects, mirroring macro trends where yield hunts propel capital flows. Stakers capture alpha from rollup activity, aligning incentives with Bitcoin’s long-term appreciation from today’s $66,814.00 base.

Bitcoin (BTC) Price Prediction 2027-2032

Factoring in GOAT Rollup adoption, sustainable BTC yield, zkBTC development, and Bitcoin scaling growth

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $105,000 | $165,000 | $265,000 |

| 2028 | $135,000 | $225,000 | $385,000 |

| 2029 | $175,000 | $315,000 | $550,000 |

| 2030 | $235,000 | $440,000 | $780,000 |

| 2031 | $315,000 | $615,000 | $1,100,000 |

| 2032 | $420,000 | $860,000 | $1,550,000 |

Price Prediction Summary

GOAT Network’s ZK Rollup innovations are set to supercharge Bitcoin’s utility with off-chain scaling, smart contracts, and sustainable yields, propelling prices upward. From a 2026 baseline around $90,000 average, BTC could see average prices rise 83% to $165,000 in 2027, accelerating through halvings and adoption to $860,000 by 2032, with max potentials exceeding $1.5M in bullish scenarios amid market cycles.

Key Factors Affecting Bitcoin Price

- GOAT Rollup adoption unlocking scalable smart contracts and zkBTC on Bitcoin

- Sustainable BTC yield via operator rotation, MEV distribution, and on-chain revenue sharing

- 2028 Bitcoin halving increasing scarcity and price momentum

- Reduced withdrawal times (<24 hours) boosting capital efficiency and user adoption

- Regulatory developments and institutional inflows favoring BTC L2 solutions

- BTCFi ecosystem growth without bridges, preserving self-custody

- Market cycles, competition from other chains, and technical advancements like BitVM2/zkVM

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

GOAT’s yield model resonates deeply in a macro landscape scarred by zero-yield fiat regimes. As central banks navigate persistent inflation, Bitcoin at $66,814.00 embodies scarcity with compounding utility via rollups. Stakers earn from sequenced batches, proof validations, and MEV auctions, creating a flywheel absent in prior L2s.

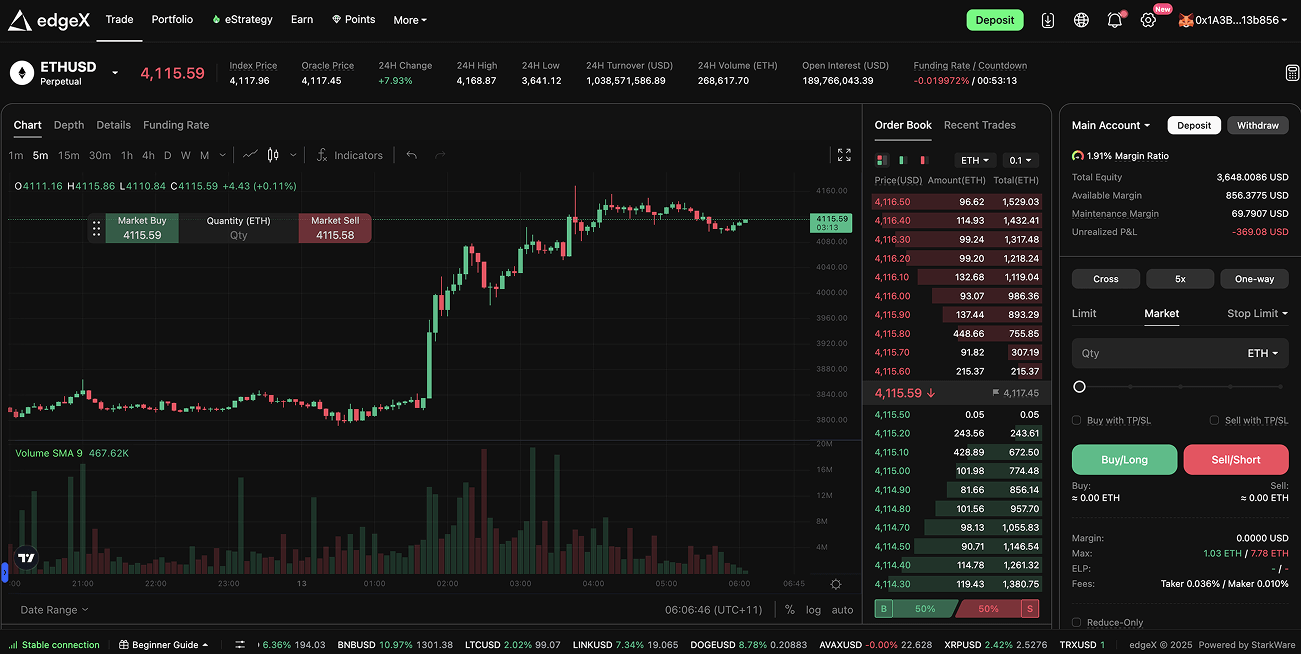

GOAT’s BTC ZK Rollup Applications

-

Perpetual DEXes: Native BTC leverage trading with sub-second finality via GOAT’s zkVM and BitVM2, enabling scalable DeFi without wrapped tokens.

-

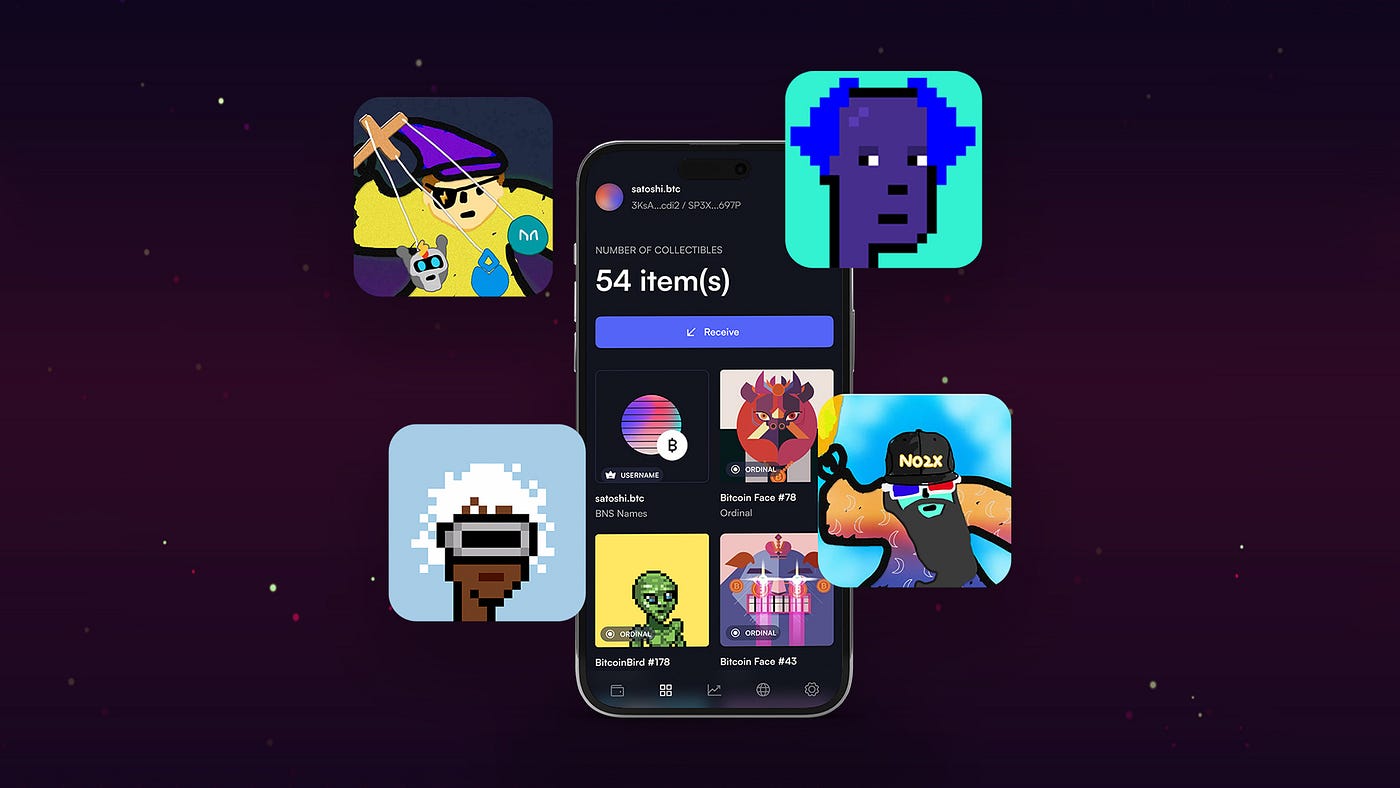

Inscription-Collateralized Lending Pools: Borrow against Bitcoin Ordinals inscriptions as collateral in secure, off-chain pools inheriting Bitcoin’s security.

-

ZK-Disputed Prediction Markets: Fraud-proof markets using ZK proofs and optimistic challenges on GOAT’s decentralized sequencers for precise resolutions.

-

Scalable Ordinal NFT Marketplaces: High-throughput trading of Ordinal NFTs with automated royalties, powered by GOAT’s real-time proof generation.

-

Native BTC Yield Farms: Sustainable BTC yields from on-chain revenue shared with stakers, bridge-free via GOAT’s economic model—no IOUs needed.

-

RWAs & Gaming Products: Tokenized real-world assets and Bitcoin-native games driving 2026 TVL surges with self-custodial zkBTC scaling.

Explore related innovations in How zkBTC Rollups Revolutionize Bitcoin Transaction Scalability.

Developer Primer: Building on GOAT Rollup

For blockchain developers eyeing BTC scaling solutions, GOAT lowers barriers with SDKs bridging Rust and Solidity. Smart contracts compile to zkMIPS circuits, verified via BitVM2 incentives. Testnets simulate mainnet economics, withdrawal proofs clocking under 24 hours. This frictionless path draws talent from Solana and Ethereum, birthing zkBTC-native dApps.

Macro tailwinds amplify: sovereign funds allocating to BTCFi demand programmable layers. GOAT’s operator rotation ensures liveness amid volatility, as BTC holds $66,814.00. Early movers capture outsized yields, positioning portfolios for rollup-driven appreciation.

GOAT in the 2026 Bitcoin Rollups Arena

By 2026, Bitcoin layer 2 rollups will fragment into ZK purists and optimistic hybrids. GOAT leads with native integration: no sidechains, pure Bitcoin settlement. Competitors grapple with bridge risks; GOAT sidesteps via BitVM2, yielding BTC directly. Ecosystem grants fuel 100 and dApps, TVL eclipsing $10B as BTC liquidity cascades.

Geopolitically, rollups fortify Bitcoin against regulatory headwinds. Self-custodial zkBTC flows evade chokepoints, empowering users in capital-controlled regimes. Investors note: at $66,814.00, BTC’s market cap underwrites trillion-dollar L2 economies. GOAT’s sustainable model bootstraps this, distributing alpha to aligned participants.

Stakeholders from institutions to retail hodlers converge on GOAT for yield without surrender. As macro currents, debt spirals, dedollarization, elevate Bitcoin, rollups like GOAT realize its destiny: not just store of value, but value engine. Native ZK proofs cement this evolution, scaling Bitcoin’s sovereignty into tomorrow’s financial backbone.