Bitcoin’s journey into the world of decentralized finance (DeFi) has been a long time coming, and with the emergence of zkBTC, we’re seeing the most promising integration yet. As of today, Bitcoin is trading at $116,078.00, and this price milestone isn’t just a headline – it’s a signal that BTC’s value can finally be unlocked across DeFi ecosystems in scalable, secure ways. The recent launch of Lightec’s zkBTC Bridge is a game changer for Bitcoin holders who want to access Ethereum-based DeFi services without giving up full asset control. With OKX Wallet now supporting zkBTC, onboarding is smoother than ever for users eager to bridge their BTC into new yield opportunities.

zkBTC: Bringing Bitcoin to DeFi Without Compromise

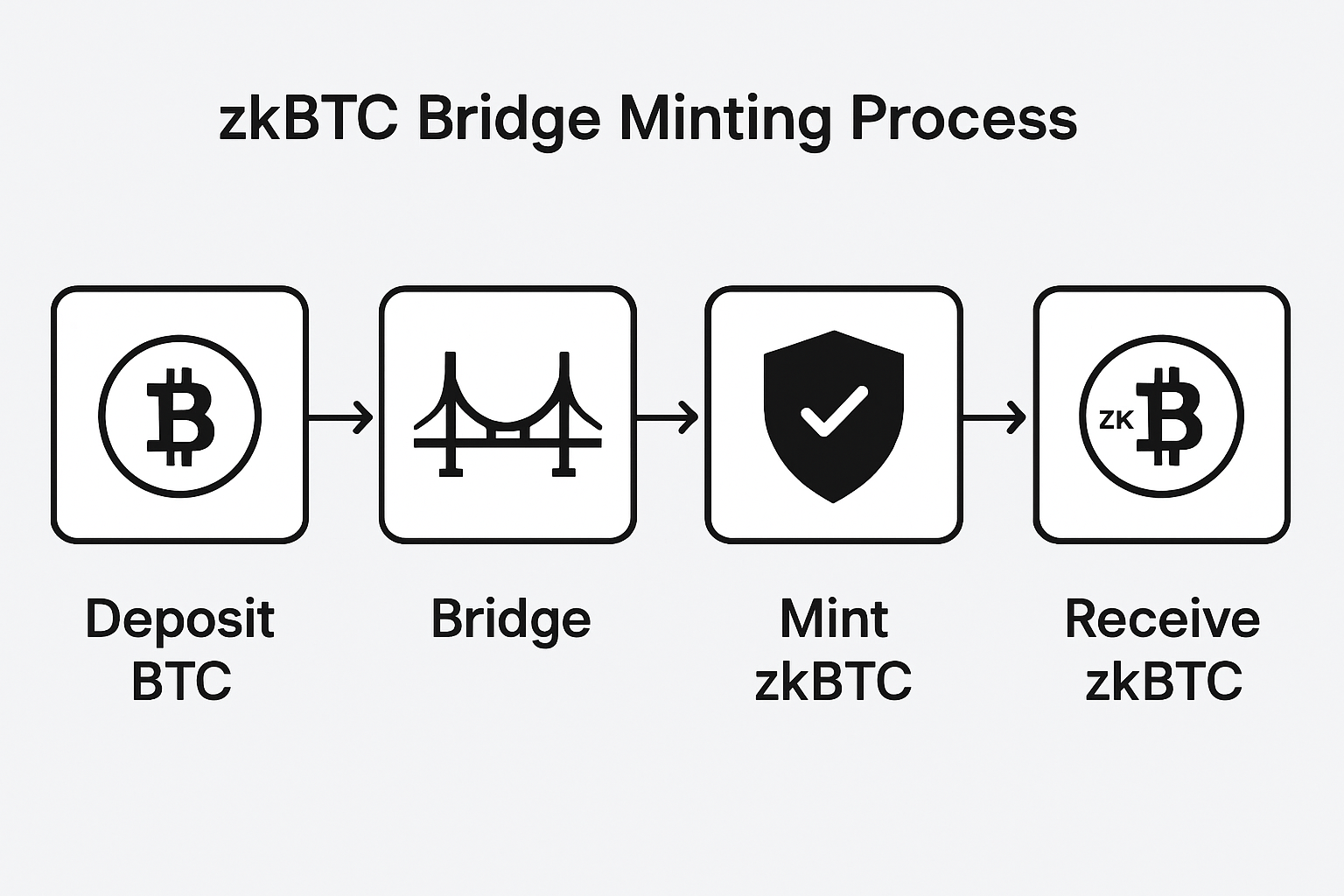

For years, integrating Bitcoin into DeFi meant relying on wrapped assets like WBTC or using federated sidechains. These solutions often required trust in third-party custodians or came with limited scalability. zkBTC flips this script by leveraging zero-knowledge proofs and rollup technology to create a Layer-2 environment purpose-built for Bitcoin. With zkBTC, users can mint tokens pegged 1: 1 to BTC through a cross-chain bridge – all while benefiting from transparent on-chain verification.

The impact is already visible. The “Bitcoin Yield Boost” program lets participants:

- Mint zkBTC from native BTC and earn cross-chain rewards plus manual weekly airdrops

- Stake zkBTC/USDT LP NFTs on Uniswap for continuous liquidity mining rewards

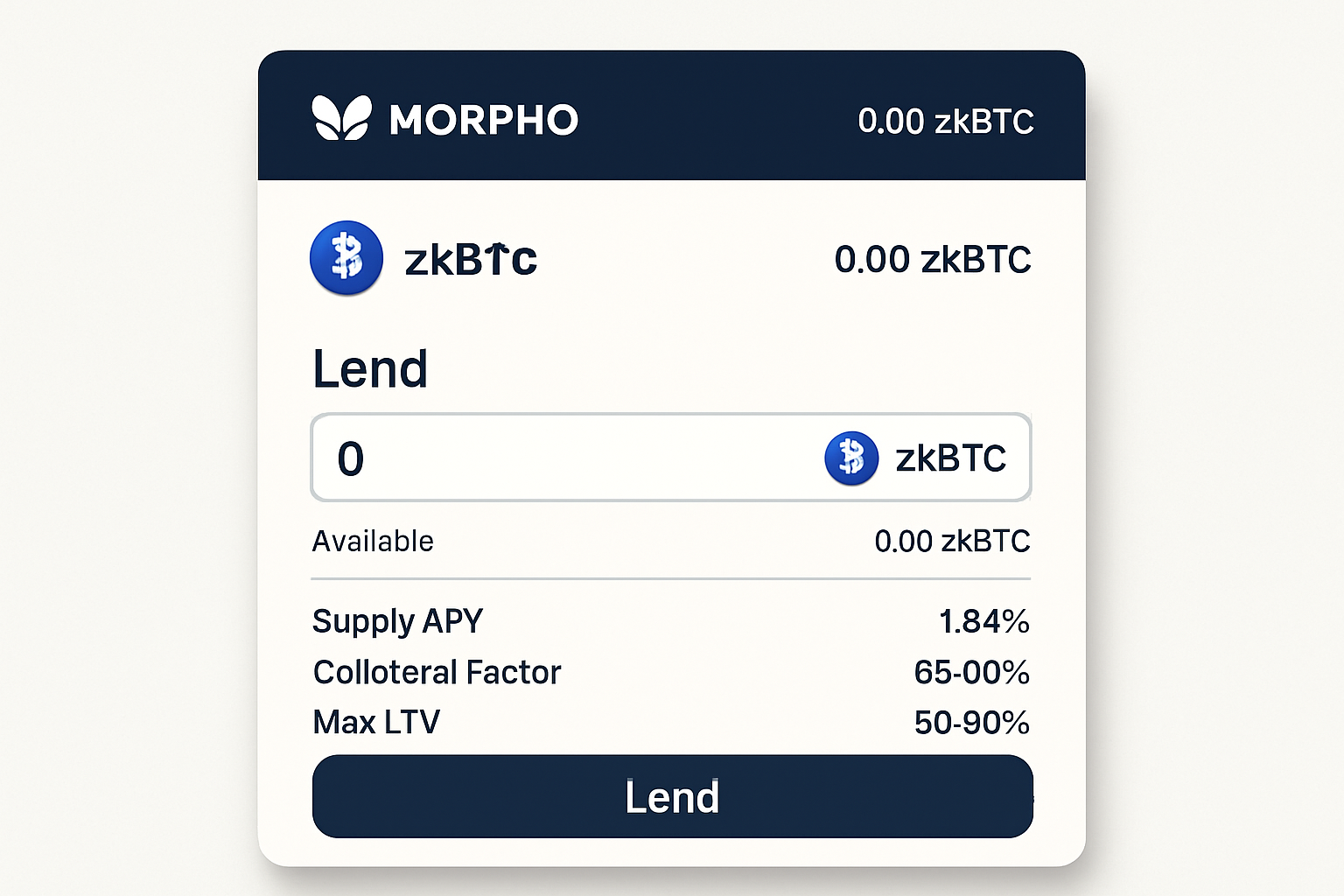

- Lend or borrow USDT using zkBTC as collateral via Morpho Lending Market, earning additional L2T token incentives

This suite of earning methods is designed to attract both seasoned DeFi users and long-term Bitcoin holders looking for yield without sacrificing decentralization or security.

Opportunities: Unlocking New Value Streams for Bitcoin Holders

The integration of zkBTC into DeFi opens up several clear opportunities:

- Enhanced Scalability: By operating as a Layer-2 solution, zkBTC dramatically increases transaction throughput and slashes fees compared to mainnet Bitcoin transactions. This scalability is essential for high-frequency DeFi activities like trading or yield farming.

- Expanded Participation: Instead of leaving their BTC idle or relying on centralized exchanges, holders can now participate in lending markets, provide liquidity, or even explore new primitives enabled by zero-knowledge tech.

- Smoother Interoperability: With bridges like Lightec’s and support from wallets such as OKX Wallet, moving between chains is becoming less intimidating. This seamless experience fosters greater adoption across ecosystems that were previously siloed.

Top Real-World Use Cases for zkBTC in DeFi

-

Cross-Chain BTC Bridge Minting: With the zkBTC Bridge, users can securely mint zkBTC (1:1 pegged to Bitcoin, currently priced at $116,078.00) by locking BTC on the Bitcoin network. This enables BTC holders to access DeFi rewards, earn cross-chain incentives, and receive weekly manual airdrops—all while retaining full control of their assets.

-

Liquidity Mining on Uniswap: zkBTC holders can provide liquidity to the zkBTC/USDT trading pair on Uniswap by staking LP NFTs. This unlocks continuous liquidity rewards and helps boost zkBTC’s presence in the DeFi ecosystem, making Bitcoin’s value more accessible and tradable across Ethereum-based protocols.

-

Borrowing & Lending on Morpho: Through integration with the Morpho lending market, users can lend USDT to earn APR and L2T token rewards, or borrow USDT by collateralizing zkBTC. This provides BTC holders with new ways to generate yield or access liquidity without selling their Bitcoin.

-

Yield Farming & Incentive Programs: zkBTC’s “Bitcoin Yield Boost” program offers various earning opportunities, including staking, liquidity mining, and cross-chain rewards. These incentives encourage active participation and help deepen zkBTC’s liquidity in the DeFi space.

-

Seamless Multi-Chain DeFi Participation: By leveraging zkBTC, Bitcoin holders can interact with a wide range of DeFi protocols across Ethereum and other blockchains. This interoperability expands the utility of BTC beyond simple holding, enabling use in lending, borrowing, trading, and more—all with enhanced scalability and reduced fees.

Tweets and Community Buzz: Is This the Next Big Leap?

The crypto community has been quick to weigh in on the significance of native Bitcoin liquidity entering DeFi protocols via secure bridges like zkBTC. Just as wBTC integration led to surges in TVL (total value locked) on Ethereum protocols back in the day, many are speculating that we’re about to see another wave – only this time with improved security and transparency thanks to zero-knowledge proofs.

The Road Ahead: Challenges Still Remain

No innovation comes without hurdles. Security remains front-of-mind; any cross-chain bridge introduces new attack surfaces that must be rigorously audited and monitored (see more here). Regulatory uncertainty also looms large as authorities worldwide grapple with how to oversee permissionless financial products spanning multiple blockchains (regulatory context here). And let’s not forget user education – making sure average holders understand both the opportunities and risks will be key if we want widespread adoption beyond crypto-native circles.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on zkBTC DeFi integration, market cycles, and evolving crypto landscape

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $84,000 | $125,000 | $162,000 | +7.7% | Consolidation post-2025 peak; DeFi adoption builds, but macro uncertainty and possible regulation weigh on growth. |

| 2027 | $92,000 | $137,000 | $180,000 | +9.6% | Renewed bullish sentiment as zkBTC and DeFi integration mature; Layer-2 adoption increases BTC utility. |

| 2028 | $108,000 | $159,000 | $210,000 | +16.1% | Potential new cycle peak; institutional adoption rises, Bitcoin DeFi ecosystem drives capital inflows. |

| 2029 | $120,000 | $172,000 | $225,000 | +8.2% | Market correction or sideways movement as cycle matures; regulatory clarity improves stability. |

| 2030 | $128,000 | $187,000 | $245,000 | +8.7% | Gradual uptrend resumes; growing use cases in DeFi, tokenization, and payment rails. |

| 2031 | $140,000 | $205,000 | $270,000 | +9.6% | Sustained adoption and integration in global finance; competition from other L1s/L2s managed by Bitcoin’s strong brand. |

Price Prediction Summary

Bitcoin’s integration into DeFi through zkBTC and similar solutions is expected to gradually increase BTC’s utility, liquidity, and demand over the next six years. Price predictions reflect both potential for new highs during bullish cycles and interim corrections or consolidations. Average prices are expected to grow steadily, with increased volatility in min/max ranges due to macroeconomic and regulatory factors. By 2031, Bitcoin could see average prices above $200,000, driven by enhanced DeFi participation, mainstream adoption, and technological advancements.

Key Factors Affecting Bitcoin Price

- zkBTC and Layer-2 scaling driving DeFi adoption for BTC, increasing utility and liquidity.

- Regulatory developments and global policy shifts affecting cross-chain and DeFi activity.

- Security and reliability of cross-chain bridges and smart contracts.

- Macroeconomic factors (interest rates, inflation, global risk appetite) impacting investor flows.

- Competition from other blockchains and evolving L1/L2 ecosystems.

- Institutional participation and new use cases (tokenization, payments, RWA integration).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For developers and project teams, zkBTC DeFi integration is more than just a technical upgrade – it’s an open invitation to build new primitives and financial products that were previously out of reach for Bitcoin. The ability to leverage Bitcoin’s massive liquidity pool, now valued at $116,078.00 per BTC, means protocols can experiment with innovative lending models, cross-chain swaps, and even decentralized options markets without sacrificing Bitcoin’s native security guarantees.

As more infrastructure comes online – like the Lightec zkBTC Bridge and OKX Wallet support – we’re seeing a real shift in how users approach capital efficiency. Instead of passively holding BTC or relying on centralized yield products, users can now put their assets to work in permissionless DeFi environments. This is especially attractive given the current market volatility and the increasing demand for non-custodial risk management tools.

Navigating the Risks: Security, Compliance, and User Experience

The promise of Bitcoin rollups in DeFi is massive, but it’s not without friction points. Security is always the elephant in the room when you talk about cross-chain bridges. Even with advanced zero-knowledge proofs underpinning zkBTC’s architecture, continuous audits and bug bounties are essential to maintaining user trust. It’s encouraging to see projects like Lightec prioritizing transparent on-chain verification and rapid response frameworks for potential exploits.

On the compliance front, regulatory clarity remains elusive. As jurisdictions around the world update their stance on DeFi protocols and cross-chain tokens, projects must remain agile (regulatory context here). Proactive engagement with regulators – along with robust KYC/AML procedures where appropriate – will be vital for institutional adoption.

User experience is another major hurdle. For many BTC holders who’ve never interacted with Ethereum or Layer-2s before, concepts like LP NFTs or collateralized lending can feel daunting. That’s why education initiatives are so important right now; clear guides, responsive support channels, and simple onboarding flows (like OKX Wallet’s one-click connection) make all the difference between curiosity and conversion.

What Comes Next? zkBTC’s Role in a Multi-Chain Future

If there’s one thing we’ve learned from past cycles, it’s that liquidity follows utility. The more useful zkBTC becomes across different chains and protocols, the more likely we are to see meaningful inflows from both retail users and institutional players. With ongoing incentives like “Bitcoin Yield Boost” and expanding ecosystem integrations (see zkBTC ecosystem details), it feels like we’re just scratching the surface of what Bitcoin can do outside its base layer.

As we look ahead to Q4 2025 and beyond, all eyes are on how quickly these solutions can scale without compromising on decentralization or user safety. If zkBTC continues to deliver on its promises of scalability, transparency, and composability – while addressing regulatory headwinds head-on – there’s every reason to believe that Bitcoin at $116,078.00 will be seen as just the beginning of its journey through DeFi.