Bitcoin’s ascent above $100,000 has made headlines around the world, but for many BTC holders, the real question is how to put their assets to work without leaving the security of the Bitcoin network behind. With the launch of the zkBTC Bridge mainnet in July 2025, Bitcoiners now have a powerful tool to unlock DeFi yields on Ethereum while retaining the privacy and sovereignty that define Bitcoin. At the heart of this breakthrough is zero-knowledge proof (ZKP) technology, which is rapidly becoming the backbone of trustless cross-chain infrastructure.

Bitcoin at $108,511: A New Era for On-Chain Yield

As of October 19,2025, Bitcoin (BTC) is trading at $108,511, reflecting a 1.41% daily increase. This milestone is more than just a psychological threshold – it signals a maturing market where BTC holders are hungry for new ways to maximize returns without compromising on decentralization or security. Traditional options like wrapped tokens or custodial bridges have struggled with risks ranging from counterparty exposure to opaque reserves. The zkBTC Bridge, powered by Lightec and ZKP cryptography, offers a compelling alternative by enabling BTC holders to bridge assets to Ethereum’s DeFi ecosystem transparently and securely.

“zkBTC is not just another bridge. It’s a trustless gateway that merges Bitcoin’s security with Ethereum’s programmability, all enforced by zero-knowledge proofs. “

How Zero-Knowledge Proofs Power Trustless BTC Asset Issuance

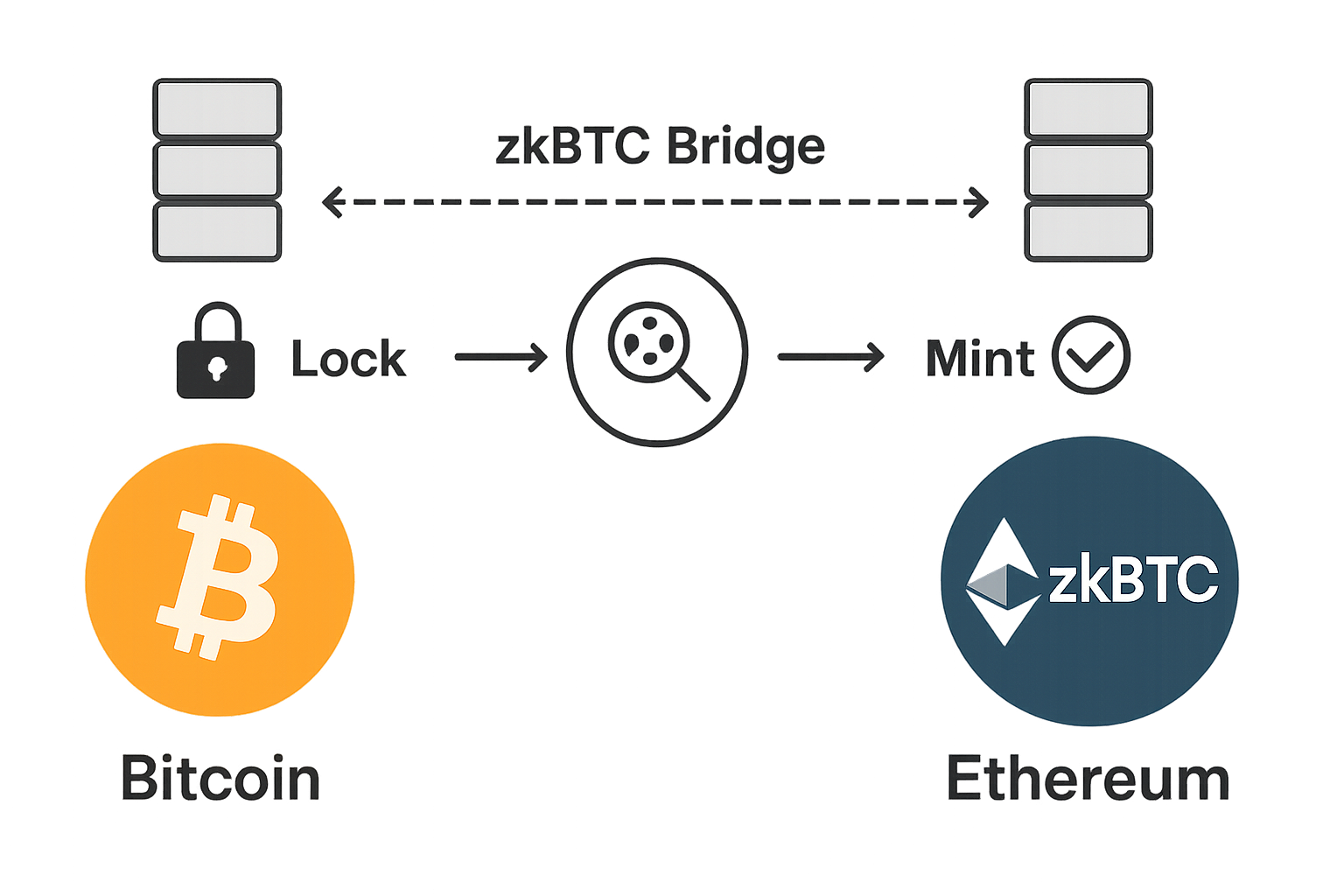

Zero-knowledge proofs are the engine behind zkBTC’s innovation. In simple terms, ZKPs allow one party to prove that a transaction or computation is valid without revealing any sensitive details about it. This means the zkBTC Bridge can verify the authenticity of BTC deposits on the Bitcoin blockchain while keeping user data private and secure.

The process works as follows:

- Locking BTC: Users send their Bitcoin to a special ZKP-managed address on the Bitcoin blockchain.

- Generating Proofs: An off-chain zero-knowledge proof is created, attesting that the deposit has occurred without exposing private keys or transaction details.

- Minting zkBTC: This proof is relayed and verified by an Ethereum smart contract, which then mints an equivalent amount of zkBTC tokens on Ethereum.

This entire flow avoids the pitfalls of custodial IOUs or centralized validators. Instead, it leverages mathematical guarantees that are rapidly becoming the gold standard for cross-chain interoperability.

Real Yield: How BTC Holders Tap Into DeFi Without Selling

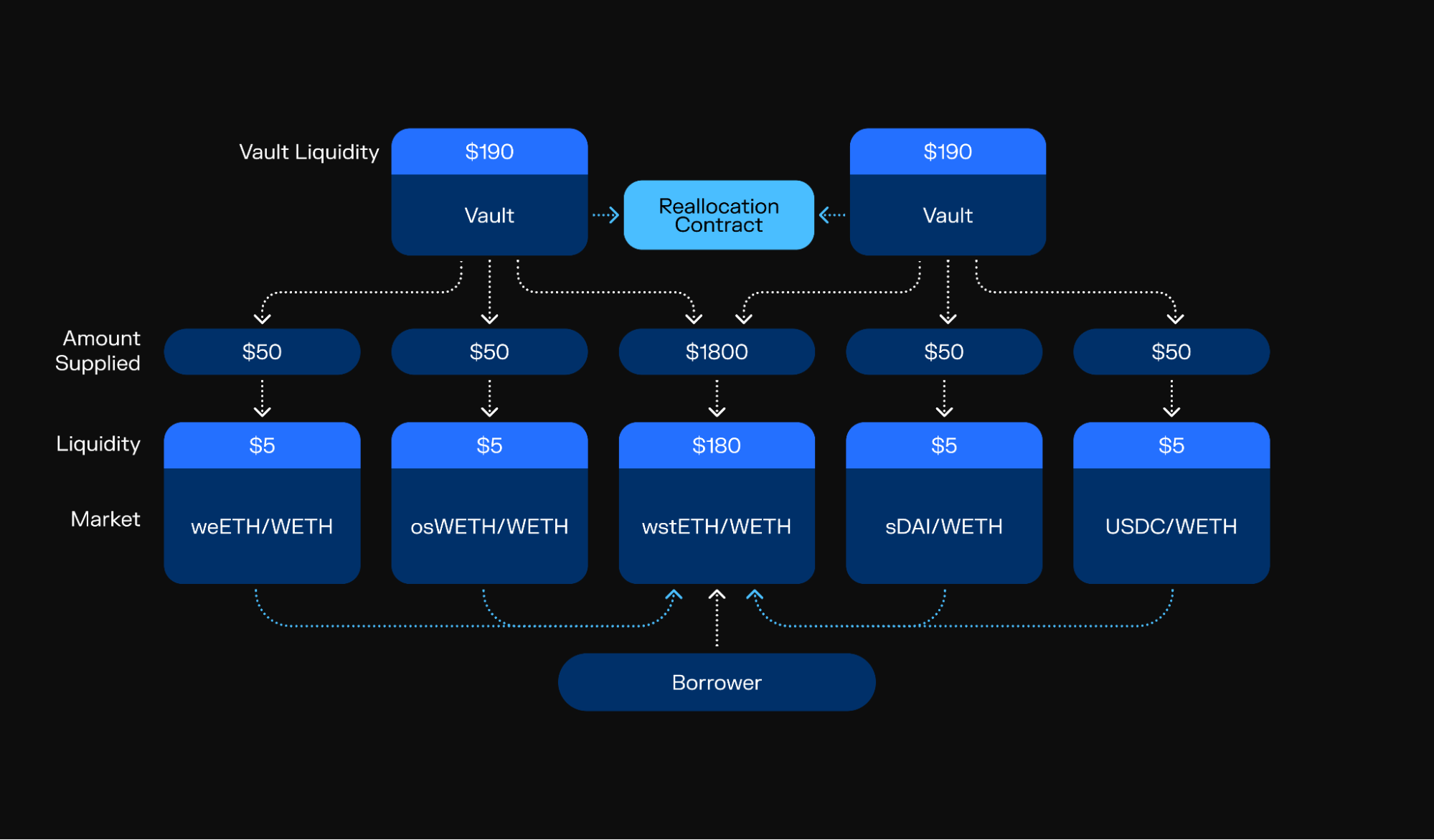

The most exciting outcome of this architecture is that Bitcoiners can now participate in DeFi protocols using zkBTC, all while their original coins remain locked and provably secure on the Bitcoin chain. On Ethereum, zkBTC can be supplied as collateral on lending platforms like Morpho or added to liquidity pools on Uniswap – unlocking yield opportunities previously out of reach for native BTC holders.

Top 5 DeFi Protocols for zkBTC Yield Strategies

-

Uniswap – As the largest decentralized exchange on Ethereum, Uniswap offers robust liquidity pools where zkBTC holders can provide liquidity and earn trading fees. The recent Bitcoin Yield Boost program includes zkBTC liquidity mining incentives on Uniswap, further enhancing yield opportunities.

-

Morpho – Morpho is a leading lending and borrowing protocol on Ethereum. With zkBTC integration, users can supply zkBTC as collateral or lend it out, earning interest and additional rewards through the Bitcoin Yield Boost initiative.

-

Aave – Aave is a widely used DeFi lending platform that supports a variety of assets. zkBTC holders can deposit their tokens to earn passive income or use them as collateral for borrowing other cryptocurrencies, leveraging Aave’s deep liquidity and security.

-

Balancer – Balancer is a decentralized automated portfolio manager and trading platform. zkBTC can be added to custom liquidity pools, allowing users to earn fees and participate in Balancer’s dynamic DeFi ecosystem.

-

Curve Finance – Known for its efficient stablecoin and wrapped asset swaps, Curve now supports zkBTC pools. This enables zkBTC holders to provide liquidity and earn yield with minimal slippage and low impermanent loss risk.

The recently announced “Bitcoin Yield Boost” program further incentivizes adoption by offering rewards for minting zkBTC, providing liquidity, and engaging with partner protocols. This marks a significant shift in how Bitcoin can be used as programmable capital across chains without ever leaving the user’s control.

The Road Ahead: Next-Gen Bridges and Native Interoperability

Lightec’s ongoing work on ZenKeeper aims to eliminate even off-chain verification steps during BTC asset issuance by relying solely on advanced ZKPs. This could further streamline cross-chain activity and set a new benchmark for both security and efficiency in asset bridging.

Bitcoin (BTC) Price Prediction Table: 2026-2031 Post-zkBTC Bridge Launch

Forecast incorporates the impact of zkBTC Bridge, DeFi yield opportunities, and zero-knowledge proof adoption.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $97,000 | $119,000 | $144,000 | +9.7% | zkBTC DeFi yield attracts moderate BTC inflows; macro volatility limits upside |

| 2027 | $110,000 | $136,000 | $170,000 | +14.3% | Increased institutional adoption; regulatory clarity on DeFi bridges |

| 2028 | $124,000 | $154,000 | $206,000 | +13.2% | Wider zkBTC adoption; BTC DeFi becomes mainstream |

| 2029 | $140,000 | $174,000 | $246,000 | +13.0% | New BTC L2s and cross-chain protocols boost use cases |

| 2030 | $158,000 | $196,000 | $295,000 | +12.6% | Global regulation matures; BTC as a major DeFi collateral |

| 2031 | $180,000 | $221,000 | $355,000 | +12.8% | Full integration of BTC in multi-chain DeFi; macro cycle peak |

Price Prediction Summary

Bitcoin is projected to see steady growth over the next 6 years, supported by the zkBTC Bridge unlocking DeFi yield opportunities and advancing zero-knowledge proof technology. The minimum price scenarios account for potential market corrections, while maximum price scenarios reflect strong adoption and favorable macro conditions. Average prices represent a balanced outlook, with year-over-year growth rates averaging 12-14%.

Key Factors Affecting Bitcoin Price

- Adoption of zkBTC Bridge and DeFi yield opportunities for BTC holders

- Advancements in zero-knowledge proof technology enhancing security and privacy

- Macro-economic cycles, including potential global recessions or bull runs

- Regulatory clarity on cross-chain protocols and DeFi

- Competition from alternative L2s and cross-chain bridges

- Institutional participation and integration of BTC in global financial products

- Overall sentiment and technological progress in the crypto ecosystem

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As the zkBTC Bridge ecosystem matures, we’re witnessing a genuine transformation in how Bitcoin scaling solutions are implemented. Unlike earlier wrapped BTC models that depended on centralized custodians, zkBTC’s approach is fully non-custodial and mathematically verifiable. This is a game changer for anyone who values Bitcoin’s ethos of trust minimization and transparency.

For BTC holders, the appeal is clear: you can put your Bitcoin to work in DeFi and earn competitive yields, all while your assets remain under the protection of cryptographic proofs, not a third party’s promises. The privacy features inherent to zero-knowledge proofs also mean that your transaction history and balances are shielded from prying eyes, a crucial benefit as on-chain analytics become more sophisticated.

Why zkBTC Privacy and Security Matter More Than Ever

With BTC at $108,511 and institutional interest surging, the stakes for secure cross-chain movement have never been higher. Each time Bitcoin crosses a new price milestone, the potential rewards, and risks, for DeFi participation grow. By leveraging zkBTC privacy and ZKP-powered validity proofs, users can bridge large sums with confidence that neither their funds nor their sensitive data are exposed.

Moreover, the zkBTC Bridge is designed for composability. Developers can integrate zkBTC into new protocols, experiment with innovative DeFi primitives, and even explore BTC rollups that further scale throughput. This flexibility is what sets ZKP-based bridges apart from legacy models.

“Zero-knowledge proofs are now the backbone of DeFi’s next wave of privacy and scalability, and Bitcoin is finally at the center of it. ”

What’s Next for Bitcoin Rollups and Cross-Chain DeFi?

The launch of the zkBTC Bridge is only the beginning. With ZenKeeper on the horizon, off-chain verification could soon be a relic of the past, replaced by pure on-chain proof systems. This would not only boost security but also open the door for more advanced BTC asset issuance models, including programmable Bitcoin on its own mainchain, a topic explored in-depth in our technical overview (read more here).

As zero-knowledge infrastructure consolidates its position at the heart of crypto’s cross-chain economy, expect to see:

Top Trends in Bitcoin Scaling & ZKP-Powered DeFi (2025)

-

1. Mainnet Launch of zkBTC Bridge Unlocks DeFi for Bitcoin HoldersThe zkBTC Bridge, developed by Lightec, went live on mainnet on July 21, 2025. It enables Bitcoin (BTC) holders to securely transfer assets to Ethereum, granting access to DeFi protocols without intermediaries. BTC is currently trading at $108,511 as of October 19, 2025.

-

2. Zero-Knowledge Proofs (ZKPs) Become Core to Cross-Chain SecurityZKPs are now central to trustless bridges like zkBTC, allowing BTC transfers to Ethereum without revealing sensitive details. This ensures privacy and security while eliminating the need for custodians.

-

3. DeFi Yield Opportunities Expand for Bitcoin UsersBitcoin holders can now mint zkBTC tokens on Ethereum and participate in DeFi platforms such as Uniswap and Morpho, earning yield without selling their BTC. The Bitcoin Yield Boost program further incentivizes liquidity mining and lending.

-

4. Elimination of Off-Chain Verification with ZenKeeperThe upcoming ZenKeeper protocol, developed by Lightec, leverages ZKPs to remove off-chain verification in BTC asset issuance, streamlining and securing cross-chain transactions.

-

5. Consolidation of Crypto Infrastructure Around ZKPsMajor blockchain projects are converging on zero-knowledge proof technology to address scalability, privacy, and interoperability, solidifying ZKPs as a foundational layer for DeFi innovation.

In this new era, Bitcoiners aren’t just HODLing, they’re earning real yield, participating in governance, and experimenting with composable financial products. The convergence of ZKPs, rollup protocols, and trustless bridges like zkBTC signals that Bitcoin’s role in DeFi is only getting started.