Bitcoin is roaring at $123,363.00, and the narrative is shifting fast: holders are demanding more than just price appreciation. Enter GOATRollup – the first Bitcoin-native zkRollup unlocking real yield and true DeFi utility for BTC, all without compromising on decentralization or security. Forget the synthetic tokens and custodial wrappers; GOAT Network is rewriting the rules for BTCFi with a transparent, on-chain Layer 2 built for this new era.

GOAT Network: Real Yield, No Shortcuts

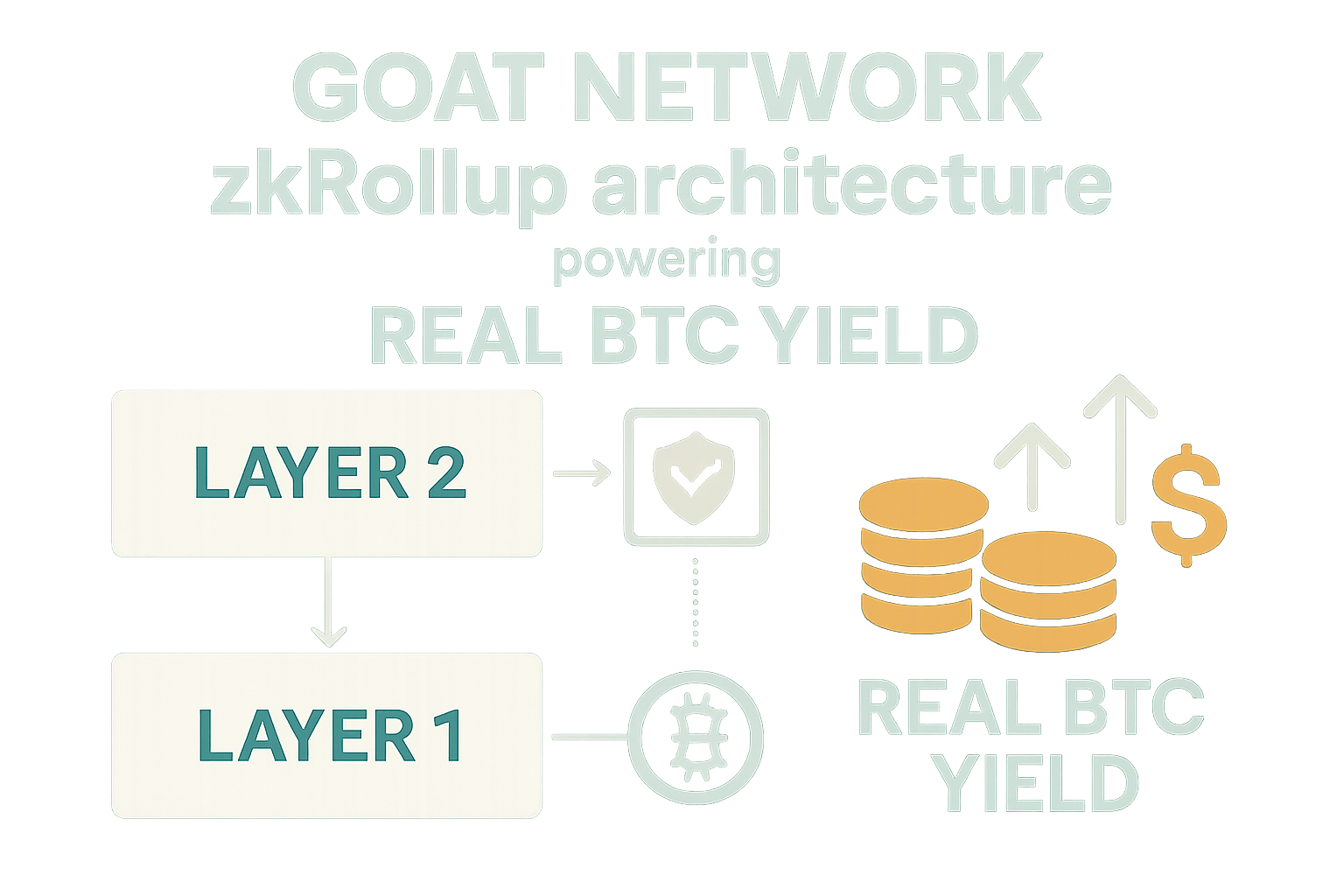

GOAT Network’s team puts it bluntly: “A real Bitcoin L2 is not built on shortcuts. ” Instead of repurposing EVM templates or relying on federated bridges, GOATRollup delivers a ground-up zkRollup powered by zkVM, BitVM2, and a decentralized sequencer network. This technical backbone preserves native Bitcoin security while opening the floodgates for DeFi innovation.

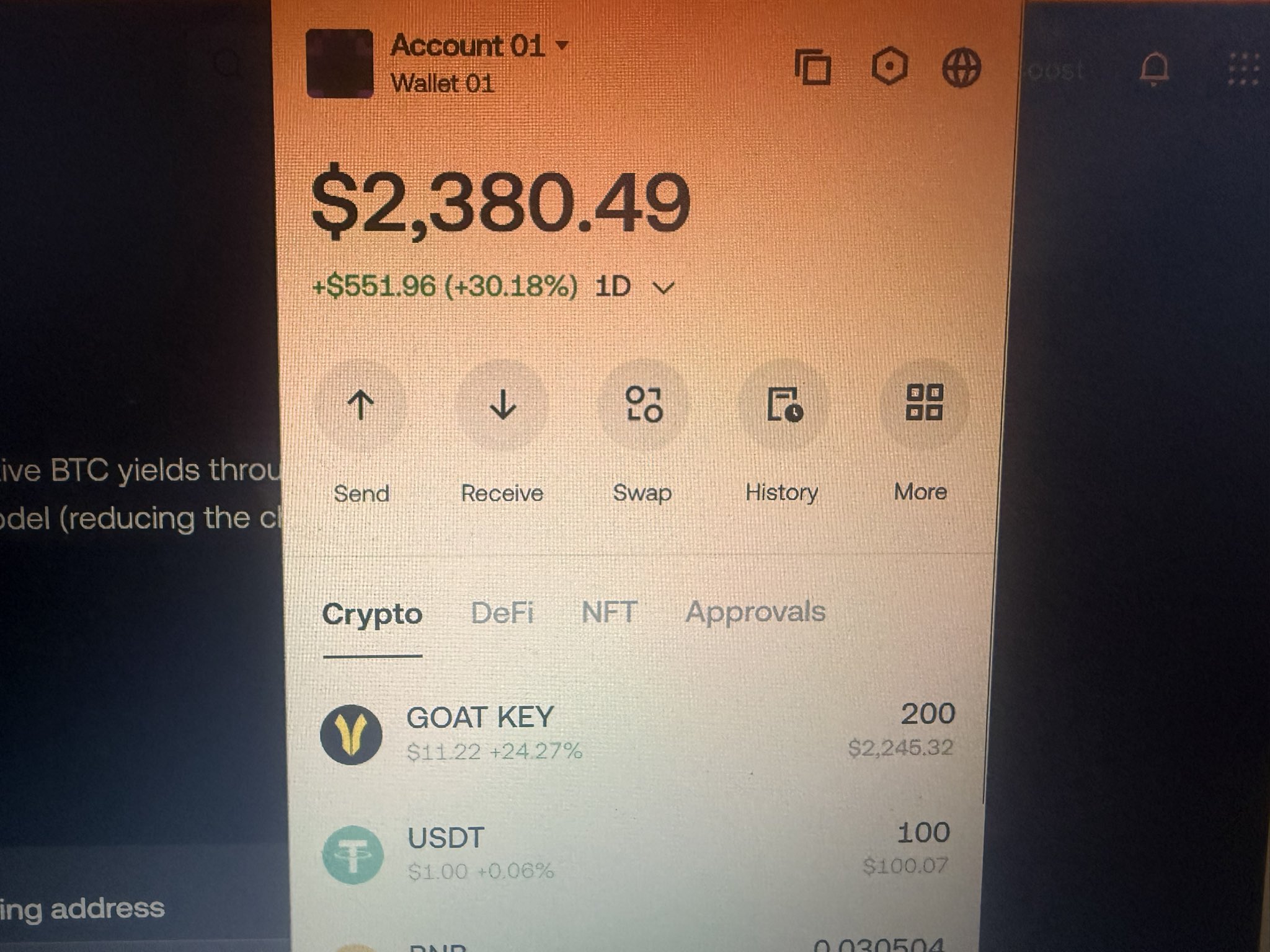

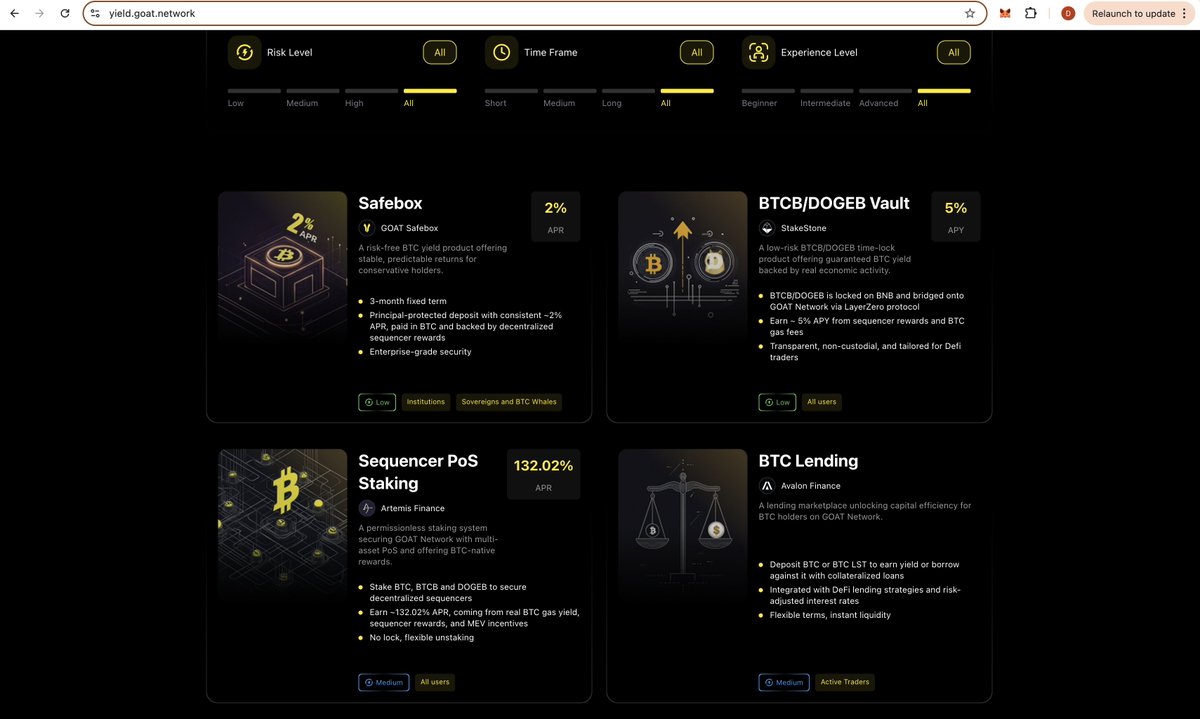

The results are already live. On May 28,2025, GOAT launched its BTC Yield Dashboard, featuring:

- GOAT Safebox: A non-custodial, risk-free yield vault offering 2% APY in native BTC, users simply time-lock their coins for three months to earn protocol-guaranteed returns funded by sequencer rewards.

- BTCB/DOGEB Vault: Earn 5% APY with minimal risk by depositing BTCB or DOGEB (on BNB Chain), with rewards powered by real gas fees and sequencer incentives.

- Sequencer PoS Staking: In partnership with Artemis Finance, stake BTC, BTCB, or DOGEB to support decentralization and earn up to 10% APY from sequencer rewards and MEV.

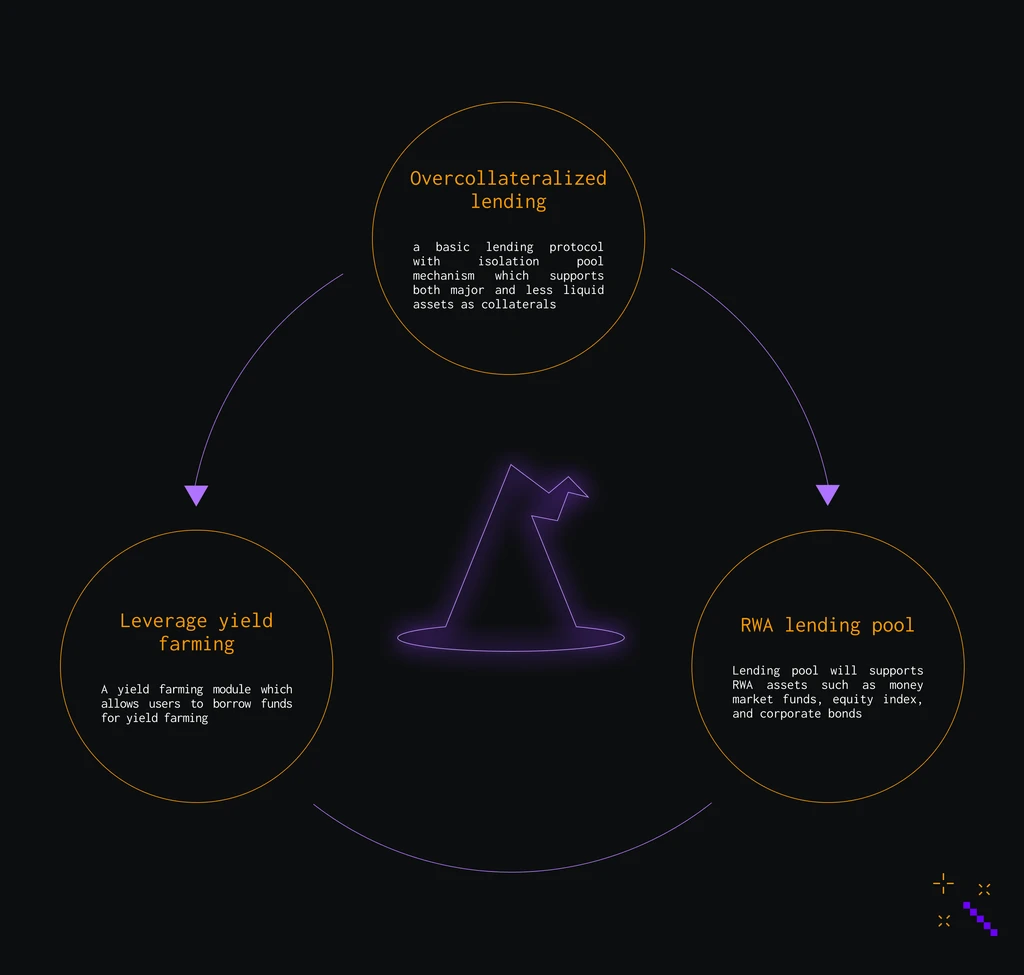

- BTC Lending via Avalon Finance: Deposit native BTC or liquid staking tokens to earn yield or borrow against them, optimizing capital efficiency without leaving the Bitcoin ecosystem.

Pushing Bitcoin DeFi Beyond HODLing

The old playbook was simple: buy BTC, hold tight. But as yields across DeFi exploded on other chains, Bitcoiners were left behind – until now. GOAT Network’s zkRollup architecture transforms passive assets into active capital. Users can stake, lend, or participate in multi-asset vaults directly on a trustless Layer 2 anchored to mainnet security.

This isn’t vaporware. The BitVM2 Beta testnet went live July 31,2025 – making GOAT the world’s first production-ready zkRollup with real-time proving. Withdrawals are processed immediately after proof generation; no more waiting days for exit windows. Liquidity stays fluid and frictionless – a core requirement for any serious DeFi protocol.

The Tech Stack Powering Sustainable BTC Yield

Skeptics ask: where does this “real yield” come from? The answer is in protocol design. Each product is underpinned by actual economic activity, transaction fees collected from Layer 2 usage, MEV captured by decentralized sequencers, plus rewards distributed through PoS staking mechanics. This creates a flywheel effect: as more users transact on GOATRollup protocols (NFT minting rollups included), more fees accrue to stakers and vault depositors.

Key Features of GOAT Network’s BTCFi Ecosystem

-

BTC Yield Dashboard: Launched on May 28, 2025, this platform offers a suite of BTCFi products enabling users to earn real yield in native BTC directly on the Bitcoin blockchain, with transparent risk-adjusted options.

-

GOAT Safebox: A non-custodial, risk-free yield product delivering 2% APY in native BTC. Users lock BTC for 3 months via secure timelock contracts, earning protocol-guaranteed returns powered by sequencer rewards.

-

BTCB/DOGEB Vault: Designed for DeFi users, this vault allows deposits of BTCB or DOGEB on BNB Chain to earn 5% APY backed by real gas fees and sequencer rewards, minimizing risk while maximizing returns.

-

Sequencer PoS Staking: In partnership with Artemis Finance, GOAT Network enables permissionless PoS staking of BTC, BTCB, and DOGEB, offering up to 10% APY through sequencer rewards, BTC gas fees, and MEV.

-

BTC Lending with Avalon Finance: Users can deposit BTC or liquid staking tokens to earn yield or borrow against their assets with flexible terms, optimizing returns while maintaining liquidity.

-

Real-Time Proving with BitVM2: On July 31, 2025, GOAT Network became the first Bitcoin zkRollup to implement real-time proving in production, enabling instant withdrawals after proof generation for enhanced asset liquidity and user experience.

No centralized intermediaries. No IOUs disguised as “yield. ” Just transparent smart contracts delivering returns in native BTC at every step of the stack.

Bitcoin (BTC) & GOATED Price Prediction Table (2026-2031)

Forecasts incorporate GOAT Network’s zkRollup DeFi integration, current BTC price trends, and evolving market dynamics. Prices in USD.

| Year | BTC Minimum Price | BTC Average Price | BTC Maximum Price | BTC YoY % Change (Avg) | GOATED Minimum Price | GOATED Average Price | GOATED Maximum Price | GOATED YoY % Change (Avg) |

|---|---|---|---|---|---|---|---|---|

| 2026 | $98,000 | $135,000 | $165,000 | +9% | $3.80 | $5.25 | $8.00 | +50% |

| 2027 | $110,000 | $158,000 | $200,000 | +17% | $4.90 | $7.90 | $13.00 | +51% |

| 2028 | $125,000 | $180,000 | $235,000 | +14% | $6.20 | $11.50 | $19.00 | +46% |

| 2029 | $140,000 | $206,000 | $270,000 | +14% | $8.00 | $14.60 | $25.00 | +27% |

| 2030 | $130,000 | $188,000 | $255,000 | -9% | $7.10 | $13.20 | $23.00 | -10% |

| 2031 | $120,000 | $175,000 | $230,000 | -7% | $6.20 | $12.00 | $20.00 | -9% |

Price Prediction Summary

Bitcoin is expected to remain in a strong uptrend through 2029, driven by increased adoption of BTCFi and innovations like GOAT Network’s zkRollup. As real BTC yield becomes mainstream, DeFi utility will support higher price floors. However, cyclical corrections and macroeconomic pressures may result in moderate pullbacks in 2030-2031. GOATED, as the native asset of GOAT Network, is forecast to outperform BTC in percentage terms during growth phases but will also see sharper corrections in bear cycles.

Key Factors Affecting Bitcoin Price

- Institutional adoption of BTCFi products and real yield platforms (e.g., GOAT Network).

- Continued technical progress in Bitcoin Layer 2 solutions (zkRollup, BitVM2, decentralized sequencers).

- Macro environment: global liquidity cycles, interest rates, and regulatory clarity for DeFi.

- Competition from other smart contract chains and BTCFi protocols.

- Potential for regulatory headwinds or tailwinds impacting DeFi and staking.

- Market sentiment, halving events, and BTC’s evolving narrative from store-of-value to utility asset.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

GOAT Network isn’t just tacking DeFi onto Bitcoin as an afterthought. It’s engineering a new standard for BTC rollup protocols, where decentralized sequencers and zero-knowledge proofs guarantee both speed and security. The integration of zkVM and BitVM2 means transactions are verifiable, censorship-resistant, and instantly withdrawable, ushering in a level of user sovereignty Bitcoiners have demanded for years.

Yield sustainability is the name of the game. GOAT’s multi-asset staking (BTC and DOGE) and native vaults are already attracting liquidity from users seeking risk-adjusted returns without leaving the Bitcoin trust model. The protocol’s design ensures that real yield is generated from actual network activity, not from inflationary tokenomics or unsustainable incentives.

How GOATRollup Is Reshaping the BTCFi Ecosystem

The impact is tangible. For the first time, BTC holders can:

Top Ways BTC Holders Earn Real Yield on GOAT Network

-

GOAT Safebox: Earn 2% APY in native BTC by locking your BTC for 3 months in a non-custodial, risk-free vault. Returns are protocol-guaranteed and powered by sequencer rewards, ensuring your yield is both secure and decentralized.

-

BTCB/DOGEB Vault: Deposit BTCB or DOGEB on BNB Chain and earn 5% APY, backed by real gas fees and sequencer rewards. This vault is designed for DeFi users seeking reliable, low-risk returns.

-

Sequencer PoS Staking: Stake BTC, BTCB, or DOGEB permissionlessly to support GOAT’s decentralized sequencer network and earn up to 10% APY. Rewards are fueled by sequencer fees, BTC gas, and MEV, in partnership with Artemis Finance.

-

BTC Lending via Avalon Finance: Deposit BTC or liquid staking tokens to earn yield or borrow against your holdings with flexible terms. This lets you optimize returns while maintaining liquidity, all within the GOAT Network ecosystem.

-

Instant Withdrawals with Real-Time Proving: Thanks to BitVM2 Beta testnet and real-time zkRollup proofs, users can now withdraw BTC instantly after proof generation—boosting liquidity and flexibility for yield strategies.

This shift is fueling a new wave of innovation across the Bitcoin zkRollup DeFi landscape. NFT minting rollups, permissionless lending markets, and MEV-driven staking pools are all possible on a foundation that stays true to Bitcoin’s ethos, no shortcuts, no centralized bridges.

The market has taken notice. With Bitcoin trading at $123,363.00, capital efficiency is more critical than ever. Institutions and retail alike are searching for ways to do more with their BTC stack while minimizing risk exposure to third parties or wrapped tokens. GOATRollup’s approach, delivering real yield on native assets, hits the sweet spot for today’s high-stakes environment.

What’s Next? Scaling Adoption and Network Effects

The roadmap ahead is aggressive: expanded support for additional assets (including stablecoins), enhanced NFT minting rollups, and deeper integrations with major wallets and custodians, all while maintaining uncompromising decentralization through its sequencer set.

If you’re looking to ride the next wave in Bitcoin Layer 2 innovation, and actually earn real yield denominated in native BTC, GOAT Network is setting the pace. The combination of live products, transparent mechanics, and relentless focus on decentralization cements its status as a leader in the evolving BTCFi ecosystem.

Bitcoin Technical Analysis Chart

Analysis by Bryce Callahan | Symbol: BINANCE:BTCUSDT | Interval: 1h | Drawings: 4

Technical Analysis Summary

Aggressive traders should draw a primary uptrend line from the local low near $115,000 (Oct 1st) to the higher low near $122,200 (Oct 5th), capturing the bullish momentum. Mark horizontal resistance at $125,500 (recent local high) and support at $122,200 (recent low post-pullback). Use rectangles to highlight the recent consolidation zone between $122,200 and $124,000. Place arrows to indicate the breakout move on Oct 4th and the sharp rejection at $125,500. Annotate with text to call out the failed breakout and the subsequent bullish recovery attempt. Aggressively seek breakout trades above $125,500 with tight stops below $122,200.

Risk Assessment: high

Analysis: Volatility is intense near resistance; failed breakouts and sharp pullbacks create high-risk, high-reward setups. Aggressive positioning is warranted but must be paired with disciplined stops.

Bryce Callahan’s Recommendation: Trade the breakout above $125,500 or bounce off $122,200, but keep stops tight and size appropriately. Ride the wave, manage the risk.

Key Support & Resistance Levels

📈 Support Levels:

-

$122,200 – Recent local low after pullback; buyers stepped in aggressively.

strong

📉 Resistance Levels:

-

$125,500 – Recent high and sharp rejection zone; needs to be cleared for continuation.

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$125,500 – Breakout confirmation above resistance; momentum likely to accelerate if flipped.

high risk -

$122,200 – Aggressive long off strong support for a bounce play.

medium risk

🚪 Exit Zones:

-

$127,000 – Profit target on breakout momentum extension.

💰 profit target -

$121,800 – Stop loss just below support to manage downside risk.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: N/A (volume not visible on this chart, recommend adding volume for confirmation of breakout or breakdown moves).

Always watch for volume spike confirmation on breakout above $125,500.

📈 MACD Analysis:

Signal: N/A (MACD not visible, but momentum appears to be recovering post-pullback).

Look for MACD bullish cross on lower timeframes for confirmation.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Bryce Callahan is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).