Bitcoin’s ongoing quest for scalability has entered a new era with the emergence of zkBTC Rollups. As Bitcoin trades at $112,488.00 in late 2025, the network faces unprecedented transaction demand, putting pressure on fees and confirmation times. Zero-knowledge rollup (zk-rollup) technology, already proven on Ethereum, is now poised to transform Bitcoin’s transaction throughput while preserving its core values of security and decentralization.

Why Transaction Scalability Matters More Than Ever

With Bitcoin adoption surging and new use cases, from tokenized assets to Layer 2 DeFi, competing for block space, scalability is no longer a distant concern. At the current price of $112,488.00, even minor fee fluctuations can have significant impacts on both retail users and institutional flows. Traditional scaling attempts like SegWit and Lightning Network have moved the needle but haven’t fully unlocked mass-scale throughput for everyday transactions.

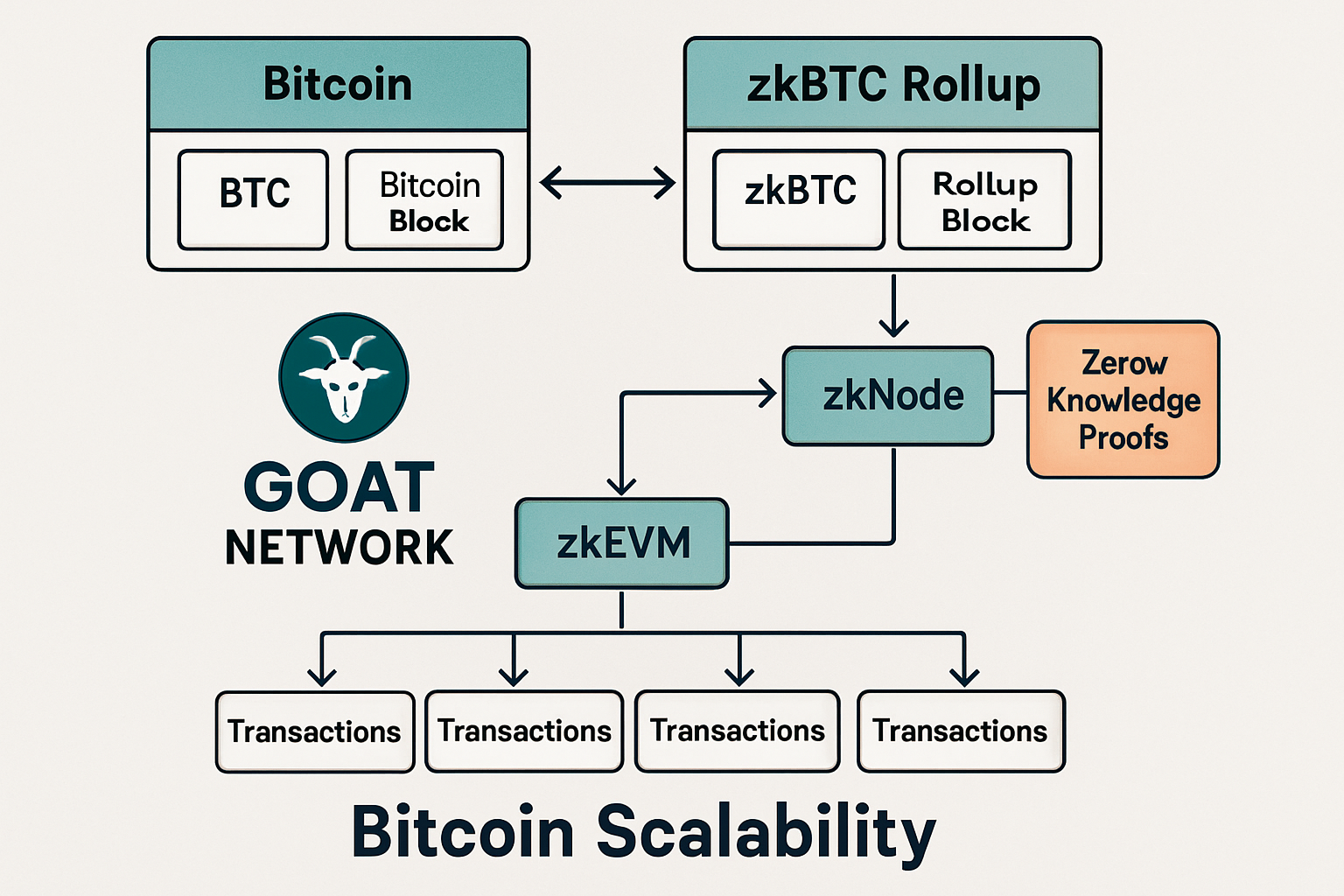

This is where zkBTC rollups come in. By aggregating hundreds or thousands of transactions off-chain and submitting only a succinct cryptographic proof to the main chain, zk-rollups promise orders-of-magnitude improvements in capacity without compromising Bitcoin’s trustless ethos. The result? Lower fees, faster confirmations, and greater accessibility for all participants.

The Mechanics: How zkBTC Rollups Work

Zero-knowledge proofs (ZKPs) are at the heart of this breakthrough. In a zkBTC rollup, transactions are bundled together off-chain by a coordinator who then generates a ZKP attesting that all included transactions are valid according to Bitcoin’s consensus rules, without revealing private details about individual transfers.

This proof is posted to the Bitcoin blockchain alongside minimal auxiliary data. The main chain validators simply verify the proof instead of re-executing every transaction. This drastically reduces data load per block while preserving full auditability and security guarantees.

Recent innovations from GOAT Network have made this vision practical for Bitcoin:

- Label Forward Propagation: Abstracts input-output relationships in cryptographic circuits so they can be reused efficiently across multiple batches.

- Homomorphic Obfuscation Circuits: Safeguard privacy when circuits are reused at scale.

- Aggressive Data Compression: Optimized structures shrink auxiliary data from gigabytes to megabytes, over 1,000x smaller, reducing hardware requirements so more nodes can participate in validation.

- zkMIPS Virtual Machine: Supports both STARKs and SNARKs for rapid proof generation and verification.

Together these advances have slashed deployment timelines from years to months, signaling that production-ready zkBTC rollups are on the near horizon.

The Current Landscape: Top zkBTC Projects and Market Context

The race to scale Bitcoin with zero-knowledge proofs has attracted top cryptography teams globally. Projects like GOAT Network are not only innovating technically but also setting new standards for decentralization by lowering node requirements through efficient encoding techniques (source). This democratizes participation in Layer 2 networks, an essential step toward robust security as usage scales up.

The broader crypto industry recognizes zero-knowledge technology as foundational for Web3’s next chapter. According to industry trackers such as Blockchain Technologies and KuCoin Research, zk-rollup projects dominate lists of “most promising scalability solutions” in both Ethereum and emerging Bitcoin ecosystems. For investors and builders alike, understanding how these protocols work, and which ones are closest to market readiness, is crucial for capitalizing on this paradigm shift.

Bitcoin Price Prediction 2026-2031: Impact of zkBTC Rollups on BTC Scalability

Professional BTC price projections factoring in zkBTC Rollup adoption, technological breakthroughs, and evolving market dynamics (2025 baseline: $112,488)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $105,000 | $128,000 | $165,000 | +13.8% | Initial zkBTC rollup adoption; increased throughput but global macro uncertainty. |

| 2027 | $115,000 | $150,000 | $198,000 | +17.2% | Mainnet zkBTC rollups live; rising institutional adoption, regulatory clarity in US/EU. |

| 2028 | $134,000 | $178,000 | $235,000 | +18.7% | Widespread use of BTC for payments; further fee reduction and L2 ecosystem growth. |

| 2029 | $150,000 | $207,000 | $270,000 | +16.3% | BTC competes with stablecoins and CBDCs for global settlement; some regulatory headwinds. |

| 2030 | $168,000 | $240,000 | $310,000 | +15.9% | zkBTC rollups reach maturity; significant DeFi and tokenization on Bitcoin. |

| 2031 | $185,000 | $275,000 | $360,000 | +14.6% | BTC seen as programmable money; strong global adoption, but competition from next-gen chains. |

Price Prediction Summary

The outlook for Bitcoin through 2031 is increasingly bullish, driven by rapid zkBTC rollup development, which is set to dramatically improve transaction scalability and lower fees. The average price is projected to more than double from current levels by 2031, with substantial upside potential if technological and adoption milestones are met. However, price volatility, macro cycles, and regulatory factors could still introduce risk and periodic corrections.

Key Factors Affecting Bitcoin Price

- zkBTC rollup deployment timelines and adoption rates

- Global regulatory environment for Bitcoin and L2s

- Institutional adoption and integration of BTC in financial products

- Competition from other scalable blockchains and L2 solutions

- Macro-economic cycles and global monetary policy

- Integration of advanced privacy and programmability features (e.g., zkMIPS, homomorphic circuits)

- Network effects from reduced transaction fees and greater throughput on Bitcoin

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As zkBTC rollups approach production readiness, the implications for Bitcoin’s transaction landscape are profound. With the ability to bundle thousands of transactions into a single proof, users benefit from significantly reduced fees and near-instant settlement times. This efficiency gain is particularly impactful at today’s $112,488.00 BTC price point, where on-chain congestion can quickly translate into prohibitively high costs for everyday transfers.

Unlike earlier Layer 2 approaches, zkBTC rollups do not require trust in centralized operators or custodians. Instead, security is mathematically enforced by zero-knowledge proofs and the underlying Bitcoin consensus itself. This means that even as transaction volume scales up, users retain full sovereignty over their assets and can always verify the integrity of the system independently.

Unlocking New Use Cases and Ecosystem Growth

The arrival of scalable zkBTC rollups is set to catalyze a wave of innovation across Bitcoin’s ecosystem. Developers can now build applications that were previously impractical due to cost or speed constraints: microtransactions, gaming rewards, decentralized exchanges, and even privacy-preserving financial tools become feasible on Bitcoin’s base layer.

Projects like GOAT Network are already demonstrating how advanced circuit design and aggressive data compression unlock new possibilities for both developers and regular users. Lowering hardware requirements means more individuals can run validating nodes, further decentralizing the network and reinforcing its censorship resistance.

This democratization is critical as institutional adoption accelerates. Enterprises exploring tokenized assets or cross-border payments on Bitcoin demand both robust security and predictable costs, qualities that zkBTC rollups are uniquely positioned to deliver.

Challenges Ahead: What Needs to Be Solved?

No technology shift comes without hurdles. For zkBTC rollups, developer tooling must mature to support seamless integration with existing wallets and infrastructure. User education is also key; understanding how funds move between Layer 1 and Layer 2 will be essential for safe participation. Finally, governance mechanisms for coordinating upgrades or dispute resolution in decentralized rollup environments remain an open research area.

However, with deployment timelines shrinking from years to months thanks to innovations like zkMIPS virtual machines and homomorphic obfuscation circuits, these challenges appear increasingly surmountable. The momentum behind zero-knowledge proofs in blockchain, now a pillar of both scalability and privacy, suggests that market-ready solutions will soon be within reach.

What’s Next for Bitcoin Scalability?

The next 12 months may see the first large-scale production deployments of zkBTC rollups on mainnet Bitcoin, a milestone that could redefine what’s possible for digital cash at scale. As transaction throughput increases while fees drop precipitously, we may witness a renaissance in grassroots adoption alongside new institutional entrants seeking reliable settlement rails.

For those looking to stay ahead of this curve, whether builders, investors, or everyday users, the time to engage with deep dives on protocol mechanics has never been better. As always in crypto innovation cycles, early understanding often leads to outsized opportunity as new primitives reach maturity.

Bitcoin’s ethos has always centered on trustless security and open participation. With zkBTC rollups rapidly moving from theory into practice at a time when BTC trades above $112,488.00, scalability bottlenecks may finally give way to a more inclusive financial system, without sacrificing what makes Bitcoin unique in the first place.