As Bitcoin hovers at $87,146.00 amid a slight 24-hour dip of $-3,763.00 (-0.0414%), with recent highs touching $91,898.00 and lows at $87,113.00, the ecosystem edges closer to a transformative upgrade. GOAT Network’s impending GOAT Rollup BitVM Bridge launch in December 2025 stands poised to unlock Bitcoin native zk-rollup capabilities, sidestepping the pitfalls of wrapped tokens and external bridges. This innovation, rooted in BitVM2 protocols, promises trustless verification of off-chain computations directly on Bitcoin’s base layer, fostering scalable smart contracts and genuine BTC yield generation.

GOAT Network’s bridge represents a pivotal shift in Bitcoin Layer-2 architecture. By integrating BitVM2 with their proprietary zkVM, GOAT eliminates the trust assumptions plaguing traditional rollups reliant on custodians or synthetic assets. Instead, users retain sovereignty over native BTC, channeling it into high-throughput applications while inheriting Bitcoin’s uncompromising security. This Bitcoin native zk-rollup 2025 milestone arrives at a juncture when BTC’s market cap underscores the urgency for efficient scaling; without such advancements, congestion and fees could stifle DeFi and dApp proliferation on the world’s premier blockchain.

Unpacking the GOAT BitVM Bridge Mechanics

The GOAT Rollup BitVM Bridge leverages BitVM2’s fraud-proof paradigm, enabling Bitcoin to validate zero-knowledge proofs without soft forks or governance votes. Traditional Bitcoin L2s often dilute security through wrapped BTC (WBTC) or multisig bridges, exposing users to counterparty risks. GOAT circumvents this by deploying a multi-round randomized challenge mechanism, thwarting operator double-spending and slashing dispute resolutions from Bitcoin’s standard 14-day window to under one day. Their zkMIPS proofs, generated via an in-house zkVM, ensure computational integrity across provers, delivering sub-3-second real-time proving across five parallel nodes.

GOAT Network is developing the GOAT BitVM bridge, scheduled to go live in December 2025. Combined with GOAT’s in-house zkVM, this will make GOAT the first sustainable Bitcoin ZK Rollup.

This technical elegance addresses core Bitcoin scaling pain points. BitVM2’s reimbursement efficiency, paired with zkVM’s succinct proofs, minimizes on-chain footprint while maximizing throughput. Developers gain a canvas for complex logic, think perpetuals, lending protocols, and yield farms, all settled natively on Bitcoin. Early benchmarks from GOAT’s BitVM2 Beta-Mainnet in Q4 2025 signal readiness, with cross-chain integrations like the DOGE Native Bridge hinting at broader interoperability.

BitVM2 and zkVM: Forging zkBTC Security Guarantees

At its core, BitVM2 extends Bitcoin’s scripting language to emulate a Turing-complete verifier for BitVM2 zk proofs Bitcoin. GOAT refines this with zkVM Bitcoin scaling optimizations, where ZKM’s zkVM produces proofs attesting to arbitrary program execution. This duo establishes a “trustless execution path, ” as articulated in GOAT’s documentation: fog-like obfuscation of state transitions resolved by lighthouse beacons of validity proofs. Security inherits Bitcoin’s economic finality; challengers stake BTC to dispute fraud, with slashing enforcing honesty.

Contrast this with Ethereum’s optimistic rollups or even other Bitcoin L2 experiments: GOAT’s approach demands no sequencer trust, no oracles for pricing, and zero dilution of BTC’s monetary purity. The result? A Layer-2 where zkVM Bitcoin scaling supports app-specific chains with full EVM compatibility, yet anchored to Bitcoin’s proof-of-work consensus. As BTC trades at $87,146.00, such primitives could catalyze institutional inflows, mirroring Solana’s yield allure but with Bitcoin’s pedigree.

Explore how GOAT leverages BitVM2 for native yield

Pioneering Sustainable Bitcoin Yield Rollups

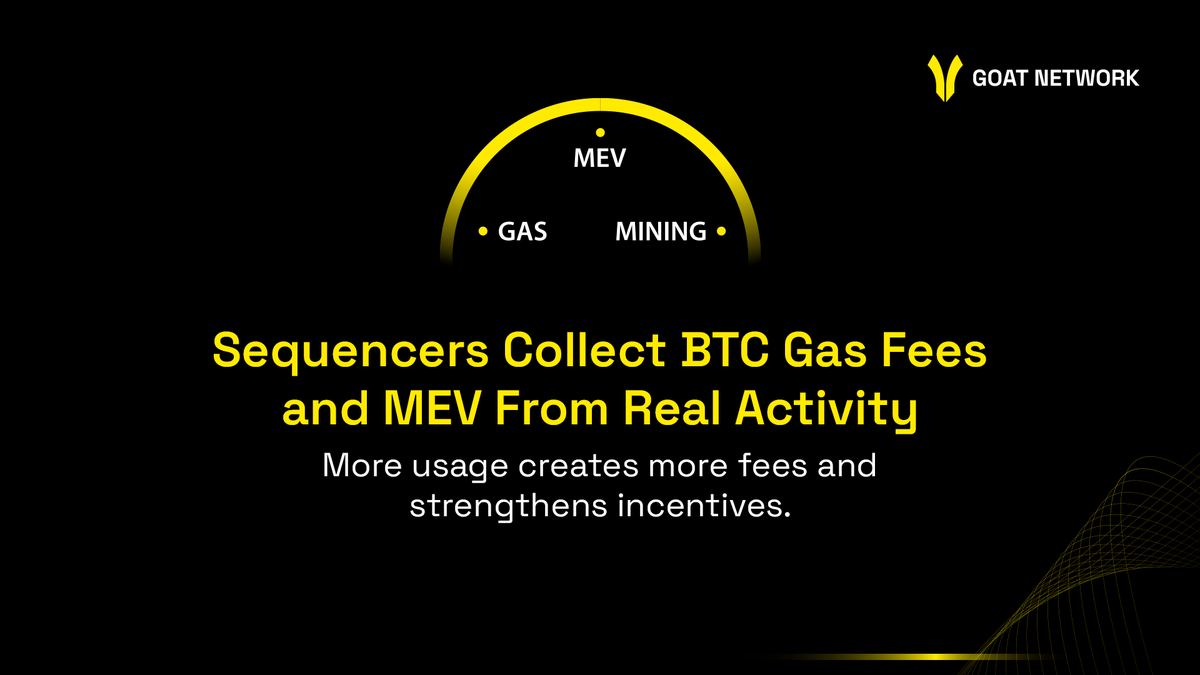

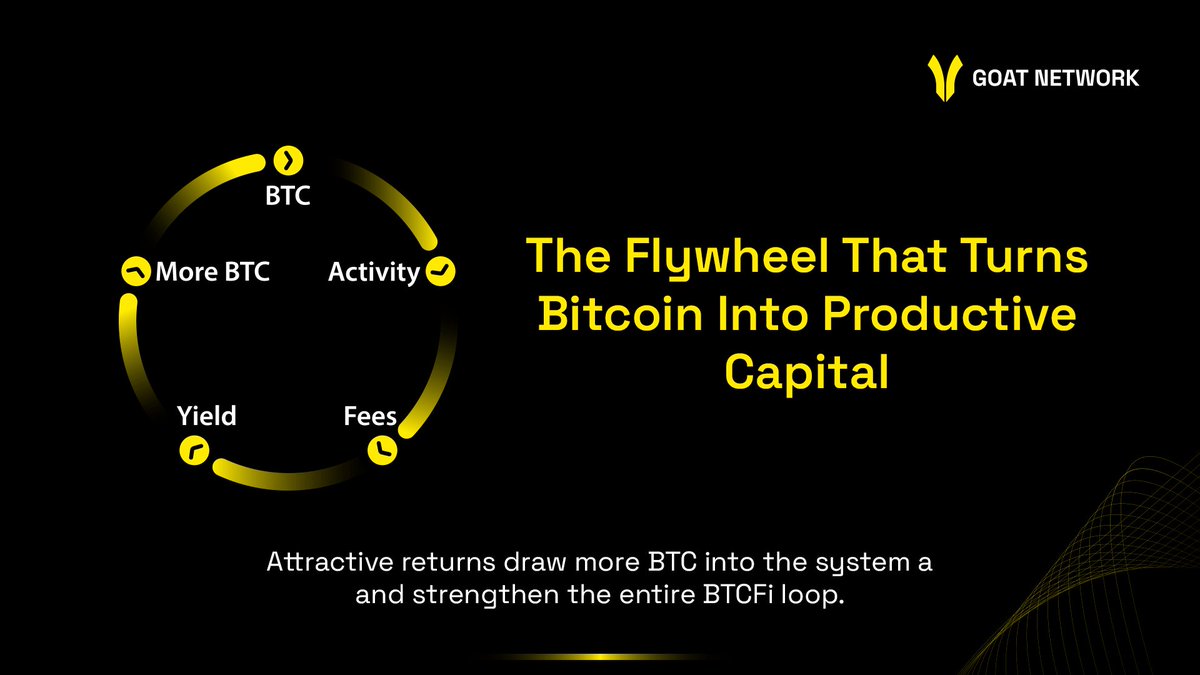

GOAT’s liquid staking platform crowns the bridge’s utility, enabling holders to earn sustainable Bitcoin yield rollup returns without relinquishing custody. Native BTC stakes into restaked positions, powering the rollup’s prover network and sequencer operations. Yields accrue from MEV capture, transaction fees, and protocol incentives, all denominated in BTC, bypassing token dilution. This three-pronged strategy, BitVM bridge, zkVM proving, liquid staking, constructs an ecosystem where yield compounds atop Bitcoin’s appreciation potential.

Bitcoin (BTC) Price Prediction 2026-2031

Predictions incorporating the impact of GOAT BitVM Bridge launch in December 2025, enabling native Bitcoin ZK rollups, scaling solutions, and sustainable BTC yield adoption

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2026 | $70,000 | $120,000 | $180,000 | +33% (from 2025 est. $90K) |

| 2027 | $100,000 | $160,000 | $240,000 | +33% |

| 2028 | $140,000 | $220,000 | $350,000 | +38% |

| 2029 | $200,000 | $320,000 | $500,000 | +45% |

| 2030 | $250,000 | $380,000 | $550,000 | +19% |

| 2031 | $300,000 | $480,000 | $750,000 | +26% |

Price Prediction Summary

Bitcoin prices are forecasted to experience substantial growth from 2026 to 2031, propelled by the GOAT BitVM Bridge’s introduction of trustless Bitcoin-native ZK rollups and real BTC yield opportunities. Starting from a 2026 average of $120K (up 33% from 2025’s ~$90K baseline), BTC could reach an average of $480K by 2031 in bullish scenarios, reflecting enhanced scalability, adoption in BTCFi, and alignment with the 2028 halving cycle. Min/Max ranges account for bearish corrections and euphoric peaks.

Key Factors Affecting Bitcoin Price

- GOAT BitVM Bridge launch (Dec 2025): Enables native ZK rollups without wrapped tokens, boosting Bitcoin L2 scalability and security via BitVM2.

- Sustainable BTC yield via GOAT’s liquid staking, attracting holders and institutions.

- 2028 Bitcoin halving amplifying supply scarcity amid rising demand.

- Regulatory progress toward clearer frameworks for BTC L2s and DeFi.

- Broader market cycles, institutional inflows, and competition from other L2s influencing volatility.

- Technological advancements in zkVM and real-time proving reducing costs and enhancing UX.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With BTC at $87,146.00, early adopters stand to capture asymmetric upside as GOAT deploys. Institutional-grade BTC yield beckons, potentially rivaling TradFi alternatives while embedding Bitcoin deeper into global finance.

Market dynamics amplify this appeal. As Bitcoin consolidates around $87,146.00, down $-3,763.00 (-0.0414%) over 24 hours between $91,898.00 and $87,113.00, Layer-2 yield primitives like GOAT’s could stem outflows to higher-return chains. Investors weary of idle BTC holdings now eye rollups that deliver compounded returns without forsaking base-layer security. GOAT’s model, fusing GOAT Rollup BitVM bridge with liquid staking, positions it as a frontrunner in BTCFi’s maturation.

GOAT’s Roadmap: From Beta to Bitcoin-Native Dominance

GOAT’s trajectory builds methodically. The BitVM2 Beta-Mainnet, already live in Q4 2025, validated sub-3-second proofs across five provers, a feat unmatched in Bitcoin L2s. December’s GOAT BitVM Bridge deployment seals native zk-rollup functionality, enabling seamless BTC deposits for rollup execution. Post-launch, expect DOGE interoperability and expanded zkVM support for EVM dApps, drawing liquidity from memecoin traders and DeFi power users alike. This sequencing mitigates risks, prioritizing provable security before aggressive scaling.

Critically, GOAT sidesteps the ‘fog’ of opaque state management plaguing nascent Bitcoin L2s. Their ‘lighthouse’ validity proofs, powered by zkMIPS, illuminate execution fidelity, ensuring no hidden vectors for exploitation. In a landscape littered with bridge hacks totaling billions, this rigor commands premium valuations for GOAT’s ecosystem token and staked BTC positions.

Sustainable #BTC yield on #GOATNetwork begins with #Bitcoin itself. GOAT Network is developing the GOAT BitVM bridge, scheduled to go live in December 2025.

Peer comparisons underscore GOAT’s edge. While Stacks offers smart contracts via Clarity, it lacks zk succinctness; Arkham’s rollups demand wrapped assets. GOAT delivers unadulterated Bitcoin native zk-rollup 2025 execution, where every satoshi traces back to UTXOs without intermediaries. This purity, I argue, will anchor institutional BTC allocations, much as Ethereum’s L2s funneled trillions into DeFi post-Merge.

Developer and Investor Implications

For developers, zkVM Bitcoin scaling opens floodgates. Build perpetual DEXes with native BTC collateral, oracle-free options markets, or yield-bearing savings vaults, all verified via BitVM2. Tooling matures rapidly: GOAT’s SDKs support Rust and Solidity, with real-time proving slashing latency barriers. Throughput rivals optimistic systems yet inherits Bitcoin’s censorship resistance, ideal for global settlement layers.

Investors face a calculus shift. At $87,146.00, BTC’s velocity stagnates without yield levers. GOAT’s sustainable Bitcoin yield rollup mechanisms, drawing from MEV and fees, project 5-15% annualized returns conservatively, scaling with adoption. Liquid staking tokens (LSTs) trade at premiums, offering exit liquidity while capturing upside. Risks persist, prover centralization, adoption lags, but BitVM2’s slashing economics align incentives sharply.

Dive into Bitcoin’s zk-rollup evolution

GOAT Network redefines Bitcoin’s scalability playbook. By wedding BitVM2’s fraud proofs to zkVM’s efficiency, it births a Layer-2 where native BTC fuels innovation without compromise. As 2025 closes with the bridge live, expect BTC’s $87,146.00 perch to magnetize fresh capital, propelling rollups from niche to necessity. Bitcoin’s monetary supremacy endures, now augmented by programmable yield and infinite scale.