As Bitcoin trades at $67,888.00 amid the volatility of early 2026, savvy investors eye these dips as prime windows for bitcoin rollups stacking. The recent plunge below $64,000 on February 5 offers a stark reminder of market cycles, yet it underscores the strategic edge of layer-2 solutions. Bitcoin rollups, powered by zero-knowledge proofs, enable cheaper, faster accumulation without the friction of mainnet fees, positioning holders to scale toward 1 BTC even as prices fluctuate between $65,839 lows and $68,428 highs.

This guide dissects how to leverage BTC scaling dips through rollup protocols. With capital shifting from Bitcoin’s $90K breakdown in 2025 toward ZKP innovations, projects like Citrea are pushing Bitcoin’s boundaries. Stacking sats on rollups isn’t just efficient; it’s a disciplined path to zkBTC accumulation 2026, mitigating volatility while capitalizing on institutional inflows.

Navigating 2026 Dips with Dollar-Cost Averaging on Rollups

Bitcoin’s 24-hour gain of and $721.00 feels tentative against broader concerns over regulations and speculative retreats. Yet, history favors those who accumulate during fear. A dollar-cost averaging (DCA) plan tailored for rollups transforms these dips into opportunities. Instead of chasing peaks, allocate fixed sums weekly into BTC via rollup bridges, where transaction costs plummet compared to layer-1.

Consider the math: At $67,888.00, securing 1 BTC requires precision. During the February 5 drop, buyers snagged BTC near $64,000 levels, lowering averages. Rollups amplify this by batching deposits, slashing fees by up to 99% as recent reports highlight. My view? Rollups turn passive hodling into active bitcoin L2 hodling, where you stack without erosion from network congestion.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts considering ZK Rollups scalability, 2026 dips around $68K, Hoskinson’s $250K bullish target, and $10K bearish risks

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $45,000 | $120,000 | $250,000 |

| 2028 | $70,000 | $180,000 | $350,000 |

| 2029 | $100,000 | $300,000 | $600,000 |

| 2030 | $80,000 | $250,000 | $500,000 |

| 2031 | $150,000 | $400,000 | $800,000 |

| 2032 | $200,000 | $550,000 | $1,100,000 |

Price Prediction Summary

Bitcoin is projected to recover from 2026 volatility, with average prices rising progressively from $120K in 2027 to $550K by 2032, fueled by ZK Rollups enhancing scalability, halvings in 2028/2032, and adoption. Bullish maxima reflect institutional inflows and tech upgrades; minima account for regulatory pressures, corrections, and mean reversion risks. Dollar-cost averaging during dips recommended for 1 BTC accumulation.

Key Factors Affecting Bitcoin Price

- ZK Rollups and Bitcoin L2 scalability advancements boosting transaction efficiency

- Bitcoin halvings in 2028 and 2032 reducing supply and driving cycles

- Institutional adoption, ETFs, and accumulation strategies amid dips

- Regulatory developments and macroeconomic factors influencing volatility

- Competition from ZKP projects but Bitcoin’s dominance in store-of-value narrative

- Historical 4-year cycles with potential for 3-5x gains post-halving peaks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

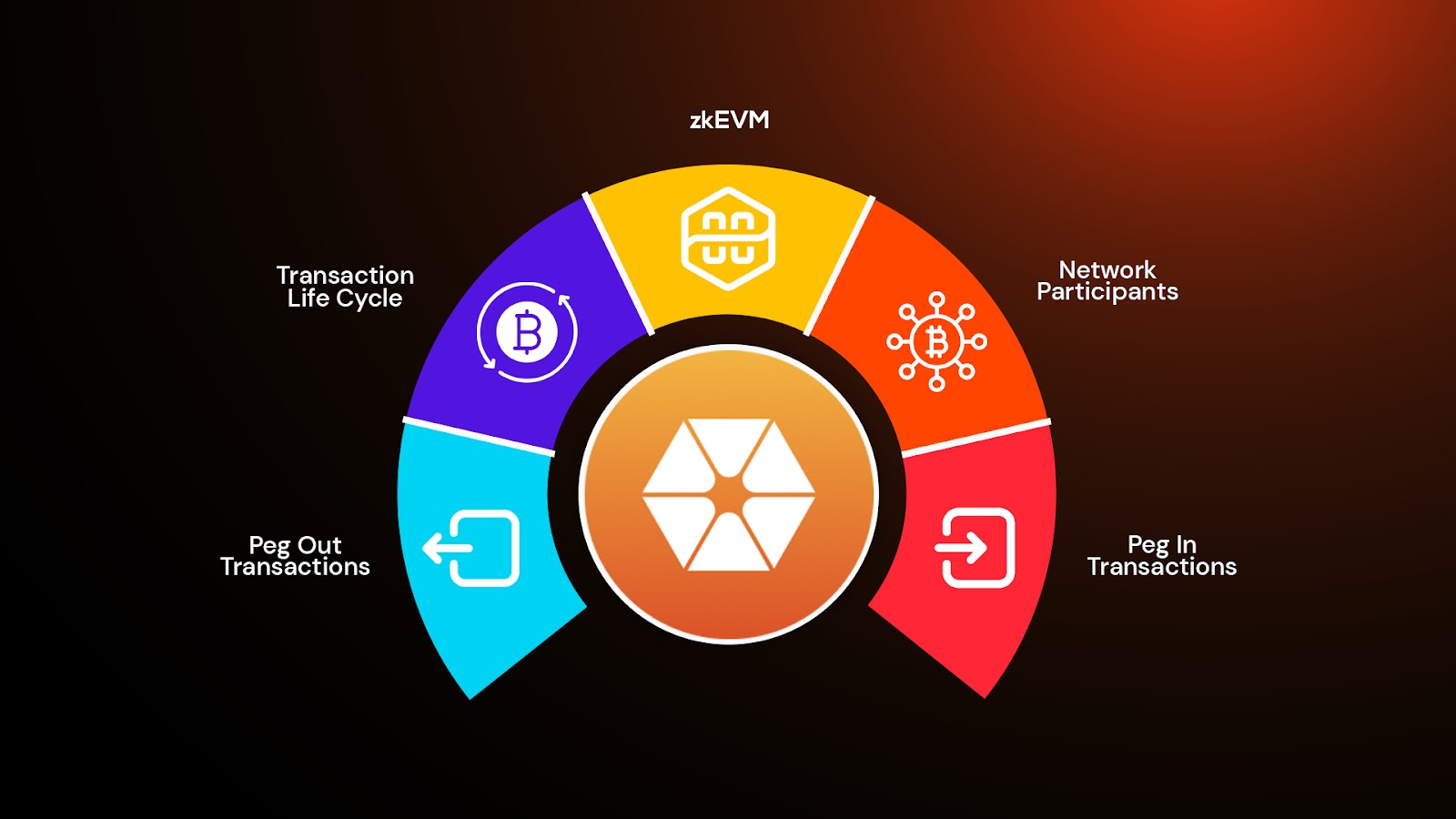

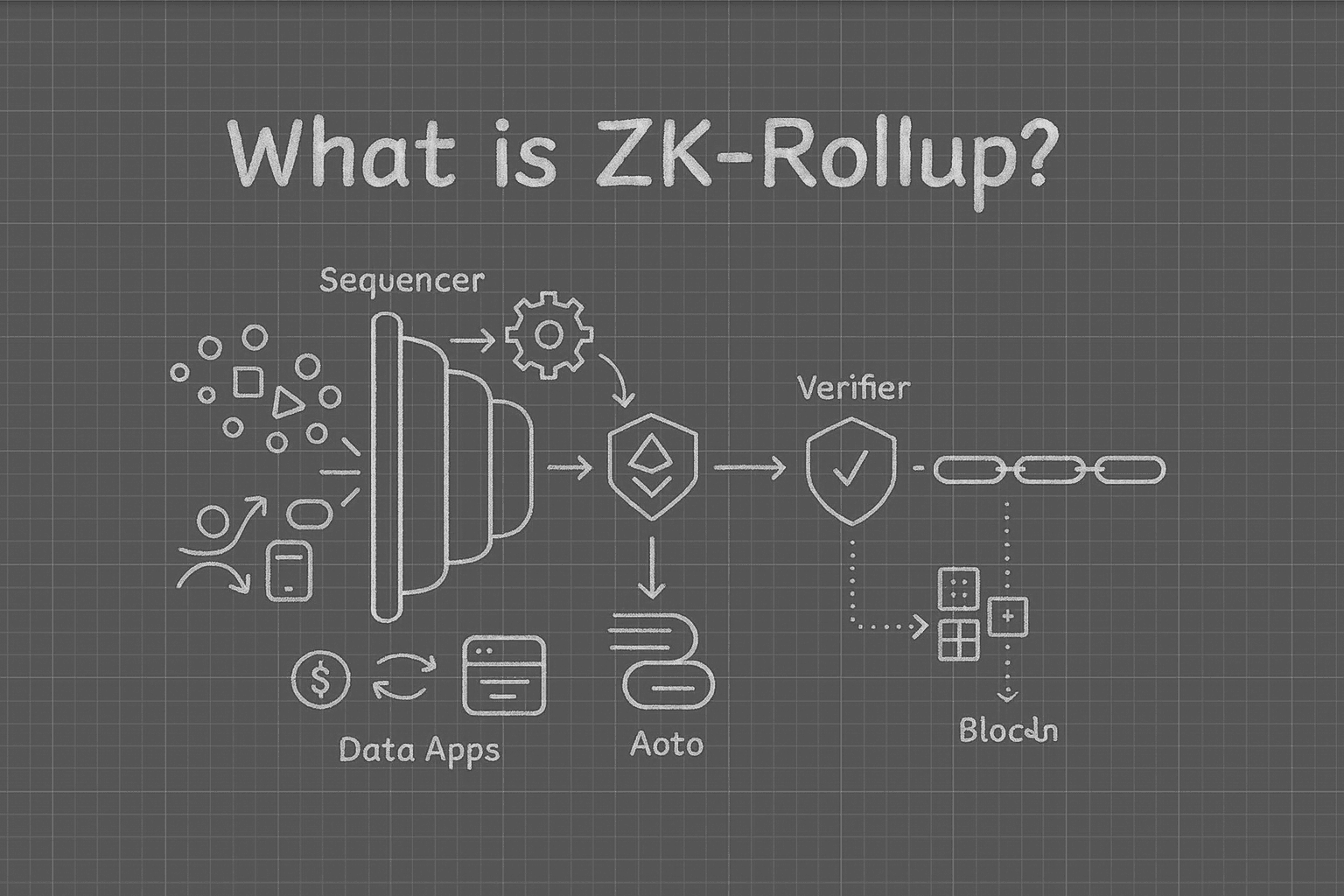

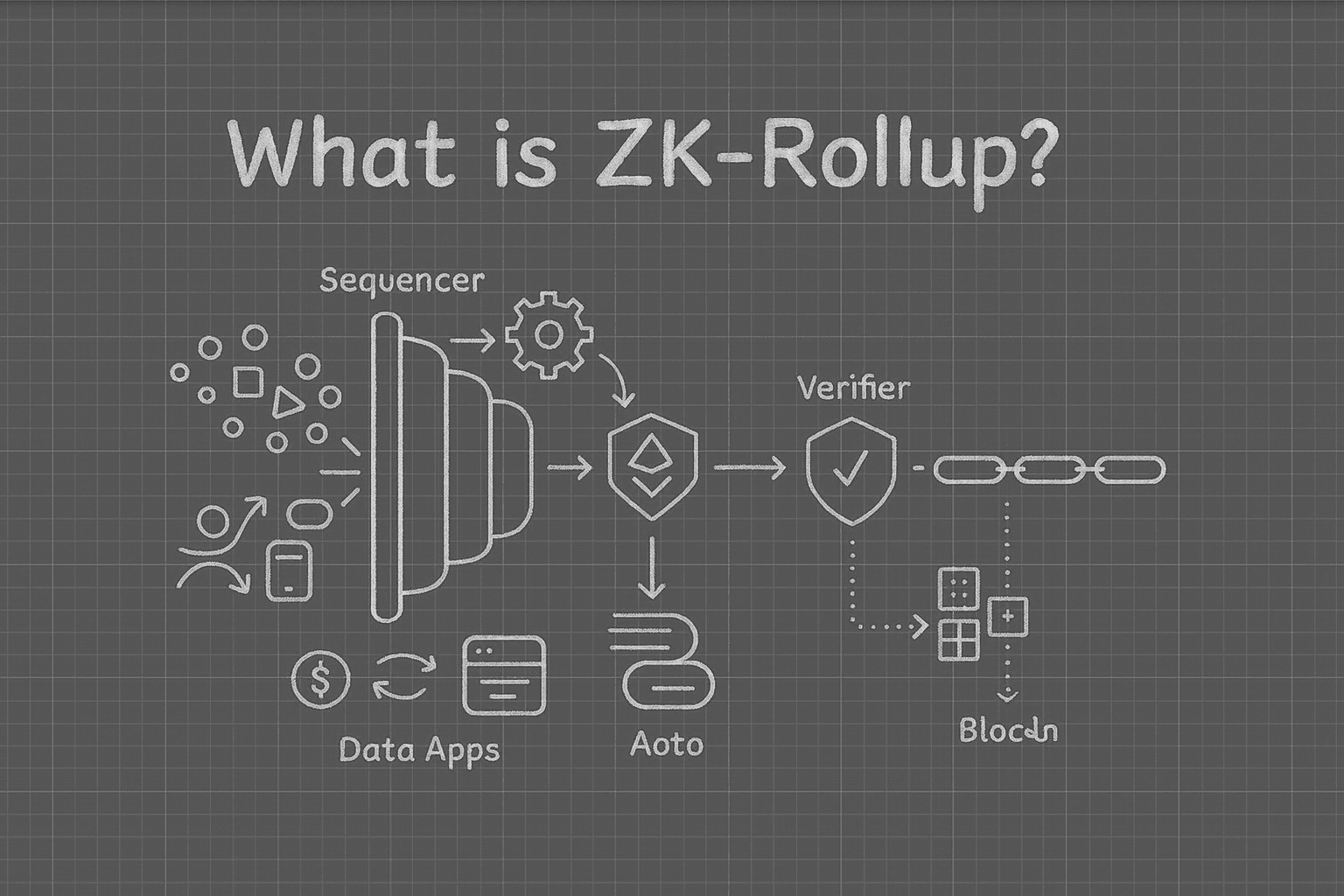

Why ZK Rollups Outpace Traditional Scaling for BTC Accumulation

Zero-knowledge rollups settle batches on Bitcoin, inheriting its security while boosting throughput. Unlike optimistic rollups, ZK variants prove validity off-chain, slashing dispute windows to minutes. This matters in dips: When Bitcoin hit $65,839 intraday, rollup users executed swaps and stakes at fractions of mainnet gas, preserving capital for more sats.

Projects topping 2026 lists – think Citrea’s Bitcoin-native ZK push or emerging zkBTC leaders – redefine scalability. Sources like zkrollups. io rank top 25 by speeds exceeding 1,000 TPS, ecosystems ripe for DeFi and NFTs on Bitcoin. Opinion: Ethereum’s ZK success portends Bitcoin’s; early movers in these will hodl 1 BTC equivalents via tokenized yields, far outstripping spot buys.

Blueprint for 1 BTC Rollups Stacking: Select Protocols and Tactics

Target protocols with proven Bitcoin bridges. Citrea, spotlighted in Ethereum Malaysia talks, exemplifies ZK rollups extending Bitcoin limits. Pair with dYdX-style DEXes on rollups for perpetuals, hedging dips while stacking. Start small: Bridge $100 weekly via rollup entry points, compound via liquidity pools yielding 5-15% APY on BTC collateral.

Risk calculus favors this over spot: Volatility at 13% daily drops demands layered strategies. Monitor 24h ranges; buy rollup BTC when below $67,000 thresholds. By mid-2026, as throughput hits milestones, your stack compounds toward 1 BTC, blending patience with tech leverage.

- Scan top ZK rollups daily via aggregator sites.

- Automate DCA bots on rollup chains.

- Diversify into zkBTC for privacy-enhanced hodling.

These foundational tactics set the stage for scaling your portfolio amid Bitcoin’s current $67,888.00 perch, where every dip below recent $65,839 lows tests resolve but rewards execution. zkBTC protocols shine here, tokenizing Bitcoin for rollup-native yields without custody risks, turning raw accumulation into compounded growth.

Executing this blueprint demands vigilance on protocol maturity. Citrea’s innovations, as unpacked in recent Ethereum Malaysia sessions, demonstrate Bitcoin rollups handling thousands of TPS while settling validly on-chain. Pair that with dYdX-inspired perpetuals, and you hedge volatility at $67,888.00 without exiting BTC exposure. My take: Pure spot hodling misses these edges; bitcoin L2 hodling via rollups captures alpha from scaling narratives.

Top ZK Rollup Projects Primed for BTC Stacking in 2026

2026 rankings from sources like blockchaintechs. io and zkrollups. io spotlight protocols redefining BTC scaling dips. Citrea leads with Bitcoin-native ZK proofs, enabling seamless sats stacking. Others, including zkBTC frontrunners, offer privacy layers amid regulatory scrutiny, batching transactions to sidestep mainnet spikes. These aren’t speculative gems like BlockDAG or Nexchain; they’re infrastructure bets with real throughput gains, some slashing fees 99% per openPR reports.

Top 10 ZK Rollups for 2026 BTC Stacking

-

Citrea: Bitcoin-native ZK rollup settling directly on BTC. TPS: 10,000+ projected. Fees: sub-$0.01. Ecosystem: BTC DeFi pioneer, enabling trustless BTC yield farming during dips. citrea.xyz

-

dYdX: High-throughput DEX chain with ZK proofs. TPS: 2,000+. Fees: ~$0.005. Ecosystem: Perpetual trading, supports BTC pairs for efficient stacking strategies. dydx.exchange

-

zkSync Era: Leading Ethereum ZK rollup. TPS: 300+ peak. Fees: $0.001-$0.003. Ecosystem: 200+ dApps, BTC bridges for cross-chain accumulation. zksync.io

-

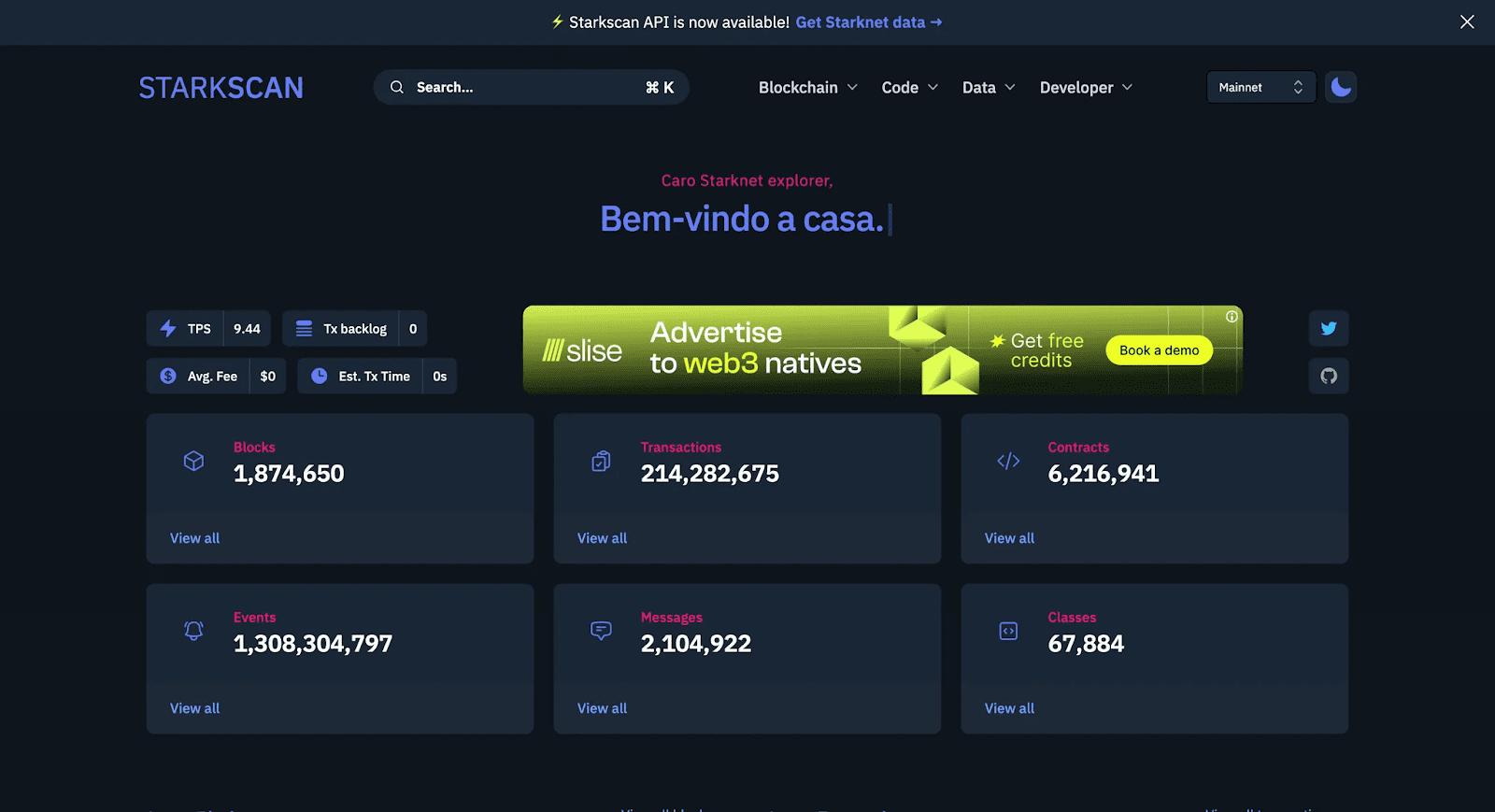

Starknet: STARK-proven ZK L2. TPS: 140+ peak. Fees: ~$0.003. Ecosystem: DeFi, gaming; BTC interoperability via oracles for dip buying. starknet.io

-

Scroll: zkEVM rollup on Ethereum. TPS: 180+ peak. Fees: ~$0.001. Ecosystem: DeFi protocols, BTC wrappers for low-cost transactions. scroll.io

-

Linea: ConsenSys zkEVM rollup. TPS: 50+ peak. Fees: ~$0.001. Ecosystem: Enterprise-grade, BTC integration for secure stacking. linea.build

-

Polygon zkEVM: zkEVM with Polygon scaling. TPS: 100+ potential. Fees: sub-$0.01. Ecosystem: Vast Polygon apps, BTC DeFi access. polygon.technology

-

Taiko: Based ZK rollup. TPS: 1,000+ projected. Fees: <$0.01. Ecosystem: EVM-equivalent, emerging BTC L2 bridges. taiko.xyz

-

Loopring: ZK-rollup DEX pioneer. TPS: 2,000+ via rings. Fees: $0.0001. Ecosystem: Trading, NFTs; efficient for BTC spot accumulation. loopring.org

-

Immutable X: ZK L2 for NFTs/gaming. TPS: 9,000+. Fees: zero gas. Ecosystem: Gaming economies, BTC NFT exposure for diversified stacking. immutable.com

Selecting from these means prioritizing audited bridges and liquidity. At Bitcoin’s $67,888.00 level, post-$64,000 plunge, inflows favor projects blending DeFi with Bitcoin security. Opinion: Skip hype-driven ZK coins; anchor in rollups where your 1 BTC path accelerates through native yields, outpacing vanilla DCA by 2-3x annually.

Bitcoin Technical Analysis Chart

Analysis by Elena Porter | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

As Elena Porter, apply conservative overlays: 1. Draw a primary downtrend line connecting the September 2026 peak at approximately $115,000 to the recent low near $65,839 on February 5, 2026, extending to current levels around $67,888. Use ‘trend_line’ with moderate opacity. 2. Mark horizontal support at $65,000-$66,000 and resistance at $68,500 using ‘horizontal_line’. 3. Highlight recent consolidation range from January 20 to February 12, 2026, between $65,800-$68,000 with ‘rectangle’. 4. Add Fibonacci retracement from the major high ($115,000) to recent low ($65,839) using ‘fib_retracement’, focusing on 38.2% ($82,500) and 50% ($90,000) levels. 5. Place callouts on declining volume and MACD bearish divergence. Emphasize precision with clean lines, no clutter.

Risk Assessment: medium

Analysis: Volatile correction phase with bearish technicals but fundamental tailwinds from scalability; low volume mitigates crash risk.

Elena Porter’s Recommendation: Patience prevails—DCA sparingly below $66k, max 1% risk per trade, monitor ZK flows for BTC impact.

Key Support & Resistance Levels

📈 Support Levels:

-

$65,839 – Recent 24h low, aligns with prior consolidation base.

strong -

$65,000 – Psychological round number, historical bounce zone.

moderate

📉 Resistance Levels:

-

$68,428 – 24h high, immediate overhead supply.

moderate -

$70,000 – Key retracement level from downtrend.

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$67,000 – Dip buy on support hold, DCA aligned with low risk tolerance.

low risk -

$65,839 – Strong support retest for conservative longs.

medium risk

🚪 Exit Zones:

-

$68,428 – Profit target at resistance.

💰 profit target -

$65,000 – Tight stop below key support.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining on downside

Volume drying up during selloff, bullish divergence signaling potential exhaustion.

📈 MACD Analysis:

Signal: bearish divergence

MACD line below signal with contracting histogram, caution for further downside.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Elena Porter is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Risk-Adjusted Stacking: Mitigate Pitfalls in Rollup Accumulation

Volatility persists – 13% daily swings demand buffers. Rollup risks like sequencer centralization or bridge exploits loom, yet ZK’s cryptographic rigor minimizes them versus optimistic alternatives. Diversify across 3-5 protocols; allocate 20% to zkBTC for privacy, 40% DCA core, 40% yield farms. Monitor 24h highs at $68,428; scale buys below $67,000.

Regulatory headwinds, fueling the February retreat, underscore Bitcoin’s resilience. Hoskinson’s $250k call banks on adoption; bears eye $10k retrace if liquidity dries. Rollups insulate via off-chain efficiency, letting you stack sats uninterrupted. Track aggregator dashboards for real-time TVL shifts – rising volumes signal protocol strength.

- Stress-test bridges with small transfers first.

- Set stop-losses on leveraged positions within rollups.

- Rebalance quarterly, favoring high-TPS leaders.

By Q4 2026, as ZK milestones compound, your methodical stack nears 1 BTC parity, fortified against mean reversion. This isn’t gambling on rebounds; it’s engineering exposure through superior infrastructure. Precision in protocol choice, patience through dips, performance in yields – the rollup edge positions Bitcoin holders for dominance in a multi-trillion scaled ecosystem.