Bitcoin’s rise to $113,943.00 has reignited the debate around scaling, trust-minimized interoperability, and the future of decentralized finance (DeFi) on the world’s most secure blockchain. In this landscape, BitScaler emerges as a transformative framework, enabling secure, non-custodial Bitcoin DeFi without relying on bridges or wrapped assets. This approach is not just theoretical – it is being actively deployed by Portal to Bitcoin, which recently unveiled BitScaler as the backbone of its custody-free trading architecture.

BitScaler Channel Factories: The Next Leap in Bitcoin Scaling

Traditional attempts to bring DeFi to Bitcoin have often relied on custodial bridges or synthetic tokens – solutions that introduce counterparty risk and undermine Bitcoin’s core value proposition of self-custody. BitScaler takes a fundamentally different approach by leveraging channel factories, a multi-party extension of the Lightning Network concept. Instead of opening hundreds of individual payment channels (each requiring an on-chain transaction), channel factories allow multiple users to create and manage shared liquidity pools in a single on-chain action.

This architecture slashes transaction fees and dramatically increases throughput. By consolidating off-chain transactions into one initial on-chain setup, BitScaler enables complex DeFi operations – including lending, trading, and atomic swaps – while preserving Bitcoin’s trust-minimized security model. According to Cointelegraph, BitScaler’s use of Taproot-enhanced channel factories reduces fees by up to 90%, making high-frequency DeFi activity viable for ordinary users.

Atomic Swaps Without Bridges: True Non-Custodial Interoperability

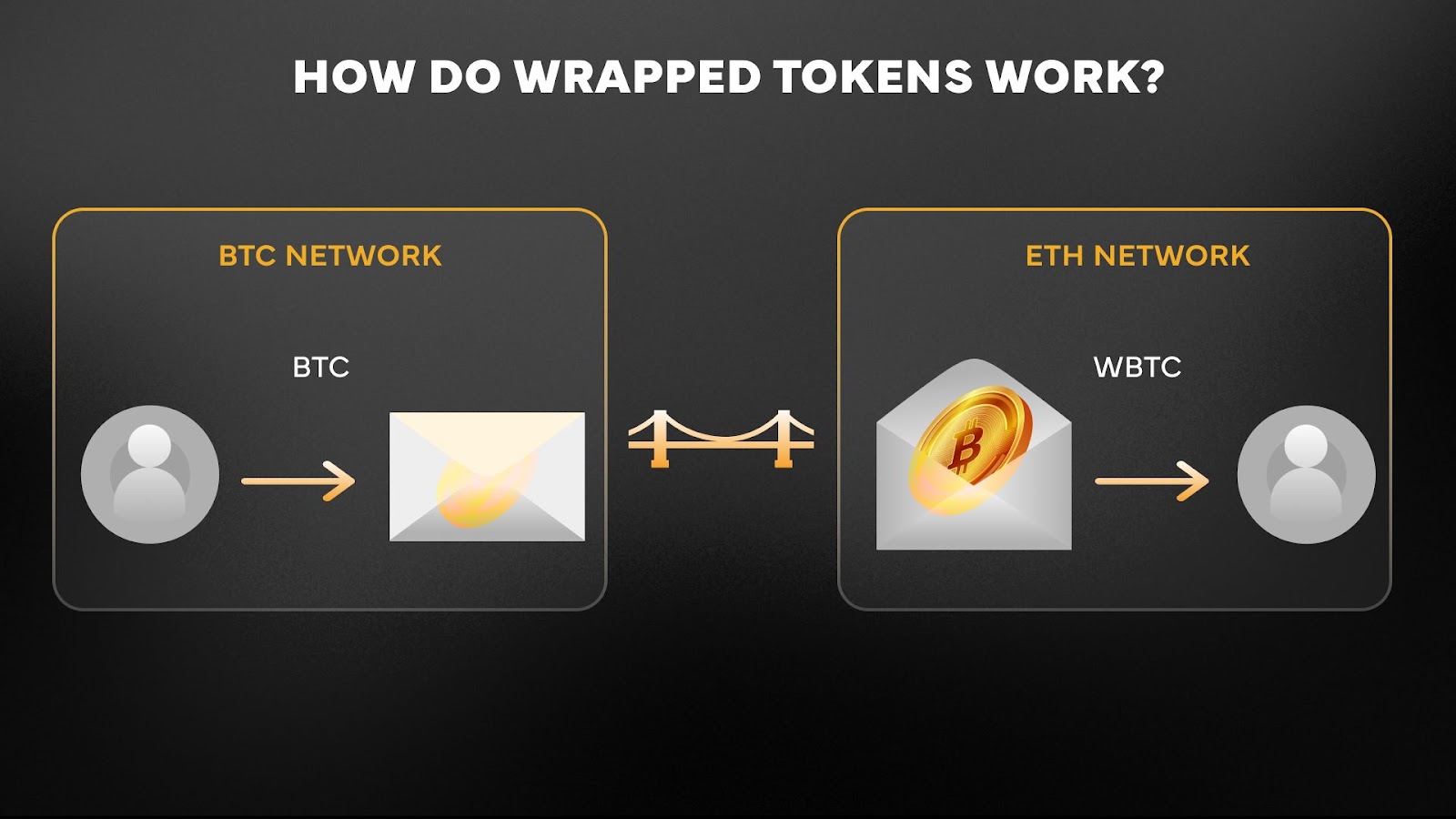

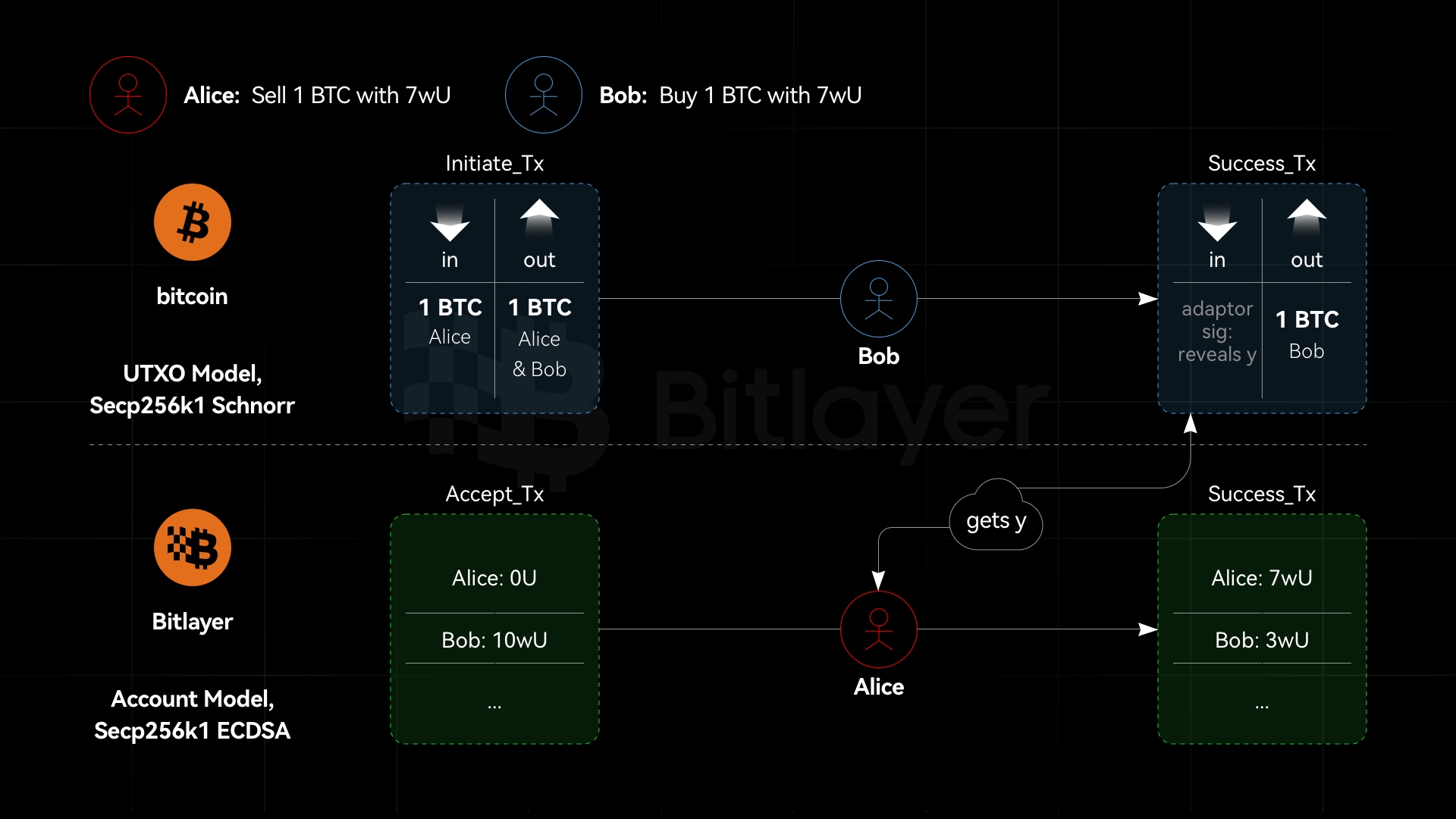

The holy grail for Bitcoin DeFi has always been seamless cross-chain swaps that do not require trust in any intermediary or bridge operator. BitScaler delivers this by integrating atomic swap technology directly into its channel factory framework. Users can exchange assets across blockchains without ever relinquishing custody or resorting to wrapped tokens – eliminating risks like de-pegging events or custodial failures that have plagued other ecosystems.

This breakthrough is not lost on industry observers:

BitScaler’s atomic swap mechanism ensures that either both sides of a trade execute successfully or neither does, protecting users from partial execution or asset loss. This model supports true peer-to-peer trading and unlocks new possibilities for shared liquidity across networks, all while keeping users in full control of their private keys.

Non-Custodial Delegation: Enhancing Security and Usability

One persistent challenge with advanced multi-party channels is the need for participants to remain online to co-sign transactions. BitScaler addresses this with a novel non-custodial signing delegation mechanism: users can appoint delegates who are authorized to co-sign transactions on their behalf without ever taking custody of funds. This preserves the non-custodial ethos while making participation in complex DeFi protocols practical for regular users.

This innovation further distinguishes BitScaler from previous attempts at scaling Bitcoin for DeFi use cases. By combining Taproot-enabled scripting with delegated signing protocols, BitScaler maintains robust security guarantees while streamlining user experience.

Bitcoin (BTC) Price Prediction Table: 2026–2031

Based on current market trends, BitScaler/Portal DeFi innovations, and macroeconomic conditions as of October 2025.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $128,000 | $158,000 | +12% | Market consolidation after 2025’s rally; DeFi adoption on Bitcoin grows, but macro uncertainty tempers highs. |

| 2027 | $110,000 | $146,000 | $190,000 | +14% | Mainstream DeFi use on BTC, Taproot/BitScaler scaling, but regulatory headwinds persist. |

| 2028 | $125,000 | $168,000 | $230,000 | +15% | Regulatory clarity boosts institutional entry; BTC as DeFi collateral expands, driving demand. |

| 2029 | $142,000 | $195,000 | $280,000 | +16% | Global macro uptrend, Bitcoin DeFi matures, competition from other chains increases volatility. |

| 2030 | $165,000 | $226,000 | $340,000 | +16% | Next BTC halving, sustained DeFi adoption, potential ETF/fund flows, but tech risks remain. |

| 2031 | $190,000 | $260,000 | $410,000 | +15% | Bitcoin DeFi ecosystem rivals Ethereum, major institutions onboard, but high volatility persists. |

Price Prediction Summary

Bitcoin is forecasted to experience steady growth over the next six years, driven by innovations like BitScaler and Portal’s bridgeless, non-custodial DeFi. While minimum price predictions account for possible corrections or regulatory impacts, the average and maximum projections reflect strong adoption, technological breakthroughs, and increased institutional involvement. Volatility will remain high, but the long-term trend is positive as Bitcoin cements its role in decentralized finance.

Key Factors Affecting Bitcoin Price

- Adoption of BitScaler and Portal’s bridgeless DeFi technologies, reducing fees and increasing throughput.

- Increased demand for non-custodial, cross-chain Bitcoin DeFi solutions.

- Potential regulatory shifts (positive or negative) affecting crypto and DeFi markets.

- Macroeconomic factors such as inflation, interest rates, and global asset flows.

- Competition from other DeFi-enabled blockchains (e.g., Ethereum, Solana, Avalanche).

- Mainstream and institutional adoption of Bitcoin as a DeFi collateral asset.

- Future Bitcoin halvings impacting supply dynamics.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Shared Liquidity Pools Matter for BTC DeFi

The ability to create multi-party liquidity pools natively on Bitcoin opens doors for applications previously limited to Ethereum or other smart contract platforms. With shared liquidity powered by channel factories, market makers can deploy capital more efficiently and traders can access deeper markets without sacrificing self-custody or introducing third-party risk.

This marks a significant step forward in realizing truly decentralized finance atop Bitcoin’s base layer – no bridges required.

BitScaler’s channel factory architecture is not just a technical upgrade, it’s a paradigm shift for Bitcoin scaling solutions and the entire DeFi landscape. By leveraging Taproot’s advanced scripting, BitScaler enables the formation of complex, multi-signature arrangements and batched transactions, all while minimizing on-chain overhead. This means that even as Bitcoin’s price hovers at $113,943.00, users can interact with DeFi protocols without being priced out by high fees or forced to trust custodians.

Unlike legacy approaches, where bridges or wrapped assets introduce systemic risks, BitScaler’s model ensures that every transaction is verifiable and enforceable on Bitcoin’s base layer. Users retain full control of their BTC throughout the lifecycle of every swap, loan, or trade. This is especially critical as institutional capital and retail investors alike seek exposure to decentralized markets without compromising on security.

Security, Scalability, and the Road Ahead

Security remains the cornerstone of any Bitcoin-native solution. BitScaler’s reliance on atomic swaps and delegated signing eliminates both single points of failure and the honeypot risk common in custodial bridge designs. As highlighted by industry analysts in Crypto Society’s AMA recap, this approach drastically reduces attack surfaces while preserving the transparency and auditability inherent to Bitcoin.

“Portal is the only custody-less interoperability protocol for Bitcoin. Portal enables fast, low cost atomic swaps between native Bitcoin assets. . . ” (The Defiant)

Key Advantages of BitScaler Over Traditional BTC DeFi Bridges

-

True Non-Custodial Operation: BitScaler enables users to maintain 100% self-custody of their Bitcoin throughout all DeFi activities, eliminating the need to trust third-party custodians or bridge operators. This approach removes a major attack vector present in traditional bridge solutions.

-

No Use of Bridges or Wrapped Tokens: Unlike conventional BTC DeFi solutions that rely on bridges and wrapped assets (such as wBTC), BitScaler operates directly on Bitcoin’s base layer. This eliminates risks of de-pegging, smart contract exploits, and custodial failures associated with wrapped tokens.

-

Scalability Through Channel Factories: BitScaler leverages modified channel factories to aggregate multiple off-chain transactions into a single on-chain action. This significantly reduces transaction fees and increases throughput, supporting complex DeFi applications while preserving Bitcoin’s security model.

-

Atomic Swaps for Secure Cross-Chain Interoperability: BitScaler employs atomic swaps to enable seamless, trust-minimized exchanges between Bitcoin and other blockchains. Users retain full control of their funds at all times, mitigating the risks found in bridge-based interoperability.

-

Non-Custodial Signing Delegation: BitScaler introduces a non-custodial signing delegation mechanism, allowing users to delegate transaction signing without relinquishing asset control. This enhances both security and usability, especially for complex DeFi operations.

-

Significant Fee Reduction: By utilizing Taproot and channel factory optimizations, BitScaler can reduce transaction fees by up to 90% compared to traditional on-chain bridge solutions, making DeFi more accessible and efficient for Bitcoin users.

The scalability gains are equally compelling. With channel factories consolidating what would be hundreds or thousands of on-chain operations into a handful of transactions, network congestion is alleviated even during periods of high demand, critical as BTC maintains its position above $100,000.

What This Means for Developers and Investors

For developers building next-generation DeFi protocols, BitScaler provides a robust toolkit: Taproot-compatible scripting for custom logic, non-custodial delegation for user-friendly interfaces, and atomic swap primitives built directly into the channel factory layer. Investors benefit from deeper liquidity pools, lower slippage, and reduced counterparty risk, all without leaving the safety of native BTC custody.

The path forward is clear: as more projects integrate BitScaler technology and as adoption accelerates across both retail and institutional segments, we can expect to see an explosion in non-custodial BTC DeFi activity, without bridges or wrapped tokens undermining trust assumptions.

BitScaler stands at the forefront of enabling shared liquidity for Bitcoin natively, ushering in a new era where users can finally access advanced financial primitives on-chain with full control over their assets. It’s a future where Bitcoin doesn’t just store value but powers dynamic markets across chains, securely and scalably.