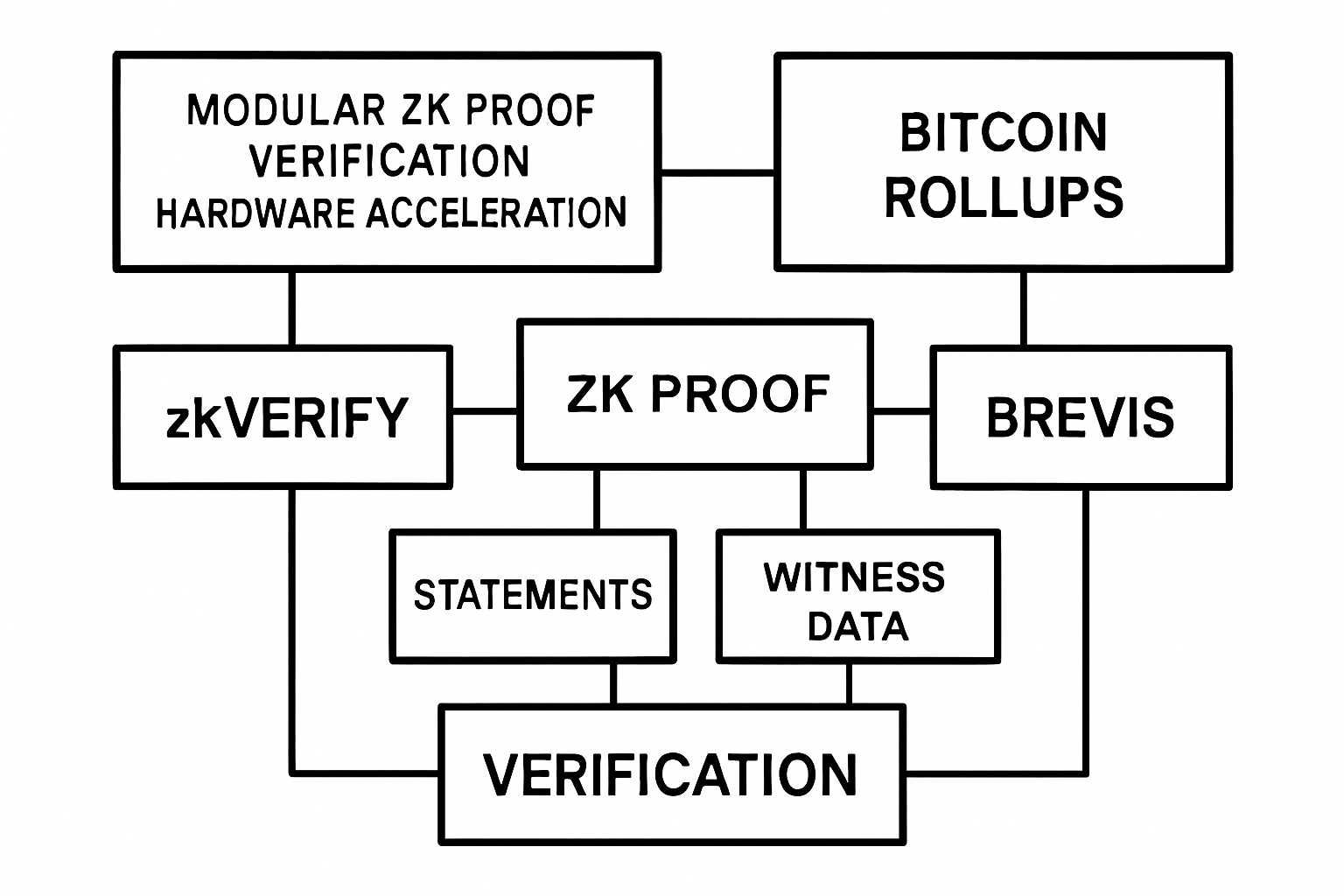

As Bitcoin (BTC) trades at $121,801.00, the ecosystem is witnessing a pivotal shift in scalability architecture. The latest advances in zero-knowledge (ZK) proof technology, particularly through zkVerify and Brevis, are redefining what’s possible for trustless, high-speed Bitcoin rollups. By offloading computationally intensive ZK proof verification and optimizing cross-chain data access, these solutions are directly addressing the bottlenecks that have historically limited Bitcoin’s throughput and programmability.

zkVerify: Modular ZK Proof Verification for Bitcoin Rollups

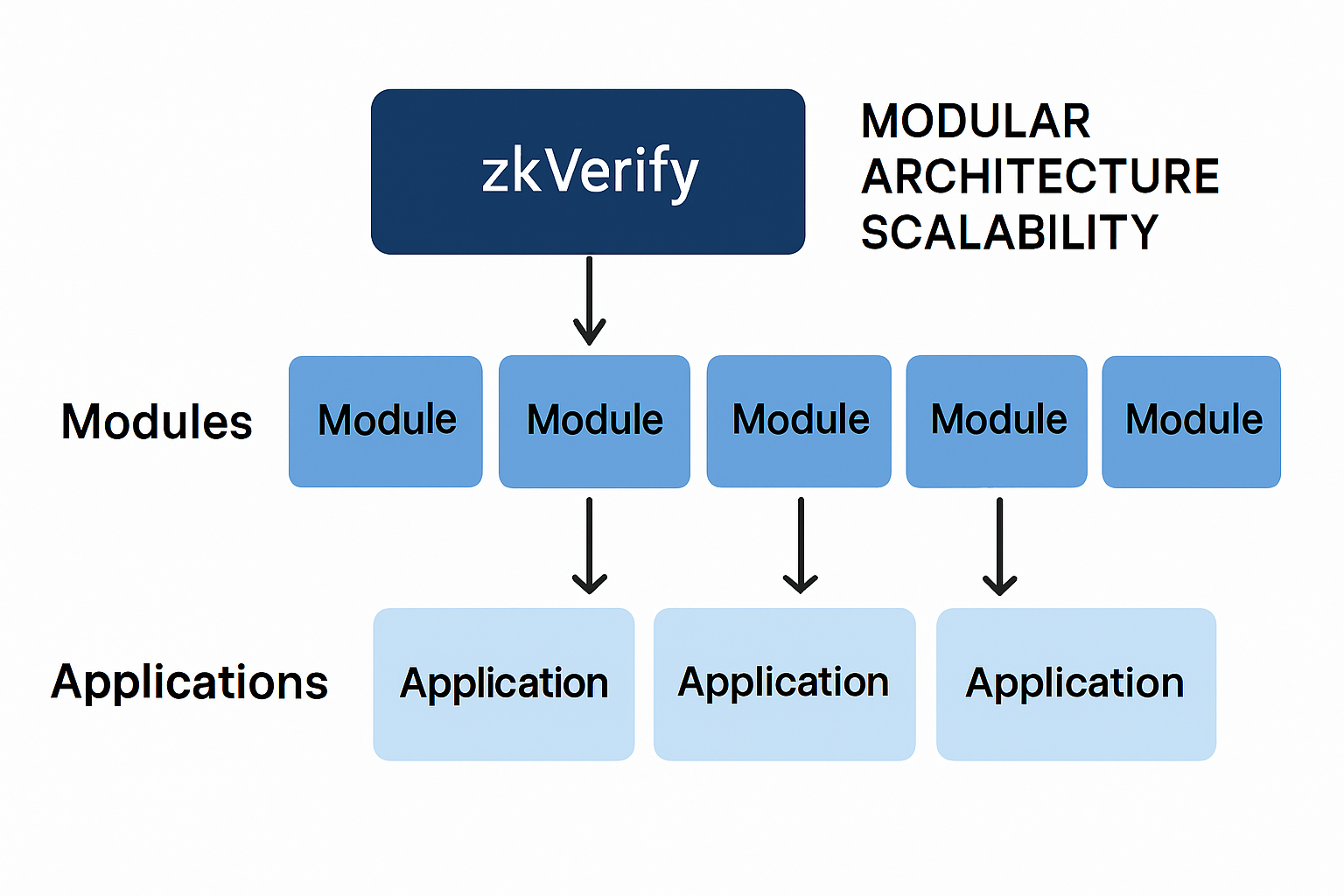

zkVerify stands out as the first dedicated blockchain network purpose-built for zero-knowledge proof verification at scale. Unlike traditional L1s that intermingle settlement, consensus, and execution, zkVerify isolates the verification function into a modular layer. This design enables applications and rollups to submit their ZK proofs to zkVerify’s specialized infrastructure rather than burdening the Bitcoin base layer.

The result is a dramatic reduction in both cost and latency for ZK proof validation. For Bitcoin rollups, this means that high-throughput transaction batches can be processed with minimal on-chain overhead, preserving decentralization while unlocking new performance ceilings. As highlighted by Delphi Digital and The Defiant, zkVerify’s approach is not just theoretical; it is live on mainnet as of 2025, providing a universal settlement optimization layer for any protocol leveraging ZKPs (source).

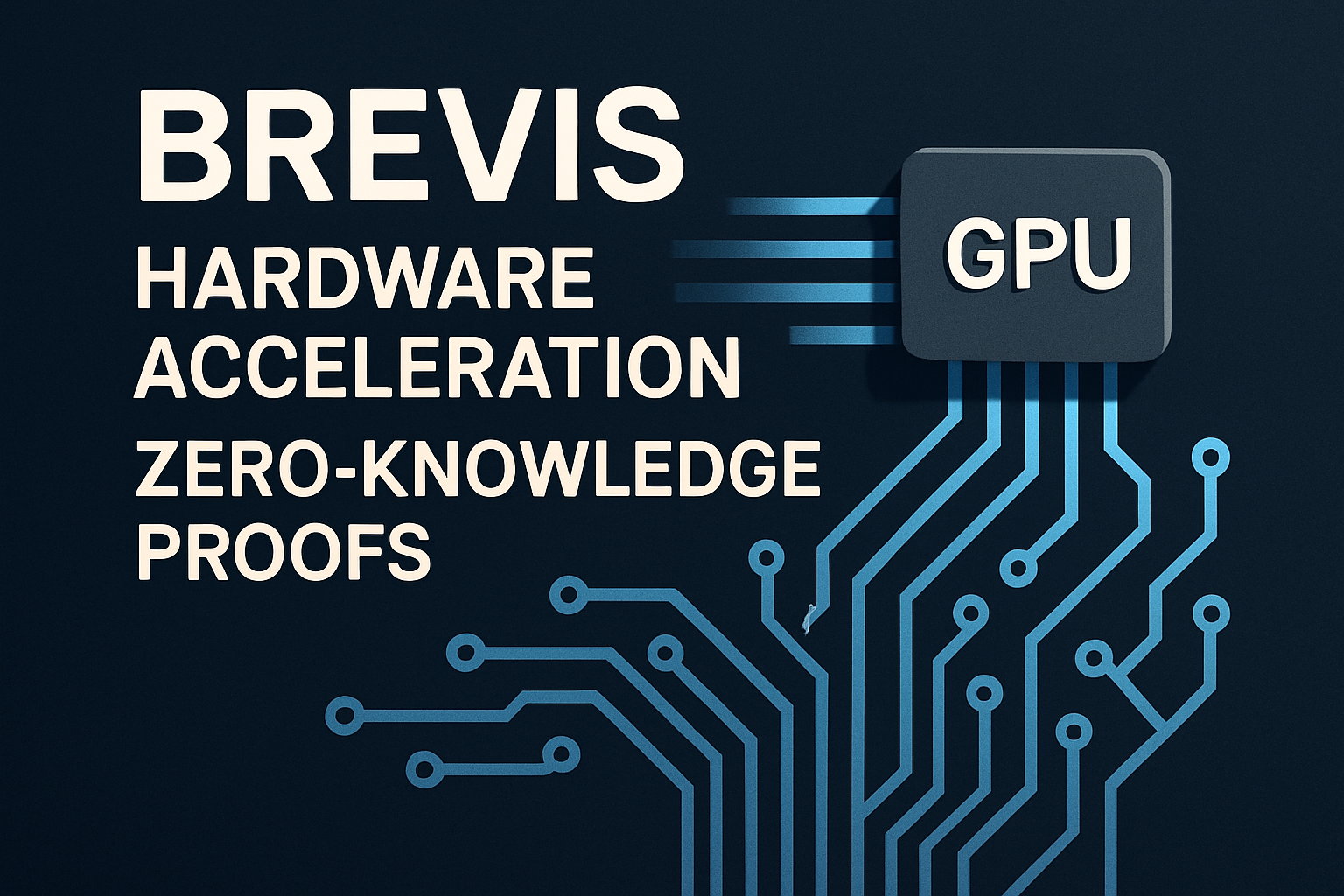

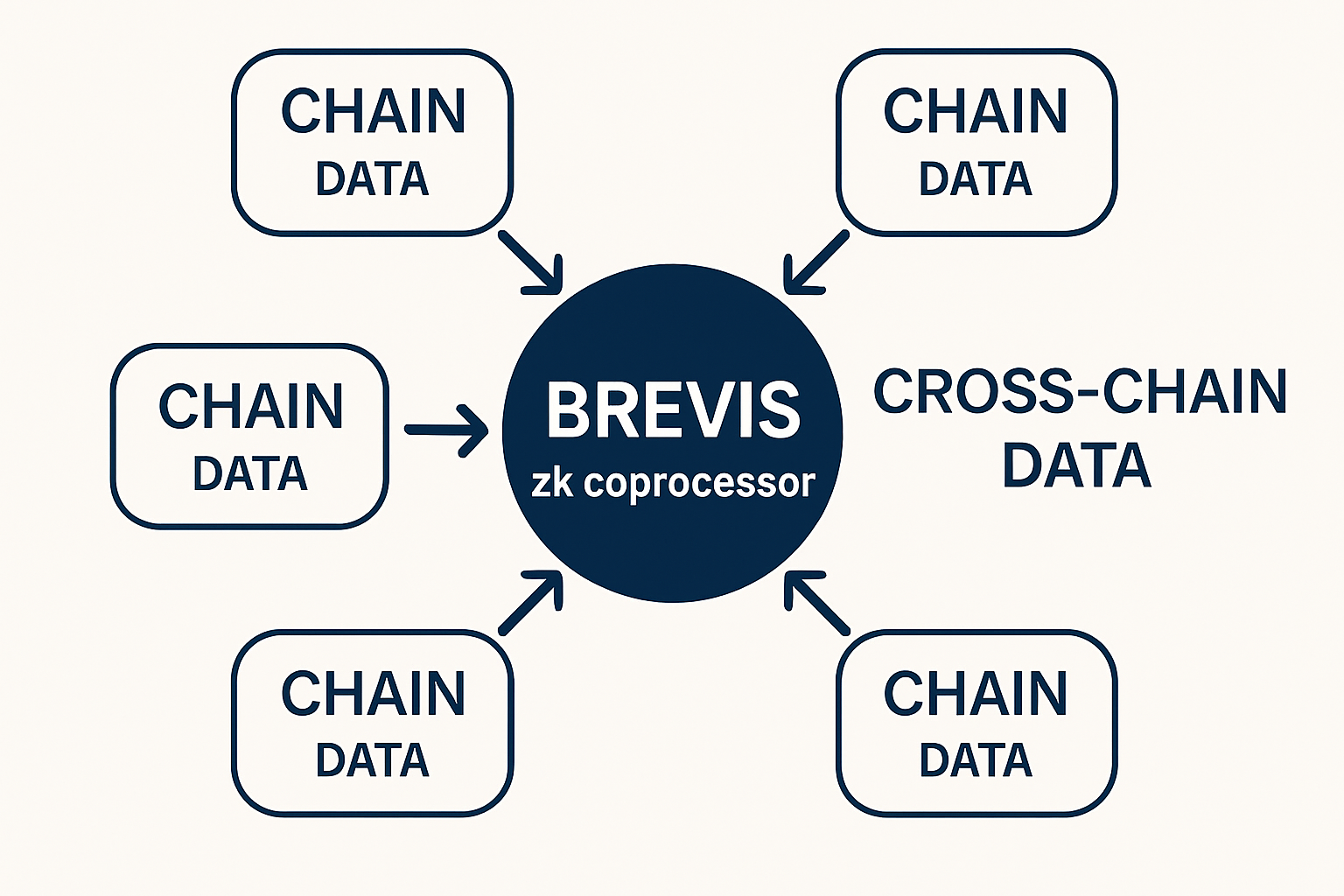

Brevis: Hardware-Accelerated Zero-Knowledge Coprocessing

Brevis takes a complementary approach by focusing on hardware acceleration for zero-knowledge computations across blockchains. Its smart ZK coprocessor leverages components like zkFabric, zkQueryNet, and zkAggregatorRollup, enabling decentralized applications to access and compute over multi-chain data sets without sacrificing trustlessness or security.

The core innovation lies in Brevis’ use of FPGAs (Field Programmable Gate Arrays) as opposed to GPUs or ASICs, a choice validated by research from Paradigm and MIT due to FPGAs’ superior cost efficiency and energy profile for ZKP workloads. This hardware-centric architecture greatly accelerates proof generation and verification cycles, making real-world zk adoption feasible at scale (source). For Bitcoin rollups, this translates to faster finality times and lower operational costs.

The Impact: Trustless Verification Meets High-Speed Performance at $121,801.00 BTC

The integration of zkVerify’s modular verification layer with Brevis’ hardware-accelerated coprocessor forms a powerful foundation for next-generation Bitcoin rollups. By removing the computational burden from the base chain and introducing efficient cross-chain data accessibility, these technologies enable:

- Trustless verification: Rollup proofs are validated independently of centralized sequencers or trusted setups.

- High-speed throughput: Off-chain computation combined with rapid on-chain settlement drastically reduces confirmation times.

- Sustainable scalability: Energy-efficient hardware ensures that increased transaction volumes do not compromise decentralization or economic viability.

- Ecosystem composability: Developers can build privacy-preserving applications that natively interact with multiple blockchains using robust ZKP primitives.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on current $121,801.00 price, ZK rollup advancements, and evolving crypto market conditions

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $97,000 | $135,000 | $173,000 | +10.8% | Post-halving consolidation, ZK rollup adoption grows |

| 2027 | $110,000 | $155,000 | $195,000 | +14.8% | Layer-2 and ZK tech mature, steady institutional inflows |

| 2028 | $125,000 | $180,000 | $235,000 | +16.1% | Mainstream ZK rollup integration, bullish macro cycle |

| 2029 | $140,000 | $210,000 | $280,000 | +16.7% | Regulatory clarity, global payment use cases expand |

| 2030 | $120,000 | $250,000 | $340,000 | +22.2% | Potential supercycle, BTC as digital reserve asset |

| 2031 | $140,000 | $285,000 | $400,000 | +14.0% | Mature ZK infrastructure, peak adoption, new competition |

Price Prediction Summary

Bitcoin is expected to experience steady growth through 2031, driven by the successful integration of zero-knowledge proof technologies like zkVerify and Brevis, which significantly enhance scalability, security, and transaction speed. While price volatility and market cycles will persist, the adoption of advanced rollup solutions positions BTC for continued relevance and market cap expansion. Minimum and maximum ranges account for both bearish regulatory scenarios and bullish mass adoption cycles.

Key Factors Affecting Bitcoin Price

- Adoption and integration of ZK rollup technologies (zkVerify, Brevis) in Bitcoin ecosystem

- Market cycles post-halving and macroeconomic trends

- Institutional investment and regulatory clarity, especially in the US and EU

- Competition from other scalable L1/L2 solutions and alternative digital assets

- Global economic conditions and inflationary pressures

- Potential for BTC to act as a digital reserve asset in global finance

- Innovation in hardware acceleration and blockchain interoperability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The current market environment, with Bitcoin holding steady above $120,000, highlights both the demand for scalable solutions and the urgency of deploying robust infrastructure like zkVerify and Brevis. As more protocols begin integrating these tools into their stack, we anticipate an acceleration in both user adoption and developer experimentation within the broader Bitcoin rollup landscape.

For developers and ecosystem architects, the implications of this new stack are profound. By leveraging zkVerify’s universal settlement optimization and Brevis’s FPGA-powered coprocessing, Bitcoin rollups can now provide a user experience that rivals or exceeds high-throughput L2s on other chains, without compromising Bitcoin’s core values of censorship resistance and decentralization.

Key Advantages: Why zkVerify and Brevis Matter for Bitcoin Scalability

Key Technical Advantages of zkVerify and Brevis for Bitcoin Rollups

-

Dedicated ZK Proof Verification Layer: zkVerify introduces the first modular blockchain specifically designed for zero-knowledge proof (ZKP) verification, offloading intensive computation from Bitcoin’s main chain and reducing network congestion.

-

Scalability Through Modular Architecture: By decoupling proof verification from settlement, zkVerify enables Bitcoin rollups to process transactions faster and more cost-effectively, enhancing overall throughput without compromising security.

-

Hardware-Accelerated ZK Proofs: Brevis leverages advanced hardware acceleration (e.g., FPGAs) to dramatically speed up ZK proof generation and verification, optimizing performance for high-volume Bitcoin rollups.

-

Cross-Chain Data Access and Computation: Brevis’s smart ZK coprocessor (including zkFabric, zkQueryNet, and zkAggregatorRollup) allows secure, trustless querying and computation on data from multiple blockchains, empowering sophisticated Bitcoin rollup applications.

-

Reduced Transaction Costs: Offloading ZKP verification to zkVerify’s dedicated layer and utilizing Brevis’s efficient data processing significantly lowers transaction fees for Bitcoin rollups, making them more economically viable.

-

Enhanced Security and Decentralization: Both platforms maintain Bitcoin’s core principles by enabling advanced scalability solutions without altering the base layer, preserving trustlessness and decentralization.

One of the most critical innovations is the decoupling of proof verification from both execution and settlement. This not only minimizes on-chain data bloat but also allows for parallelized scaling strategies, where multiple rollup instances can submit ZKPs to zkVerify simultaneously, all while leveraging Brevis’s high-throughput hardware acceleration. The result is a modular, horizontally scalable environment where transaction costs remain predictable even as usage spikes.

Security is further enhanced through trustless verification commitments, as seen in emerging projects like B² Network. By anchoring ZKP commitments directly to Bitcoin, these architectures ensure that even if a secondary layer fails or is compromised, the security guarantees provided by the base chain remain intact. This approach aligns with best practices outlined in recent cryptographic research (source), reinforcing the integrity of cross-chain applications.

“The future of Bitcoin scalability lies in modularity and hardware acceleration. With zkVerify and Brevis, we’re seeing the blueprint for trust-minimized, high-speed rollups take shape right now. “

This evolution is not just theoretical. As highlighted by real-time sentiment from industry leaders:

Next Steps: The Road Ahead for Trustless Bitcoin Rollups

The next phase will involve deeper integration of these technologies into wallets, bridges, and decentralized applications (dApps) built atop Bitcoin rollups. Developers now have access to primitives that enable privacy-preserving swaps, cross-chain lending markets, proof-of-reserve attestations, and more, all without sacrificing performance or composability.

As BTC maintains its position at $121,801.00, institutional interest continues to rise alongside retail adoption. The combination of zkVerify’s modular verification layer with Brevis’s hardware-accelerated coprocessing stands to unlock new capital flows by making high-value transactions both affordable and secure at scale.

Which feature excites you most about modular ZK verification on Bitcoin?

zkVerify and Brevis are pioneering scalable, trustless Bitcoin rollups by offloading ZK proof verification and enabling efficient, cross-chain data access. As a developer, which innovation are you most eager to build with?

With these advancements in place, and as more projects adopt trustless verification powered by zero-knowledge proofs, the path toward mass adoption becomes clearer. The era of slow confirmation times and prohibitive fees is giving way to a new paradigm where Bitcoin serves as a truly programmable settlement layer without ever compromising its foundational ethos.