With Bitcoin holding firm at $111,867.00, the conversation around its scalability and privacy is more urgent than ever. As transaction volumes swell and user expectations evolve, developers are turning to advanced cryptographic techniques to keep Bitcoin both efficient and private. Enter zkBTC rollups: a new breed of Layer-2 protocols harnessing zero-knowledge proofs to address two of Bitcoin’s most pressing challenges, scalability and privacy.

Why zkBTC Rollups Are Gaining Traction in 2025

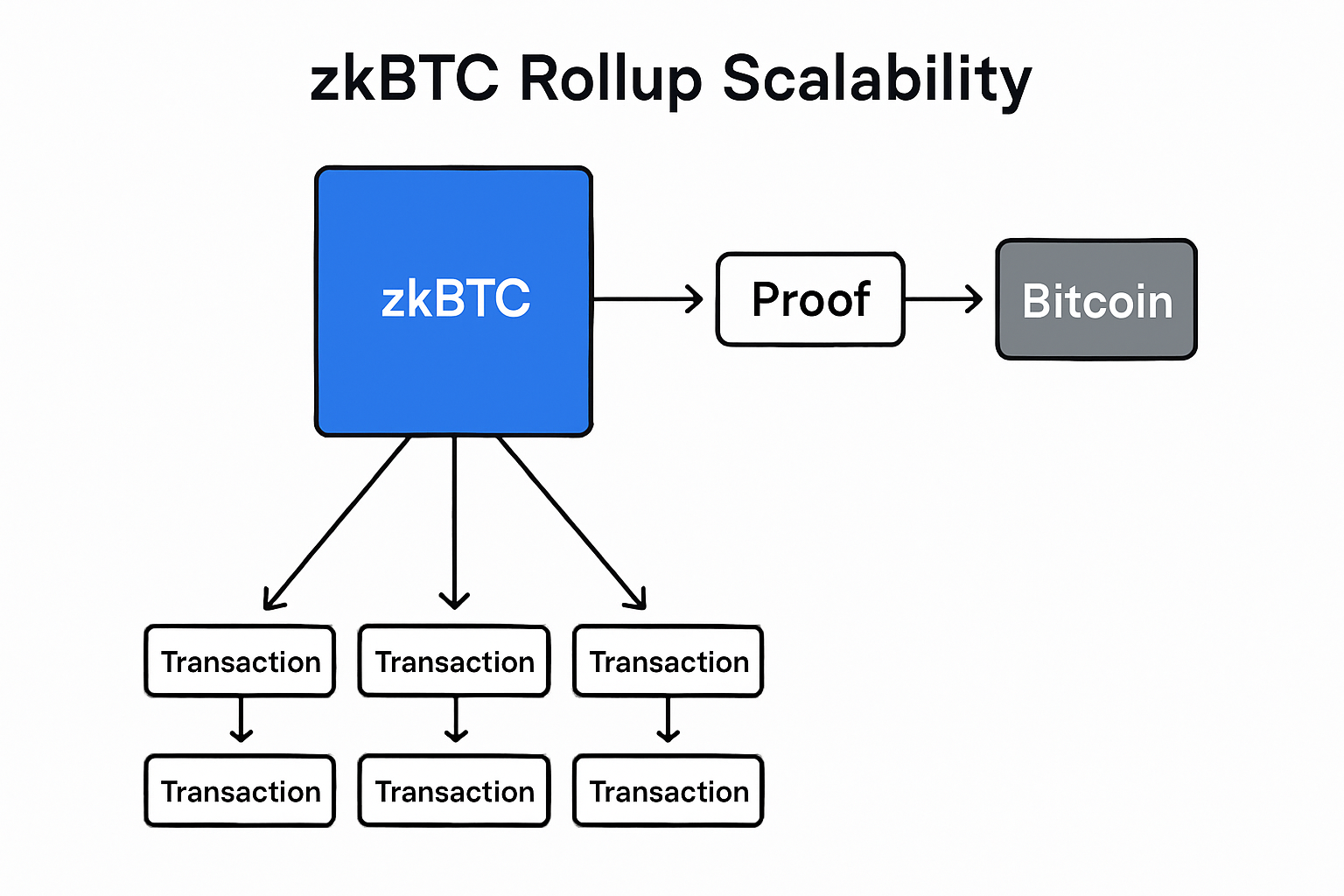

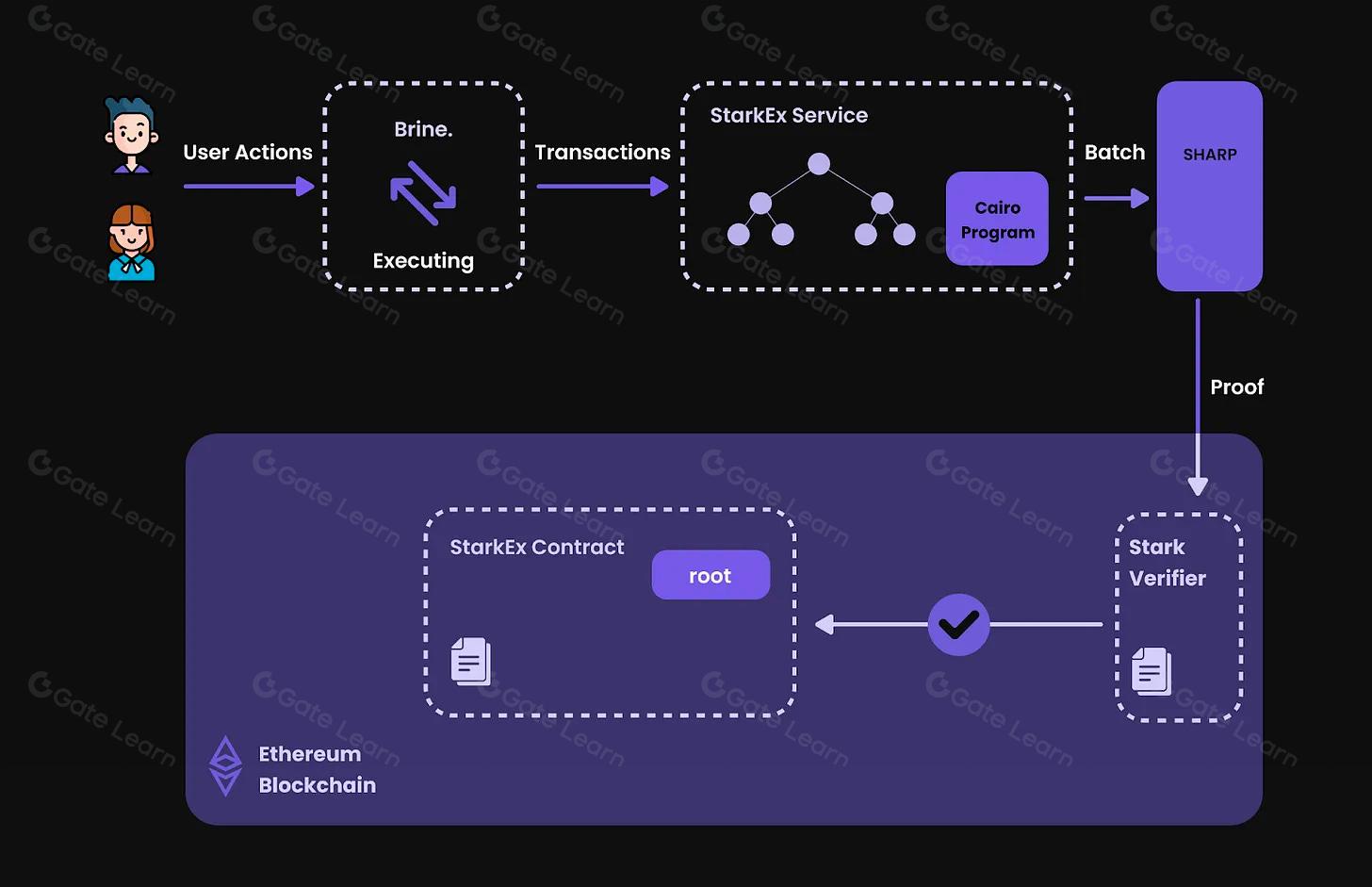

The rise of zkBTC rollups is no accident. Traditional on-chain scaling has hit practical limits, with fees and confirmation times fluctuating unpredictably as network demand spikes. Rollup technology sidesteps these bottlenecks by moving the heavy computational lifting off-chain. Instead of every transaction clogging up the main blockchain, rollups aggregate hundreds (or thousands) into a single batch, then anchor a compressed proof back to Bitcoin’s base layer.

The secret sauce? Zero-knowledge proofs. These cryptographic marvels allow validators to confirm that all batched transactions are legitimate, without revealing any sensitive details about the transactions themselves. This not only slashes data overhead but also unlocks new levels of privacy for Bitcoin users.

How Zero-Knowledge Proofs Power Scalable Bitcoin Protocols

Zero-knowledge proofs (ZKPs), especially in the form of succinct non-interactive arguments of knowledge (SNARKs), have revolutionized how blockchains can verify computation. For developers, this means that entire blocks of off-chain activity can be proven valid with just a few bytes posted on-chain. In practice, zkBTC rollups create a trustless environment where anyone can validate state transitions without needing access to granular transaction data.

This architecture not only reduces congestion but also shrinks fees, a crucial factor as Bitcoin’s price hovers above $111,000. Users benefit from faster settlements and lower costs while retaining cryptographic guarantees about their funds’ safety.

Key Benefits of zkBTC Rollups for Developers

-

Enhanced Scalability: zkBTC rollups process transactions off-chain and aggregate them into batches, significantly increasing Bitcoin’s transaction throughput and reducing network congestion.

-

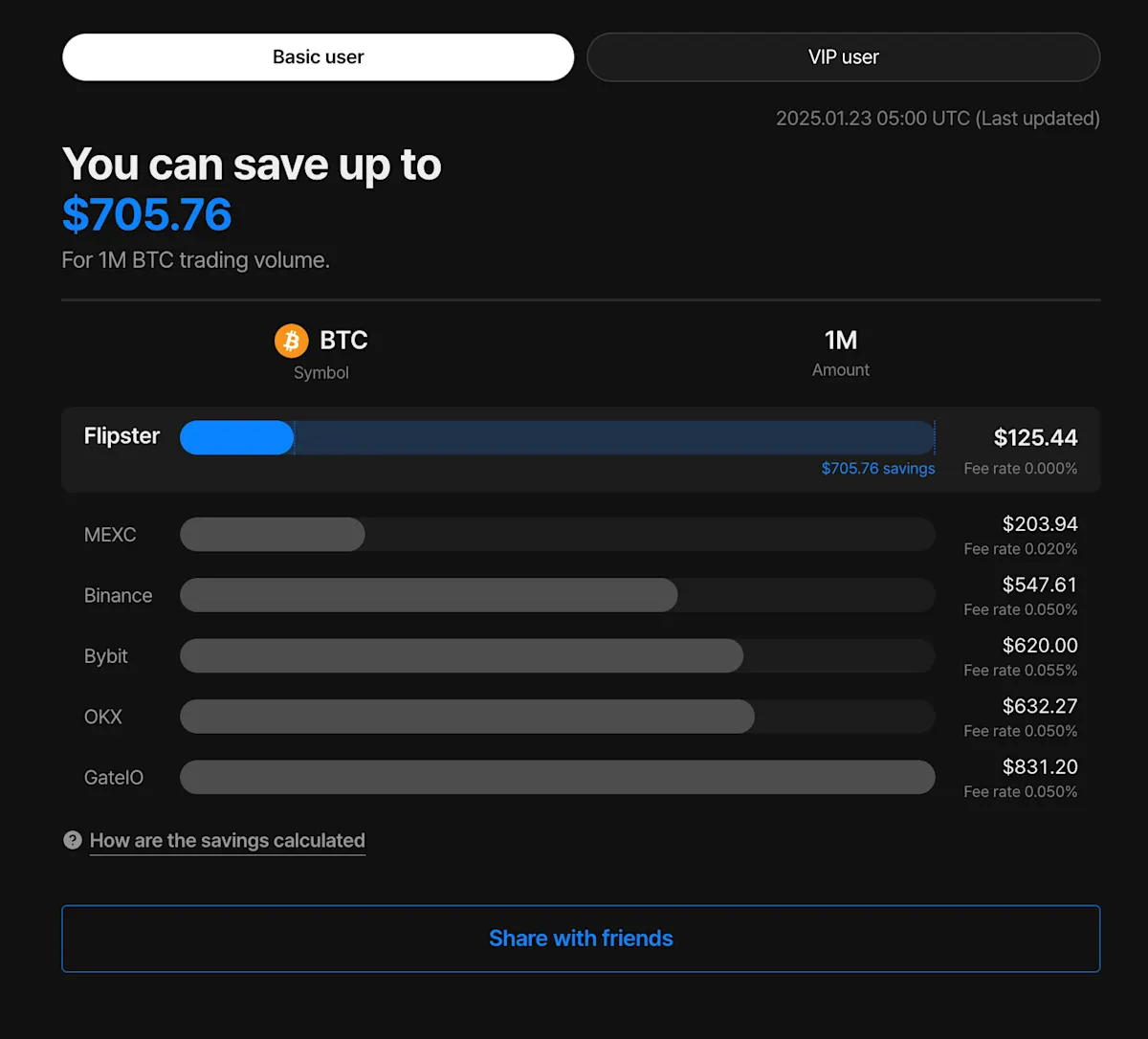

Lower Transaction Fees: By reducing the load on the main Bitcoin blockchain, zkBTC rollups enable lower transaction fees for users and developers, making Bitcoin-based applications more cost-effective.

-

Improved Privacy: Zero-knowledge proofs in zkBTC rollups ensure that transaction details remain confidential, providing enhanced privacy for developers and end-users without sacrificing security.

-

EVM Compatibility: zkBTC is EVM-compatible, allowing developers to leverage existing Ethereum tools, smart contracts, and development frameworks within the Bitcoin ecosystem.

-

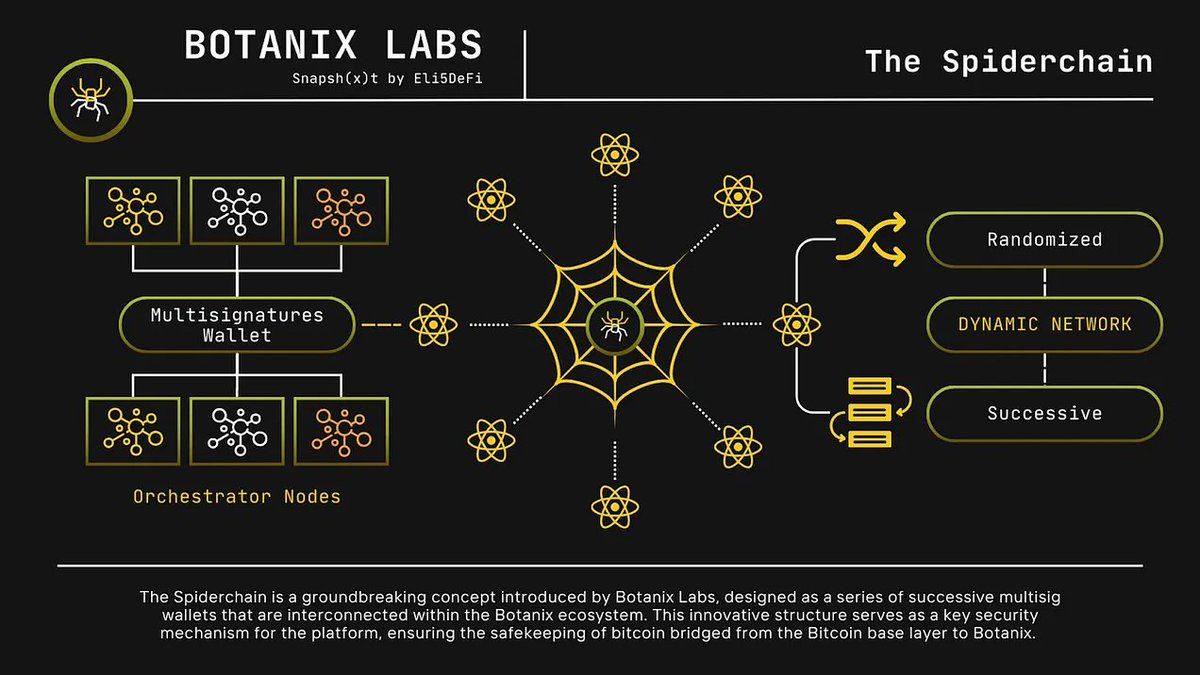

Trustless Interoperability: The zkBTC roadmap includes trustless bridges for native BTC, Ordinals, BRC-20, and Runes, enabling seamless cross-chain interactions and expanding development possibilities.

-

Support for Wrapped Bitcoin (wBTC): zkBTC integrates wBTC as a gas token, streamlining transaction payments and facilitating DeFi development on Bitcoin.

-

Developer Ecosystem Growth: By reducing barriers to entry and improving scalability, zkBTC rollups foster a robust ecosystem for building scalable, privacy-focused Bitcoin applications.

Current Landscape: zkBTC’s Roadmap and Developer Opportunities

The zkBTC project is at the forefront of these innovations. As an EVM-compatible Layer-2 solution, it aims to bridge wrapped Bitcoin (wBTC) with native BTC assets, enabling seamless DeFi integrations, Ordinals support, BRC-20 token transfers, and more. The development roadmap includes trustless bridges and ecosystem tools designed for both privacy-centric users and application builders seeking scalable rails for their projects.

For developers exploring Bitcoin rollup development, zkBTC offers APIs and SDKs tailored for rapid prototyping without sacrificing security or compliance standards. The ability to leverage zero-knowledge proofs within familiar EVM environments opens up new design space for wallets, DEXs, NFT platforms, and beyond.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Forecast based on current $111,867.00 BTC price, factoring in zkBTC rollup adoption, Layer-2 scaling, and evolving crypto market dynamics.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg) |

|---|---|---|---|---|

| 2026 | $89,000 | $120,000 | $145,000 | +7.3% |

| 2027 | $102,000 | $138,000 | $175,000 | +15.0% |

| 2028 | $116,000 | $158,000 | $210,000 | +14.5% |

| 2029 | $135,000 | $185,000 | $260,000 | +17.1% |

| 2030 | $155,000 | $210,000 | $315,000 | +13.5% |

| 2031 | $170,000 | $235,000 | $375,000 | +11.9% |

Price Prediction Summary

Bitcoin is expected to experience steady growth over the next six years, driven by the adoption of zkBTC rollups and broader Layer-2 scaling solutions that enhance both privacy and transaction throughput. While market volatility and regulatory factors may introduce fluctuations, the base case points to a healthy uptrend, with average prices more than doubling by 2031. Bullish scenarios could see BTC approach or even surpass $350,000 if adoption accelerates and institutional interest remains strong. Bearish scenarios, reflected in the minimum price column, account for potential macroeconomic headwinds or regulatory crackdowns, but even in these cases, Bitcoin is expected to maintain significant value above current levels.

Key Factors Affecting Bitcoin Price

- Adoption and integration of zkBTC rollups and other Layer-2 scaling solutions, driving transaction volume and utility.

- Increased institutional adoption and entry of new investment products (e.g., ETFs, Bitcoin-backed assets).

- Regulatory clarity and potential for favorable frameworks in major markets (US, EU, APAC).

- Continued development of Bitcoin DeFi, Ordinals, BRC-20, and cross-chain interoperability via trustless bridges.

- Macro-economic conditions including inflation, global liquidity, and fiat currency stability.

- Potential for major technological upgrades (e.g., Taproot expansion, privacy enhancements).

- Market cycles, including the impact of Bitcoin halving events and overall crypto sentiment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Delicate Balance: Privacy vs Transparency in Layer-2 Scaling

A core challenge in scaling public blockchains is maintaining transparency without compromising user confidentiality. ZK-rollups strike this balance elegantly, transaction validity is mathematically assured while individual transaction details remain shielded from prying eyes. This duality positions zkBTC as a critical tool for both institutional adoption (where compliance matters) and grassroots users seeking financial sovereignty.

Developers are increasingly aware that while Bitcoin’s public ledger is foundational for trust, it can also be a double-edged sword for privacy. Zero-knowledge proofs allow for a system where users can prove ownership, transfer, and settlement without exposing addresses, amounts, or counterparties. For high-value traders, enterprises, and privacy-conscious individuals alike, this means sensitive activity stays confidential even as the network itself remains auditable and secure.

Moreover, zkBTC rollups are designed to be composable. This means projects can layer additional features, like programmable privacy rules or selective data disclosure, on top of the base protocol. Such flexibility is crucial for developers building next-generation wallets or decentralized applications (dApps) that must navigate regulatory gray zones while still delivering user-centric privacy.

Developer Workflow: Integrating zkBTC Rollups

Getting started with zkBTC rollups isn’t as daunting as it might seem. The ecosystem is rapidly maturing with open-source libraries, robust documentation, and active community support. Here’s a streamlined workflow developers can follow:

- Choose your integration layer: Decide whether you’re building directly on the EVM-compatible zkBTC network or leveraging its APIs from an existing Bitcoin application.

- Utilize SDKs and toolkits: Access developer tools provided by zkBTC to handle batching, proof generation, and state synchronization.

- Implement privacy features: Use zero-knowledge proof primitives to shield transaction data according to your app’s requirements.

- Test in sandbox environments: Deploy smart contracts and run test transactions using wrapped BTC (wBTC) before moving to mainnet.

This modular approach ensures rapid prototyping while keeping security top-of-mind, a necessity given Bitcoin’s current price at $111,867.00, where even minor vulnerabilities could have outsized financial impact.

What’s Next for Bitcoin Privacy Scaling?

The future of Bitcoin scalability looks increasingly intertwined with zero-knowledge technology. As zkBTC advances toward integrating trustless bridges for native BTC assets and supporting protocols like Ordinals and BRC-20s, the possibilities widen for both DeFi innovation and mainstream adoption.

The market’s appetite for scalable Bitcoin protocols is only intensifying as the network secures trillions in value above the $100,000 threshold. Developers who master zkBTC rollup integration today are positioning themselves at the forefront of tomorrow’s financial infrastructure, where speed, privacy, and cross-chain composability aren’t trade-offs but expectations.

If you’re ready to push the boundaries of what’s possible on Bitcoin, and deliver true privacy at scale, the time to start experimenting with zero-knowledge rollups is now.