Bitcoin is trading at $109,641.00, and the network’s next growth phase is unfolding on Layer 2. GOAT Rollup, powered by ZKM, is at the epicenter of this shift. Their mission: scale Bitcoin with a zero-knowledge rollup that’s not just secure but delivers real BTC yield to users, node operators, and the broader DeFi ecosystem. This isn’t a recycled Ethereum playbook – it’s a ground-up rethink for native Bitcoin scaling.

GOAT Rollup: The First True Bitcoin-Native zkRollup

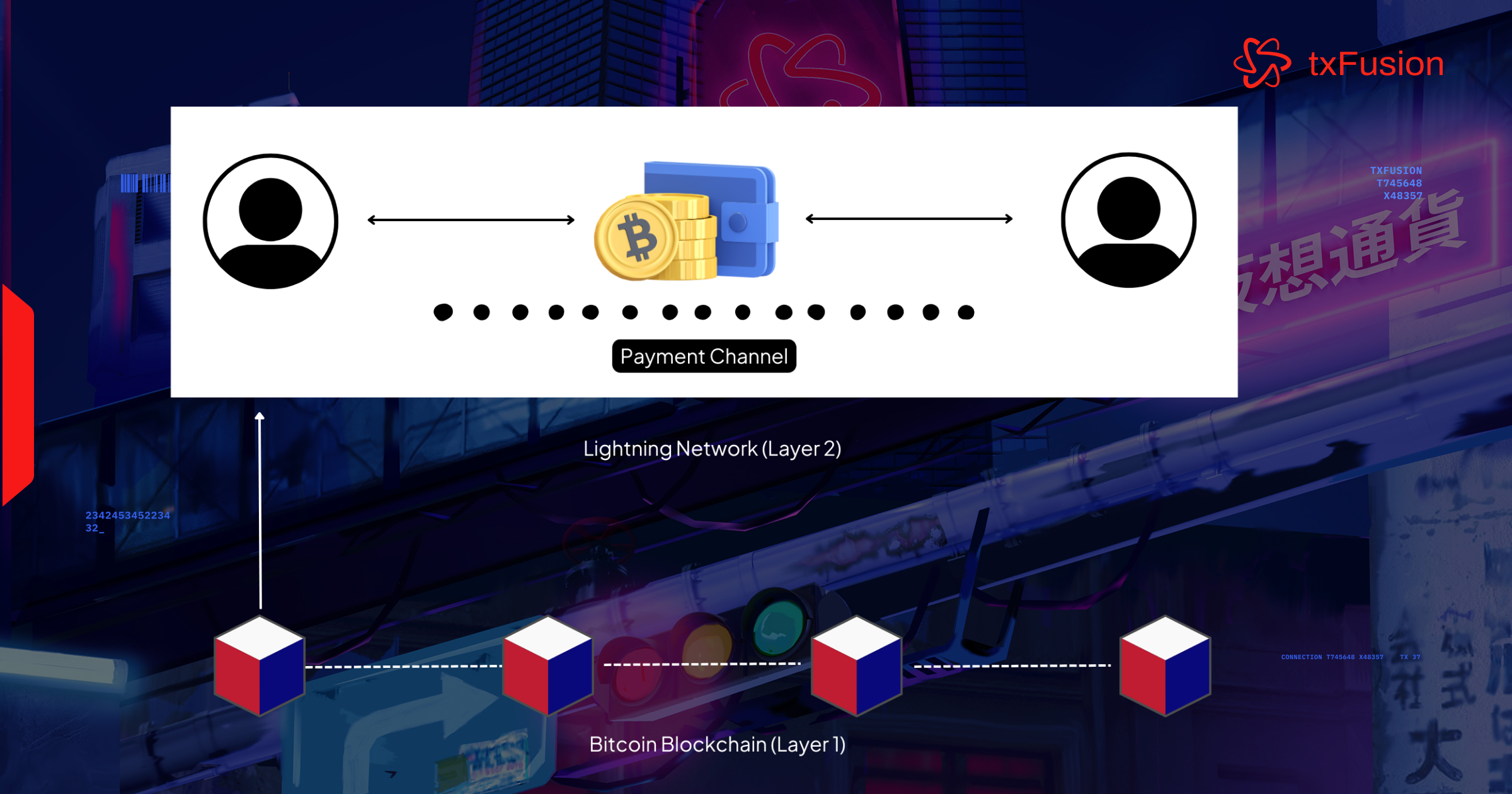

Let’s cut through the noise. Most so-called Bitcoin L2s either rely on federated multisigs or wrap BTC onto EVM chains, introducing trust assumptions and diluting Bitcoin’s security guarantees. GOAT Network, developed by ZKM, is different:

- Zero-knowledge proofs (ZKPs) enable off-chain transaction bundling with cryptographic validity posted to Bitcoin mainnet.

- No custodial bridges. Withdrawals are enforced by real-time proofs, not permissioned committees.

- Transaction fees paid in actual BTC, not synthetic assets or wrapped tokens.

This architecture means GOAT Rollup inherits the security of Bitcoin itself while unlocking new throughput and use cases that have long eluded the base layer. For developers and investors chasing sustainable yield and composability without compromise, this is seismic.

ZKM Technology: Real-Time Proofs and Decentralized Sequencers

The July 31 BitVM2 Beta testnet launch was a landmark moment for GOAT Network. Using ZKM’s proprietary zkVM (Ziren), GOAT achieved something no other Bitcoin rollup has managed: real-time proof generation in production. Here’s why it matters:

- Pipelined parallel proof architecture: Block proofs in ~2.6 seconds; aggregation in ~2.7 seconds; Groth16 SNARKs in ~10.38 seconds (source)

- No more week-long withdrawal delays. Users can exit as soon as their proof posts to mainnet – a game-changer for capital efficiency.

- Distributed GPU-powered prover network: Ensures liveness and censorship resistance while keeping costs down for end users.

The decentralized sequencer model is another innovation worth spotlighting. Unlike centralized operators or closed validator sets, GOAT lets any node operator participate in sequencing blocks – earning both transaction fees (in BTC) and mining rewards in $GOATED tokens as compensation for honest work securing the network (details here). This approach aligns incentives across all stakeholders while decentralizing power from day one.

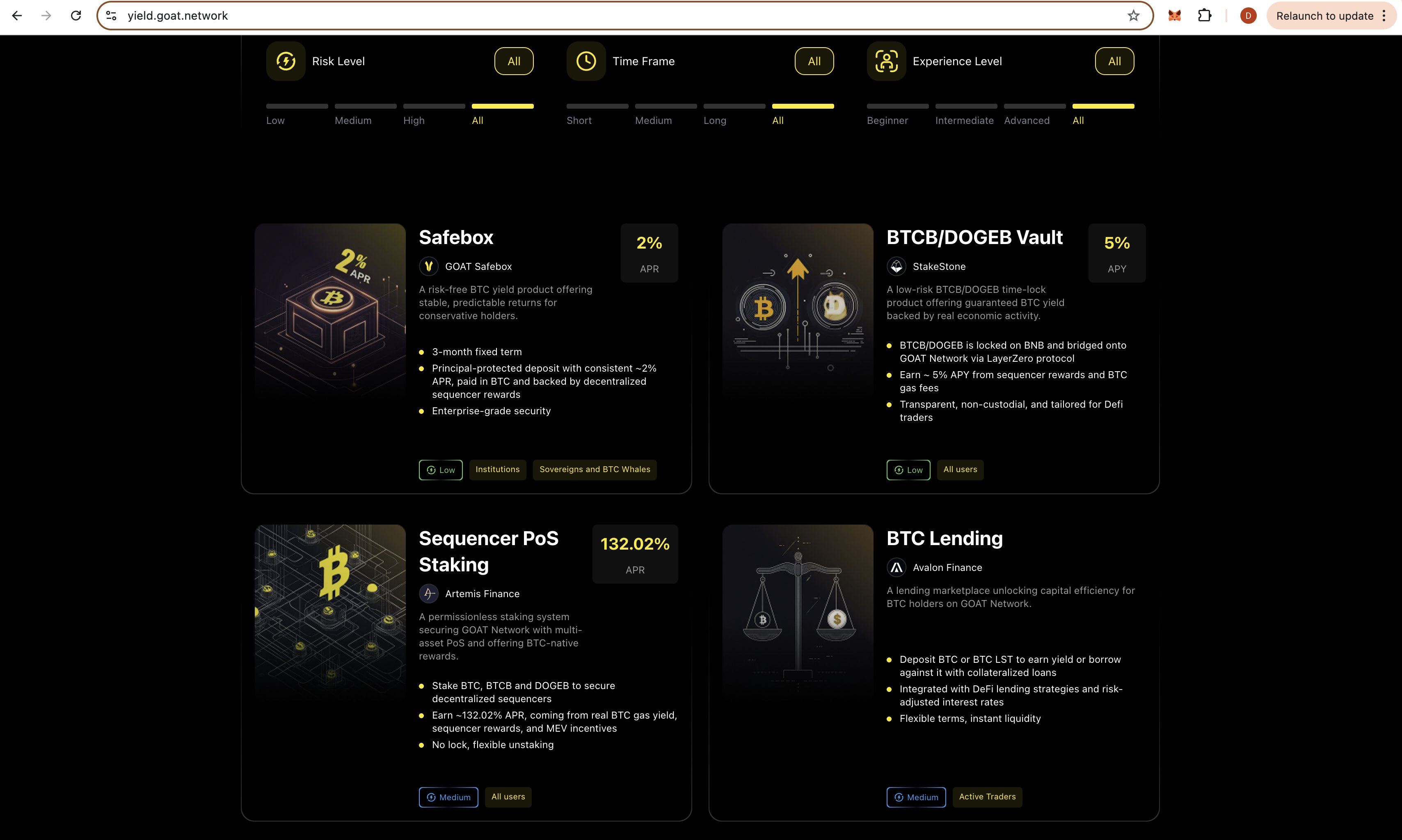

Sustainable BTC Yield: Unlocking Native DeFi With Real Fees

The real alpha? GOAT Network delivers actual BTC yield – not IOUs or speculative tokens – by sharing transaction fees directly with stakers and node operators. Here’s how it works:

- Bare-metal BTC staking: Lock your coins natively to earn yBTC receipt tokens usable across the ecosystem.

- Bread-and-butter DeFi primitives: Staking, lending, perpetuals – all denominated in real BTC with yields sourced from shared fees and MEV opportunities (more here).

- No synthetic bridges or rehypothecation risks: Withdrawals are fully trustless thanks to ZK-powered proofs anchored on mainnet.

This model isn’t just theory; it’s backed by hard numbers. As of September 27, five institutional node operators have committed a combined 5,000 BTC, providing deep liquidity for protocol-native yield strategies as $GOATED launches on Binance Alpha.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on current market conditions, technological advancements (GOAT Network, ZKM), and evolving BTCFi landscape.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $90,000 | $120,000 | $145,000 | +9.5% | BTCFi adoption accelerates, but macro volatility persists. GOAT Network gains traction, supporting BTC yield narrative. |

| 2027 | $105,000 | $137,000 | $170,000 | +14.2% | Wider integration of ZK rollups and L2s. Regulatory clarity boosts institutional participation. BTCFi TVL rises. |

| 2028 | $120,000 | $158,000 | $200,000 | +15.3% | Next Bitcoin halving and maturing BTCFi. Increased DeFi activity on GOAT/other L2s. Potential ETF inflows. |

| 2029 | $135,000 | $182,000 | $235,000 | +15.2% | Sustained BTCFi growth, new use cases (e.g., lending, perpetuals). Global adoption rises, but some regulatory headwinds. |

| 2030 | $145,000 | $210,000 | $275,000 | +15.4% | Bitcoin seen as digital reserve. L2s like GOAT reach mainstream. New BTCFi primitives add value and fees. |

| 2031 | $165,000 | $240,000 | $320,000 | +14.3% | BTCFi ecosystem matures. Real yield attracts traditional finance. Competition with other chains, but Bitcoin remains dominant. |

Price Prediction Summary

Bitcoin is projected to experience steady growth through 2031, driven by Layer 2 innovations like GOAT Network and ZKM, real BTC yield opportunities, and the maturation of BTCFi. While volatility and regulatory risks remain, the emergence of scalable, yield-generating protocols positions BTC for both capital appreciation and new utility. Average price forecasts suggest Bitcoin could reach $240,000 by 2031, with bullish scenarios targeting $320,000+ as BTCFi gains mainstream adoption.

Key Factors Affecting Bitcoin Price

- Adoption and success of Bitcoin-native zkRollups (e.g., GOAT Network, ZKM)

- Growth of BTCFi (Bitcoin DeFi) and sustainable BTC yield products

- Institutional participation and regulatory clarity

- Macro cycles (halvings, inflation, global liquidity)

- Competition from other Layer 1s and Layer 2s

- Security and composability of new L2 solutions

- Market sentiment and geopolitical events

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

GOAT Network’s BTCFi suite is already live for early adopters, with the Alpha mainnet demonstrating real-time ZK rollup performance. The composability unlocked by yBTC (the receipt token for staked BTC) means users can deploy capital across lending markets, perpetuals, and staking pools, without ever leaving the Bitcoin security envelope. This is a first in Bitcoin’s scaling journey: sustainable yield generated from actual protocol usage, not inflationary emissions or synthetic wrappers.

The implications are massive. With Bitcoin trading at $109,641.00, institutional players are taking notice. The initial 5,000 BTC commitment from node operators isn’t just a headline, it’s the liquidity foundation for a new era of trustless BTC-native DeFi. As more transactions flow through the rollup, fee revenue grows, directly boosting yields for stakers and sequencers while making Bitcoin’s own network healthier through increased base layer activity.

The Entangled Rollup Framework: How GOAT and ZKM Future-Proof Bitcoin Scaling

Behind the scenes, ZKM’s Entangled Rollup framework gives GOAT Network its edge. By leveraging BitVM2 and zkMIPS technologies, GOAT enables seamless interoperability between Bitcoin L1 and L2, without compromising on decentralization or trustlessness. This means:

- Trustless bridges: Withdrawals enforced by cryptographic proofs, not multisig signers.

- Composable smart contracts: Developers can build complex BTCFi applications with confidence in execution guarantees.

- Sustainable economics: Fee markets priced in native BTC keep incentives aligned with long-term network health.

The result? A robust foundation for next-gen financial primitives, from derivatives to automated market makers, all powered by real Bitcoin yield and zero-knowledge security.

Top 5 Benefits of Using GOAT Rollup and ZKM for Native BTCFi

-

1. Real BTC Yield Generation — GOAT Network enables users to earn sustainable yields directly in Bitcoin (BTC) by staking or providing liquidity, with transaction fees collected in BTC and distributed to node operators and participants. This native yield model is a first for Bitcoin Layer 2s, creating new earning opportunities for BTC holders.

-

2. Real-Time ZK Rollup Withdrawals — Leveraging ZKM’s Ziren zkVM and a distributed GPU prover network, GOAT supports real-time proof generation. Users can withdraw BTC almost instantly after proof creation, eliminating the long waiting periods typical of earlier rollup solutions.

-

3. Native Bitcoin Security — GOAT Rollup maintains Bitcoin’s core security by verifying zero-knowledge proofs directly on the Bitcoin mainchain. This ensures that all bundled transactions inherit the robust, battle-tested security of the Bitcoin network.

-

4. Decentralized Sequencer Model — GOAT’s decentralized sequencer architecture allows multiple node operators (with 5,000 BTC already committed by five institutions) to secure the network and earn both BTC and $GOATED tokens. This model increases network resilience and democratizes rewards.

-

5. Enhanced BTCFi Ecosystem & Deep Liquidity — With the launch of the $GOATED token on Binance Alpha and institutional backing, GOAT Network offers deep liquidity for DeFi applications like lending, staking, and perpetuals—all settled natively in BTC. This unlocks a new era of Bitcoin-based financial products.

What’s Next? The Roadmap to Mainnet Adoption

The upcoming expansion to seven node operators will further decentralize sequencing power while deepening liquidity pools for yBTC-based DeFi products. As $GOATED gains traction post-Binance Alpha launch, expect aggressive growth in both TVL (total value locked) and protocol usage metrics.

This isn’t just another L2 experiment, it’s a paradigm shift in how value accrues on Bitcoin. For developers looking to build on uncompromising security or investors seeking authentic yield at the heart of crypto’s largest asset, GOAT Network is setting the new standard.

The inflection point for true Bitcoin-native scaling is here, and it runs on zero-knowledge proofs, decentralized sequencers, and real BTC yield that finally puts users first.