In the fast-evolving world of Bitcoin rollups and zero-knowledge (ZK) scaling, milestones matter. This week, zkVerify hit a landmark achievement: over 1 million ZK proofs verified on mainnet. For those tracking the future of blockchain scalability and privacy, this isn’t just another number. It’s a signal that the infrastructure for next-gen BTC scaling solutions is maturing fast, and developers, investors, and builders should pay close attention.

zkVerify: The Modular Layer Supercharging ZK Rollups

Let’s break it down. zkVerify, launched by Horizen Labs, is a decentralized proof verification layer purpose-built to validate ZK proofs quickly, securely, and at scale. It’s not just about speed, it’s about radically slashing costs. In 2023 alone, Ethereum zk-rollups spent over $47 million on proof verification fees. zkVerify claims to cut these costs by up to 91%, freeing up capital for actual innovation instead of burning it on computation.

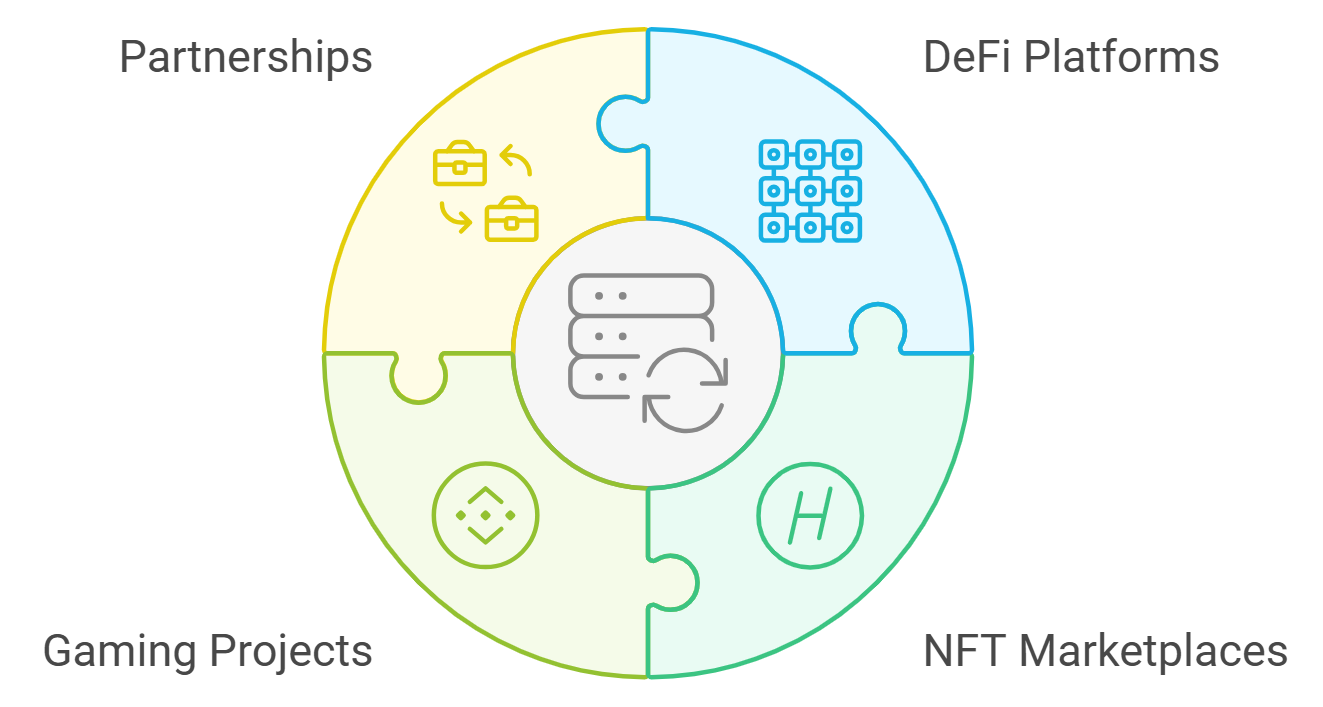

This modular L1 doesn’t just talk a big game, it delivers. With support for multiple SNARK proving schemes and seamless integration across Ethereum, Solana, Bitcoin L2s, and more, zkVerify aims to be the universal backbone for ZK proof verification in Web3. The platform’s architecture means devs can plug in without being shackled by their settlement layer’s limitations, and that opens doors for BTC rollups hungry for efficiency.

“Zero-knowledge proofs are the rocket fuel of blockchain scalability, but only if you can verify them fast enough and cheap enough. “

Why 1 Million Proofs Matters for Bitcoin Rollups

The impact on Bitcoin rollups is immediate and massive. As BTC trades at $122,283.00, more eyes than ever are on how to scale Bitcoin without compromising its core principles. Traditional blockchains choke on high-throughput workloads because every node must re-execute every transaction, a recipe for traffic jams as adoption grows.

ZK rollups change this dynamic by compressing thousands of transactions into a single succinct proof that anyone can check, no need to replay all the raw data. But verifying these proofs is computationally expensive (and therefore costly), especially on legacy chains like Ethereum or Bitcoin mainnet.

This is where zkVerify steps in as a game-changer:

- Dramatic Cost Reductions: By offloading verification from primary blockchains to zkVerify’s purpose-built layer, projects can slash operational expenses, potentially saving tens of millions per year.

- Scalability Unleashed: With over a million proofs processed already (and 5.5 million during incentivized testnets), zkVerify has demonstrated it can handle real-world ZK workloads at scale.

- Ecosystem Agnostic: Support for multiple SNARK schemes means developers aren’t locked into one protocol, they get flexibility plus performance.

The Ripple Effect Across Layer-2s and Beyond

The implications go beyond cost savings or technical benchmarks, this milestone marks a shift in what’s possible for BTC scaling solutions like BitcoinOS’ historic ZK proof on mainnet. By making verification efficient and affordable, zkVerify enables new types of Bitcoin L2s that don’t require trust in centralized sequencers or custodianship models.

This isn’t theoretical anymore, the numbers prove it works at scale. And with current market optimism (BTC holding strong at $122,283.00), there’s real momentum behind deploying new rollup architectures that leverage zero-knowledge cryptography without breaking the bank.

Bitcoin (BTC) Price Prediction Table (2026-2031)

Forecast incorporates zkVerify’s ZK scaling milestone, current BTC market data, and evolving Bitcoin rollup ecosystem.

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | YoY % Change (Avg) | Market Scenario Insight |

|---|---|---|---|---|---|

| 2026 | $103,500 | $135,000 | $158,000 | +10.4% | Potential post-halving consolidation; ZK rollup adoption accelerates, but macro uncertainty remains. |

| 2027 | $115,000 | $153,000 | $187,000 | +13.3% | Gradual institutional adoption of Bitcoin L2s; regulatory clarity improves. ZK scaling brings more DeFi to BTC. |

| 2028 | $132,000 | $177,000 | $220,000 | +15.7% | Broader mainstream acceptance; ZK technology matures, driving L2 ecosystem growth. |

| 2029 | $150,000 | $202,000 | $255,000 | +14.1% | Cycle peak potential; ZK rollups and privacy features become standard on Bitcoin L2s. |

| 2030 | $170,000 | $230,000 | $295,000 | +13.9% | Sustained network effects and new applications; BTC as a settlement layer for global value transfer. |

| 2031 | $195,000 | $265,000 | $340,000 | +15.2% | Further scaling breakthroughs; Bitcoin ecosystem rivals traditional financial infrastructure. |

Price Prediction Summary

Bitcoin’s price outlook from 2026-2031 is robust, underpinned by the rapid maturation and adoption of ZK scaling solutions like zkVerify. While market cycles and regulatory factors may cause volatility, the integration of cost-effective ZK proof verification is expected to drive significant L2 innovation and broader use cases for Bitcoin, supporting a progressive price trajectory with both bullish and bearish scenarios considered.

Key Factors Affecting Bitcoin Price

- zkVerify’s milestone proves ZK scaling is viable for Bitcoin L2s, catalyzing adoption.

- Regulatory developments: Favorable global regulation can boost institutional interest, while harsh policies could limit upside.

- Market cycles: Post-halving effects and macroeconomic factors may cause volatility, but long-term trend remains positive.

- Technological progress: Continued improvements in ZK proof systems, interoperability, and privacy features support higher valuations.

- Competition: Advances in other L1s (Ethereum, Solana) and competing ZK solutions could impact BTC’s market share and upside.

- Adoption of Bitcoin L2s: The pace at which DeFi, NFTs, and new applications migrate to Bitcoin rollups will influence price trajectory.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Bottom Line: Infrastructure Is Destiny

If you’re building or investing in the future of blockchain scalability, especially around Bitcoin, you need to understand why modular layers like zkVerify are changing the rules of engagement. This isn’t just hype; it’s hard data meeting real-world demand.

As the dust settles on zkVerify’s 1 million proof milestone, it’s clear that the landscape for zero-knowledge scaling is changing at a blistering pace. The days of exorbitant verification fees and slow throughput are numbered. Instead, we’re entering an era where cost-effective, high-speed zk verification is the new standard, an absolute necessity for Bitcoin rollups and ambitious BTC scaling solutions.

What does this mean for developers and investors? For starters, the economic calculus around launching or migrating a Bitcoin rollup has shifted dramatically. Projects can now factor in 91% lower costs for proof verification thanks to zkVerify, which translates into more resources for protocol incentives, user rewards, and ecosystem growth. It’s not just about saving money; it’s about unlocking new business models that were previously unviable due to high operational overhead.

How zkVerify Sets the Stage for Next-Gen BTC Scaling

The beauty of zkVerify lies in its modularity. By acting as a universal plug-and-play verification layer, it allows any Bitcoin L2 or rollup protocol to scale without being handcuffed by the limitations of their base chain. This means:

Top BTC Rollup Protocols Embracing zkVerify & ZK Scaling

-

BitcoinOS: This modular Bitcoin Layer-2 protocol made headlines by verifying the first-ever ZK proof directly on the Bitcoin mainchain. BitcoinOS is actively exploring zkVerify integration to supercharge scalability and privacy for BTC rollups.

-

Botanix: As a leading EVM-compatible Bitcoin rollup, Botanix is leveraging zero-knowledge proofs to enhance transaction throughput and privacy. The project is working closely with zkVerify to streamline proof verification and reduce operational costs.

-

B² Network: This innovative Bitcoin Layer-2 solution is pioneering ZK rollup technology for BTC. B² Network is collaborating with zkVerify to optimize proof verification, aiming for faster and cheaper BTC rollup settlements.

-

Rollux: Built on Syscoin, Rollux is a prominent Bitcoin rollup protocol that integrates ZK scaling solutions. The team is actively exploring zkVerify to further cut verification costs and boost scalability for Bitcoin-based dApps.

-

zkChain: Focused on bringing ZK rollups to Bitcoin, zkChain is evaluating zkVerify’s universal proof verification layer to accelerate adoption and unlock new privacy features for BTC users.

Interoperability becomes real, projects can move proofs between different blockchains with minimal friction. Innovation accelerates, developers can experiment with new privacy-preserving applications or cross-chain liquidity solutions without worrying about cost blowouts. And most importantly, end-users benefit: faster settlement times, lower fees, and enhanced privacy on Bitcoin-backed assets like zkBTC.

The market is already responding. With BTC holding firm at $122,283.00, there’s a renewed appetite from both institutional players and crypto-native builders to deploy capital into scalable infrastructure plays. As zkVerify continues to rack up proof volume on mainnet, and as its $VFY token gains traction, expect even more projects to jump aboard.

If you’re not planning for modular ZK infrastructure in your Bitcoin scaling roadmap by now, you’re already behind.

Looking Ahead: What Comes After 1 Million?

The next wave is all about composability and network effects. As more protocols tap into zkVerify’s decentralized verification layer, we’ll see a flywheel effect kick in: greater usage drives better security guarantees (through more robust validator participation), which attracts even more projects seeking reliable ZK proof validation at scale.

This also sets the stage for advanced use cases like programmable privacy (think confidential DeFi on Bitcoin) and seamless cross-chain bridges powered by succinct proofs validated off-chain but settled trustlessly back onto L1s like Bitcoin.

Ready to Build? Join the ZK Revolution

If you’re a developer itching to push boundaries or an investor scouting the next inflection point in crypto infrastructure, now is your moment. Dive into zkVerify’s docs, join community testnets, or start building your own rollup leveraging this modular layer, the future of scalable Bitcoin isn’t waiting around.