Bitcoin’s relentless march toward mainstream adoption has brought an urgent need for scalability. With Bitcoin (BTC) currently trading at $112,392.00, network congestion and high transaction costs have become critical barriers to growth. Enter zkBTC rollups: a new breed of Layer-2 protocols leveraging zero-knowledge proofs to unlock fast, low-cost Bitcoin transactions while preserving the chain’s legendary security and decentralization.

Zero-Knowledge Proofs: The Engine Behind zkBTC Rollups

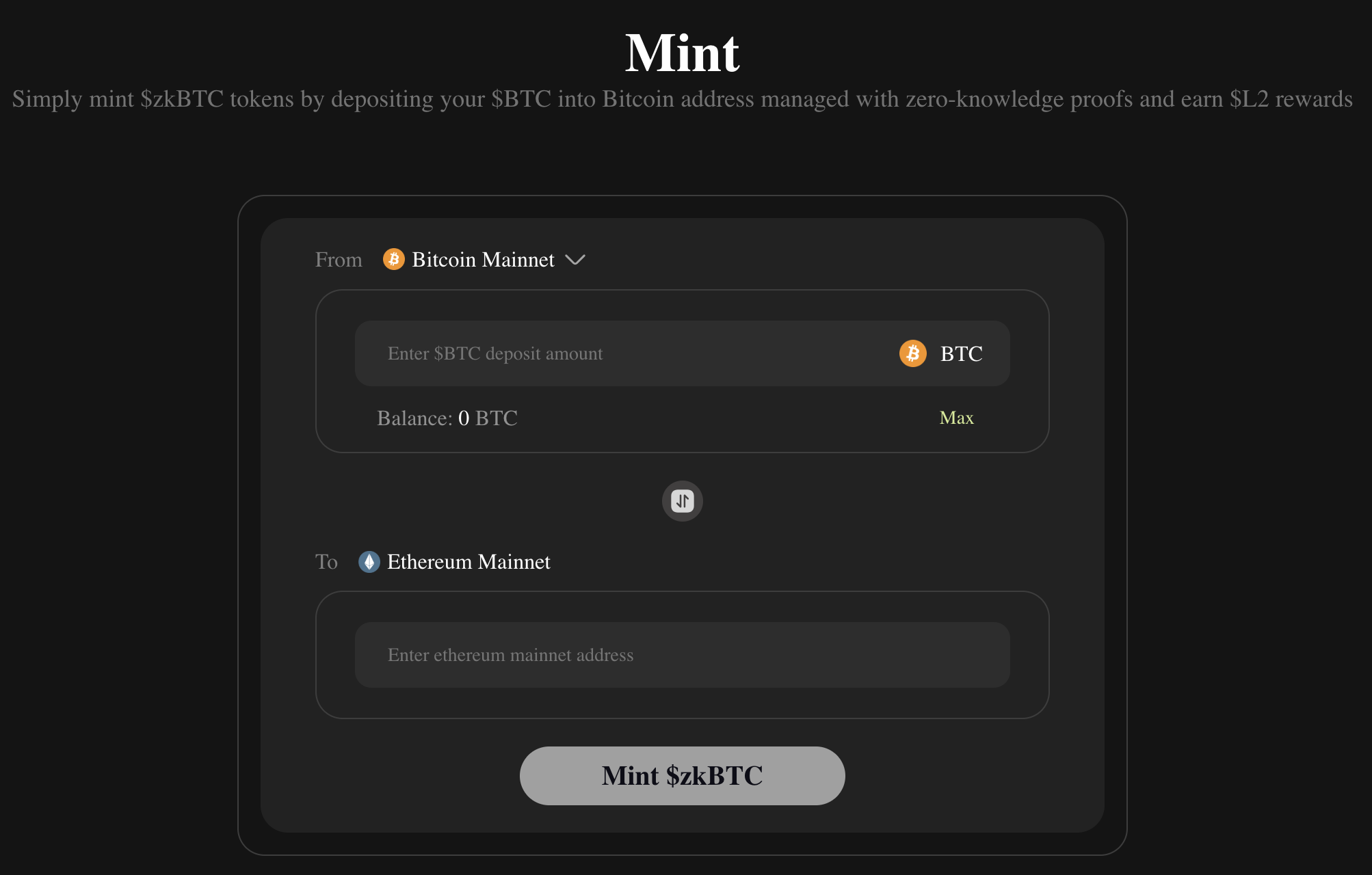

The technical heart of zkBTC rollups lies in zero-knowledge proofs (ZKPs). These cryptographic marvels allow one party to prove the validity of a statement without revealing any underlying data. In the context of Bitcoin scaling, ZKPs enable rollup protocols to process thousands of transactions off-chain, then submit a single succinct proof back to the main Bitcoin blockchain. This approach slashes both transaction costs and confirmation times, all while maintaining trustless security.

This technology isn’t just theoretical, Ethereum’s Layer-2 ecosystem has already demonstrated how ZK-rollups can reduce congestion and lower fees (ledger.com). Now, zkBTC is bringing these advances to Bitcoin, promising dramatic improvements in usability for developers, traders, and everyday users alike.

How zkBTC Rollups Transform Bitcoin Transactions

At their core, zkBTC rollups aggregate hundreds or even thousands of Bitcoin transactions off-chain, bundle them into a single batch, and generate a cryptographic proof attesting to their validity. Only this proof, and minimal associated data, gets posted on-chain. The result? Substantial throughput gains and a drastic reduction in per-transaction fees.

- Speed: By moving computation off-chain, rollups enable near-instant finality for most user transactions.

- Cost: Users pay only a fraction of traditional on-chain fees since costs are amortized across all bundled transactions.

- Security: Zero-knowledge proofs ensure that every state transition is valid under Bitcoin’s consensus rules, no trust required.

This model is especially powerful during periods of high demand when on-chain fees spike. For example, while legacy BTC transfers might cost $10 or more during congestion, zkBTC rollup users can expect sub-dollar transaction costs, even as network activity surges.

The zkBTC Roadmap: Building Scalable Infrastructure for $112,392 Bitcoin

The ambition behind zkBTC goes far beyond simple fee reduction. As outlined in the project’s roadmap (zkbtc.com/roadmap), development is unfolding in structured phases:

- Phase 0: Testnet launch and research partnerships with key infrastructure providers.

- Phase 1: Mainnet v1 debut with trustless Ethereum integration and wBTC as gas token via Polygon’s AggLayer.

- Phase 2: Mainnet v2 upgrades introduce native BTC bridges and innovative burning mechanisms like BEIP-1559 for sustainable fee management.

- Phase 3: Trustless bridging expands support for Ordinals, BRC-20 tokens, Runes, and beyond.

This roadmap positions zkBTC not just as a scaling solution but as the foundation for an entire ecosystem of EVM-compatible applications built atop Bitcoin’s robust base layer. By tapping into Polygon’s proven zero-knowledge tech stack (zkbtc.com), zkBTC aims to deliver both performance and interoperability at scale.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Professional Forecast Incorporating zkBTC Rollups and Layer-2 Scaling Impact

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $132,000 | $168,000 | +17.5% | Post-halving consolidation, zkBTC mainnet v1 adoption, moderate volatility |

| 2027 | $110,000 | $155,000 | $195,000 | +17.4% | zkBTC mainnet v2, BTC burning mechanism, increased institutional interest |

| 2028 | $124,000 | $178,000 | $226,000 | +14.8% | Broader Layer-2 adoption, regulatory clarity, mass-market applications |

| 2029 | $142,000 | $202,000 | $262,000 | +13.5% | Full implementation of trustless bridges, enhanced DeFi on Bitcoin |

| 2030 | $158,000 | $227,000 | $299,000 | +12.4% | Global scaling, new BTC use cases, potential market euphoria |

| 2031 | $175,000 | $253,000 | $338,000 | +11.5% | Mature Layer-2 ecosystem, mainstream integration, competitive blockchain landscape |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is broadly bullish, underpinned by the successful rollout and adoption of zkBTC Rollups and related Layer-2 technologies. These innovations are expected to drive transaction efficiency, lower fees, and open new use cases, supporting sustained price appreciation. However, significant volatility remains possible due to market cycles, evolving regulation, and macroeconomic factors. Minimum and maximum price ranges reflect both bearish and bullish scenarios, offering a comprehensive view for investors.

Key Factors Affecting Bitcoin Price

- Adoption and technical success of zkBTC Rollups and other Layer-2 solutions

- Regulatory environment for Bitcoin and crypto globally

- Macroeconomic trends (inflation, interest rates, global liquidity)

- Bitcoin halving cycles and supply dynamics

- Institutional and retail adoption rates

- Competition from other blockchains and Layer-1 assets

- Development of DeFi and NFT ecosystems on Bitcoin via Layer-2s

- Security, decentralization, and trust in new scaling solutions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As Bitcoin continues to trade above the six-figure mark at $112,392.00, the urgency for scalable infrastructure has never been greater. The zkBTC roadmap is more than a technical plan, it’s a strategic blueprint for mainstream adoption, developer innovation, and cross-chain liquidity. By integrating features like trustless bridges for Ordinals and BRC-20 tokens, zkBTC is poised to enable entirely new classes of decentralized finance (DeFi) and NFT applications directly on Bitcoin.

Real-World Impact: Faster, Cheaper Bitcoin for Everyone

The practical benefits of zkBTC rollups are already rippling through the ecosystem. Developers can build dApps that tap into Bitcoin’s security without being hamstrung by high fees or slow block times. Traders experience near-instant settlement and predictable costs, making arbitrage and market-making more efficient. Everyday users, whether sending remittances or minting NFTs, enjoy a frictionless experience that finally rivals the speed and cost of traditional payment rails.

Top Use Cases Unlocked by zkBTC Rollups

-

Decentralized Finance (DeFi) Protocols on Bitcoin: zkBTC rollups enable high-speed, low-cost DeFi applications such as lending, borrowing, and yield farming directly on Bitcoin, leveraging EVM compatibility and Polygon’s zkEVM technology.

-

Instant Peer-to-Peer Payments: With zkBTC rollups, Bitcoin transactions settle in seconds with minimal fees, making everyday payments and remittances faster and more affordable than ever before.

-

Cross-Chain Swaps and Interoperability: zkBTC’s trustless bridges facilitate seamless swaps between Bitcoin, Ethereum, and other major chains, unlocking new liquidity and trading opportunities across ecosystems.

-

NFT Minting and Trading on Bitcoin: zkBTC rollups make it feasible to mint, buy, and sell NFTs using Bitcoin, supporting Ordinals, BRC-20, and Runes standards with low fees and high throughput.

-

Scalable Gaming and Metaverse Applications: By reducing transaction costs and latency, zkBTC rollups open the door for blockchain-based games and metaverse platforms to leverage Bitcoin’s security and liquidity.

This isn’t just theory; it’s being implemented in real time as projects leverage zkBTC’s EVM compatibility to port over Ethereum-native applications. Polygon’s AggLayer further amplifies this by pooling liquidity across chains, reducing fragmentation and deepening markets for BTC-based assets.

Navigating Security and Decentralization at Scale

One of the most compelling aspects of zero-knowledge proofs on Bitcoin is their ability to scale without compromising the chain’s core values. Unlike some Layer-2 solutions that introduce new trust assumptions or centralized operators, zkBTC rollups inherit Bitcoin’s security guarantees via cryptographic proofs posted directly to mainnet.

This architecture ensures that even as transaction throughput soars, users retain full custody and censorship resistance. Governance upgrades, such as introducing additional BTC variants as gas tokens or deploying BEIP-1559, are subject to community input, aligning incentives between developers, miners, and end-users.

What Comes Next for Bitcoin Rollup Protocols?

The future looks bright, and competitive, for Bitcoin scalability. As more teams experiment with zero-knowledge proofs and EVM-compatible rollups on Bitcoin, we’ll see a proliferation of new protocols vying to offer even lower fees, faster settlement times, and broader interoperability with other blockchains.

The real test will be user adoption at scale: Will wallets integrate seamless zkBTC support? Can DeFi protocols attract meaningful liquidity from legacy chains? How quickly can developers migrate popular Ethereum dApps onto Bitcoin’s newly scalable rails?

If early indicators hold true, 2025 could be remembered as the year when zkBTC rollups unlocked fast, low-cost transactions on Bitcoin, finally delivering on Satoshi’s promise of peer-to-peer electronic cash, for everyone.