Bitcoin’s meteoric rise continues, with the current price holding at $124,313.00. As adoption grows, so do concerns about network congestion and transaction privacy. Traditional Bitcoin transactions are transparent and can be slow or expensive during periods of high demand. This is where zkBTC rollups enter the scene, offering a transformative approach to Bitcoin privacy scaling and throughput.

Why Scalability and Privacy Matter for Bitcoin

Bitcoin’s original design prioritizes security and decentralization, but it comes with trade-offs: limited transaction capacity (about 7 transactions per second) and full public visibility of all transactions on-chain. These limitations can stifle mainstream adoption for both individuals and businesses seeking efficiency or privacy. As the market matures, new solutions are essential to maintain momentum above the $100,000 mark and beyond.

Rollups are among the most promising Bitcoin scalability solutions. By moving transaction processing off-chain while preserving security guarantees through cryptographic proofs, rollups can unlock higher throughput and lower fees without compromising trust.

Understanding Zero-Knowledge Proofs and ZK Rollups

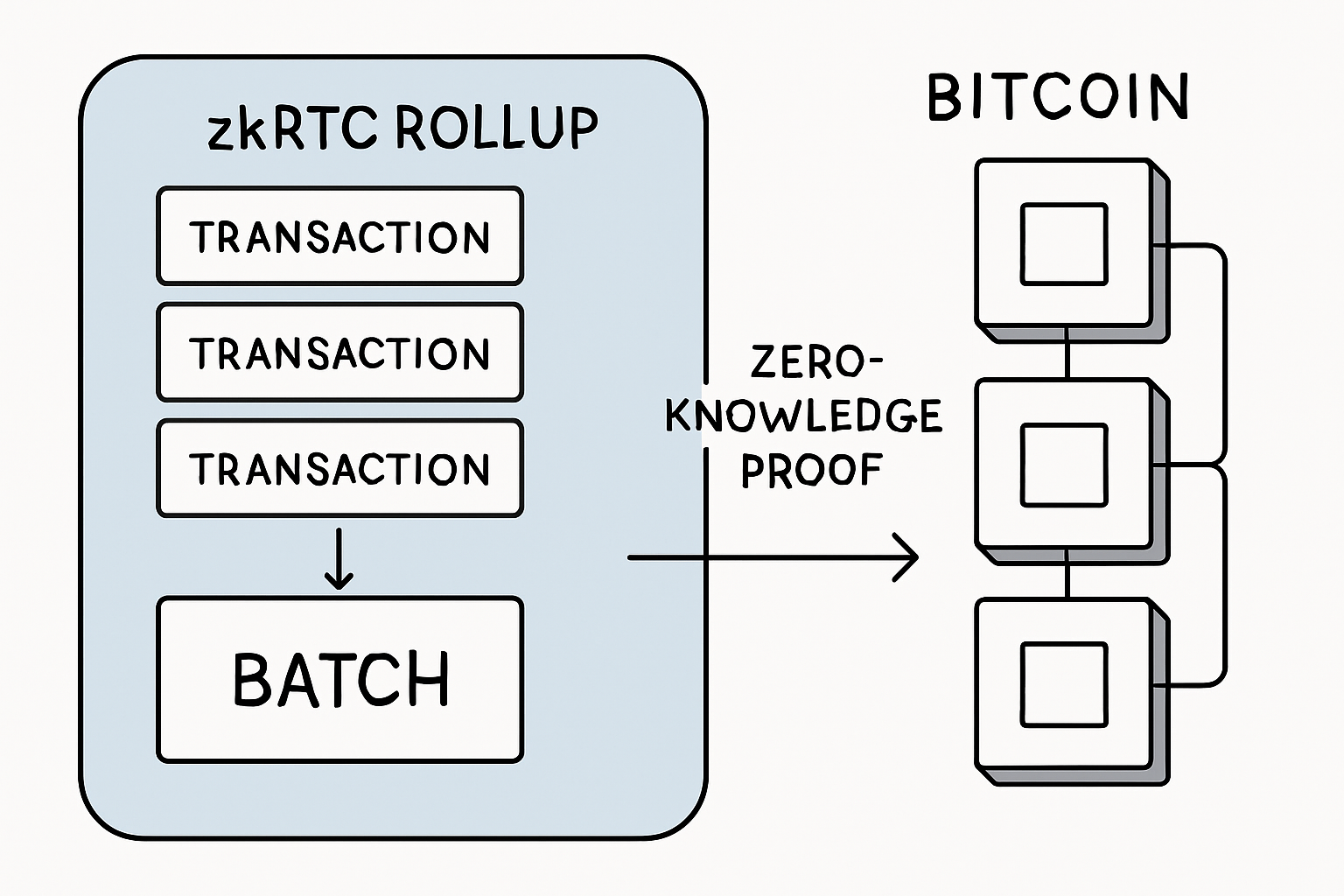

Zero-knowledge proofs (ZKPs) are cryptographic protocols that allow one party to prove a statement is true without revealing any additional information about that statement. In blockchain applications, ZKPs enable transaction validation or identity verification while keeping sensitive details confidential (Chainlink). This technology underpins zero-knowledge rollups (ZK rollups), which bundle many transactions together off-chain and submit a single proof to the mainnet.

ZK rollups have been widely adopted on Ethereum but are now coming to Bitcoin through initiatives like zkBTC. The core idea is simple yet powerful: aggregate hundreds or thousands of transactions into a batch, generate a validity proof using zero-knowledge techniques, then post only that proof (and minimal data) on-chain. The result? Massive scalability gains with robust privacy guarantees (Coinbase).

How zkBTC Rollups Work Under the Hood

The zkBTC protocol employs Polygon’s zero-knowledge-powered zkEVM to bring EVM compatibility, and thus smart contract functionality, to the Bitcoin ecosystem (zkbtc.com). Here’s how it works in practice:

- Batched Transactions: Users submit their BTC transfers or smart contract calls to zkBTC’s Layer-2 chain.

- ZK Proof Generation: The protocol aggregates these into batches and computes a succinct zero-knowledge proof attesting to their validity.

- Mainnet Settlement: Only this proof (not individual transaction data) is posted to the Bitcoin base layer for settlement.

- User Privacy: Because only aggregated data is visible on-chain, individual transaction details remain private, an enormous upgrade over standard transparent UTXOs.

This architecture allows zkBTC to support not just BTC transfers but also Ordinals, Runes, BRC-20 tokens, and decentralized applications, all within a secure framework that preserves user privacy (zkbtc.com). For developers building on Bitcoin or investors looking for private Bitcoin transactions with low fees, this marks a significant leap forward.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on zkBTC Rollups, Zero-Knowledge Proof Advancements, and Current Market Data ($124,313.00 as of October 2025)

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $130,000 | $156,000 | +4.6% | Potential post-halving volatility; regulatory scrutiny on privacy features may cause swings |

| 2027 | $110,000 | $146,000 | $186,000 | +12.3% | zkBTC adoption increases; broader institutional entry; bullish scenario if Layer-2s scale rapidly |

| 2028 | $125,000 | $162,000 | $210,000 | +11.0% | Growing dApp ecosystem on Bitcoin; Layer-2 competition intensifies; privacy debates persist |

| 2029 | $140,000 | $178,000 | $236,000 | +9.9% | Next halving year; supply shock could drive prices up; macroeconomic factors in play |

| 2030 | $155,000 | $195,000 | $265,000 | +9.6% | Mainstream adoption of zkBTC and Ordinals; global regulatory clarity; new market entrants |

| 2031 | $168,000 | $210,000 | $292,000 | +7.7% | Mature Layer-2 ecosystem; Bitcoin viewed as both a settlement and smart contract layer |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 remains bullish, driven by technological advancements such as zkBTC rollups for scalability and privacy, expanding use cases, and increasing institutional adoption. While volatility and regulatory risks remain, the integration of zero-knowledge proofs and Layer-2 solutions positions Bitcoin for sustained growth. Conservative estimates show steady gains, while upper ranges reflect scenarios of accelerated mainstream adoption and favorable macroeconomic trends.

Key Factors Affecting Bitcoin Price

- Adoption and scalability of zkBTC and other Layer-2 solutions

- Institutional investment and mainstream adoption of Bitcoin

- Regulatory developments, especially regarding privacy features

- Competition from other blockchains with advanced smart contract and privacy capabilities

- Global macroeconomic conditions and monetary policy

- Bitcoin halving cycles and their impact on supply dynamics

- Expansion of Bitcoin’s ecosystem (dApps, Ordinals, BRC-20, etc.)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Benefits of Private and Scalable Transactions With zkBTC Rollups

The impact of zkBTC rollups extends across several dimensions:

- Dramatically increased throughput: By processing most activity off-chain and settling in batches, zkBTC enables far more transactions per second than native Bitcoin.

- User confidentiality: Zero-knowledge proofs shield sender/receiver identities and transfer amounts from public view while still guaranteeing correctness (Chainlink).

- Ecosystem expansion: Smart contract support means dApps can now harness Bitcoin’s liquidity without sacrificing scalability or privacy (zkbtc.com).

- Sustainable fee structure: Batching reduces per-user costs even as network activity grows, a key factor as BTC trades well above $100k levels.

For both retail users and institutions, these advantages converge to create a fundamentally different Bitcoin experience. Transaction bottlenecks and privacy concerns have historically deterred some participants from leveraging the Bitcoin network for everyday payments or large-scale business transactions. zkBTC rollups directly address these pain points, making private Bitcoin transactions accessible without compromising on security or decentralization.

Security Considerations: Trust Minimization and Validity

Despite the promise of zero-knowledge proofs for Bitcoin scalability solutions, it’s crucial to approach new infrastructure with caution. The security model of zkBTC rollups relies on the cryptographic soundness of ZKPs and the robustness of off-chain operators. Users should understand that while zero-knowledge proofs can eliminate invalid transactions from being processed (Chainalysis), the implementation details, such as circuit design and upgrade mechanisms, require rigorous auditing.

It’s also important to note that while zkBTC enhances privacy for end-users, metadata leakage is still possible if users are not careful in their operational security practices. As with any emerging technology in digital assets, risk management remains paramount.

Best Practices for Secure and Private zkBTC Rollup Usage

-

Verify zkBTC Rollup Protocol Authenticity: Interact only with the official zkBTC platform and double-check contract addresses and URLs to prevent phishing or malicious dApp interactions.

-

Regularly Update Software and Firmware: Ensure your wallet applications, browser extensions, and hardware wallet firmware are up to date to protect against known vulnerabilities and exploits.

-

Use Privacy Features Appropriately: Leverage the privacy benefits of zkBTC rollups by avoiding address reuse and utilizing features that obscure transaction details, such as stealth addresses or shielded transactions where available.

-

Monitor Transaction Fees and Network Status: Check current zkBTC and Bitcoin mainnet fees before transacting. High congestion can affect confirmation times and costs, even with rollups.

-

Understand Withdrawal and Settlement Processes: Familiarize yourself with zkBTC’s withdrawal mechanisms, including any time delays or minimum withdrawal amounts, to avoid unexpected issues when moving funds back to the Bitcoin mainnet.

-

Stay Informed About Security Audits and Updates: Follow official zkBTC channels and reputable crypto security sources (such as OpenZeppelin or ConsenSys Diligence) for news on protocol audits, bug bounties, and critical updates.

The Road Ahead: Expanding Bitcoin’s Capabilities

With Bitcoin maintaining its position at $124,313.00, scaling solutions like zkBTC are poised to play a pivotal role in supporting further adoption. As more developers experiment with decentralized applications on top of Bitcoin, we can expect an influx of innovative use cases, from confidential payments to programmable finance, all benefiting from the dual pillars of privacy and scalability.

The integration of smart contracts via EVM compatibility opens up possibilities previously reserved for other blockchains, now anchored by Bitcoin’s unparalleled security guarantees. However, mass adoption will depend on continued improvements in user experience, wallet integrations, and developer tooling within the zkBTC ecosystem.

Security is the foundation of innovation. As new layers are built atop Bitcoin, it’s essential that protocols like zkBTC undergo continuous scrutiny from both independent researchers and the open-source community.

Getting Started With Private Bitcoin Transactions

If you’re considering using zkBTC rollups for private or high-throughput transactions, start by reviewing current documentation and community resources (zkbtc.com). Engage with testnets where available before committing significant funds. For developers, exploring zkEVM-compatible smart contracts could unlock powerful new dApp designs leveraging both privacy and efficiency.

The landscape for Bitcoin privacy scaling is evolving rapidly. By staying informed about advancements in zero-knowledge proofs for Bitcoin, you’ll be better positioned to navigate this next era, one where scalability no longer comes at the expense of privacy or trustlessness.