As Bitcoin continues to maintain its dominance in the digital asset ecosystem, with the current price at $115,489.00, the demand for scalable transaction throughput and lower fees has never been more urgent. Rollups – Layer 2 solutions that process transactions off-chain before posting proofs and data back to Bitcoin – are emerging as a key answer. Yet, at the heart of every rollup protocol lies a fundamental challenge: data availability. Without robust data availability guarantees, even the most advanced rollup can falter, leaving user funds at risk and undermining trust in Bitcoin’s evolving infrastructure.

Why Data Availability is Critical for Bitcoin Rollups

In the context of Bitcoin rollups, data availability refers to ensuring that all transaction data needed to reconstruct or verify the state of the rollup is accessible to every network participant. This property is not just a technical nicety – it is essential for security, censorship resistance, and user autonomy.

Consider this: if users cannot access the underlying transaction data from a rollup, they cannot independently verify their balances or safely exit back to the main chain. This creates an existential risk where malicious operators could withhold data, effectively trapping user funds or invalidating withdrawal proofs. As noted in Bitcoin Magazine’s analysis, “in a rollup using Bitcoin for data availability it is literally not possible for the state of the rollup to change without the data needed. ” Without guaranteed access to this critical information, no amount of cryptographic wizardry can protect users from catastrophic loss.

The Block Size Bottleneck: Economic Realities at $115,489.00 BTC

Bitcoin’s block size limit – currently capped at 4MB – imposes strict constraints on how much rollup transaction data can be posted directly on-chain. At today’s $115,489.00 BTC price point, this limitation translates into real economic pressure. For example:

- Posting 400KB of rollup data every six blocks: At a fee rate of 10 satoshis per byte, each such post costs roughly $2,640 per block.

- Monthly costs: This quickly escalates into tens of thousands per month if sustained throughput is required.

The result? Rollup developers must make hard trade-offs between maximizing security (by storing all necessary data on-chain) and minimizing operational costs. The economics become even more daunting as adoption grows and blockspace becomes more competitive.

Approaches to Data Availability: On-Chain vs Off-Chain vs Hybrid Models

The industry has responded with several approaches to address these conflicting demands:

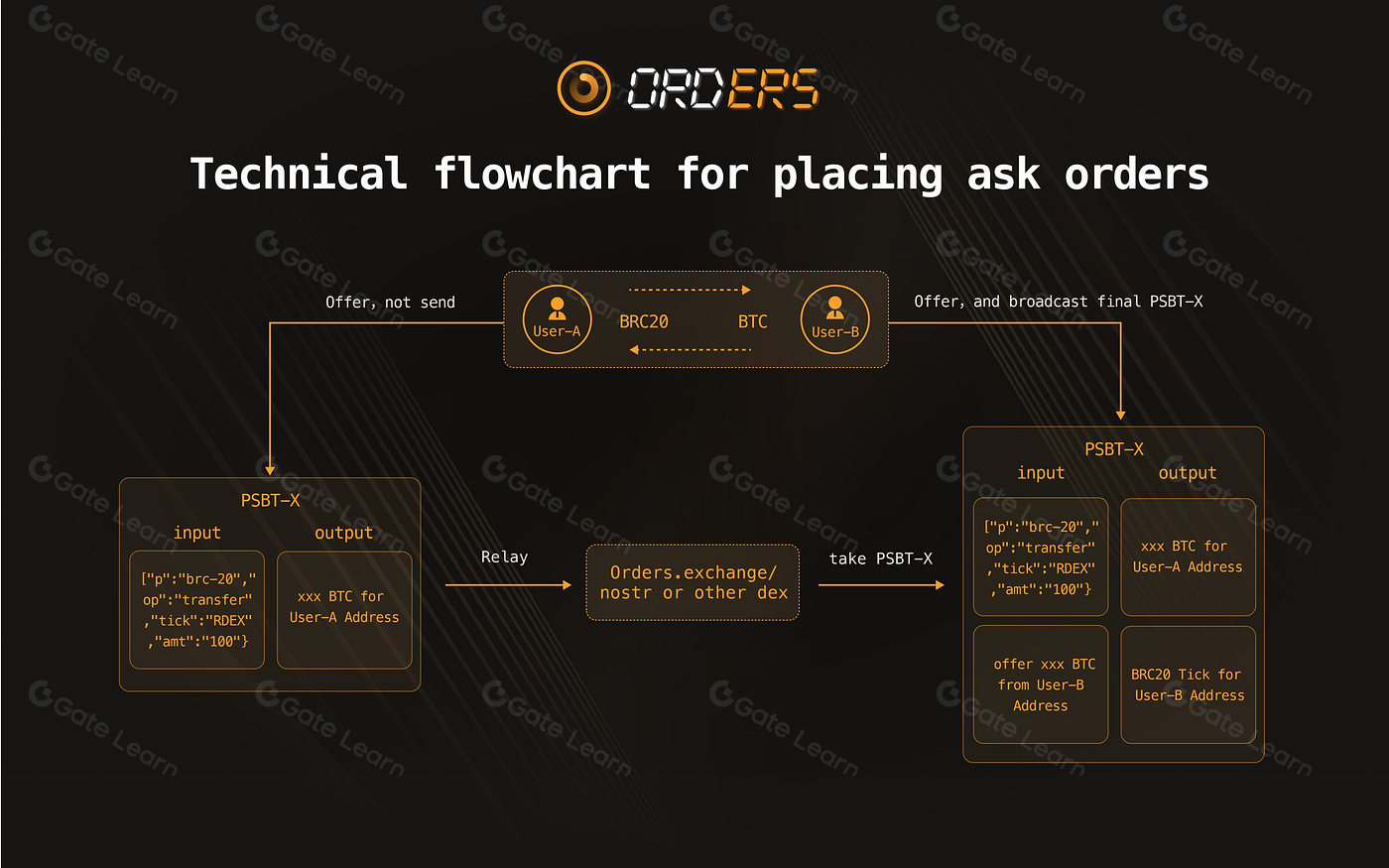

- On-Chain Data Posting: The gold standard for trustlessness; all transaction data is published directly onto Bitcoin’s blockchain. While secure and censorship-resistant, it is costly and limited by blockspace constraints (see detailed cost analysis here).

- Off-Chain Storage with Commitments: Data is stored off-chain but referenced via cryptographic commitments posted on-chain. This reduces fees but introduces new risks: if off-chain providers withhold or lose data (a so-called “data withholding attack”), users may be unable to prove their balances or exit safely (explore technical risks here).

- Hybrid Models (Volition): Some protocols allow users to choose between on-chain and off-chain storage for their transactions depending on their risk appetite and need for efficiency (hybrid model breakdown here). These systems offer flexibility but require careful engineering and clear communication around trade-offs.

This diversity reflects both innovation and ongoing uncertainty around optimal design choices for rollup data availability. No single approach has emerged as universally superior; instead, projects are experimenting across this spectrum as they seek scalable yet secure solutions compatible with Bitcoin’s ethos.

As the Bitcoin ecosystem evolves, the question of data availability in rollups is driving both technical debate and practical innovation. The trade-offs are stark: on-chain posting delivers maximal security and user sovereignty but at a steep cost, especially with Bitcoin currently priced at $115,489.00. Off-chain models reduce expenses but introduce new vectors for risk and require trust in external actors or committees. Hybrid models like volition attempt to split the difference, empowering users to make granular choices about their own security and costs.

Pros & Cons of Data Availability Approaches for Bitcoin Rollups

-

On-Chain Data Availability: Pros: Maximum security and trustlessness—data is immutable and accessible to all via the Bitcoin blockchain. Cons: High costs due to Bitcoin’s limited block size (4MB) and expensive transaction fees; for example, posting 400KB every six blocks can cost approximately $2,640 per block at current rates (BTC price: $115,489). Scalability is constrained by block space limitations.

-

Off-Chain Data Availability (with Commitments): Pros: Significantly reduces on-chain costs and enables higher throughput by storing data externally. Cons: Introduces new trust assumptions—users rely on Data Availability Committees (DACs) or external providers. Vulnerable to data withholding attacks, which can prevent users from verifying transactions or withdrawing funds.

-

Hybrid (Volition) Models: Pros: Offers flexibility—users can select on-chain or off-chain storage based on their security and cost preferences. Balances scalability and security for different needs. Cons: Adds design and operational complexity; users must understand trade-offs. Security depends on correct implementation and the reliability of off-chain providers.

The stakes could not be higher. As rollups gain traction as a pathway to mass adoption, the mechanics of data availability will shape not only transaction throughput but also user safety and the integrity of Bitcoin’s Layer 2 landscape. Developers are acutely aware that shortcuts here can undermine everything else, no amount of zero-knowledge proof sophistication or cryptographic commitment can substitute for actual data being present when it’s needed.

Emerging Solutions: Data Availability Layers and Committees

To address these challenges, new solutions are emerging in the form of dedicated data availability layers (DALs) and permissionless information dispersal protocols. These systems aim to provide decentralized storage guarantees without congesting Bitcoin’s limited blockspace. For example, projects like Celestia offer a standalone DAL where rollups can publish their data verifiably, a model that could allow Bitcoin rollups to scale without compromising on transparency or user exit rights (read more here).

Data Availability Committees (DACs), meanwhile, serve as federated groups responsible for holding and releasing off-chain data as needed. While this introduces some trust assumptions, careful design, such as requiring threshold signatures or rotating committee members, can mitigate risks of collusion or censorship. Still, these solutions must prove themselves resilient under real-world adversarial conditions.

The Future of Rollup Scalability on Bitcoin

The next phase for Bitcoin rollup scalability will hinge on how effectively the ecosystem can balance cost efficiency with uncompromising security guarantees. As more teams deploy ZK-rollups and optimistic rollup frameworks onto Bitcoin’s mainnet, expect continued experimentation with both protocol-level innovations and economic incentives designed to keep data highly available.

The broader industry is watching closely, what works for Bitcoin may inform best practices across other blockchains as well. With BTC trading at $115,489.00, the economic calculus behind every byte stored on-chain is sharper than ever before. Ultimately, robust solutions for Bitcoin layer 2 data availability will determine how far, and how safely, the network can scale while preserving its foundational values.