Bitcoin’s scalability has long been its Achilles’ heel, constraining DeFi ambitions despite its unmatched security. Enter Citrea, the pioneering Citrea ZK rollup that just launched mainnet, delivering the first Bitcoin BitVM settlement for true modular scaling. At a current price of $66,646.00, BTC faces a 24-hour dip of -3.17%, yet Citrea’s arrival injects fresh momentum into ZK rollup on Bitcoin narratives, promising EVM-compatible execution without compromising L1 purity.

Citrea stands out by anchoring both data availability and settlement firmly on Bitcoin L1, sidestepping the trust assumptions plaguing many L2s. It fuses zkEVM rollups for off-chain throughput with BitVM’s fraud-proof paradigm, enabling native finality. This bitcoin modular scalability blueprint isn’t theoretical; mainnet rollout brings over 30 Bitcoin-native apps, from DEXs to lending protocols, all challengeable directly on Bitcoin.

Decoding Citrea’s zkEVM and BitVM Synergy

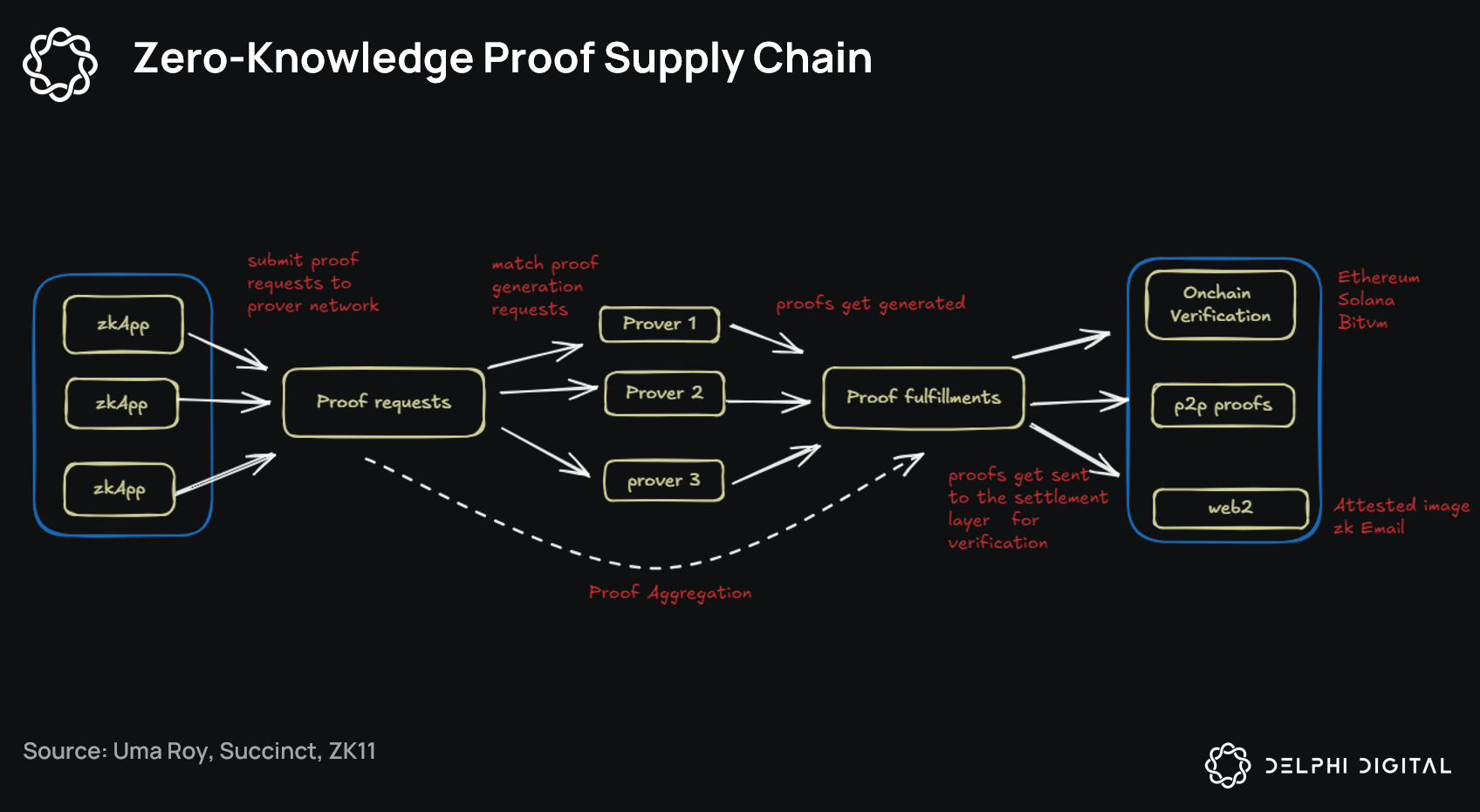

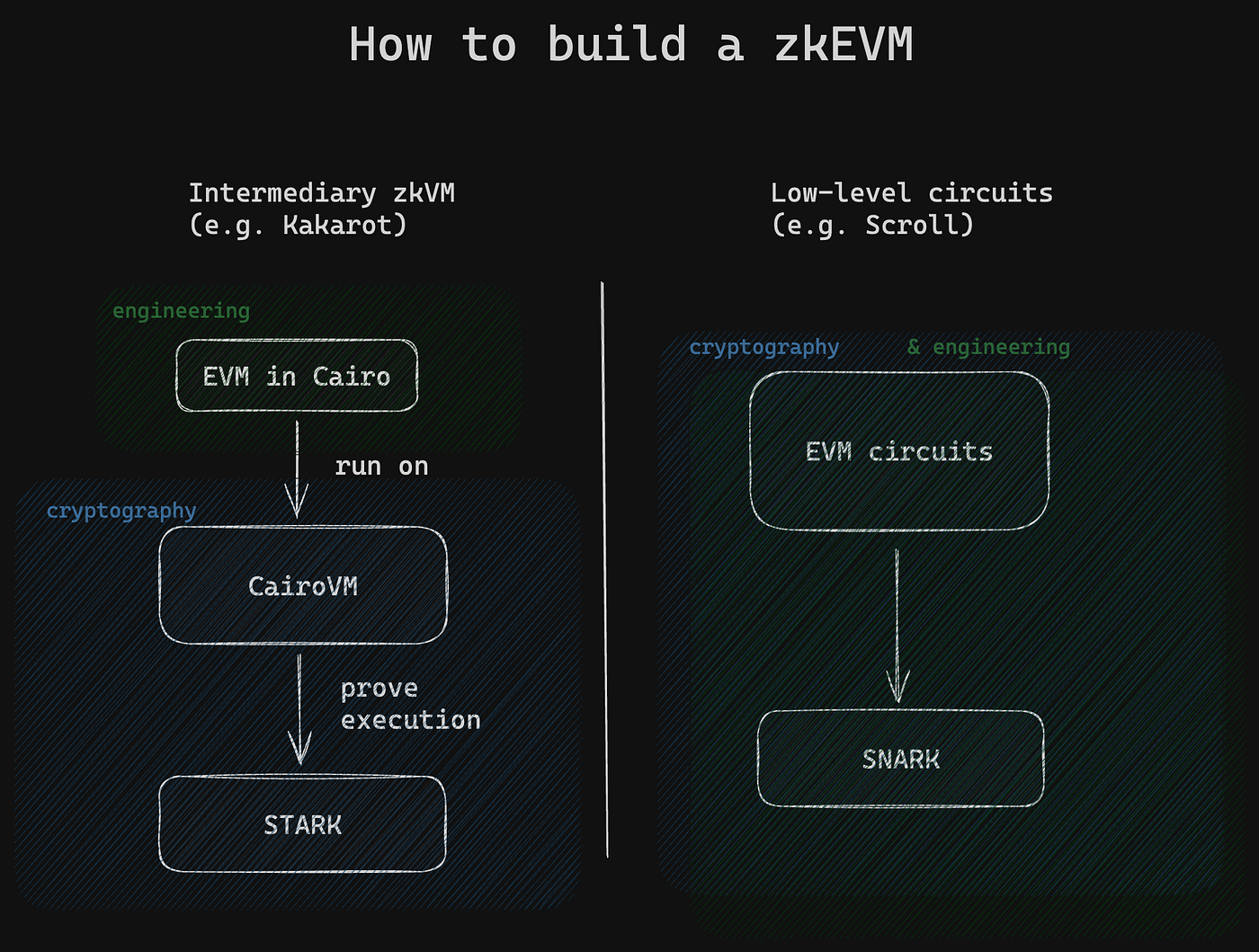

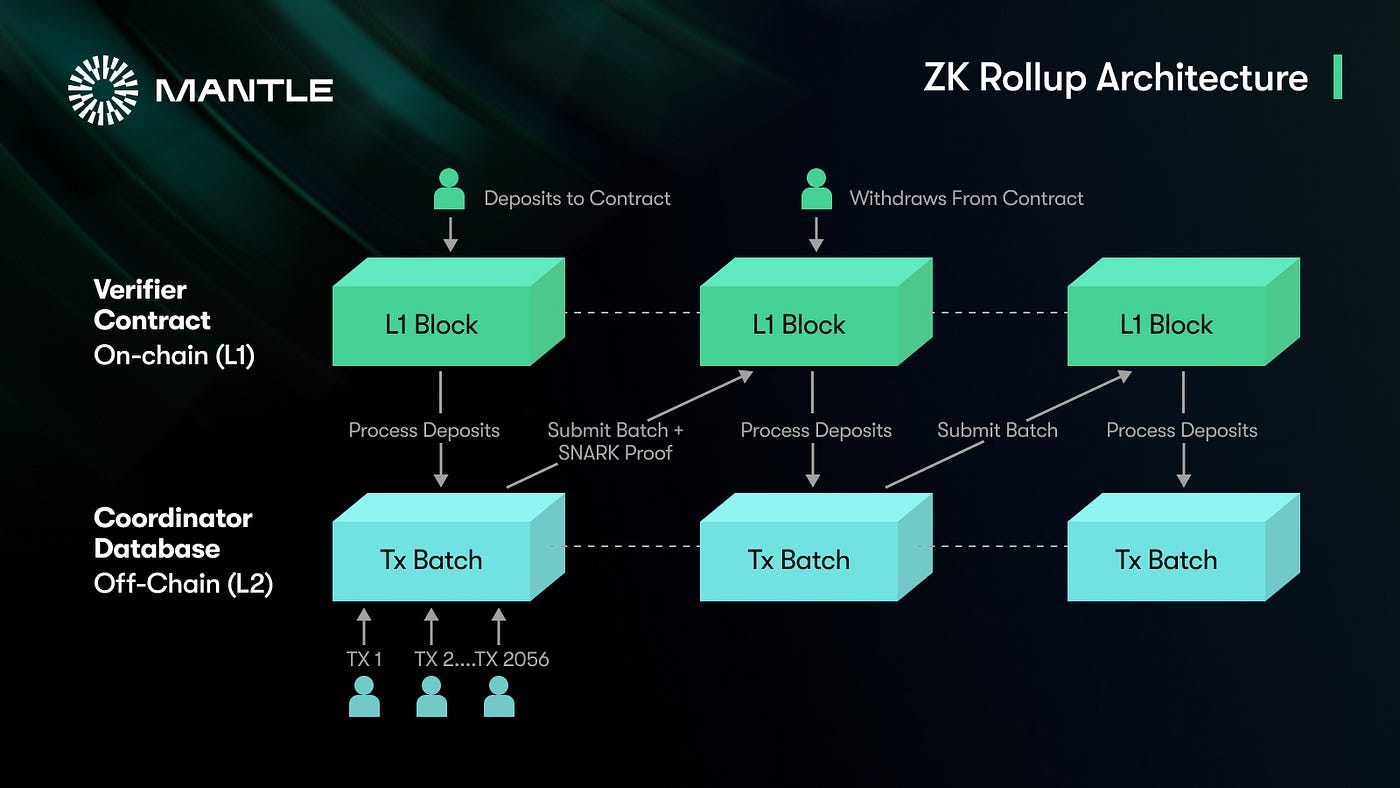

At its core, Citrea deploys a zkEVM sequencer that batches transactions, generates succinct proofs, and posts them to Bitcoin via BitVM. Unlike optimistic rollups reliant on long challenge windows, ZK proofs here offer instant validity, slashing latency while inheriting Bitcoin’s proof-of-work rigor. BitVM, the linchpin for zkBTC rollups 2026, emulates a Turing-complete VM atop Bitcoin scripts, facilitating trust-minimized bridges like Clementine for cBTC issuance.

Consider the mechanics: users deposit BTC, mint wrapped cBTC on Citrea, and dive into DeFi. Fraud proofs? They’re BitVM-verifiable on L1, ensuring no multisig custodians dilute sovereignty. This combo yields 1,000 and TPS potential, dwarfing Bitcoin’s base layer, all while preserving decentralization. Critics highlight UX friction in BitVM’s on-chain verification heft, but Citrea mitigates via optimistic aggregation layers, blending speed with security.

Citrea is the only scalability solution that uses Bitcoin both as a data availability and a settlement layer, via its BitVM-based trust-minimized bridge.

From stealth mode to spotlight, Citrea’s trajectory mirrors Bitcoin’s ethos: incremental, verifiable progress over flashy overpromises.

Citrea Mainnet: ctUSD Unlocks Native Bitcoin DeFi

The launch spotlights ctUSD, a dollar-pegged stablecoin backed by U. S. Treasuries and cash via M0 and MoonPay. Fully collateralized, it powers trustless BTC lending: deposit BTC, mint cBTC, borrow ctUSD sans bridges or wrappers. This primitive catapults Bitcoin beyond store-of-value status, birthing yield-bearing assets on native rails.

Over 30 dApps at genesis underscore adoption readiness. DEXs like those mirroring Uniswap mechanics, plus perps and options, now thrive with Bitcoin settlement. Liquidity bootstraps via incentives, but Citrea’s edge lies in finality: every state root commits to L1, impervious to sequencer failures. In a market where BTC hovers at $66,646.00 after dipping from a 24-hour high of $69,903.00, such infrastructure could catalyze rebounds by unlocking trillions in idle sats.

BitVM’s role amplifies this. By scripting disputes into Bitcoin’s taproot covenants, it enforces modular design: execution off-chain, DA and consensus on-chain. Early metrics post-launch show sequencer uptime north of 99%, with proof generation under 10 minutes. Yet, liquidity remains nascent; Citrea prioritizes tech purity over hype, a calculated bet on developer mindshare.

BitVM Settlement: Forging Bitcoin’s Modular Future

BitVM isn’t mere hype; it’s the settlement oracle enabling Bitcoin BitVM settlement. Traditional bridges falter on custody risks, but BitVM’s two-party compute model lets verifiers challenge invalid states on-chain, using Bitcoin’s economic finality. Citrea extends this to rollup validity, posting ZK proofs as BitVM inputs for extraction games.

This yields unprecedented composability. Imagine BTC-collateralized synthetics settling in blocks, or RWAs tokenized with L1 oracles. Challenges persist: script size limits cap complexity, and prover costs demand optimization. Still, Citrea’s mainnet proves viability, positioning it as bedrock for zkBTC rollups 2026.

Bitcoin (BTC) Price Predictions 2027-2032: Citrea ZK Rollup Scaling Impact

Forecasts incorporating Citrea mainnet launch, Bitcoin DeFi growth, halving cycles, and market trends as of 2026 (baseline: ~$70,000)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $85,000 | $140,000 | $220,000 | +100% |

| 2028 | $120,000 | $280,000 | $500,000 | +100% |

| 2029 | $180,000 | $420,000 | $700,000 | +50% |

| 2030 | $250,000 | $560,000 | $900,000 | +33% |

| 2031 | $320,000 | $700,000 | $1,100,000 | +25% |

| 2032 | $400,000 | $850,000 | $1,400,000 | +21% |

Price Prediction Summary

Citrea’s ZK rollup mainnet launch positions Bitcoin for explosive growth by enabling native DeFi, EVM compatibility, and scalable settlement via BitVM. Projections show average BTC prices climbing from $140K in 2027 to $850K by 2032, with bullish maxima exceeding $1M amid adoption surges and 2028 halving, while minima reflect conservative floors amid potential regulatory or macro headwinds.

Key Factors Affecting Bitcoin Price

- Citrea mainnet adoption driving Bitcoin DeFi TVL and utility beyond store-of-value

- 2028 Bitcoin halving enhancing scarcity and historical bull cycles

- ZK rollup scalability improving TPS without compromising security/decentralization

- Regulatory clarity and institutional inflows (e.g., ctUSD stablecoin, BTC lending)

- Macro trends positioning BTC as digital gold amid competition from ETH L2s

- BitVM trust-minimization and EVM compatibility attracting developers and liquidity

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Analysts peg Citrea’s TVL trajectory conservatively at $500M within quarters, contingent on EVM porting ease. With BTC at $66,646.00 consolidating post-dip, this ZK rollup could redefine scalability debates, proving modular stacks viable sans altcoin dalliances.

While Citrea’s architecture gleams with technical elegance, real-world deployment exposes friction points that could temper enthusiasm. User experience lags behind Ethereum L2s, where seamless bridging and wallet integrations are table stakes. BitVM’s verification demands hefty on-chain footprints, potentially congesting Bitcoin during disputes. Prover economics also loom large; generating ZK proofs for high-throughput batches requires specialized hardware, risking centralization if nodes can’t keep pace.

Navigating Risks in Bitcoin Modular Scalability

Citrea counters these with hybrid proving: optimistic paths for routine ops, escalating to ZK only on contention. Liquidity bootstrapping hinges on incentives like ctUSD yields, but nascent TVL demands patience. Competition brews from Ark, Bitlayer, and optimistic variants, yet Citrea’s pure ZK-BitVM fusion carves a defensible moat via native settlement. In a BTC market at $66,646.00, down 3.17% over 24 hours from a high of $69,903.00, investor scrutiny intensifies; scaling solutions must deliver utility, not vaporware.

Security audits underscore robustness, with no exploits post-mainnet. Still, BitVM’s novelty invites edge-case exploits, demanding vigilant monitoring. Citrea’s sequencer, while decentralized in theory, relies on stakers for liveness; MEV risks persist, though mitigated by proof-of-stake rotations tied to BTC collateral.

Citrea’s Key Advantages

-

Native BitVM Settlement: Uses BitVM for trust-minimized bridging and fraud proofs challengeable directly on Bitcoin L1, preserving core security.

-

Full EVM Compatibility: Enables zkEVM rollups for familiar smart contract execution on Bitcoin without altering its model.

-

ctUSD Stablecoin: Fiat-backed USD-pegged stablecoin via M0 and MoonPay, enables trustless BTC-collateralized lending with cBTC minting.

-

1000+ TPS Throughput: Delivers high scalability via ZK proofs while using Bitcoin for data availability and finality.

-

30+ dApps at Launch: Includes Bitcoin-native DEXs, lending platforms, and more for expanded DeFi utility.

Developers flock to Citrea for its EVM parity, porting Solidity contracts with minimal tweaks. Tools like Foundry integrate natively, slashing onboarding. Early adopters build perps platforms collateralized by BTC, RWAs bridged via oracles, and synthetics mirroring TradFi. This composability, rooted in ZK rollup on Bitcoin, positions Citrea as a DeFi hub without Ethereum’s gas wars.

Ecosystem Momentum: 30 and dApps Powering Citrea Bitcoin Scaling

Mainnet genesis unveiled DEXs rivaling Uniswap in AMM efficiency, lending protocols offering 5-10% APY on cBTC, and yield aggregators farming across pools. Standouts include a BTC perpetuals exchange settling via BitVM and a stablecoin swapper leveraging ctUSD arbitrage. Total dApp count hit 35 within days, with TVL climbing past $10M amid BTC’s dip to $66,646.00.

Integration with wallets like Xverse smooths UX, enabling one-click BTC deposits. Clementine bridge, BitVM-powered, issues cBTC trustlessly, bypassing multisigs. This infrastructure unlocks Bitcoin’s $1.3 trillion market cap for DeFi, where idle holdings yield nothing on L1. As BTC lowed to $66,392.00 in 24 hours, Citrea’s primitives offer hedges via leveraged positions.

Forward-looking, Citrea eyes prover optimizations via recursive SNARKs, targeting sub-minute finality. Partnerships with M0 bolster ctUSD reserves, ensuring peg stability amid volatility. For investors eyeing zkBTC rollups 2026, Citrea’s metrics signal breakout: sequencer throughput at 500 TPS, dispute resolution under 1 hour. Yet success pivots on liquidity inflection; surpassing $100M TVL could ignite network effects.

Citrea redefines Citrea Bitcoin scaling by embedding modularity without dilution. BTC at $66,646.00 tests resolve, but this ZK rollup’s fusion of zkEVM, BitVM, and native DeFi primitives heralds a paradigm shift. Developers gain canvas, users unlock yields, investors tap untapped value. In Bitcoin’s unyielding ledger, Citrea etches the blueprint for scalable sovereignty.