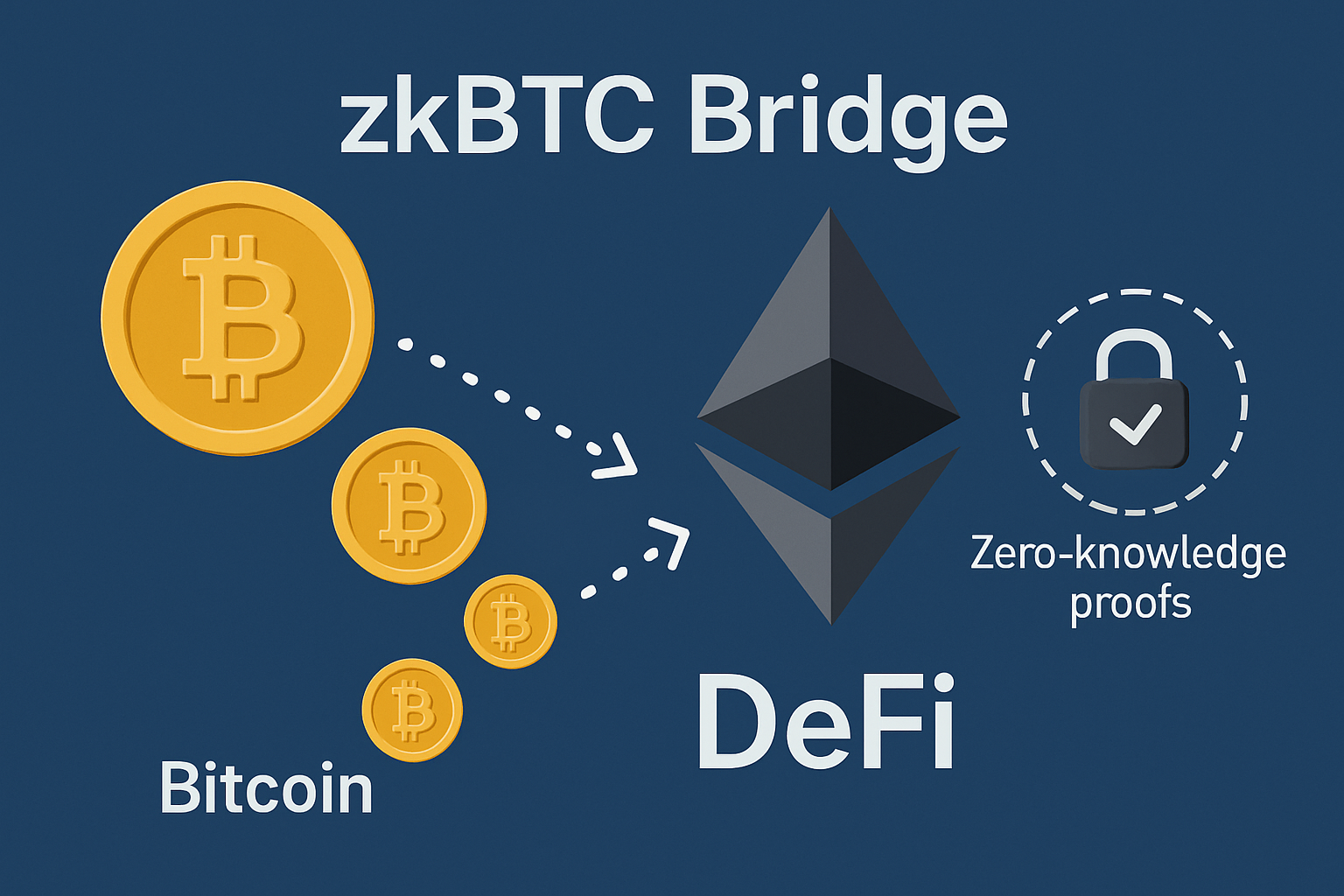

Bitcoin is currently trading at $113,565.00, and the launch of the zkBTC Bridge mainnet by Lightec is sending ripples through the DeFi world. For years, Bitcoin holders watched from the sidelines as DeFi exploded on Ethereum, frustrated by BTC’s limited composability and yield opportunities. That’s changing fast. With the zkBTC Bridge, Bitcoin can finally flow seamlessly into Ethereum’s DeFi protocols, unlocking long-awaited liquidity and new revenue streams for BTC holders, all thanks to the power of zero-knowledge proofs.

Zero-Knowledge Proofs: The Engine Behind Trustless BTC Bridges

Let’s get technical for a moment. Zero-knowledge proofs (ZKPs) are cryptographic marvels that let one party prove a statement’s truth without revealing the underlying data. In the case of the zkBTC Bridge, ZKPs verify BTC deposits on Bitcoin, then relay that proof to Ethereum, without exposing private data or relying on a centralized party. This means anyone can move BTC cross-chain with bulletproof privacy and security, paving the way for true trustless bridges.

The zkBTC Bridge leverages advanced ZKP schemes (like zk-SNARKs) to ensure that every BTC locked on Bitcoin is matched 1: 1 by zkBTC tokens minted on Ethereum. No custodians. No off-chain validators. Just math and code. This is a massive leap from previous wrapped BTC solutions that required users to trust third-party intermediaries, a single point of failure that has led to exploits and lost funds in the past.

How zkBTC Bridge Unlocks Bitcoin Liquidity in DeFi

So, what does this mean for BTC holders? The zkBTC Bridge allows you to deposit BTC into a ZKP-managed address on Bitcoin. Once confirmed, a zero-knowledge proof is generated and verified by an Ethereum smart contract, which mints an equivalent amount of zkBTC tokens. These tokens are now your passport into Ethereum’s DeFi universe, lending platforms, liquidity pools, DEXs, and more, all while your original BTC remains cryptographically secured by the bridge contract.

This unlocks a new era for BTC DeFi yield. Instead of letting your Bitcoin sit idle, you can now deploy it across DeFi protocols to earn interest, provide liquidity, or participate in yield farming strategies, without ever surrendering custody to a centralized bridge or custodian. Projects like ZenKeeper protocol are already building on top of zkBTC’s infrastructure, promising even more seamless integrations and eliminating the need for off-chain verification in BTC asset issuance.

Security, Decentralization, and Community Control

The security model here is robust. By eliminating intermediaries and leveraging ZKPs, the zkBTC Bridge reduces attack vectors and increases user control. The bridge’s design includes community governance via token models, ensuring protocol upgrades and decisions are decentralized and transparent. This is crucial as cross-chain bridges have historically been prime targets for hackers, ZKPs make these attacks exponentially harder by minimizing trust assumptions and surface area for exploitation.

For a deeper dive into how these mechanisms work under the hood, check out our technical breakdown at this resource.

Why This Matters as Bitcoin Holds Strong Above $113,000

With Bitcoin holding steady at $113,565.00, more capital than ever is poised to enter DeFi if frictionless bridges exist. Liquidity begets opportunity: as more BTC flows into DeFi via zkBTC, protocols can offer deeper markets, better yields, and more innovative financial products tailored for Bitcoiners. The trustless foundation provided by ZKPs is what makes this possible at scale.

Bitcoin (BTC) Price Prediction Post-zkBTC Bridge Launch: 2026-2031

Forecasts based on the impact of the zkBTC Bridge, DeFi integration, and evolving crypto market dynamics. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $99,000 | $123,000 | $152,000 | +8.3% | Post-zkBTC Bridge adoption accelerates, but profit taking and macro uncertainty cause volatility |

| 2027 | $108,000 | $137,000 | $173,000 | +11.4% | DeFi integration matures, institutional activity rises, but regulatory scrutiny increases |

| 2028 | $120,000 | $154,000 | $197,000 | +12.4% | Wider cross-chain adoption, Layer-2 growth, possible Bitcoin ETF expansion |

| 2029 | $135,000 | $170,000 | $223,000 | +10.4% | Mainstream Bitcoin DeFi usage, improved scalability, but global policy risks |

| 2030 | $152,000 | $187,000 | $250,000 | +10.0% | Peak adoption cycle, zkBTC Bridge widely used, but competition from other L1s and new tech |

| 2031 | $140,000 | $205,000 | $285,000 | +9.6% | Market matures, new DeFi applications, cyclical correction possible after previous run-ups |

Price Prediction Summary

Bitcoin is projected to experience steady growth in the coming years, driven by the successful integration of the zkBTC Bridge and increased participation in DeFi. Minimum price forecasts account for potential market corrections and regulatory headwinds, while maximum projections reflect bullish adoption scenarios and continued technological innovation. The average price is expected to rise from $123,000 in 2026 to $205,000 by 2031, with volatility and cyclical corrections along the way.

Key Factors Affecting Bitcoin Price

- Adoption rate of zkBTC Bridge and related DeFi protocols

- Institutional and retail participation in Bitcoin DeFi

- Regulatory developments affecting cross-chain and DeFi activity

- Technological advancements in Layer-2 solutions and ZKP security

- Macro-economic factors impacting crypto markets (e.g., global liquidity, interest rates)

- Competition from other blockchain ecosystems and interoperability solutions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

We’re witnessing the start of a flywheel effect: as BTC liquidity pours into DeFi through zkBTC, protocols can build richer products, and more users are incentivized to participate. This is the kind of network-driven growth that could finally put Bitcoin at the heart of decentralized finance, not just as collateral but as a programmable, yield-generating asset.

The Road Ahead: ZenKeeper, Interoperability, and Beyond

What’s especially exciting is the rapid pace of innovation happening on top of zkBTC infrastructure. The ZenKeeper protocol is a prime example. By using zero-knowledge proofs to fully automate BTC asset issuance, ZenKeeper eliminates off-chain verification altogether. This means faster settlements, lower risk, and a smoother user experience for anyone moving BTC between chains or minting new assets. As these protocols mature, we’ll see even more sophisticated DeFi primitives emerge for Bitcoin holders.

Interoperability is another major unlock. The zkBTC Bridge isn’t just about moving assets from Bitcoin to Ethereum, it’s about setting a new standard for trustless cross-chain movement across all ecosystems. As more chains adopt zero-knowledge proof bridges, we move closer to a truly composable web of blockchains where liquidity and data can flow securely and privately without bottlenecks or trusted parties.

For developers and advanced users, this opens up a playground for building next-gen Bitcoin rollups, privacy-enhanced applications, and novel DeFi protocols that were previously impossible due to Bitcoin’s base layer constraints. If you’re interested in technical specifics or want to see how these ideas translate into real-world code, our comprehensive guide dives deep into the architecture and use cases for zkBTC rollups.

What’s Next for Bitcoin Scaling Solutions?

The launch of the zkBTC Bridge at a time when Bitcoin is valued at $113,565.00 signals that institutional-grade liquidity is ready to move if given secure, scalable rails. Zero-knowledge bridges are already inspiring other projects to experiment with Bitcoin rollups and modular scaling solutions that could further supercharge throughput and privacy.

- Deeper liquidity pools: As zkBTC adoption grows, expect more robust BTC-based pools on Ethereum DEXs and lending markets.

- Yield innovation: New strategies will emerge for maximizing BTC DeFi yield without centralized risk.

- Privacy layers: ZKPs enable confidential transfers and shielded transactions for BTC in DeFi, a game-changer for whales and institutions.

The big takeaway: Zero-knowledge proofs are not just an incremental upgrade. They are a paradigm shift for trustless interoperability and Bitcoin utility in DeFi. The zkBTC Bridge’s mainnet launch proves that secure, composable BTC liquidity is here, and as protocols like ZenKeeper evolve, expect this trend to accelerate.

If you’re ready to explore what this means for your portfolio or development roadmap, check out our hands-on guides to integrating zkBTC with DeFi platforms at this resource.