Bitcoin is officially in uncharted territory, trading at $119,440.00 and smashing through previous all-time highs. But as the price climbs, so does the urgency to unlock real DeFi on Bitcoin, without bridges, without wrapped tokens, and without compromising on security. Enter zk-Rollups: the breakthrough technology that’s finally making trustless, scalable Bitcoin DeFi a reality.

Why Bitcoin Needs Native DeFi, and Why Bridges Are Broken

For years, anyone wanting to use their BTC in DeFi had to make a painful choice: bridge it to another chain or wrap it as an ERC-20 token like WBTC. But bridges are notorious for security risks, just ask anyone who’s lost funds in a cross-chain exploit. Wrapping BTC means trusting centralized custodians or federations, which flies in the face of Bitcoin’s ethos of self-sovereignty.

This bottleneck has left billions of dollars worth of BTC sitting idle while Ethereum and newer chains gobble up the DeFi spotlight. The market wants more than just price action above $119,440.00; it wants real financial utility for native BTC holders without trade-offs.

What Are zk-Rollups and How Do They Work on Bitcoin?

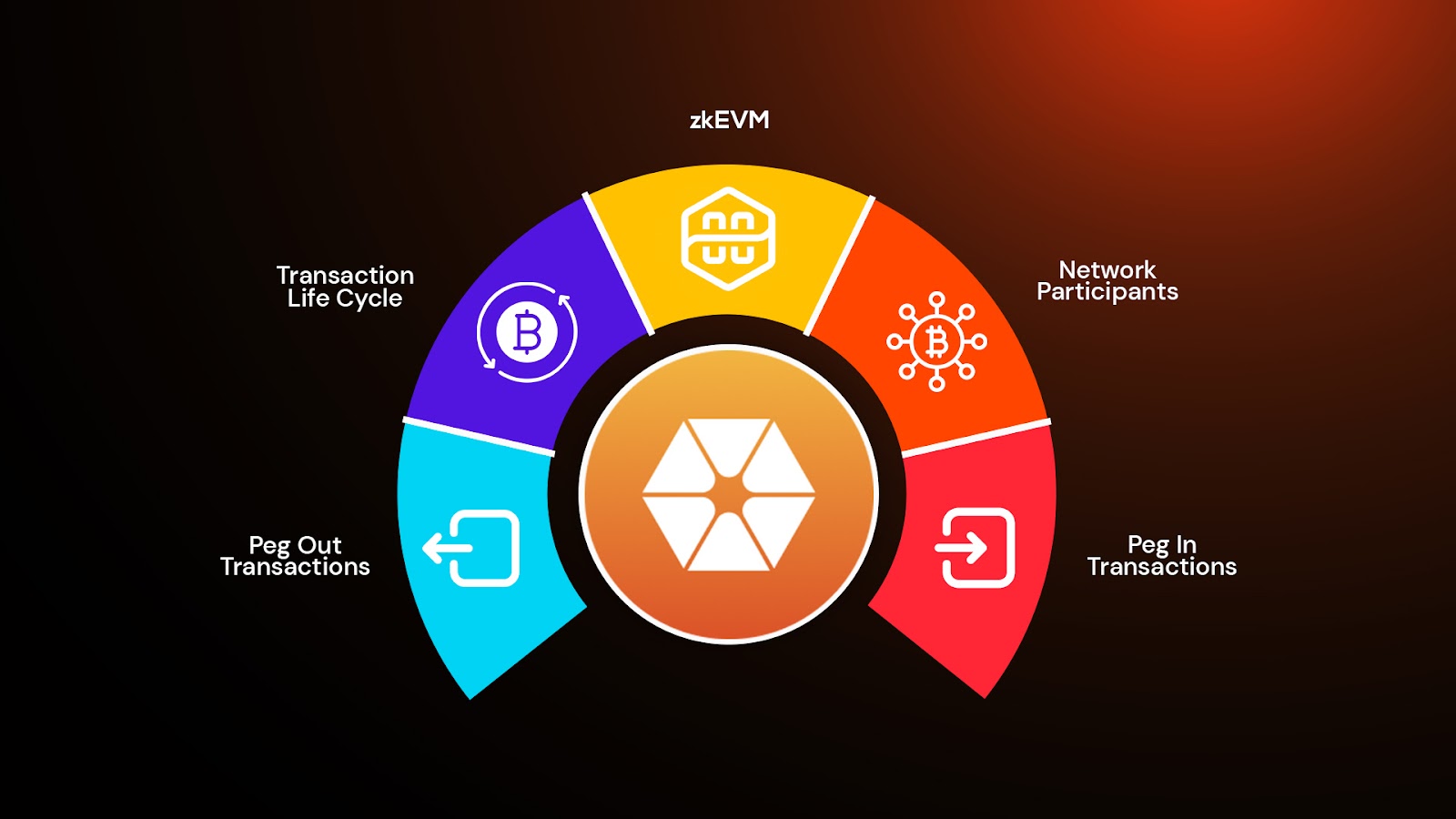

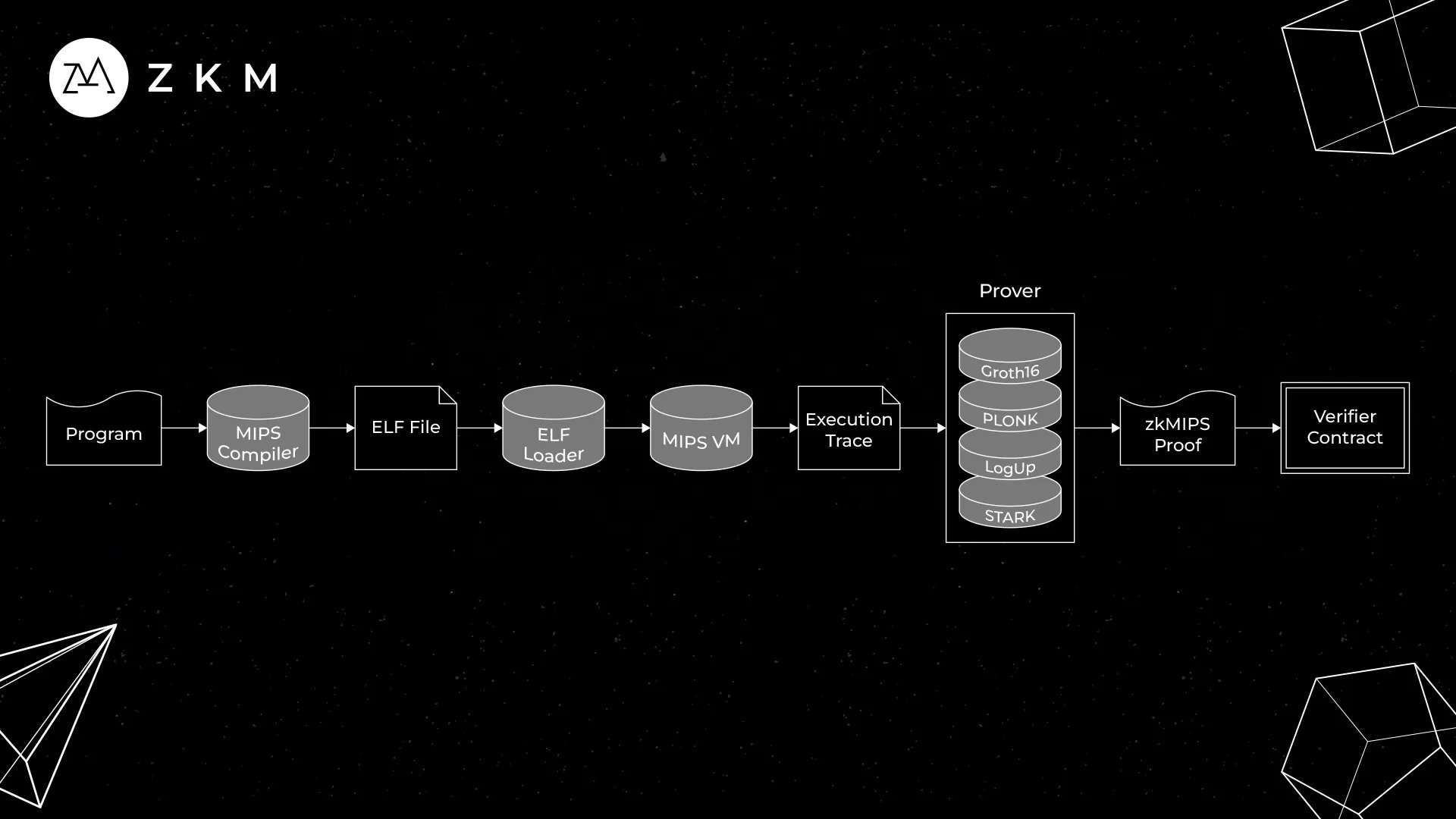

zk-Rollups, or zero-knowledge rollups, are a scaling solution that bundle hundreds (or thousands) of transactions together off-chain. They use cryptographic proofs, specifically zero-knowledge proofs, to validate all these transactions with a single succinct proof posted to Bitcoin’s main chain. It means you get massive throughput increases and lower fees while inheriting Bitcoin’s legendary security model.

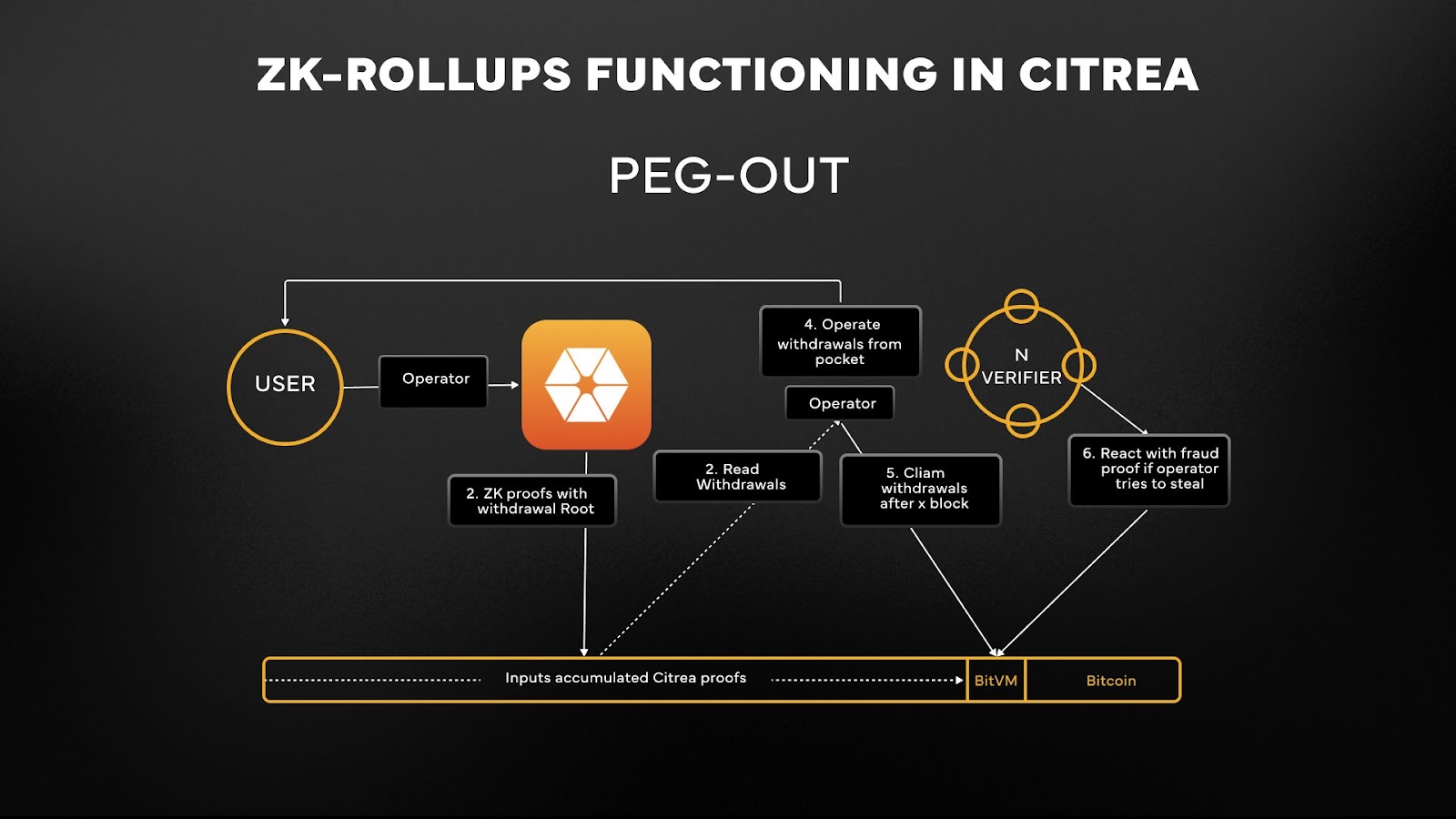

The magic? No bridges, no wrapping, just direct interaction with native BTC secured by math, not trust. This isn’t just theory anymore; projects like Citrea are leading the charge as the first-ever zk-Rollup built for Bitcoin blockspace (source). Citrea leverages zero-knowledge proofs anchored directly to Bitcoin, no custodians, no validators acting as gatekeepers.

Top 5 Benefits of zk-Rollups for BTC-Native DeFi

-

1. Eliminate Bridges and Wrapping: zk-Rollups like Citrea enable direct interaction with native Bitcoin, removing the need for risky bridges or wrapped BTC tokens. This drastically reduces attack surfaces and trust dependencies, letting users leverage true BTC in DeFi.

-

2. Enhanced Security and User Sovereignty: By anchoring zero-knowledge proofs directly to the Bitcoin blockchain, zk-Rollups maintain Bitcoin’s renowned security and censorship resistance. Platforms like Native use advanced cryptography to ensure users retain full control over their BTC, Runes, and Ordinals—without relying on custodians.

-

3. Scalable DeFi Without Compromising Decentralization: zk-Rollups dramatically increase transaction throughput while keeping fees low, all without sacrificing Bitcoin’s core principles. Solutions like dWallet Network and Avail enable smart contract functionality for native BTC with decentralized validation.

-

4. Seamless Multi-Chain Interoperability: Protocols such as Entangled Rollups leverage recursive zero-knowledge proofs to synchronize states across multiple blockchains. This eliminates liquidity fragmentation and simplifies cross-chain DeFi, all without bridges.

-

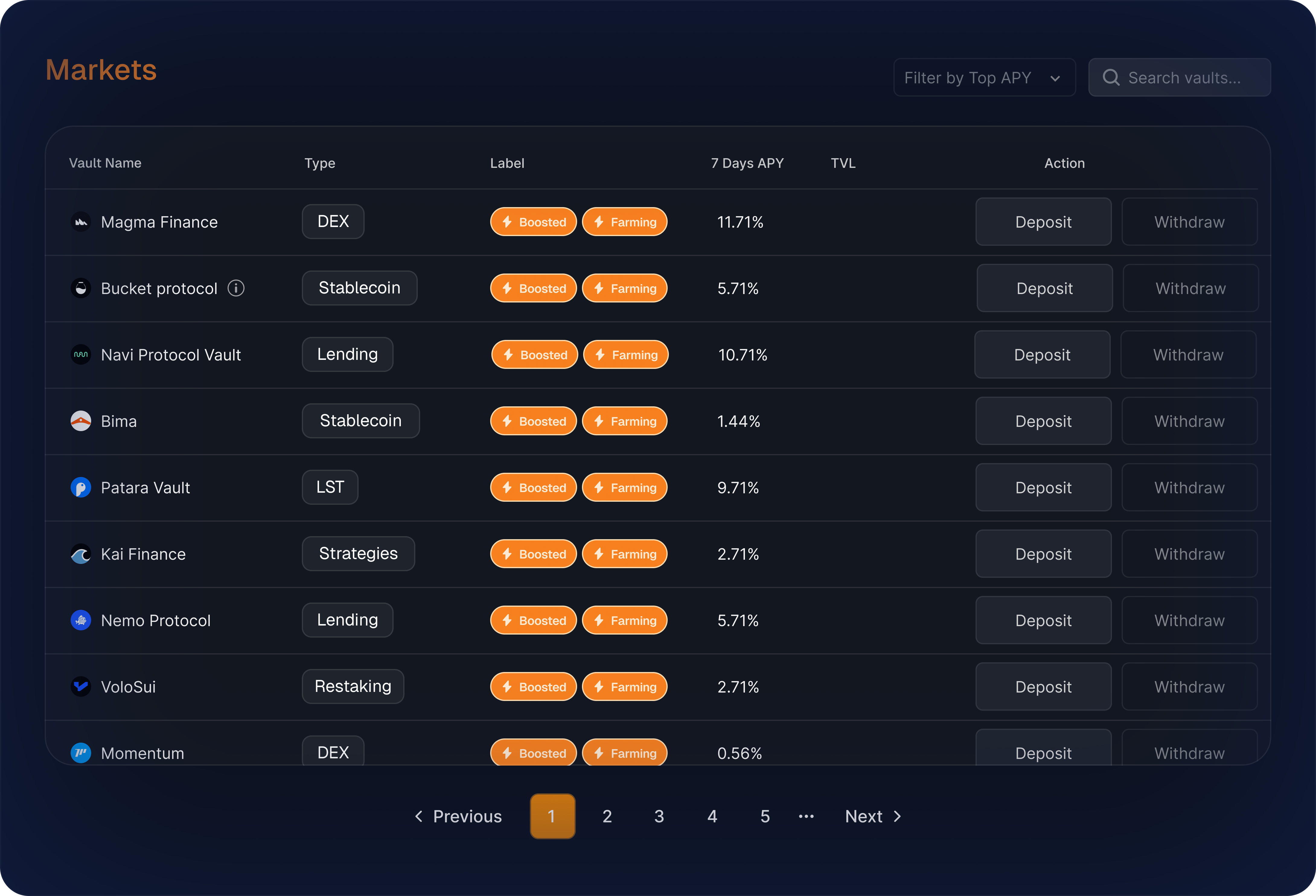

5. Unlocking New DeFi Use Cases for Bitcoin: With zk-Rollups, developers can build advanced DeFi products—like perpetual trading, stablecoins, and lending—directly on Bitcoin’s base layer. Citrea and BitScaler are pioneering frameworks making these use cases possible while keeping BTC at the center.

This approach is fundamentally different from federated sidechains or wrapped tokens because it preserves decentralization and removes trusted intermediaries from the equation. Instead of trusting a third party with your keys or coins, you trust cryptography and open-source protocols anchored to Bitcoin itself.

The New Wave: Citrea, BitScaler and Native Zero Trust Solutions

The innovation doesn’t stop at Citrea. The landscape is heating up fast:

- BitScaler: Dubbed “the holy grail” for building DeFi on Bitcoin (source), BitScaler enables perpetual trading and stablecoins using channel factories, all without leaving the safety of native BTC.

- dWallet x Avail: In April 2024, dWallet Network partnered with Avail so users can interact with smart contracts directly from their native BTC wallets, no bridges required (source). This uses multi-party computation (MPC) to create true smart contract functionality for real bitcoins, not synthetic assets.

- Native: The Zero Trust Application Platform is pushing boundaries by letting users control their BTC and other assets (like Ordinals) via advanced MPC cryptography, again eliminating custodians and bridge risk (source).

- Entangled Rollups: These rollups synchronize state across multiple chains with recursive zero-knowledge proofs, solving liquidity fragmentation without needing bridges at all (source).

If you’re not paying attention yet, you should be! These developments are setting up an entirely new paradigm where native BTC can flow freely into lending pools, DEXs, derivatives markets, and more, all while staying secured by Bitcoin’s own consensus layer.

Paving the Way for Trustless Financial Apps on $119,440.00 BTC

The implications here are massive: imagine building complex financial products atop your bitcoin at today’s price point of $119,440.00, knowing you never once relinquished custody or relied on some sketchy bridge protocol. That’s what zk-rollups are delivering right now, and it’s only getting started.

Let’s zoom in on why this matters. When you combine Bitcoin’s stratospheric price of $119,440.00 with the ability to engage in lending, yield farming, perpetuals, and stablecoin issuance, all without ever leaving the Bitcoin chain or trusting a bridge, you’re looking at a seismic shift in both utility and security. This is not just incremental progress; it’s a leap toward a future where BTC-native financial apps rival anything on Ethereum or Solana.

How zk-Rollups Are Reshaping BTCFi, Right Now

With projects like Citrea, BitScaler, and Native blazing trails, developers can finally build on Bitcoin with confidence. Here’s how zk-rollups are already reshaping the landscape:

- Liquidity Unlocked: No more fragmented pools or capital inefficiency. Entangled Rollups and zero-knowledge proofs synchronize assets across ecosystems without bridges.

- Programmability Without Compromise: dWallet x Avail unlocks smart contract logic for native BTC, think DeFi legos, but with real bitcoin as the building blocks.

- User Sovereignty: Advanced MPC cryptography lets you keep custody of your coins while interacting with complex protocols, no more “not your keys, not your coins” nightmares.

- Censorship Resistance: By anchoring proofs directly to Bitcoin, rollups inherit its legendary resistance to attack and manipulation.

- No More Bridge Hacks: With zk-rollups eliminating trusted intermediaries, those headline-grabbing multi-million dollar exploits are finally becoming relics of the past.

If you’re a developer or investor watching from the sidelines, now is the time to get involved. The primitives for trustless BTC-native DeFi are here, and they’re only getting stronger as more teams join the fray. The days of choosing between security and utility are ending; now you can have both.

What Comes Next: The Road Ahead for Bitcoin zk-Rollups

The momentum is undeniable. As zk-rollup frameworks mature and integrate with tools like BitScaler channel factories and Native’s Zero Trust platform, expect an explosion of new use cases: decentralized options markets for BTC at $119,440.00, permissionless lending against Ordinals or Runes, even fully on-chain DAOs governed by native bitcoin holders. And all of this happens without surrendering security or decentralization.

The next wave? Watch for composability between rollups (thanks to innovations like Entangled Rollups), seamless cross-chain swaps secured by math instead of multisigs, and mainstream DeFi UX that finally puts Bitcoiners front-and-center, without compromise.

The bottom line: if you believe in Bitcoin’s mission of censorship-resistant money that empowers individuals worldwide, then you should be watching what’s happening with zk-rollups right now. The rails for a truly open financial system built on native BTC are being laid at lightning speed, and those who adapt fastest stand to benefit most as this ecosystem explodes alongside Bitcoin’s record price action.