Bitcoin is on fire in 2024, smashing through the $100,000 mark and holding strong at $107,030.00. But as the world’s most valuable blockchain flexes its muscles, the big question for developers, traders, and investors is clear: can Bitcoin handle the scale and speed demanded by global adoption? Enter zk-Rollups – the Layer 2 juggernaut that’s rewriting the rules for Bitcoin scalability, efficiency, and privacy.

Let’s cut through the hype: zk-Rollups aren’t just an Ethereum phenomenon anymore. In 2024, they’re powering a new era of Bitcoin Layer 2 scalability, slashing transaction fees, boosting throughput, and unlocking smart contract capabilities once thought impossible on BTC. The secret sauce? Zero-knowledge proofs, which bundle thousands of transactions off-chain and submit a single cryptographic proof to Bitcoin’s mainnet. The result: less congestion, lower costs, and ironclad security.

Why zk-Rollups Are Essential for Bitcoin Layer 2 in 2024

With Bitcoin’s base layer (L1) designed for security and decentralization, scaling on-chain is a non-starter. Layer 2 solutions like zk-Rollups offer a breakthrough: they enable massive scalability without compromising Bitcoin’s core principles. Instead of bloating the main chain with every transaction, zk-Rollups aggregate activity off-chain and use zero-knowledge validity proofs to guarantee correctness. This means more users, more apps, and more innovation, all without sacrificing trust.

But not all zk-Rollup projects are created equal. In 2024, a select group is leading the charge in Bitcoin Layer 2 scalability. Let’s spotlight the top 5 zk-Rollup protocols you absolutely need to know:

Top 5 zk-Rollup Projects Powering Bitcoin Layer 2 in 2024

-

zkSync Era – A leading zk-Rollup protocol, zkSync Era leverages zero-knowledge proofs to deliver fast, low-cost transactions while maintaining robust security. Its growing ecosystem and developer-friendly tools are accelerating Bitcoin Layer 2 scalability.

-

Polygon zkEVM – Polygon zkEVM brings Ethereum Virtual Machine compatibility to zk-Rollups, allowing seamless deployment of Ethereum-based dApps on Bitcoin Layer 2. Its advanced cryptography ensures high throughput and low fees.

-

Starknet – Developed by StarkWare, Starknet uses STARK-based zero-knowledge proofs to enable scalable, secure smart contracts. Its integration with Bitcoin Layer 2 solutions is driving innovation and expanding the capabilities of the Bitcoin ecosystem.

-

Scroll – Scroll focuses on EVM compatibility and efficient zk-Rollup design, making it easier for developers to build scalable applications on Bitcoin Layer 2. Its emphasis on open-source development fuels rapid adoption.

-

Merlin Chain – Merlin Chain is a pioneering ZK-Rollup dedicated to Bitcoin scalability, offering fast, secure, and cost-effective transactions. It stands out for its commitment to enhancing Bitcoin’s efficiency and supporting DeFi innovation.

Meet the Leaders: The Top 5 zk-Rollup Projects Transforming Bitcoin

Each project on this list brings a unique approach to Bitcoin scaling, but all share a common mission: leverage zero-knowledge cryptography to supercharge throughput, cut fees, and open the door for advanced decentralized applications.

- zkSync Era: Renowned for its user-friendly developer stack, zkSync Era is making waves by bridging Ethereum’s rollup expertise to Bitcoin. Its focus on EVM compatibility is attracting DeFi builders eager to tap into Bitcoin liquidity while enjoying low fees and fast finality.

- Polygon zkEVM: Polygon’s zkEVM is setting the standard for full-featured, Turing-complete smart contracts on Bitcoin Layer 2. By using zero-knowledge proofs to validate EVM transactions, Polygon zkEVM is fueling a new generation of cross-chain DApps that can settle to Bitcoin with unprecedented efficiency.

- Starknet: Powered by STARK proofs, Starknet is all about scalability and privacy. Its unique architecture allows for massive transaction batching and supports complex computation off-chain, making it a top choice for developers building next-gen apps that demand both speed and privacy on Bitcoin.

- Scroll: With a laser focus on seamless developer experience and robust security, Scroll is quickly gaining traction as a Bitcoin-centric zk-Rollup. Its transparent proof verification process is a hit among those who want bulletproof assurance without the technical headaches.

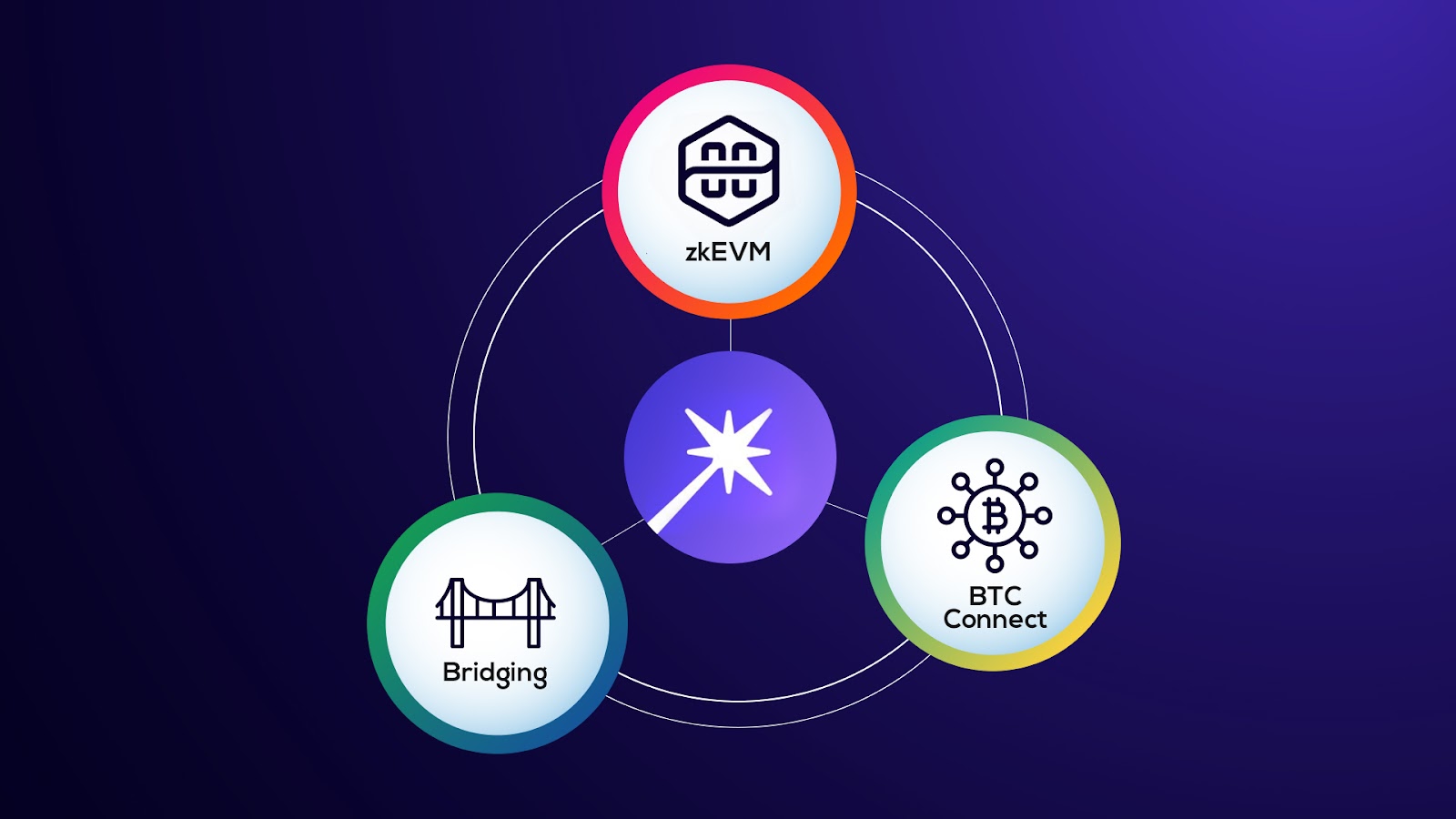

- Merlin Chain: The first native Bitcoin zk-Rollup, Merlin Chain is rewriting the playbook by integrating directly with the Bitcoin Virtual Machine (BitVM). This allows Ethereum-style smart contracts to run on Bitcoin, opening the floodgates for DeFi, gaming, and more, all secured by Bitcoin’s base layer.

These protocols are not just theoretical, they’re live, evolving fast, and attracting serious capital and developer attention. For example, Merlin Chain recently launched its devnet and is already onboarding projects eager to tap into Bitcoin’s massive liquidity pool.

How zk-Rollups Are Slashing Fees and Boosting Throughput

The magic of zk-Rollups lies in their ability to bundle thousands of transactions into a single proof that gets verified on Bitcoin’s mainnet. This means users can send BTC or interact with smart contracts at a fraction of traditional fees, even as network demand surges. For traders and DeFi users, this is a game changer: no more waiting hours for confirmations or shelling out sky-high fees during peak periods.

The numbers don’t lie. In 2024, transaction costs on leading rollups like zkSync Era and Polygon zkEVM are routinely 10-50x lower than on mainnet, while throughput has soared to thousands of transactions per second. This is catalyzing an explosion of new use cases, from high-frequency trading platforms to NFT marketplaces, all secured by Bitcoin’s legendary immutability.

If you want a deeper dive into how zero-knowledge rollups are unlocking fast, low-cost transactions on Bitcoin, check out our technical breakdown here.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Professional BTC Price Forecasts Considering ZK-Rollup Layer 2 Scalability, Market Cycles, and Technology Trends

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | YoY % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $92,000 | $120,000 | $155,000 | +12% | Post-halving consolidation, ZK-Rollups mature, moderate regulatory clarity |

| 2027 | $110,000 | $143,000 | $185,000 | +19% | Adoption of Layer 2, institutional growth, moderate global economic uncertainty |

| 2028 | $129,000 | $172,000 | $225,000 | +20% | Peak Layer 2 usage, DeFi on Bitcoin grows, tech advances |

| 2029 | $150,000 | $202,000 | $270,000 | +17% | Global macro tailwinds, mainstream integration, regulatory easing |

| 2030 | $175,000 | $238,000 | $325,000 | +18% | Next Bitcoin halving, high institutional adoption, Layer 2 security innovations |

| 2031 | $200,000 | $280,000 | $390,000 | +18% | Potential ETF expansion, global adoption, mature DeFi and ZK ecosystem |

Price Prediction Summary

Bitcoin is positioned for long-term growth, driven by Layer 2 scalability (especially ZK-Rollups), enhanced security, and growing mainstream/institutional adoption. After a consolidation period in 2026, price appreciation is expected to accelerate as Layer 2 solutions mature and regulatory conditions improve. The bullish scenario reflects significant global adoption and technological breakthroughs, while the bearish scenario accounts for potential setbacks in regulation or macroeconomic headwinds.

Key Factors Affecting Bitcoin Price

- Adoption and technical maturity of ZK-Rollups and other Layer 2 solutions on Bitcoin

- Regulatory developments in major markets (US, EU, Asia) impacting institutional flows

- Global economic cycles, inflation, and monetary policy affecting risk assets

- Rate of Layer 2 DeFi and application development on Bitcoin (e.g., Citrea, BitVM)

- Competition from other smart contract platforms and L1/L2 solutions

- Security, data availability, and decentralization innovations in ZK-Rollups

- Bitcoin’s halving cycles and supply dynamics

- Potential ETF approvals and broader institutional participation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

But scaling Bitcoin isn’t just about raw speed and cheaper fees. Security and decentralization are non-negotiable. That’s why the latest zk-Rollup protocols are doubling down on innovations like proof of download, proof of storage, and new role separations to ensure data availability and resilience against centralization threats. These cryptographic techniques guarantee that even as activity moves off-chain, the integrity and transparency of Bitcoin’s mainnet remain untouched.

Starknet and Scroll are leading the charge here, integrating advanced zero-knowledge proof systems that minimize trust assumptions while maximizing throughput. Starknet’s use of STARKs, for example, makes it possible to verify massive batches of transactions with minimal computational overhead, while Scroll’s transparent proof verification helps developers and users trust what’s happening under the hood, no black boxes, just verifiable math.

Merlin Chain: The Native zk-Rollup for Bitcoin

If you’re looking for a project that truly embodies the spirit of Bitcoin-native innovation, Merlin Chain is impossible to ignore. By building on the Bitcoin Virtual Machine (BitVM), Merlin Chain lets developers deploy smart contracts with the security of Bitcoin’s base layer, without sacrificing scalability or composability. Its devnet launch in June 2024 drew massive attention from both Bitcoin maxis and Ethereum DeFi veterans, eager to experiment with dApps that settle directly to BTC.

This is a major leap for the ecosystem. For years, developers had to choose between Bitcoin’s security and Ethereum’s programmability. Now, zk-Rollups like Merlin Chain are making it possible to have both, opening the door for trustless lending, gaming, DAOs, and more, all secured by Bitcoin at $107,030.00.

What This Means for Developers, Investors, and the Future of Bitcoin

The rise of zk-Rollups on Bitcoin is more than just a technical upgrade, it’s a paradigm shift. Developers can now build complex dApps that tap into Bitcoin’s unmatched liquidity, while traders enjoy lightning-fast settlements without exorbitant fees. Investors benefit from a more vibrant, scalable network that can support everything from DeFi primitives to next-gen NFTs.

With zkSync Era, Polygon zkEVM, Starknet, Scroll, and Merlin Chain leading the pack, the future of Bitcoin Layer 2 scalability is here, and it’s powered by zero-knowledge cryptography. As these protocols mature, expect even greater improvements in privacy, interoperability, and on-chain composability. If you want to understand how these advances stack up against other rollup models, check out our comparison guide here.

Top 5 zk-Rollup Projects Powering Bitcoin Layer 2 in 2024

-

zkSync Era: A leading zk-Rollup protocol, zkSync Era brings high throughput and low fees to Bitcoin by leveraging zero-knowledge proofs for secure, scalable transactions. Its robust developer ecosystem makes it a popular choice for building next-gen dApps.

-

Polygon zkEVM: Polygon zkEVM offers Ethereum Virtual Machine compatibility with zk-Rollup security, enabling seamless deployment of Ethereum-based applications on Bitcoin Layer 2. It delivers fast finality and significant cost savings for users.

-

Starknet: Powered by STARK proofs, Starknet is a permissionless zk-Rollup that brings scalable smart contracts to Bitcoin. Its advanced cryptography ensures robust security and high efficiency for complex applications.

-

Scroll: Scroll focuses on native zkEVM integration, providing developer-friendly tools and interoperability between Bitcoin and Ethereum ecosystems. Its open-source approach accelerates innovation in Layer 2 solutions.

-

Merlin Chain: Specifically designed for Bitcoin, Merlin Chain utilizes zk-Rollup technology to enhance transaction speed and scalability. It is a pioneer in bringing efficient Layer 2 scaling directly to the Bitcoin network.

There’s no turning back. As institutional capital flows in and developer activity accelerates, expect these zk-Rollup solutions to define the next era of Bitcoin adoption. Whether you’re a builder, trader, or long-term holder, now is the time to get hands-on with the tooling, join testnets, and stake your claim in this new frontier.

The bottom line: Bitcoin at $107,030.00 isn’t just a price milestone, it’s a signal that the network is ready for prime time at a global scale. With zk-Rollups leading the charge, scalability is no longer a bottleneck. The only question left is: how will you leverage this new wave of innovation?