Bitcoin has officially entered a new era of scalability and decentralized finance, with GOAT Network leading the charge. As Bitcoin trades at $113,914.00, the demand for on-chain utility and native yield is at an all-time high. Yet, for years, unlocking real DeFi on Bitcoin felt out of reach due to technical limitations and slow-moving infrastructure. That’s changing fast thanks to the convergence of zk Rollups and the innovative BitVM2 protocol: two pillars behind GOAT Network’s rapidly growing Layer 2 ecosystem.

GOAT Network zk Rollup: Scaling Bitcoin Without Compromise

The core of GOAT Network’s breakthrough is its Bitcoin-native zk Rollup. This technology bundles hundreds or thousands of off-chain transactions into a single on-chain commitment, slashing fees and supercharging throughput, without sacrificing Bitcoin’s legendary security. Unlike other Layer 2s that rely on synthetic assets or centralized bridges, GOAT leverages zero-knowledge proofs to maintain trustless settlement directly on Bitcoin.

The secret sauce? The network’s proprietary zkMIPS virtual machine, which generates block proofs in just 2.6 seconds and SNARK proofs in about 10.38 seconds (source). This means near-instant finality for users and developers, an essential ingredient for responsive DeFi apps and seamless user experiences.

BitVM2: Fast Dispute Resolution Meets Turing-Complete Smart Contracts

The second pillar is BitVM2, a protocol designed to bring Turing-complete smart contract execution to Bitcoin rollups while solving one of the toughest problems in Layer 2 security: dispute resolution speed. Traditionally, fraud-proof-based rollups required a challenge window as long as 14 days. BitVM2 slashes this period to under one day using a multi-round challenger selection process (source). The result? Faster transaction finality, improved composability for DeFi, and a more dynamic environment for building next-gen protocols directly atop Bitcoin.

This architecture doesn’t just improve user experience, it’s foundational for enabling secure BTC staking yield and unlocking true programmable money on Bitcoin without relying on wrapped tokens or custodial solutions.

Native BTC Yield: Sustainable Staking Without Leaving the Chain

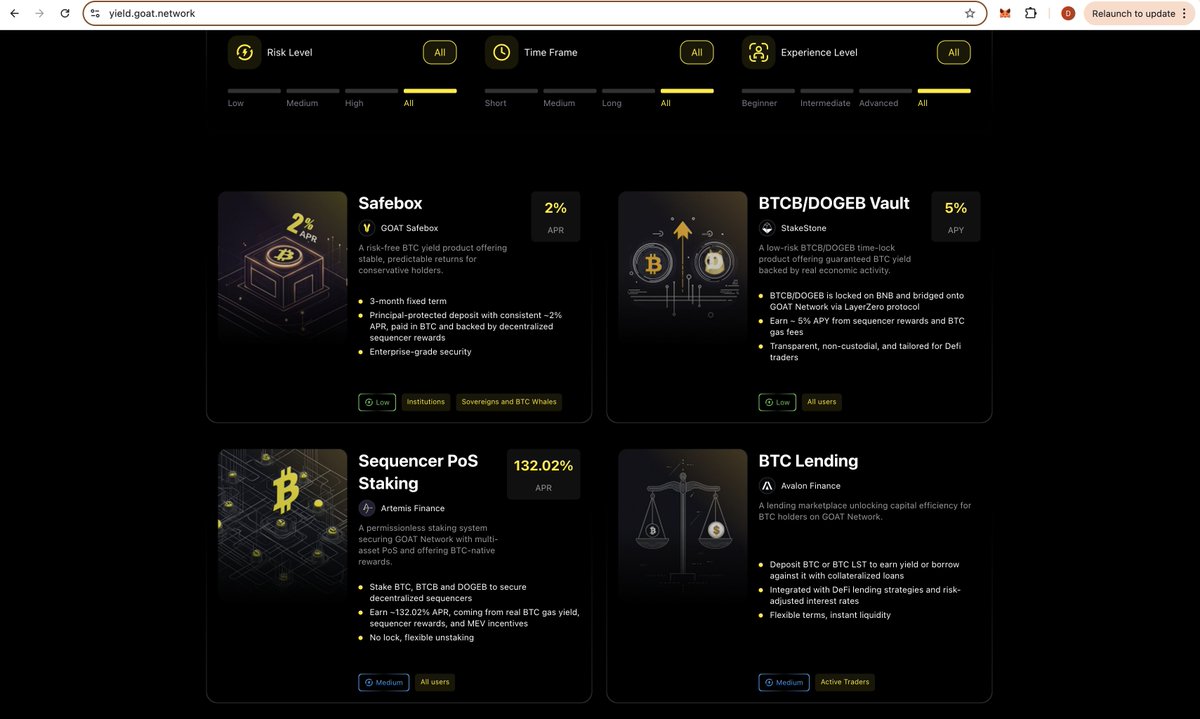

The holy grail for many Bitcoiners has been earning real yield without leaving the safety of native BTC or trusting third parties. GOAT Network delivers this through its decentralized sequencer model: users can stake their BTC in sequencer nodes that process rollup transactions, earning a share of gas fees paid in actual Bitcoin, not IOUs or synthetic representations.

This model not only incentivizes network participation but also aligns economic security with decentralization goals. More transactions mean more fees distributed to stakers, which in turn strengthens the entire Layer 2 ecosystem and drives healthy fee markets back to the base chain. As activity grows on GOAT Network, so does the potential yield for participants, all while holding real BTC at all times (source).

Bitcoin (BTC) Price Prediction 2026-2031: Impact of zk Rollups and DeFi Yield on BTC Value

Professional outlook based on GOAT Network’s Layer2 innovations, market cycles, and adoption trends. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $89,000 | $125,000 | $158,000 | +10% | Post-halving consolidation; DeFi adoption gains traction |

| 2027 | $102,000 | $139,000 | $184,000 | +11% | Bullish momentum; Layer2 and native yield adoption accelerates |

| 2028 | $116,000 | $156,000 | $211,000 | +12% | Broader institutional entry; regulatory clarity expands market |

| 2029 | $135,000 | $176,000 | $243,000 | +13% | Next halving year; Layer2 DeFi reaches maturity |

| 2030 | $151,000 | $202,000 | $278,000 | +15% | Mainstream integration of Bitcoin DeFi; competition intensifies |

| 2031 | $170,000 | $232,000 | $320,000 | +14% | Sustained adoption; Bitcoin as digital yield-bearing asset |

Price Prediction Summary

Bitcoin is projected to maintain a strong uptrend through 2031, driven by the maturation of Layer2 technologies like GOAT Network’s zk Rollups and BitVM2, which enable real DeFi use cases and native yield. While volatility and macroeconomic factors will cause year-to-year fluctuations, the outlook remains bullish, with average prices progressing from $125,000 in 2026 to $232,000 in 2031. The maximum price could reach as high as $320,000 in a sustained bullish scenario, while the minimums reflect potential drawdowns during bear phases or regulatory headwinds.

Key Factors Affecting Bitcoin Price

- Adoption and scalability of Bitcoin Layer2 solutions (GOAT Network, zk Rollups, BitVM2)

- Mainstream use of Bitcoin-native DeFi and yield products

- Market cycles, including halving events and macroeconomic trends

- Institutional investment and regulatory developments

- Competition from other Layer1s and Layer2s offering DeFi and yield

- Security, network upgrades, and user experience enhancements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Big Picture: Why This Matters Now

With $113,914.00 as today’s spot price, it’s clear that institutional capital and retail interest are converging around scalable solutions that preserve Bitcoin’s ethos while opening up new financial primitives like lending, trading, and automated market making, all denominated natively in BTC.

GOAT Network’s approach is resonating because it doesn’t force users into the trade-offs that have plagued previous Bitcoin scalability solutions. There’s no need to wrap BTC, trust a centralized bridge, or give up self-custody. Instead, the network’s zk Rollup and BitVM2 stack bring high-throughput, low-fee settlement while keeping all assets and proofs anchored to Bitcoin’s main chain. This architecture lays a foundation for true Bitcoin DeFi, where composability, permissionless innovation, and sustainable yield become possible without leaving the world’s most secure blockchain.

Developers now have the tools to build Turing-complete smart contracts directly on Bitcoin Layer 2, unlocking everything from lending protocols to automated market makers, all denominated in native BTC. The shortened dispute window via BitVM2 means dApps can offer fast withdrawals and composable interactions without exposing users to long delays or liveness risks. For users, this translates into a seamless DeFi experience that feels as responsive as Ethereum or Solana but with the unmatched security of Bitcoin.

Key Advantages of GOAT Network zk Rollup and BitVM2

Key Benefits of GOAT Network zk Rollup and BitVM2 for Bitcoin DeFi Users

-

Scalable Bitcoin Transactions: GOAT Network’s zk Rollups aggregate multiple off-chain transactions into a single on-chain transaction, significantly increasing throughput and reducing transaction fees for Bitcoin users.

-

Enhanced Security with Native Bitcoin Layer 2: By leveraging BitVM2 and zkMIPS, GOAT Network inherits Bitcoin’s native security while enabling advanced DeFi features on a secure Layer 2 environment.

-

Faster Transaction Finality: BitVM2’s multi-round challenger mechanism reduces the challenge period from 14 days to under one day, allowing for quicker dispute resolution and more responsive DeFi applications.

-

True Native Bitcoin Yield: Users can earn yield directly in Bitcoin by staking BTC into decentralized sequencer nodes, receiving a share of gas fees without relying on synthetic assets or centralized intermediaries.

-

Decentralized Sequencer Infrastructure: GOAT Network’s decentralized sequencer nodes process rollup transactions, enhancing network resilience and reducing single points of failure in the DeFi ecosystem.

-

Real-Time Proof Generation: The zkMIPS virtual machine enables rapid proof generation (block proofs in ~2.6 seconds, SNARK proofs in ~10.38 seconds), supporting high-speed DeFi operations on Bitcoin.

It’s not just about speed or cost savings. By decentralizing sequencer roles and distributing gas fees directly in BTC, GOAT Network creates a virtuous cycle where increased usage boosts both yield opportunities for stakers and fee revenue for miners on the base chain. This model helps ensure that scaling doesn’t come at the expense of miner incentives, a critical consideration as Bitcoin transitions through future halving cycles.

The timing couldn’t be better: with BTC consistently holding above $100,000, demand for capital-efficient yield strategies is surging among both institutional players and everyday holders. GOAT Network’s natively-yielding rollup makes it possible to earn on idle BTC without ever leaving the comfort zone of mainnet security.

What Comes Next?

The race to build scalable, secure DeFi on Bitcoin is heating up, and GOAT Network is setting new standards for what’s possible. As more developers deploy dApps atop its infrastructure and more users seek out real BTC yield, we’ll likely see further innovation in Layer 2 design, privacy features (thanks to zero-knowledge proofs), and cross-chain interoperability.

If you’re a developer looking to build on Bitcoin or an investor searching for sustainable BTC-native returns in today’s market (with Bitcoin at $113,914.00), it’s worth watching how GOAT Network leverages zk Rollups and BitVM2 to shape the next chapter of decentralized finance.