As Bitcoin continues to trade above the $120,000 threshold, with the current price at $121,820.00, the limitations of its base layer have never been more apparent. Transaction throughput and privacy remain top concerns as adoption grows. In response, a new generation of Bitcoin scalability solutions is emerging, with zk-rollups at the forefront. These zero-knowledge powered rollups are poised to transform how users interact with Bitcoin by enabling both private and scalable transactions without sacrificing security.

What Are zk-Rollups? The Core Technology Explained

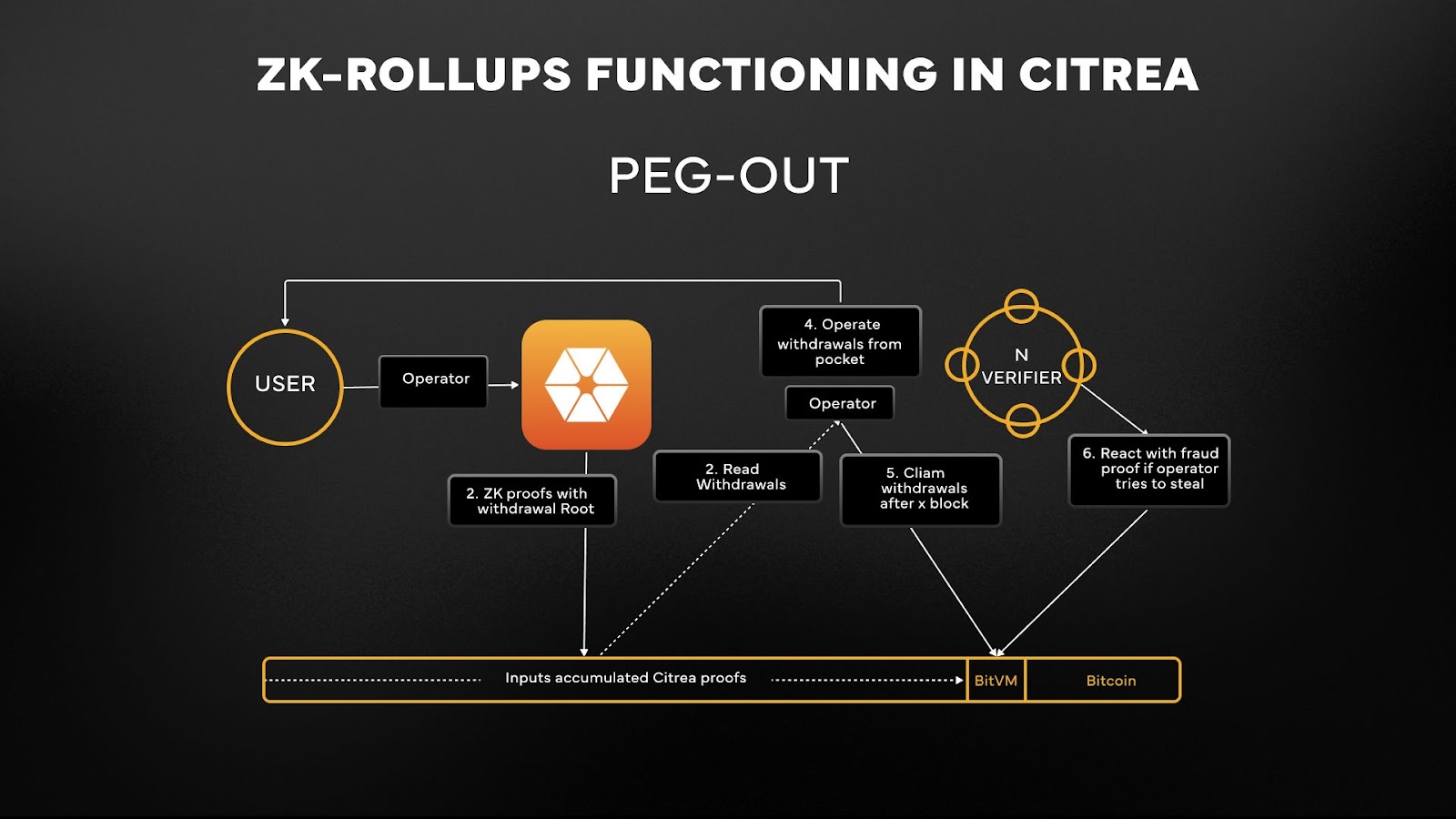

zk-rollups on Bitcoin represent a leap forward in Layer 2 scaling. Unlike traditional on-chain transactions that require every node to verify each individual transfer, zk-rollups bundle hundreds or even thousands of transactions off-chain. Using zero-knowledge proofs, they generate a cryptographic validity proof for the entire batch, which is then submitted to the main Bitcoin blockchain.

This approach dramatically reduces the data load on the base layer. Rather than storing every transaction detail on-chain, only essential summary data and a succinct proof are posted. The result: higher throughput, lower fees, and improved privacy for end users.

Zero-knowledge proofs allow validators to confirm transaction correctness without exposing sender, recipient, or amount details – a breakthrough for privacy-focused Bitcoin scaling.

The Dual Promise: Privacy and Scalability for Bitcoin

The combination of scalability and privacy is what sets zkBTC rollups apart from other solutions. By aggregating transactions off-chain and using cryptography to prove their validity, zk-rollups can:

- Dramatically increase capacity: Thousands of transactions can be settled in a single on-chain action.

- Lower costs: Less data per transaction means reduced network congestion and cheaper fees.

- Boost privacy: Transaction details remain confidential – only the validity proof is public.

This technology addresses two long-standing challenges: keeping user activity private while scaling to meet global demand. As highlighted by recent research (blog.xally.ai), zero-knowledge rollup protocols are uniquely positioned to deliver both benefits simultaneously for Bitcoin users.

The State of zk-Rollups on Bitcoin at $121,820

The momentum behind Bitcoin privacy scaling has accelerated over the past year. Key developments include John Light’s influential 2022 research paper outlining zk-rollup integration possibilities for Bitcoin and Rollkit’s modular framework enabling sovereign rollup deployment as of March 2023 (trustmachines.co). However, there are still hurdles before fully trustless zkBTC rollups become standard:

- Sovereign rollups currently lack seamless trustless transfers between Layer 1 (Bitcoin) and Layer 2 environments.

- The deployment of zero-knowledge CPU proof verification on Bitcoin remains in active development.

- No major production-ready zk-rollup has yet launched on mainnet – most work is still in test environments or early pilot phases.

This landscape mirrors earlier stages seen with Ethereum’s ZK ecosystem but with unique technical constraints due to Bitcoin’s conservative scripting system. Still, ongoing research suggests that breakthroughs could arrive sooner than many expect as demand for both scalability and privacy intensifies at these price levels.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Professional forecasts incorporating the impact of Layer 2 (zk-Rollup) adoption and evolving market conditions

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $97,500 | $140,000 | $185,000 | +14.9% | Layer 2 adoption grows, but regulatory uncertainty causes volatility. Early zk-Rollup solutions live but limited mainstream impact. |

| 2027 | $115,000 | $170,000 | $220,000 | +21.4% | Zk-Rollups mature; major exchanges and wallets integrate L2. Regulatory clarity improves, increasing institutional inflows. |

| 2028 | $130,000 | $200,000 | $260,000 | +17.6% | Strong adoption of Bitcoin L2s, including zk-Rollups. On-chain privacy features see higher demand. Bullish macro environment. |

| 2029 | $150,000 | $230,000 | $300,000 | +15.0% | Mainstream adoption of private, scalable BTC transactions. Competition from other blockchains intensifies, but Bitcoin retains dominance. |

| 2030 | $175,000 | $265,000 | $350,000 | +15.2% | Widespread Layer 2 usage; Bitcoin becomes a transactional and settlement layer. Macroeconomic tailwinds support higher valuations. |

| 2031 | $195,000 | $310,000 | $400,000 | +17.0% | Bitcoin ecosystem benefits from robust Layer 2 activity. Global regulatory frameworks established, boosting investor confidence. |

Price Prediction Summary

Bitcoin is expected to experience steady price growth through 2031, driven by the adoption of Layer 2 solutions like zk-Rollups, improved scalability, and enhanced privacy features. While volatility will persist due to market cycles and regulatory factors, the long-term outlook remains bullish, especially as technical advancements unlock new use cases and institutional participation increases.

Key Factors Affecting Bitcoin Price

- Adoption and technical maturity of zk-Rollups and other Layer 2 solutions on Bitcoin

- Global regulatory developments impacting privacy and scalability solutions

- Macro-economic trends, including inflation and monetary policy

- Competition from other scalable and privacy-focused blockchains

- Institutional adoption and integration of Bitcoin Layer 2 technologies

- Market sentiment and cycles (e.g., halving events, speculative bubbles)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As the Bitcoin ecosystem adapts to these evolving demands, developers and researchers are actively exploring how to bridge the gap between current limitations and the vision of seamless, private, high-throughput transactions. The surge in interest around zero-knowledge proofs on Bitcoin is not just theoretical, multiple research groups and startups are racing to deliver practical implementations that can withstand the network’s rigorous security standards.

Emerging Projects and the Competitive Landscape

While Ethereum has already seen several zk-rollup projects reach mainnet (such as StarkNet and zkSync), Bitcoin’s journey is distinct. The lack of native smart contract flexibility means that solutions must be tailored specifically for its UTXO model and conservative upgrade path. Nonetheless, a handful of ambitious initiatives are pushing boundaries:

Top zk-Rollup Projects Advancing Bitcoin Scalability

-

Rollkit by Celestia: Rollkit is a modular rollup framework developed by Celestia, enabling developers to deploy sovereign rollups on Bitcoin. It supports research and prototyping of zk-Rollups for Bitcoin scalability, though full trustless BTC transfers are still under development.

-

zkSync: Although primarily built for Ethereum, zkSync has announced research initiatives and collaborations exploring zk-Rollup technology for Bitcoin. Their expertise in zero-knowledge proofs positions them as a key player in potential Bitcoin integrations.

-

Chainway: Chainway is developing zk-Rollup-based solutions specifically for Bitcoin, with a focus on enabling scalable and private BTC transactions. Their open-source research aims to bring advanced cryptographic scalability to the Bitcoin ecosystem.

-

ZeroSync: ZeroSync is pioneering the use of zero-knowledge proofs to verify the Bitcoin blockchain, allowing for efficient syncing and potential foundations for zk-Rollup scalability layers.

-

Trust Machines: Trust Machines is actively researching and developing zk-Rollup solutions for Bitcoin, aiming to unlock scalable and private transactions by leveraging zero-knowledge CPU proof verification.

These projects range from modular frameworks like Rollkit, enabling sovereign rollups, to more experimental efforts that aim to embed zero-knowledge proof verification directly into Bitcoin’s consensus rules. Each approach comes with its own trade-offs between trust assumptions, compatibility, and performance.

The competitive landscape is also being shaped by increasing collaboration between Bitcoin core developers, academic researchers, and Layer 2 innovators. This cross-pollination is critical as it ensures that privacy enhancements do not compromise decentralization or censorship resistance, two pillars of the Bitcoin ethos.

Real-World Applications: What zkBTC Rollups Could Unlock

If successfully deployed at scale, zkBTC rollups could transform a variety of use cases:

- Private payments: Everyday users could transact without exposing balances or counterparties.

- Scalable DeFi protocols: Decentralized exchanges and lending markets could operate on Bitcoin without prohibitive fees or slow confirmation times.

- Enterprise settlements: Institutions could leverage Bitcoin for confidential cross-border transfers at a fraction of current costs.

This potential has not gone unnoticed by investors and market analysts. As highlighted in recent coverage from Token Metrics Moon Awards and LG Technology Ventures, zk-rollups are widely regarded as foundational to the next wave of blockchain adoption, especially as BTC remains above $121,820.00, drawing global attention to scalability bottlenecks (blog.xally.ai).

Challenges Ahead: Security, Adoption and User Experience

No technology is without its challenges. For zk-rollups on Bitcoin, several hurdles must be overcome before mainstream adoption can occur:

- Security audits: Zero-knowledge circuits are notoriously complex; rigorous testing is essential to prevent vulnerabilities.

- User experience: Wallets and interfaces must abstract away cryptographic complexity while ensuring users retain control over their assets.

- Ecosystem coordination: Upgrades or soft forks may be required for full integration, a process that demands broad community consensus.

The coming year will likely see pilot deployments in controlled environments, gradually expanding as confidence grows in both technical robustness and real-world utility. The lessons learned from Ethereum’s ZK rollup journey will serve as valuable blueprints, but adaptation to Bitcoin’s unique architecture remains key.

Looking Forward: The Roadmap for Private and Scalable BTC Transactions

The drive toward scalable privacy solutions is no longer a distant aspiration, it’s becoming a necessity as transaction volumes rise alongside price momentum. With BTC holding steady at $121,820.00, pressure will only increase for Layer 2 innovations that can preserve low fees and user confidentiality (trustmachines.co).

If current R and D trends continue, and if ecosystem stakeholders align around pragmatic upgrades, zkBTC rollups have the potential to redefine what’s possible on the world’s largest blockchain. Users could soon enjoy near-instant settlement with robust privacy guarantees, all anchored by the security of the original chain.